Accepting credit cards is a must for every business in the modern era. But payment processing fees can add up quickly—and most companies are paying more than they should be to accept credit cards.

That’s why we created this guide.

Using our industry experience, we’ve compiled everything you need to know about reducing costs associated with credit card processing. The information below can help save you tens of thousands of dollars.

You’ll also find tons of links to other valuable resources on our website that expand on subjects in greater detail. Check those out if you want a deeper explanation of any terms or concepts you come across.

Types of Credit Card Processing Fees

On a high level, there are three main components to credit card processing fees—interchange, assessments, and markups. We’ll take a closer look at each of these below.

Interchange Fees

Interchange is assessed at the card network level. These transaction fees are non-negotiable and vary based on the card, merchant, and transaction environment.

For example, a Visa card and American Express card charged the exact same amount of money at the same business will likely be assessed two different interchange fees. A Visa rewards card will likely have a different interchange rate than a Visa business card.

Even the same exact card could be charged two different interchange fees, depending on the transaction environment (in-person vs. online).

Check out our Complete Guide to Interchange for a deeper explanation of how this works. You can find the latest interchange rates from different card networks here as well.

Assessment Fees

Interchange and assessment fees are both charged by the card networks. Every card has a specific assessment fee that’s tied to it, and it’s common for processors to markup the assessment fee.

Wells Fargo has an excellent Qualification Matrix resource that breaks down interchange rates and assessments for each individual card. It’s worth exploring if you want to see some specific examples.

Markup Costs

Your payment processor needs to make money to facilitate the transaction. To do so, they include built-in markup prices and additional fees associated with their services. Examples of markup costs include:

- Discount rate

- Authorization fee

- Per transaction fee

- Cancellation fees

- Statement fee

- IRS reporting fee

- Monthly fees

- PCI compliance fee

- PCI non compliance fee

- PCI regulatory fee

- Software fee

- Payment gateway fee

- Incidental fees

- CPU fee

- AVS free

- Terminal fee

Many of these fees can be eliminated from your statement.

5 Easy Steps to Lower Credit Card Processing Fees

Reducing your credit card fees might seem intimidating. But it’s actually fairly easy when you follow the proven five-step blueprint below.

- Audit Your Previous Statements

- Evaluate Your Contract

- Do Some Research

- Negotiate and Push Back

- Monitor Your Monthly Credit Card Fees

Even small business owners can handle this process and start saving money right away.

Step 1 – Audit Your Previous Statements

The first thing you need to do is look at your current credit card processing costs. Audit your last three statements and compare the discount rate, per transaction rate, authorization, monthly fees, and every other charge on the statement.

The goal here is to see if there is consistency and transparency. You should also look to see if a rate increase has occurred at any point. Knowing your baseline costs is critical to how much wiggle room you have in negotiations.

If you’re having trouble reading your statements, get a free audit and analysis from our team here at Merchant Cost Consulting.

Step 2 – Evaluate Your Contract

Pull out your contract and read the fine print. Find out if you’re still under contract and how much time is left remaining on the agreement.

Being under contract does not have an effect on a rate reduction. However, the term remaining on the contract will impact your ability to reduce existing fees.

For example, if you have less than six months remaining, you can reduce costs significantly. But if you have 24 or more months remaining, the savings may not be as prominent as you may have liked.

Step 3 – Do Some Research

If you’re reading this guide, you’re already doing your homework. You want to be as informed as possible about the different types of processing, pricing structures, your rates, and other rates offered on the market.

Identifying markup costs is key. That’s another area where you’ll be able to trim the fat and remove unnecessary fees from your monthly statement.

Education is going to be your biggest advantage when you get to the next step.

Step 4 – Negotiate and Push Back

Most businesses don’t realize this, but credit card processing is negotiable. The interchange and assessments imposed by the credit card networks are firm, but everything else is up for discussion.

