Credit card processing statements are packed with fees that are often confusing for business owners. One of those charges that we’re commonly asked about is Mastercard’s NABU Fee.

So if you’ve spotted a NABU fee on your statement and you’re not sure what it means, you’ve come to the right place.

Read on to make sure you’re being charged correctly and how to tell if your processor is taking advantage of you.

What is the Mastercard NABU Fee?

NABU stands for Network Access and Brand Usage, which is a per-transaction assessment charged by Mastercard to cover the operational costs of running authorizations through their network.

The NABU fee applies to every authorized or refunded Mastercard transaction, whether it’s a credit card or signature debit purchase. Think of this like a small toll paid on every transaction that travels through Mastercard’s system.

You may see this charge on your statement itemized as any variation of the following names:

- MC NABU

- Mastercard NABU Fee

- MC NABU Fee

- Mastercard Network Access Fee

- Network Access Brand Usage Fee

- NABU Fee

As a flat-rate assessment, the fee goes directly to Mastercard itself. Processors and issuing banks aren’t supposed to get a piece from this charge.

How Much is the MC NABU Fee?

There are two different rates for the NABU fee, depending on where the cardholder’s card was issued:

- Domestic Transactions: $0.0195 per authorization

- International Transaction: $0.0295 per authorization

The domestic assessment on MC NABU applies to US-issued cards processed by merchants based in the United States, and the international rate applies to all Mastercard authorizations on cards issued outside of the US.

These are the only two rates you should see on your statement for Mastercard’s Network Access and Brand Usage Fee.

If you’re being charged a higher rate, it means your processor is padding your assessment fees and taking advantage of you. Yes, this is something that actually happens, and I’ll show you a real example of it later on.

When the Mastercard Network Access and Brand (NABU) Fee Gets Charged

The MC NABU Fee is assessed on every Mastercard authorization, regardless of whether the transaction later settles. This means that even if transactions are voided or declined, you’ll still be charged the NABU Fee if you generated an authorization response from Mastercard.

It applies to both credit and signature debit transactions on Mastercard-branded cards.

Mastercard’s NABU Fee is also charged on refunds or credits issued to Mastercard cardholders.

In simple terms, if you do anything that requires an authorization from a card that has the Mastercard logo, you’ll pay the NABU assessment fee.

Is the Mastercard NABU Fee Legit?

Yes, the MC NABU Fee is a legitimate assessment charge imposed at the card network level.

While many processors are known for adding hidden fees and bogus charges to merchant account statements, the NABU Fee is not one of them. This is something that every business pays when accepting a Mastercard.

Can the MC NABU Fee Be Removed or Negotiated?

No, all assessment fees passed through by the card networks are non-negotiable—including Mastercard’s Network Access and Brand Usage Fee.

You can’t ask your processor to remove this fee from your statement because the charge isn’t coming from them. You can only negotiate processor markups and processor-specific fees.

Just make sure your processor is actually charging you the correct rate ($0.0195 for domestic and $0.0295 for international).

Real Examples of Mastercard’s NABU Assessment Fee

Let’s look at a few different examples of how you might see the NABU fee charged on your account. Things can look slightly different depending on how your processor chooses to itemize your assessments.

Example 1 – Typical MC NABU Fee

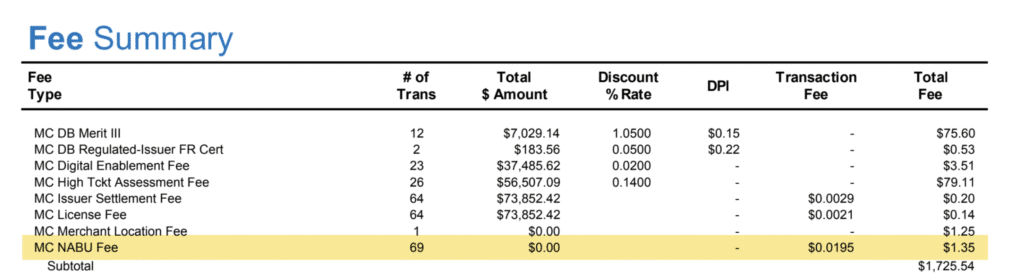

Here’s how most merchants will typically see the NABU fee on their statement:

You can see the NABU Fee itemized alongside other Mastercard assessments, including the MC License Fee and MC Digital Enablement Fee.

