Moneris is the largest merchant acquirer in Canada, serving 325,000+ points of commerce and processing over five billion transactions every year. From small businesses to enterprise ecommerce sites and everything in between, Moneris offers end-to-end payment solutions for virtually any Canadian business.

Whether you’re considering using Moneris for payment processing or you’re currently using Moneris and want to make sure you’re getting a good deal, this review will give you an insider perspective based on our first-hand experience dealing with Moneris on behalf of our clients.

MCC Quick Take on Moneris

If you’re looking solely at Canadian-specific processors, Moneris definitely ranks among the top options on the market. They have robust software, quality support, and we’ve seen them offer some really great rates for certain business types.

That said, no processor is perfect. And not every business has a great experience with Moneris.

Some sales reps are a bit aggressive and don’t offer the best rates. They’ll try to push flat-rate pricing on new accounts, especially smaller businesses, and this is never a good deal for you.

What We Like About Moneris

- Interchange-plus pricing is available.

- High-volume merchants accepting in-person payments can get a great deal.

- We don’t find too many hidden fees or bogus charges on statements we audit.

- Detailed statement breakdowns showing all interchange categories.

Where Moneris Falls Short

- Flat-rate pricing is expensive and should be avoided.

- Rate increases aren’t too frequent, but they do happen.

- High account setup fees.

- They advertise no cancellation penalties, but we’ve found early termination clauses on three-year contracts.

Moneris Pricing and Credit Card Processing Rates

Moneris offers two types of contract fee structures—flat-rate pricing and simplified pricing. The flat-rate pricing is exactly what you’d expect, and the “simplified pricing” is essentially interchange-plus, marketed to high-volume merchant accounts.

We’ll take a closer look at each one below:

Moneris Flat-Rate Pricing

If you’re on a flat-rate plan with Moneris, there are four different potential rates you could pay based on the transaction type:

- 2.65% + $0.10 per transaction — For in-person credit cards.

- $0.10 per transaction — Debit cards accepted in-person.

- 2.85% + $0.30 per transaction — For online transactions and phone payments.

- $1.00 per transaction — For debit cards accepted online or over the phone.

Believe it or not, these rates are actually lower than most of the standard flat-rate plans we see advertised in the US (which sometimes start closer to 2.9% + $0.10 per transaction for card-present sales and jump upwards of 3.4% + $0.30 for card-not-present transactions).

The fact that they only charge a $0.10 markup for in-person debit cards is great. That said, the rest of the flat-rate pricing offered by Moneris is still not a good deal.

If you’re a brand new business and don’t have a ton of volume, they may try to force you into this. Just don’t sign a long-term contract so you can get moved in interchange-plus as quickly as possible. High-volume merchants should never consider these plans, as flat-rate processing will eat into your profit margins.

Moneris Simplified Pricing

Do whatever you can to get a simplified pricing structure with Moneris. With this structure, you just pay the interchange rates and assessment fees charged by the card networks, plus a (smaller) markup per transaction to Moneris.

You’re getting wholesale rates, and if you’re a good negotiator, high-volume accounts can get pretty good deals.

The interchange-plus contracts with Moneris are completely customized for each account. Your rate will ultimately depend on your business type, risk level, MCC code, volume, and how nice your sales rep wants to be.

We typically see businesses paying between 30 to 55 basis points (0.30% to 0.50%) per transaction on credit cards. Debit cards are cheaper, ranging around $0.10 to $0.16 for in-person transactions.