Pick up the phone and call your processor. Use the information you’ve gathered in the previous steps to your advantage.

Most companies will tell you from the beginning that they can’t go any lower. But push back on that. This is just a negotiation tactic used to get you off the phone. They obviously don’t want to lower your rates because it hurts their profit margins. But they don’t want to lose your business either.

It may take two or three calls to get them to lower your rates, but keep fighting.

Step 5 – Monitor Your Monthly Credit Card Fees

Monitor your credit card merchant statements monthly. Most processors spike their rates quarterly, and some even do it as often as a monthly rate increase.

You need to be aware of this because lowering your credit card processing fees is only half the battle. You need to ensure that your pricing always stays low and never increases once you negotiate.

It requires a monthly audit in order to make sure that credit card merchant fees aren’t being increased. If a business is looking at a merchant processing statement with an untrained eye, rate increases are going to be impossible to detect. Merchant Cost Consulting is the only way to find each and every hidden fee on your merchant statement each month.

Tips to Reduce Processing Costs Without Switching Credit Card Processors

In addition to the steps above, there are a few tips and best practices you need to keep in mind as you’re going through this process—and you don’t need to switch your processor.

Always Negotiate

Always negotiate with your processor.

The more business you give them, the more leverage you have. So as your transaction volume increases, you should be able to talk down your rates.

Understanding your pricing structure, contract, fees, and educating yourself prior to negotiations will really help you avoid merchant fees. Most businesses just accept the costs presented by the processor and never try to negotiate. Even if your processor is increasing your rates, always try to push back and keep them as low as possible.

Maintain PCI Compliance

I’m sure you’ve seen the acronym “PCI” somewhere on your statement. It stands for “payment card industry.” The credit card companies have a set of security standards that you need to comply with.

Failure to comply with these data security standards can lead to hefty fees and penalties.

In many cases, your processor will help ensure that you’re set up to remain PCI compliant. However, some processors charge you for PCI compliance fees. That’s right. So you could be getting charged even if you’re compliant. Why? It seems like just another bogus charge that processors add in to inflate your bill. This is something that could be brought up during the negotiation process as well.

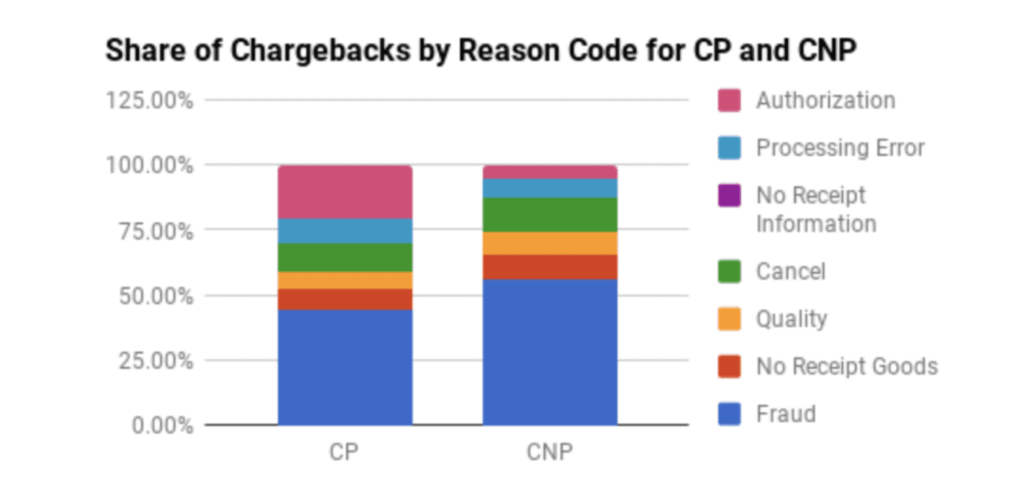

Reduce the Risk of Credit Card Fraud

High-risk merchants have higher processing costs.