The total amount charged on these cards isn’t included because it’s not used to determine the rate. In this case, it’s 69 transactions that were all charged at the domestic rate of $0.0195 per authorization.

Whether those 69 transactions resulted in $100 or $10,000 in sales, the total fee would be exactly the same.

Example 2 – MABU Fees Including Returns and International Cards

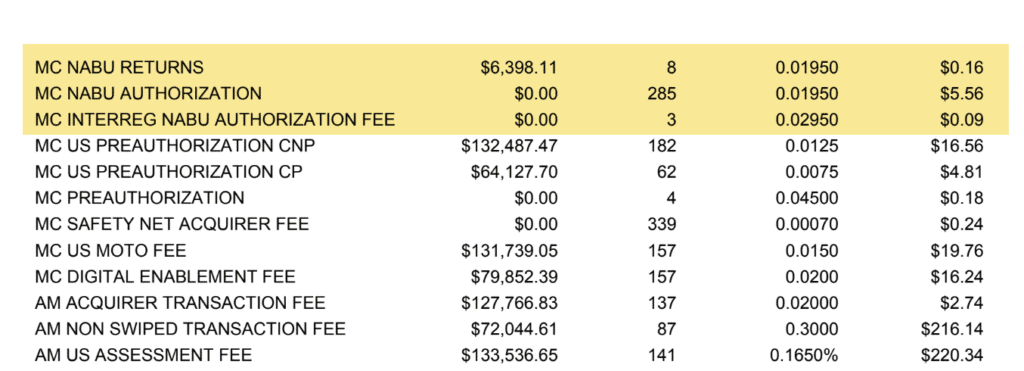

This example is a bit more detailed because the processor includes separate line items for returns and international cards.

International and domestic transactions should be on separate line items because they are charged at different rates ($0.0195 vs. $0.0295).

But not every processor will include your returns on a separate line.

The cost would be the same either way, but it’s nice to have this level of detail and transparency on your statements so you know exactly where every penny is going.

Example 3 – Padded NABU Fee (Overcharged by Processor)

