If your business accepts credit cards, you probably have a basic understanding of interchange fees.

Interchange rates are set by the credit card companies. The fees are based on the category of each transaction, which is determined by factors like the merchant, card type, processing method, and other elements.

However, sometimes the transaction doesn’t include enough information, fails to meet certain requirements, or something else goes wrong. In these scenarios, the transaction moves or “downgrades” to another category.

As a result, merchants pay more for a transaction that’s been downgraded.

I created this guide to highlight some of the most common interchange downgrades. You’ll also learn more about what downgrades are, what causes them, and how to avoid them.

What Are Interchange Downgrades?

An interchange downgrade happens when a transaction fails to meet the lowest cost interchange category, automatically forcing it into the most expensive category set the by the card network.

Here’s how it works:

Every credit card transaction has a target interchange category. Your target interchange category has the lowest interchange fees, assuming everything goes according to plan. This will be the best-case scenario for your business.

When specific requirements aren’t met, not enough information is provided, or something else happens, a transaction can move from one category to another.

An interchange downgrade happens when this re-categorization occurs. As a result, you’ll incur extra interchange fees for the new category.

Interchange downgrades are somewhat of a complex subject. But if you don’t take the time to learn how they work, you could be throwing thousands of dollars away each year.

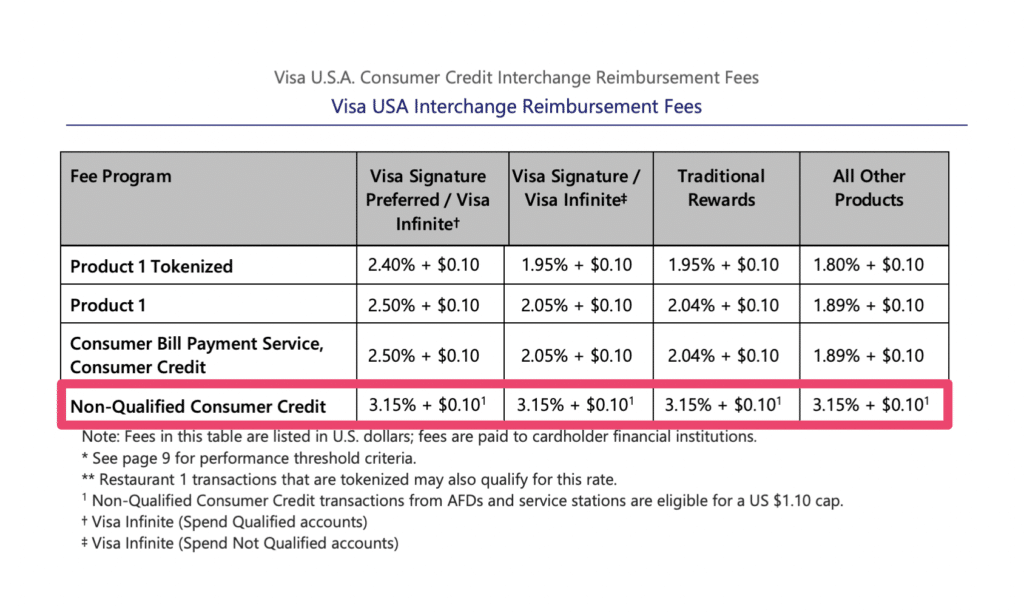

Visa Interchange Downgrades

Visa’s downgrade program is known as the Non-Qualified Consumer Credit Fee. This downgraded interchange rate is 3.15% + $0.10 per transaction, which is significantly higher than other Visa interchange rates.

Any transaction that does not meet the CPS criteria is subject to the new non-qualified interchange fees. They apply to both card present and card not present transactions as well.

3.15% + $0.10 is extremely high for an interchange category.

Remember, this is just what’s being charged by Visa at the card network level. When you factor in the assessment fees and processor markups, you could easily be paying over 4% to process these transactions.