Not only are the transaction fees higher, but you’ll also pay a chargeback fee and other fees associated with fraud. As you can see from the graph below, fraud is the number one chargeback reason for both card-present and card-not-present transactions.

Some merchant categories are at higher risk than others. But if you’re getting lots of chargebacks and multiple instances of fraud are committed at your business, it’s going to be a lot harder to negotiate.

Using an address verification service and other fraud scoring tools can help. Staying PCI compliant and avoiding EMV fallback will also help keep your rates low.

Additional Reading:

- How to Prevent Fraudulent Transactions

- Credit Card Verification Services Guide

- PCI Compliance Fees Explained

- EMV Fallback Fees Explained

Avoid Equipment Leases

Leasing your credit card hardware might sound enticing, especially for startups that don’t have a ton of cash on hand.

But leasing a terminal is a terrible idea. Leasing a single piece of equipment can cost you hundreds of dollars extra over the lifetime of the lease. At the end of the day, you’ll have nothing to show for it either; you won’t even own the hardware. Multiply this by all of the equipment required at each POS station across all of your locations; we’re talking about thousands of dollars in unnecessary costs.

Always buy your equipment outright. Financially speaking, it’s never in your best interest to lease hardware. You’ll just incur extra costs on your monthly statement.

Consult With an Expert

Working with an expert in the credit card processing space is the easiest way to lower your fees.

Here at Merchant Cost Consulting, we negotiate with credit card processors on behalf of our clients every day. We help identify the hidden fees and unnecessary fees that can be removed from statements. Our team also helps reduce transaction costs and markups imposed by the processor.

You do NOT need to switch processors to save money on credit card processing. This is not something that we recommend to our clients.