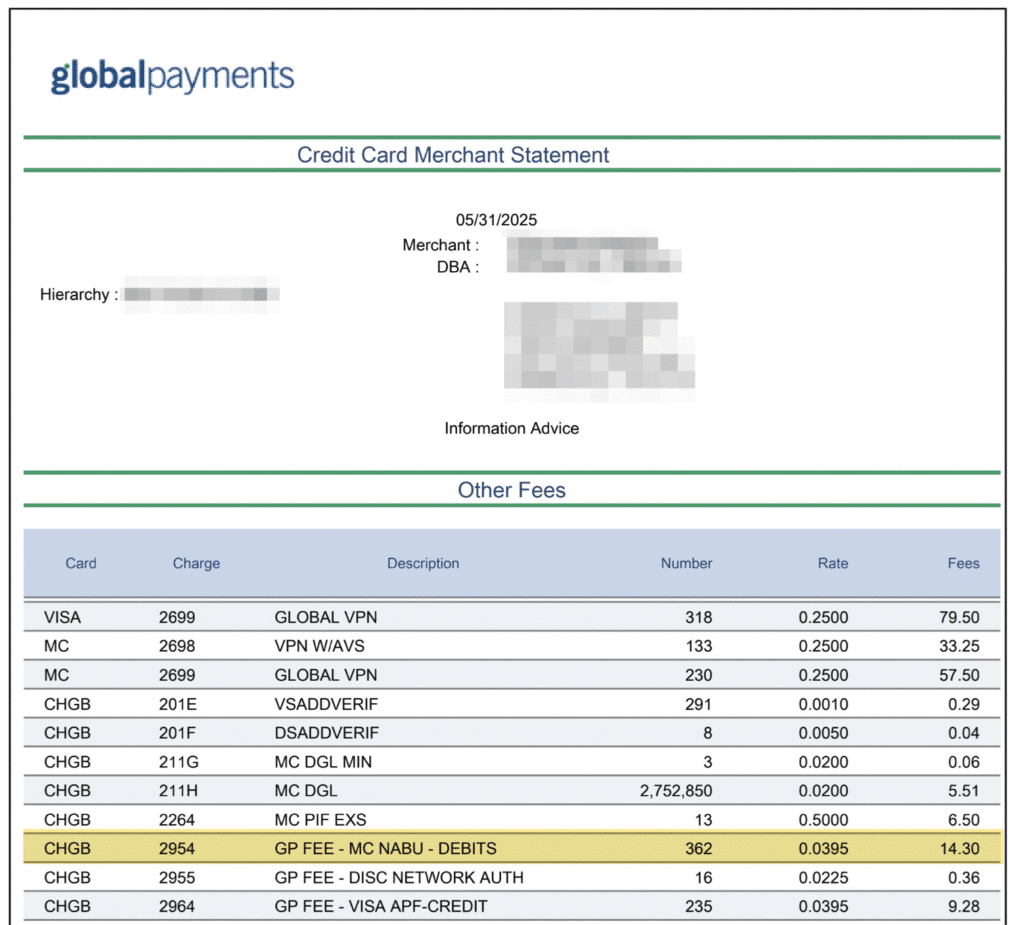

Here’s an example of a processor that’s overcharging a merchant for the NABU Fee. This is known as assessment padding, where a legitimate charge from the card network (like the NABU fee) is passed through the merchant at an increased rate.

This is a highly unethical practice because assessment fees are not supposed to include processor markups. It’s extremely difficult to spot padded assessments on your statements because the processor makes it appear as though the charge is coming directly from the card network.

But if we look closely, we can see that the MC NABU Fee is being assessed at $0.0395 instead of the $0.0195.

It’s no surprise that this is coming from Global Payments.

We’ve caught Global Payments padding assessment fees countless times, and they’re probably the biggest offender of this practice in the industry.

In this particular case, we’re talking fractions of a penny so the total charge is just $14.30 (when it should be $7.06).

While you may not think it’s worth making a big deal over $7, finding a padded assessment on your statement is usually a sign of a much larger problem. It’s a red flag that your processor is taking advantage of you and that you’re likely being overcharged for other fees.

And that’s almost always the case with this processor, as we constantly see Global Payments overcharging customers.

It’s also worth noting that there are other issues with this statement, like the NABU Fee (and other assessments) being incorrectly itemized as chargebacks.

This is why it’s so helpful to have an expert audit your statements, as this isn’t just a simple mistake by Global. They do this stuff to be intentionally deceptive in the hopes that you won’t question the thousands of dollars in overages to your account.

History and Recent Updates to the NABU Fee

Here’s a look at the latest updates to the MC NABU Fee so you can better understand why it exists and how the fee has changed over time:

- April 2009 — Mastercard introduced the NABU fee at $0.0185 per transaction, replacing its Acquirer Access Fee of $0.005.

- January 8, 2012 — Mastercard changed when the fee was assessed, moving from settlement to authorization.

- July 2013 — NABU fee increased by $0.001 to its current rate of $0.0195 per authorization and refund on US domestic transactions.

- April 2024 — Mastercard expanded the NABU Fee to also apply to non-domestic authorizations, charging $0.0295 on international cards.

Our Take on Mastercard’s NABU Fee

Overall, the MC NABU fee is a relatively small but unavoidable cost of accepting Mastercard payments. While the fee itself is non-negotiable, understanding how it works can help you verify that you’re being charged correctly.

So if you see the NABU fee on your statement, it’s not a cause for concern. Unless, of course, your processor is charging you more than $0.0195 for domestic cards and $0.0295 for international cards.

That’s something that needs to be addressed ASAP because there’s a strong probability that these few extra dollars your processor is pocketing is just the tip of the iceberg.

If they’re willing to take fractions of a penny from you, trust me, they’re willing to do a lot worse.

Reach out to our team here at MCC to get a free statement audit. We’ll let you know about any overcharges coming from your processor and identify other opportunities to reduce your total processing costs—without switching providers or changing your existing setup.