Level 2 and 3 Credit Card Processing

There are lots of misconceptions out there about accepting business credit cards. Some people will tell you that these cards are expensive to process. But in reality, there are steps you can take to lower your credit card processing rates for B2B transactions.

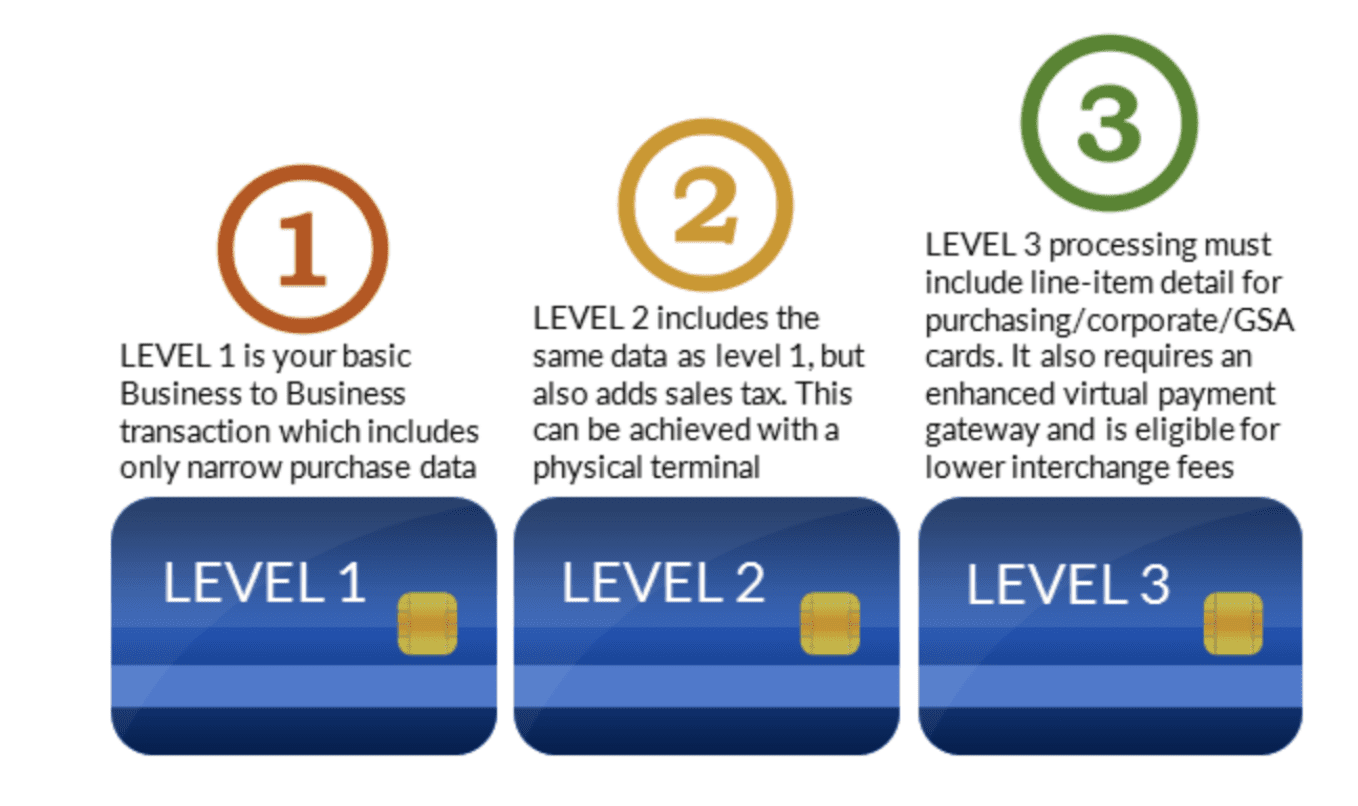

Regardless of your business size or industry, you can qualify for better rates by processing transactions with more information, known as card data. That’s where Level 2 (Level II) and Level 3 (Level III) processing comes into play.

Business cards are eligible for Level 2 processing rates and Level 3 processing rates. However, you won’t automatically qualify for those lower fees if you’re not capturing all of the required data.

Continue reading below for more clarification about Level 2 and Level 3 processing. If you accept business credit cards and fall into the B2B category, this guide can help you save money on credit card processing.

B2B Transactions — Card Types

Before we continue, I just want to quickly clarify the difference between the types of credit cards that could qualify for Level II and Level III processing.

Business Credit Cards

Business cards are issued to employees of a business. These cards are used for business-related expenses, such as travel, supplies, entertainment, and dining. In many cases, the cardholder (the employee) is liable for purchases made with that card. In some cases, there is a joint liability with the employee and business.

It’s common for business cards to be used in the small business setting.

Corporate Credit Cards

Corporate cards are similar to business cards in the sense that they are issued to employees. But typically, the business is liable for purchases made by the cardholders. The individual employees are not responsible, and there’s no requirement for a personal guarantor.

Corporate credit cards are used by larger organizations and enterprises. Level 2 and 3 Processing

There are lots of misconceptions out there about accepting business credit cards. Some people will tell you that these cards are expensive to process. But in reality, there are steps you can take to lower your credit card processing rates for B2B transactions.

Regardless of your business size or industry, you can qualify for better rates by processing transactions with more information, known as card data. That’s where Level 2 (Level II) and Level 3 (Level III) processing comes into play.

Business cards are eligible for Level 2 processing rates and Level 3 processing rates. However, you won’t automatically qualify for those lower fees if you’re not capturing all of the required data.