How Credit Card Processing Fees Work

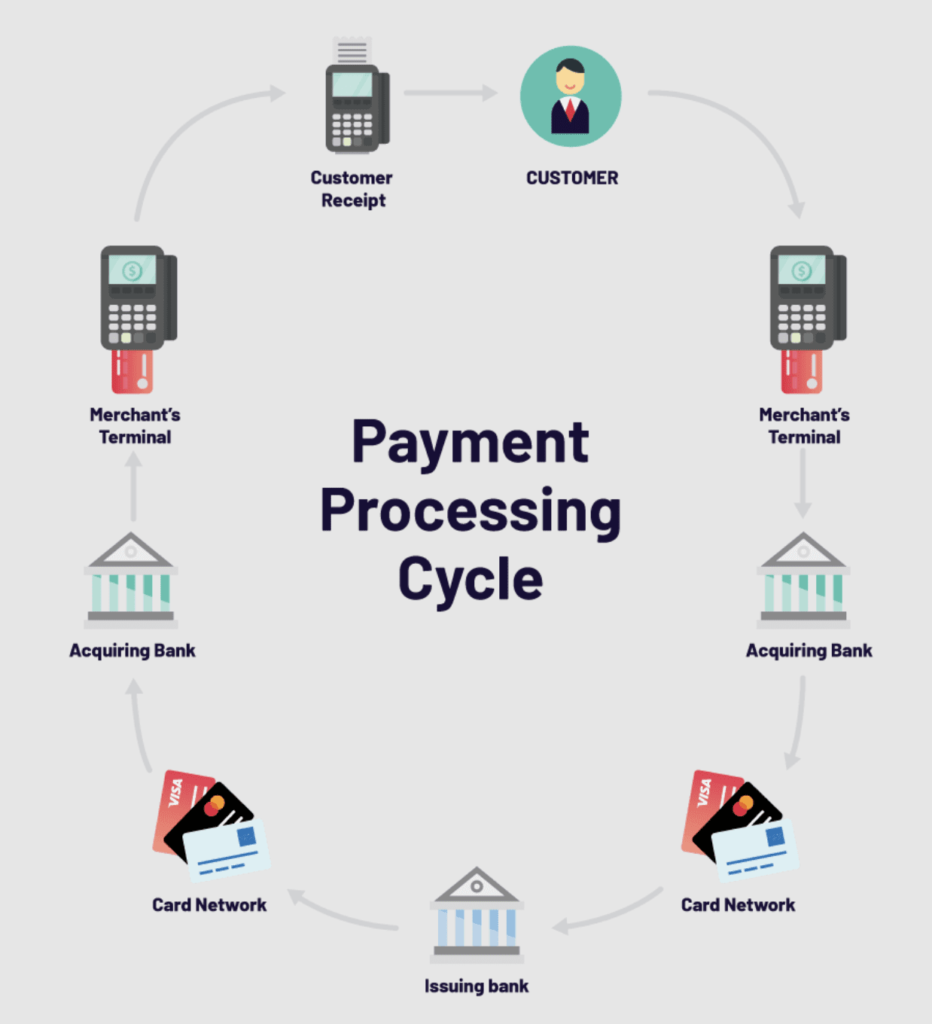

There is a lot that goes on behind the scenes when a business accepts a credit card payment from its customers. Within a split second, the credit card data and customer information gets processed through multiple channels and players within the card processing industry.

Here’s how it works.

Every entity that’s involved in the payment card industry needs to get paid for its role in processing credit card transactions. What might seem like money just changing hands between a customer and business is actually money going through multiple banks and third parties that facilitate the transaction.

Just look at the different players involved in the payment processing ecosystem:

There are different types of payment service providers, banks, and third parties that go beyond the business, customer, credit card processing company, and credit card networks.

All of these players want a piece of the pie.

Processing fees get passed to the merchant, as the business is paying for a service to accept payments. Many of these fees are justified since the companies helping you process payments should be paid for their efforts.

However, there are lots of credit card processing fees that are unnecessarily high and unjustifiable. Some businesses don’t realize that they’re paying fees that could easily be taken off of their monthly statements with a simple phone call.

Credit Card Processing Steps

Here’s a closer look at how money and information change hands within fractions of a second during a transaction:

- The cardholder buys goods or services from a business using a credit or debit card.

- The cardholder data gets transmitted through the merchant’s payment processor, which takes that information to the acquiring bank (the merchant’s bank). Note: Some payment processors double as acquirers.

- The acquiring bank captures the transaction data and forwards the info to the consumer’s credit card company (Visa, Mastercard, Amex, Discover).

- The issuing bank then requests approval, and the transaction is either approved or denied based on the status of the account and available funds. This is known as the authorization process.

- The issuer then sends the reply back to the network. If the transaction is approved, the issuing bank transmits an authorization code, and a hold gets put on the cardholder’s funds.

- The authorization code is forwarded from the card network to the acquiring bank.

- A response is routed to the merchant’s terminal.

At the end of the day, the merchant still needs to settle all of the sales and send that information to the payment processor. Then the money can change hands between the issuing bank and acquiring bank.

Here’s a visual representation of this process:

On the merchant’s side, you just see the funds deposited in your bank account—less the credit card processing fees.

Pricing Structures for Credit Card Processing

Most businesses have no idea that there are different pricing structures within the scope of card processing. They hear the lowest rate come out of a sales rep’s mouth, and that’s the provider they go with. This is not the best approach.

Interchange rates are constantly changing. There are lots of other moving parts to keep up with as well.

Below we’ll take a closer look at the five main types of credit card processing, listed in order from worst to best.

Tiered or Bundle Pricing

Tiered or bundle pricing is the worst structure for merchants. Stay as far away from this as possible.

Here’s a simple breakdown of how it works. A processor gives you three different rates that typically look like this:

- Qualified — 1.75%

- Mid-Qualified — 2.45%

- Non-Qualified — 3.25%

The card you take dictates the rate that’s charged. Simple, right? Wrong!

There’s a huge problem with tiered/bundle pricing. The processor dictates the bucket in which cards are charged. This allows them to make money hand over fist.

