If you’ve spent any time shopping around for a payment processing solution, then you’ve likely seen the term “merchant discount rate” thrown around in your search—either by a sales rep or on the provider’s website. Some of you may even see the merchant discount rate (MDR) listed in your monthly statement or mentioned in email communications from your payment provider.

Regardless of how you landed here, I’ll let you in on a little secret—the merchant discount rate isn’t actually a discount.

It’s actually quite the opposite. MDRs are fees, but referred to as “discounts” so credit card processing companies and merchant services providers can act like they’re giving you a deal.

Read on to learn more about merchant discount rates, how they work, how to calculate them, and what they mean for your business.

What is a Merchant Discount Rate?

A merchant discount rate is the fee that merchants pay to payment processing companies for credit and debit card transactions. Commonly abbreviated as MDR, the merchant discount rate is billed as a percentage of each transaction amount, and it’s sometimes referred to as the transaction discount rate (TDR) or just the discount rate.

Discount rates are automatically taken from each transaction and paid to the processing company. If your MDR is 3% and you accept a $100 credit card transaction, your processor keeps $3 and gives you the remaining $97 (as opposed to you receiving the full $100 and then owing the processor $3).

How Do Merchant Discount Rates Work?

MDRs are charged as percentage of the transaction amount. It’s one component of the payment payment processor’s markup, but it’s not the only fee that processors charge you.

If we zoom out a bit, we can see where the merchant discount rates falls within the types different fee categories associated with payment processing:

- Interchange Fees: Set by the card networks (Visa, Mastercard, Amex, Discover) and paid to the issuing bank by the acquiring bank.

- Assessment Fees: Paid directly to card associations for the use of its network, billed as a percentage of total monthly volume.

- Processor Markup: Set by the processor and paid by the merchant, which includes the discount rate. The markup also includes per-transaction fees, monthly fees, service fees, PCI fees, and anything else paid directly to the processor.

It’s important to understand that your merchant discount rate is 100% negotiable. So is every other component of your processor’s markup (unlike interchange and assessments).

Again, the discount rate is just one portion of your total processing costs. To get a more accurate picture of your total costs, you’ll need to calculate your effective rate.