Continue reading below for more clarification about Level 2 and Level 3 processing. If you accept business credit cards and fall into the B2B category, this guide can help you save money on credit card processing.

B2B Transactions — Card Types

Before we continue, I just want to quickly clarify the difference between the types of credit cards that could qualify for Level II and Level III processing.

Business Credit Cards

Business cards are issued to employees of a business. These cards are used for business-related expenses, such as travel, supplies, entertainment, and dining. In many cases, the cardholder (the employee) is liable for purchases made with that card. In some cases, there is a joint liability with the employee and business.

It’s common for business cards to be used in the small business setting.

Corporate Credit Cards

Corporate cards are similar to business cards in the sense that they are issued to employees. But typically, the business is liable for purchases made by the cardholders. The individual employees are not responsible, and there’s no requirement for a personal guarantor.4Level 2 and 3 Processing

There are lots of misconceptions out there about accepting business credit cards. Some people will tell you that these cards are expensive to process. But in reality, there are steps you can take to lower your credit card processing rates for B2B transactions.

Regardless of your business size or industry, you can qualify for better rates by processing transactions with more information, known as card data. That’s where Level 2 (Level II) and Level 3 (Level III) processing comes into play.

Business cards are eligible for Level 2 processing rates and Level 3 processing rates. However, you won’t automatically qualify for those lower fees if you’re not capturing all of the required data.

Continue reading below for more clarification about Level 2 and Level 3 processing. If you accept business credit cards and fall into the B2B category, this guide can help you save money on credit card processing.

B2B Transactions — Card Types

Before we continue, I just want to quickly clarify the difference between the types of credit cards that could qualify for Level II and Level III processing.

Business Credit Cards

Business cards are issued to employees of a business. These cards are used for business-related expenses, such as travel, supplies, entertainment, and dining. In many cases, the cardholder (the employee) is liable for purchases made with that card. In some cases, there is a joint liability with the employee and business.

It’s common for business cards to be used in the small business setting.

Corporate Credit Cards

Corporate cards are similar to business cards in the sense that they are issued to employees. But typically, the business is liable for purchases made by the cardholders. The individual employees are not responsible, and there’s no requirement for a personal guarantor.

Purchasing Credit Cards

Purchasing cards—commonly referred to as “P-cards”—essentially replace purchase orders. These cards help simplify the purchasing process for employees who are authorized to buy goods or services on behalf of a business.

Employers can usually place restrictions on purchasing cards, like setting a spending cap or limiting purchases to businesses with a specific MCC (merchant category code).

Level 2 and Level 3 Credit Card Processing Data

Credit card brands have different requirements when it comes to Level 2 and Level 3 processing. There are other slight variations to keep in mind as well. For example, Visa uses the term “data level” while Mastercard uses “data rate.” But both of these terms refer to the information provided with each card transaction.

The more information provided with a transaction, the higher the data level. This ultimately reduces the liability for fraud and chargebacks, therefore lowering the interchange rates.

Higher data levels qualify for lower credit card processing fees (depending on your pricing model).

A commercial credit card is eligible for Level II and Level III processing rates. However, these transactions could be charged at Level I if all of the data isn’t captured. Consumer credit cards are only eligible for Level 1 processing.

The requirements for each processing level vary depending on the card brand. For example, merchants need to contact American Express directly to get approved for Level 2 processing; there is no Level 3 option with Amex. Visa and Mastercard both offer Level 2 and Level 3 processing through interchange, without the need to contact them. Discover does not participate in enhanced data level processing programs.

Examples of Data Required For Level 2 and Level 3 Processing

- Tax amount

- Tax indicator

- Tax ID number

- Discount amount

- Duty amount

- Quantity

- Unit of measure

- Unit of cost

- Discount per line item

- Line item total

- Item descriptor

- Item commodity code

- Freight and shipping amount

- Product code

- Description

- Debit or credit indicator

- VAT information

- Destination zip code

- Ship from zip code

- Destination country code

Again, these requirements depend on the card brand and card type. For example, a customer code would only be needed for a purchasing card.

Benefits of Level II and Level III Processing

So what’s the benefit of Level 2 and Level 3 credit card processing?

In short, lower processing fees. As mentioned earlier, these transactions are subject to lower interchange rates. So merchants that are currently on an interchange-plus pricing model will directly benefit from lower costs. If you’re on a bundled or flat-rate plan, then you won’t notice any difference (your processor will just make more money off of you).

Companies that issue business cards to their employees will also benefit from these transactions. The enhanced data associated with each purchase gives them more information for managing spending and budgets.

It’s also common for business cards to have additional cardholder benefits, such as car rental insurance, trip insurance, free checked bags, bonus points on gas and dining, global medical insurance, and more. Obviously, these perks vary by card and issuer.

It’s worth noting that merchants are not required to capture enhanced data. For example, let’s say you process a corporate card for a B2B transaction, but only capture the bare minimum data (like you would for a consumer transaction). The card remains a corporate card, regardless of what data is processed. But that transaction won’t qualify for the lowest possible interchange rates.

For merchants that only accept the occasional business card, you probably don’t have to worry about capturing the enhanced data. Will it cost you more money? Yes. But for a few times per year, that’s not going to make or break you.

But B2Bs should always be processing enhanced data. Depending on your processing volume, this could save you tens of thousands of dollars per month.

Final Thoughts

There are lots of different ways to save money on credit card processing. Enhanced data for B2B transactions is just one of those options.

How else can you save money on processing fees? Contact our team here at Merchant Cost Consulting. Get a free audit and analysis to find out how much you can start saving—without switching processors. We’ll even negotiate with your processor on your behalf.

0 Comments