For example, the interchange rate for a debit card is often 0.05% + $0.22 per transaction. If you are on tiered/bundled pricing, the processor will categorize this card in a qualified bucket, charging you the qualified rate (1.75%). 1.75% is significantly more than 0.05% + $0.22 per transaction.

Flat-Rate Pricing

This is the second-worst pricing structure in credit card processing. The name is pretty self-explanatory—you’re charged a flat fee for every transaction.

Lots of businesses think this is a good idea because it’s easy and straightforward. But the flat fee is often significantly higher than the actual interchange rates imposed at the card level.

This is not cost-effective for your business, and your payment processing costs will add up quickly over time.

Let’s use the same interchange rate for a debit card of 0.05% + $0.22 per transaction as an example.

If you are on a flat-rate pricing plan, the processor will charge you a flat fee of 2.75%. That means the processor profits the difference of 2.75% and the cost of the interchange rate. This can be an extremely lucrative pricing model for credit card processing companies. Stay away at all costs.

BackBill/ERR Pricing

BackBill/ERR is another pricing structure that’s not cost-effective for merchants. This is a bit more outdated than others, but it’s still something we see here at MCC when we’re consulting with businesses.

Here’s how it works.

The processor sets an ERR rate during the application process. The true rates and fees you were charged each month don’t display on your monthly statements until the following month. That’s where the name “BackBill” comes from—and it’s an added headache.

For example, let’s say you accept a card with an interchange rate lower than 1.75%. Your business is charged 1.75%, and your credit card processing provider makes the difference between the two in profit. If you accept a card with an interchange rate higher than 1.75%, you are charged 1.75% plus an additional surcharge that was determined by your credit card processing provider.

Subscription or Membership Pricing

This is a relatively newer pricing structure in the payment processing industry. Depending on your monthly volume and the subscription cost, it could be a cost-effective way to accept card payments.

Here’s how it works. You pay a flat monthly fee to the processor to access certain transaction costs.

Stax Payments promotes this type of subscription rate:

With plans starting at $99 per month, you pay no markup on direct-cost interchange rates for up to $500,000 in processing.

So if your markup costs would normally be more than the monthly fee, it could be with it to consider this type of structure.

Interchange Plus Pricing

Interchange plus is the best pricing structure for merchants. It’s by far the most transparent and cost-effective option offered by credit card processing companies.

With this model, you’re charged the true interchange rate by the card network plus a markup by the processor.

If you’re looking to save the most money on credit card processing, this is the route for you. The processor markup can often be negotiated, which we’ll talk about in greater detail below.

Additional Reading: What is Interchange Plus Pricing?

Key Terms to Understand the Credit Card Processing Industry

Understanding payment processing terminology will ultimately make it easier for you to save money and lower costs.

Card Issuer

A card issuer is also known as the issuing bank. This is the entity that creates the physical piece of plastic for credit and debit cards. An example of a card issuing bank might be a Bank of America Debit card, Capital One Venture card, Chase Sapphire Reserve card—the list goes on and on.

Reach into your wallet and take out a credit card. The name of the bank or entity on the card is what we call the “card issuer.”

Card Network

There are four major credit card networks—Visa, Mastercard, Discover, and American Express.

Other card processing networks include UnionPay, JCB, Maestro, Interlink, STAR, SHAZAM, NYCE, Accel, Plus Interact, Visa ReadyLink, and Pulse. Picture the card networks as imaginary telephone wires that transfer credit and debit card data around the ecosystem.

Merchant

The merchant is the business itself. It might be a sole proprietor, LLC, Partnership, C-Corp, S-Corp, or non-profit. If you’re accepting credit card payments as a business, you are the merchant.

Acquirer

The acquiring bank is the merchant’s bank. So for most of you reading this right now, when we refer to the acquirer, we’re talking about YOUR bank.

It’s your bank’s job to collect the data from the credit card transaction when goods or services are purchased.