Read More: Effective Rate vs. Discount Rate

How to Find Your Merchant Discount Rate

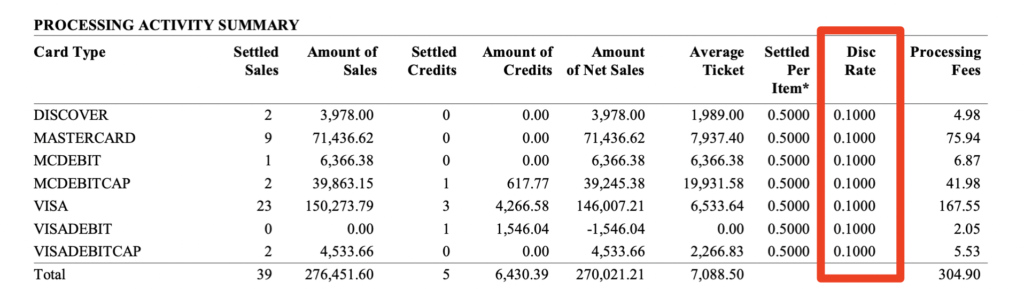

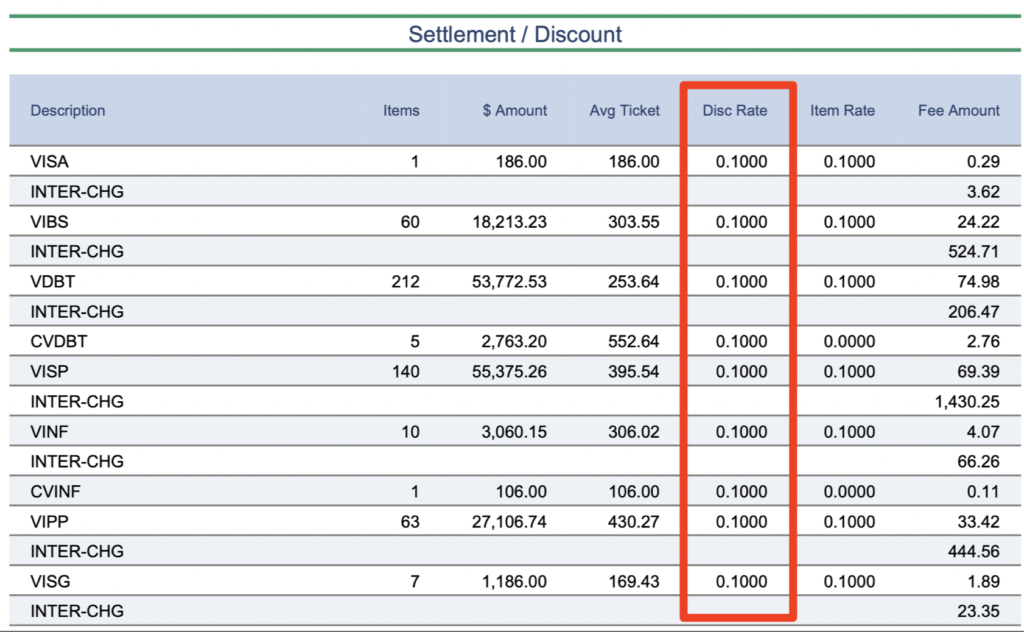

Your discount rate should be easy to find on your monthly merchant statement. Formatting and reporting varies by processor, but look for the section that itemizes your transactions either by network or interchange category.

Here’s an example that shows the discount rate in the summary:

And here’s a different format from another processor that shows the discount rate alongside interchange itemizations:

In both cases, the discount rate is 0.10% (which is the same as 10 basis points or 0.001).

Who Sets the Merchant Discount Rate?

The discount rate is set by the payment processor or merchant services provider.

Processors must account for the interchange rates and assessments imposed by the card networks—as these fees are non-negotiable and make up the majority of the merchant discount rate.

However, the processor markup portion of the discount rate is 100% negotiable. Some merchant service providers are greedier than others and charge far more than they need to for the merchant discount rate.

Interchange fees hover around 1.50% to 2.50%. This number can vary based on your business type, MCC code, industry, card type, and total processing volume.

But for simplicity’s sake, let’s say your average interchange and assessment fees total 2% of your monthly processing volume. This is a reasonable assumption for many businesses.

Some processors set the MDR anywhere from 3% to 3.5% or even upwards of 4%. Then they tell you that you’re getting the lowest possible rate—which is a complete lie.

Technically, the only fees you have to pay are the interchange rates and assessments. If your processor wants to, they don’t need to profit at all on your transactions. This isn’t realistic in most cases (except when processors just charge a monthly membership as their only fee).

We can all agree that your processor deserves something for helping you facilitate process transactions and accept card payments. But at what point does this become too much?

Processors can still make a ton of money just by charging an extra 0.20% above interchange. Yet so many set MDRs to ensure they’re getting at least 1% over the interchange rate. This can end up costing your business tens of thousands of dollars every year in fees that could otherwise be negotiated to a lower number.

What’s the Difference Between Merchant Discount Rate and Interchange Rate?

The biggest difference between the merchant discount rate and the interchange rate is where each one comes from. Interchange rates are imposed at the card network level, and discount rates are imposed by processors.

It’s also worth noting that interchange rates are non-negotiable, whereas discount rates are 100% negotiable.

Are Merchant Discount Rates Really Discounted?

No, merchant discount rates are not really discounted.

The term “discount rate” was invented by processors to essentially make card acceptance sound more affordable. It’s a marketing ploy to make businesses think they’re getting a deal in the form of a discount—when in reality, it’s just another merchant processing fee.

Final Thoughts

I hope this guide helped shed some light on how discount rates work and added some clarity to what goes on every time your business accepts a card payment.

Think you’re paying too high of a discount rate? We can help.

Our team here at MCC can review your monthly statements to see if your processor is taking advantage of you. We can also help uncover other hidden fees and ultimately negotiate your discount rates directly with your processor.

Reach out for a free audit and analysis to get started.