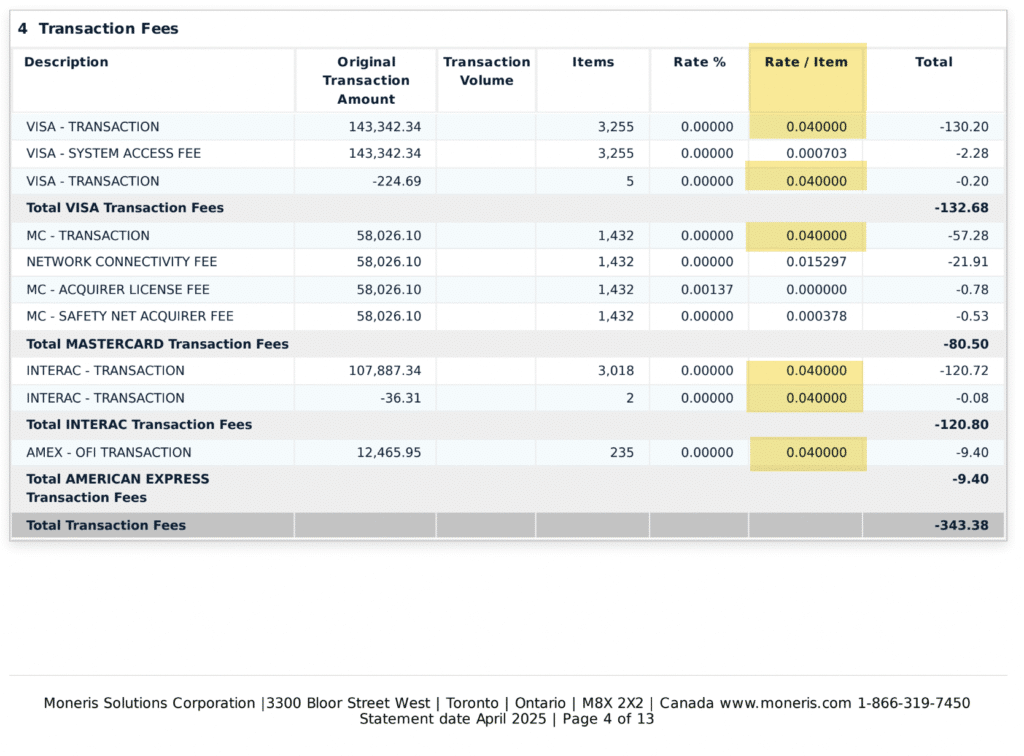

Here’s a rare instance of a business paying just $0.04 per transaction as a markup to Moneris:

Most merchants won’t qualify for a discount rate this good.

This particular business does a high volume of sales (over $320k during this specific month), and the vast majority of the transactions are in-person. They had zero chargebacks and only $261 in returns on $320k in net sales, which makes them a super low risk for Moneris.

Other Fees to Watch Out For

If you have the cash, it’s always better to purchase your equipment outright instead of renting it from Moneris. I’ve noticed that sales reps seem to be pushing the equipment rentals lately because it sounds appealing to businesses (a low monthly fee), when in reality, it’s pure profit for Moneris.

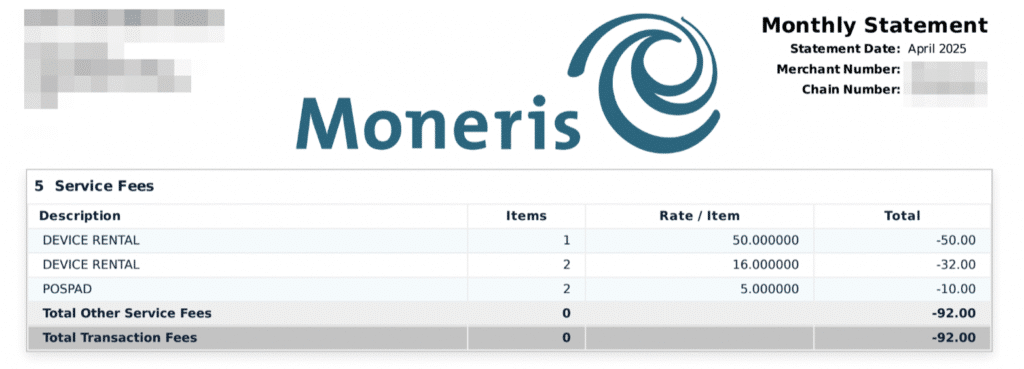

Equipment rentals range from $35 to $125 per month, depending on what you need. Here’s an example from one of our clients paying a bit less than the advertised rates currently on the Moneris website:

It may not seem like much, but at $92 per month, you’re paying over $1,100 on the year for devices that you could have likely purchased outright for the same or less.

Most businesses keep POS terminals for at least five years. So that’s over $5,500 in rental fees over that stretch, and you don’t even own the device when it’s all over.

This particular business only rents five terminals because they only have one location. But for multi-location businesses paying the current rates advertised by Moneris, you could easily be paying upwards of $750 to $1,500 per month in rental fees that could be avoided if you just purchase your terminals outright.

Latest Moneris Rate Increases, Updates, and Noteworthy News

Here’s a quick overview of the latest fee changes and updates from Moneris:

Moneris Rate Increase Effective September 2025

Moneris notified merchants of a rate increase effective September 1, 2025.

Credit card sales are being raised to 0.51% + $0.10 per transaction (up from 0.355% + $0.10), and the new debit card rate is $0.16 per transaction (up from $0.11).

This comes during the same month as new pass-through fees from the card networks are also being applied. So merchants may notice a significant change to their pricing.

RBC and BMO Consider $2 Billion Sale of Moneris

It’s being reported that the Royal Bank of Canada and Bank of Montreal are considering the idea of selling Moneris for $2 billion.

The two Canadian financial institutions currently own a 50/50 share of Moneris.