Read More: Acquiring Banks vs. Issuing Banks

Merchant Account

A merchant account is required for businesses to accept credit card payments and debit card payments. It’s essentially a line of credit because the business gets paid before the money is actually collected from the customer—similar to a short-term loan.

A merchant account lets a business accept payment on credit. But that money isn’t actually taken from the cardholder yet.

When a consumer buys something using a credit card, they’re not asked to pay it until the monthly statement comes. Even then, they don’t actually have to pay it in full.

Credit card merchant accounts don’t actually hold money. Instead, a customer’s payment passes through the credit card merchant account before being deposited into the business bank account. This happens after the transaction is approved, which typically occurs within 24-48 hours.

Big players like Visa and Mastercard don’t actually provide merchant accounts. Instead, they rely on credit card merchant processors, ISOs, banks, agents, and other third parties to sell, market, and service businesses. That’s where lots of credit card transaction fees are added in.

Credit Card Processor

A card processor, also known as a payment processor, is a third party that facilitates transactions for a business. These guys make credit card processing possible for businesses.

There are two types of card processors—direct processors and ISOs.

Examples of Direct Processors include:

- FISERV (formerly First Data)

- Worldpay (FIS)

- TSYS

- Global Payments

- Paya

- Paysafe

- Chase Paymentech

- Elavon

- American Express

- Heartland (Global)

Independent Sales Organization (ISO)

An ISO can sell credit card processing for as many direct processors as they want to. There are two types of ISOs—registered and unregistered.

An unregistered ISO is just a sales agent. They typically walk into a business, make cold calls, or email businesses trying to sell credit card processing services. A registered ISO is an actual independent company.

Some popular examples of ISOs include:

- CardConnect

- Vantiv

- Bank of America

- Wells Fargo

- Citibank

- Suntrust Bank

- BB&T

- Santander

- Moneris

- Cayan, now TSYS

- Merchant E Solutions

- IPayment

- North American Bancard

- Leaders Merchant Services

- Merchant Lynx

- Integrity

- EvO

- Sterling Payment Technologies

- BlueSnap

- Stax (formerly) Fatt Merchant

- Payment Depot

- Host Merchant Services

- Payment Cloud

Merchant Account Provider

A merchant account provider, also known as a merchant service provider, or MSP, is an organization that allows merchants to accept credit and debit cards.

They typically offer other card processing tools, like POS solutions and virtual terminals. Some might even provide industry-specific solutions, like inventory tracking tools.

The term “merchant account provider” is often synonymous with “credit card processor.” Some organizations just brand themselves differently.

Payment Gateway

Payment gateways are strictly for online businesses. They allow ecommerce companies to collect payments on the web.

Gateways take the card processing information, encrypt the data, and send the authorization request to the issuing bank through the direct processor or ISO.

Some examples of credit card merchant gateways:

- Authorize.net

- Braintree

- PayPal

- Stripe

- CardPointe

- USAePay

- PayEazy

- WePay

- BlueSnap

- PaySimple

- PayTrace

Payment Facilitator (PayFac)

Square, Stripe, PayPal, and Braintree are examples of PayFacs.

PayFacs offer credit card processing on sub-merchant platforms. This allows businesses to quickly sign up and accept credit cards without a lengthy underwriting process that gets performed on a regular basis.

It’s easier to accept payments using PayFacs, but the rates are often non-negotiable.

Final Thoughts on Lowering Credit Card Processing Fees

Are you ready to save money on credit card processing?

Whether you’re a business owner or a CFO, you can use this guide as a blueprint to lower your costs on credit and debit card transactions. You can follow the step-by-step instructions outlined article, as well as the pro tips and best practices that we covered. This will even help you eliminate processing fees that are deemed to be unnecessary.

If you need some assistance, contact our team here at Merchant Cost Consulting.

We’ll give you a free audit and analysis to let you know how much money you can save on processing—without switching processors.