If you’re skimming through your monthly merchant statement and spotted a Mastercard Safety Net Acquirer Fee, you may be wondering whether the fee is legit or just another money-grab from your processor.

I’ll start with the good news: this is a legitimate assessment fee imposed directly by Mastercard.

Read on for the full breakdown.

What is the Mastercard Safety Net Acquirer Fee?

The MC Safety Net Acquirer Fee is an assessment fee from Mastercard that’s used to cover operational costs of their Safety Net fraud prevention system.

The fee is billed at $0.0007 per authorization.

At less than one-tenth of a percent, this is a negligible amount, even for high-volume businesses. It would take over 14,000 Mastercard authorizations for the Safety Net fee to cost you $10.

Why Mastercard Charges This Fee

Mastercard’s Safety Net program was built as an extra layer of protection against large-scale fraud attacks worldwide. More specifically, it provides network-level monitoring to identify potential fraud when issuers, acquirers, and processors can’t detect or fight it.

Processors and card issuers already have their own fraud filtering and defense systems in place. But the Safety Net program from Mastercard is just another checkpoint to identify suspicious patterns that might slip through the cracks.

Safety Net is completely independent of the fraud detection systems used by processors and issuers. It monitors 200+ million transactions per day and can quickly assess risks for large threats on a global scale.

This isn’t designed for catching or stopping the occasional stolen credit card or compromised credentials. It’s more about preventing large-scale attacks where hackers can penetrate the issuer’s fraud defense systems.

Who Pays the Mastercard Safety Net Acquirer Fee?

Since acquirers (processors) are ultimately responsible for compliance, Mastercard charges the Safety Net fee directly to them. But like nearly all network fees, the processor passes it through to the merchant.

If you’re on an interchange-plus pricing plan, you’ll see the fee itemized directly on your statement.

But if you’re on a flat-rate processing plan, your processor is making enough margin on your account that they don’t need to directly pass the fee through to you. Assessment fees are already baked into the high rate per transaction you’re paying.

Whether you see the fee on your statement or not, I can assure you, it’s being assessed on every single Mastercard authorization and charged to your acquiring bank.

Is the MC Safety Net Acquirer Fee Legitimate?

Yes, Mastercard’s Safety Net Acquirer Fee is a legitimate assessment charged by Mastercard.

It’s non-negotiable with Mastercard, it’s not removable by your processor, and it’s not a junk fee.

While you can’t eliminate the fee itself, you can double-check that your processor isn’t padding or inflating it. Some unethical processors sneak additional markups into network fees, hoping that merchants won’t notice. So the only way to confirm you’re not overpaying is to do some quick math to see if it checks out.

Multiply the number Mastercard authorizations on your statements by $0.0007 and see what you get. It should match up with the Safety Net fee line item.

That said, even if your processor was padding this fee it would need to be really bad to make a noticeable difference.

Identifying Safety Net Acquirer Fees on Your Statement

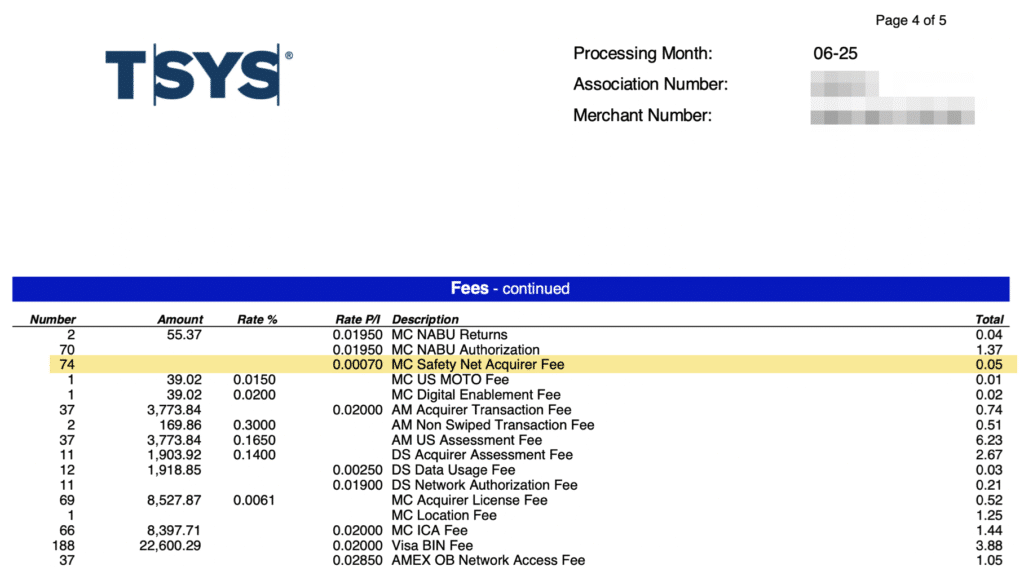

Here’s an example of the MC Safety Net Acquirer Fee that was charged to one of our clients using:

As you can see, it’s a mere $0.05.

Not worth thinking twice about. But if you want to double-check, we can multiply $0.0007 by the 74 authorizations to get $0.0518. The fee is so small and insignificant that even the processor rounded down here.

It depends on your processor, but you’ll typically find this fee alongside other assessments.

Many processors group assessments together by card network. But as you can see from this TSYS statement, it’s all broken up. The Safety Net Fee is near other Mastercard charges like the NABU Fee and Digital Enablement Fee, but then you can see other Amex, Discover, and Visa charges are all mixed in as well, out of order.

Final Thoughts

Payment processors have a knack for making fees sound legitimate (even when they’re not), so it’s always best to question unfamiliar charges on your statement.

In this case, the MC Safety Net Acquirer Fee is legit and really nothing to be concerned about.

If you happen to see the Safety Net fee on your statement that’s more than $10 (and you don’t have thousands of Mastercard authorizations), then it’s a red flag. Your processor could be trying to sneak something by you. And while $10 might not seem like much, there’s a good chance they’re doing it on other, more significant fees that could be costing you thousands.

That’s why it’s always in your best interest to have a professional audit your statements to identify hidden processing fees that you otherwise wouldn’t catch on your own.