This conversation is still in the early stages and would obviously have some regulatory hurdles to pass (assuming all parties come to an agreement).

But this would be a landmark deal if it goes through, and definitely something that everyone in the payments space needs to keep a close eye on.

A Closer Look at Moneris Monthly Statements

It’s really important that you know how to read your monthly merchant statement. Statements from Moneris look intimidating at first glance because they’re filled with hundreds of different line items.

But this is actually a good thing. Moneris does a great job of giving a detailed breakdown of what you’re paying, including the interchange rates charged by the card networks, network assessment fees, markups paid directly to Moneris, and other Moneris service fees.

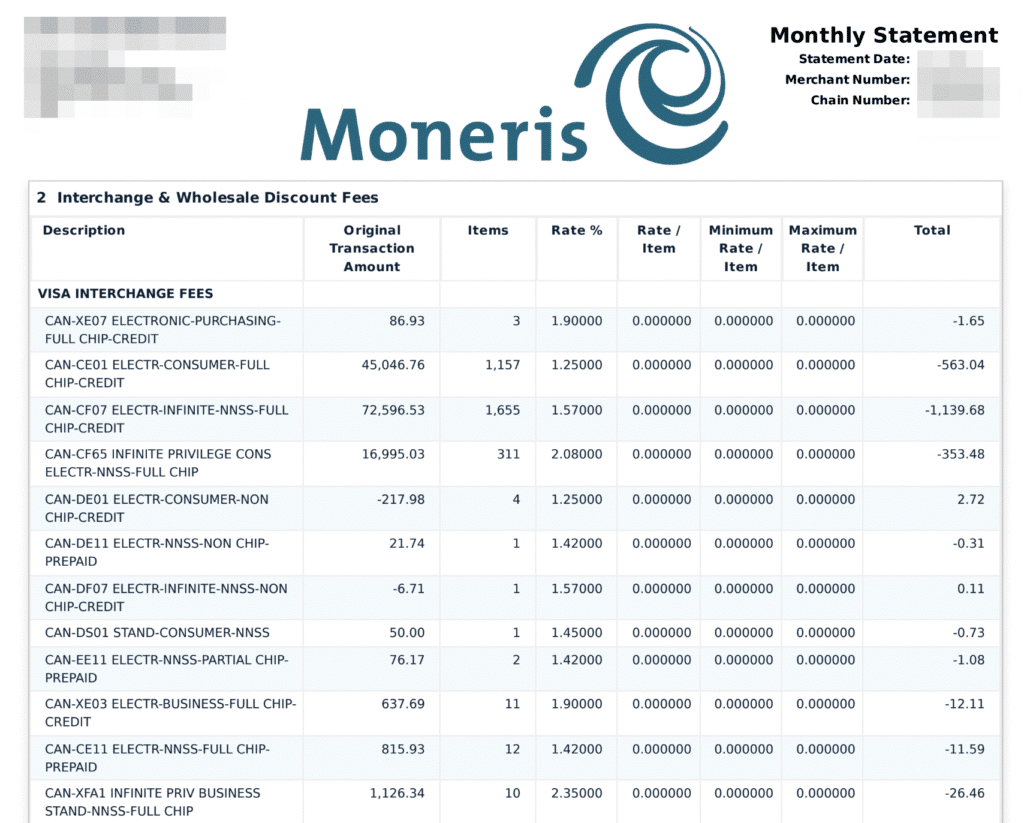

Here’s an example of what the interchange fees page looks like:

These rates are going directly to the Visa, and they match up with Visa’s interchange table. Moneris gives you this same information for Mastercard and Amex transactions as well.

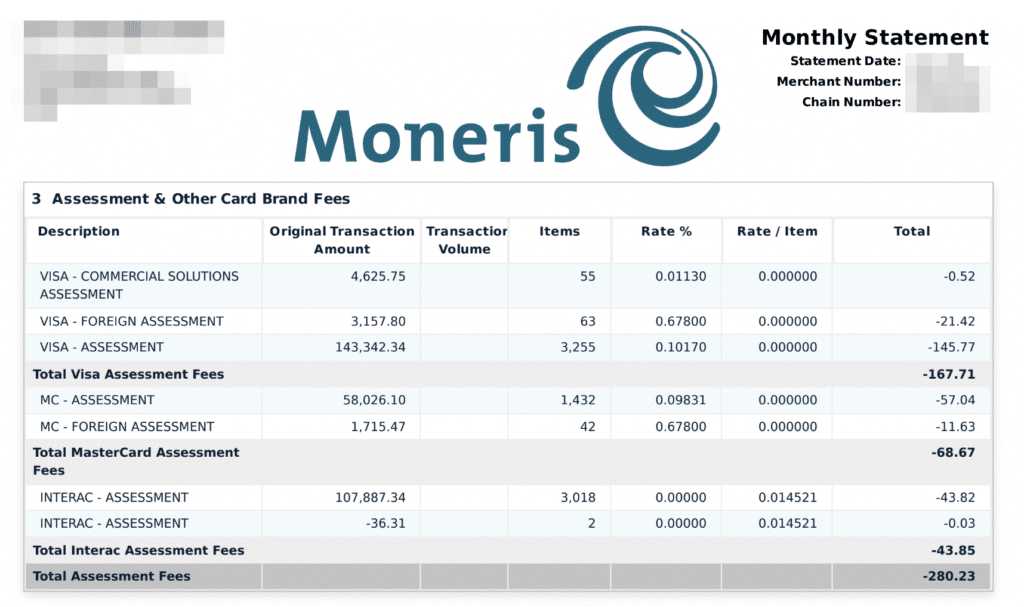

After all of the interchange rates, there’s a summary of network assessment fees in a single table.

You can see a breakdown for each card brand, including Interact debit assessments.

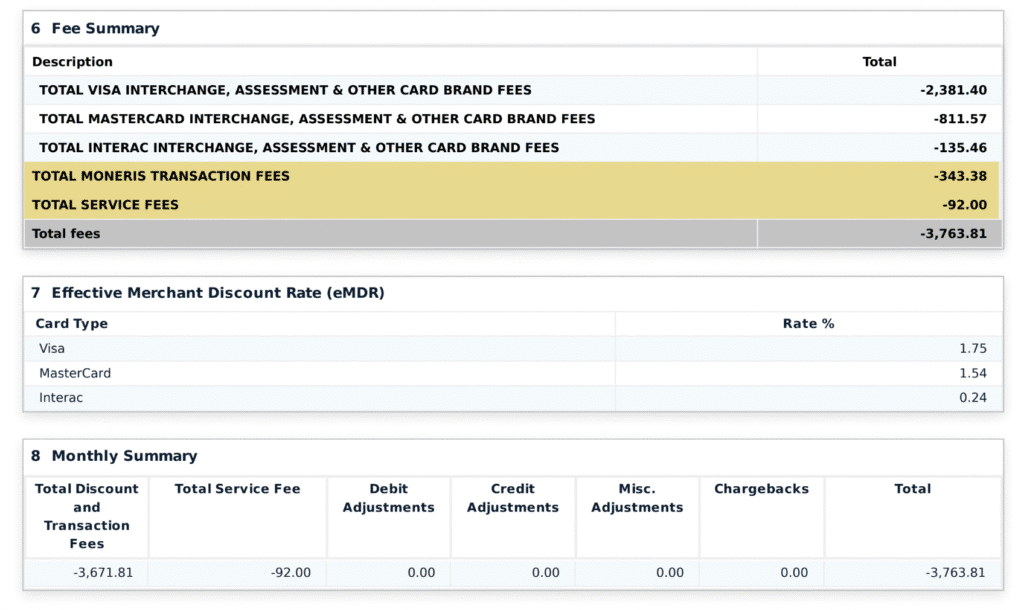

The most important part of the statement is the fee summary. This tells you the totals, including the sum of what you’re paying directly to Moneris.

The Total Moneris Transaction Fees and Total Service Fees are what’s going to Moneris. Everything else is passed through from the network. It’s super transparent.

Then they show you the total fees paid for the month (interchange, assessments, and markup), and even calculate your effective rate per card, which is a nice touch.

Always double-check these numbers. In this case, the math adds up. And we rarely catch mistakes like this on a Moneris statement.

But not every processor plays by the rules. Sometimes we’ll find an unethical processor that gives misleading information on statements to make it seem like you’re paying less than you actually are. So in short, you can’t always take their word for it (even though you usually can trust Moneris).

Our Final Thoughts on Moneris

Moneris is a solid Canadian payment processor. We’ve seen them offer some rock bottom rates to high-volume clients accepting cards in person. But also know that these rates can be significantly higher for some accounts, and you’ll eventually be hit with rate increases down the line.

Avoid flat-rate pricing with Moneris at all costs. Your sales rep will try to push its simplicity, but it’s a rip off (despite it being cheaper than other flat-rate processors).

If you’re currently using Moneris but think you’re overpaying, they’re definitely open to negotiations. And if you’re using another payment processor and thinking of switching to Moneris, you’re better off trying to negotiate a lower deal with them first before attempting to switch.

Having a merchant consultant on your side definitely helps with these negotiations. So whether you’re using Moneris or someone else, it’s worth getting a free audit to see where you can cut costs, without having to worry about switching processors or changing equipment.