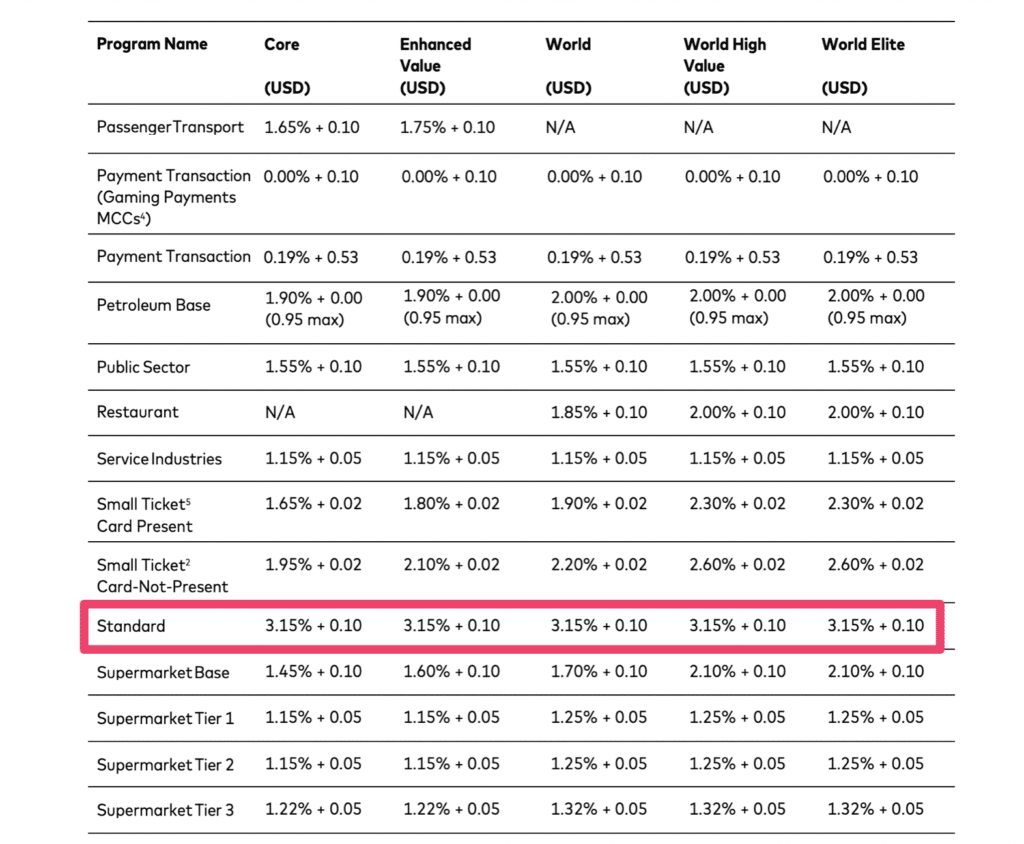

Mastercard Interchange Downgrades

Mastercard’s interchange downgrade is also subject to 3.15% + $0.10 per transaction.

It’s Mastercard’s “Standard” program category, and you can see how much more expensive it is compared to other Mastercard interchange categories:

As you can see, some Mastercard interchange rates are as low as 1.15% + $0.05 per transaction.

Its Standard downgrade is nearly triple that rate, and applies to all of the following card types:

- Mastercard Standard Core

- Mastercard Standard Enhanced

- Mastercard Standard World

- Mastercard Standard World High Value

- Mastercard Standard World Elite

If this happens once or twice, it’s not the end of the world. But imagine if you’re paying 3x the cost to accept every card transaction? It’s a major problem.

What Causes Interchange Downgrades?

There are certain scenarios that will automatically trigger an interchange downgrade. Before you can avoid an interchange downgrade, you need to understand what’s causing them in the first place.

Here are some of the most common for interchange downgrade scenarios:

Delayed Authorization

Also known as a “stale” authorization, this occurs when too much time passes between the initial authorization and the credit card settlement.

All credit card transactions must be settled for your business to receive funds from the transaction. If you wait too long to settle your transactions, the authorization will go stale. When this happens, a transaction can downgrade.

How much time you’re allowed before an authorization goes stale varies depending on the interchange qualification. But as a general rule of thumb, the majority of interchange categories require a settlement within 24 hours of a transaction occurring.

Mismatched Authorization

The sale amount must always match the authorization amount.

Let’s say a customer buys $100 worth of merchandise at your brick and mortar retail store. You obtain the authorization that’s required to approve the transaction. But then the customer decides they don’t want to buy one of the items. This change brings the sale total down to $75.

You must cancel the transaction and redo it. Otherwise, you can face a downgrade.

Poor Security

Payment processors and card networks take security measures very seriously. They require merchants to abide by certain security protocols to protect cardholders.

Your application of these security measures will impact your interchange category.

For example, let’s say you have an eCommerce store and forget to use an AVS (address verification system) to verify that the customer’s billing address matches the card used in the transaction. An interchange downgrade could occur as a result.

Missing Data

If you fail to submit the appropriate data for a transaction, it could automatically get downgraded to the most expensive interchange category.

This often happens when merchants are trying to submit Level 2 and Level 3 transaction data (that would theoretically result in lower rates). But some processors cheat the system and say that they’ll “automatically” capture this data for you to help you get lower rates.

Well, the card networks caught on to this. And that’s why automatic interchange optimization is ending.

So you’ll need to actually capture the right data and ensure it’s submitted properly to avoid a downgrade in these scenarios.

Outdated Software or Hardware

Sometimes it’s your terminal’s fault if your transactions are getting downgraded.

This can happen if your hardware is outdated or you’re using old software that isn’t up to date with the latest compliance standards. This usually results in missing data.

The card networks see this as increased risk for fraud and chargebacks, so they’ll penalize you, and downgrade your transactions.

How to Avoid Interchange Downgrades

Interchange downgrades can be expensive. Some interchange downgrades are over 1% higher than the target interchange category. That’s a ton of money.

If your business does $10 million in revenue, that’s an extra $100k in processing fees if your transactions are downgraded. Fees that could have easily been avoided.

Here are the best tips and best practices for avoiding interchange downgrades:

- Settle Batches Every Day – Delayed or “stale” authorizations are the leading cause of downgrades. Setting up batches to automatically settle daily can help you avoid this.

- Never Force Transactions – Don’t try to bypass security protocols on declined payments. This will almost always lead to a downgrade, and it increases your risk of fraud and chargebacks.

- Upgrade Your Equipment – If it’s been over five years since the last time you upgraded your terminal hardware, there’s a chance it’s ready to be replaced.

- Review Downgrade Reports – Ask your processor to send you any downgrade reports, which should explain the reason why your transactions are being downgraded to a more expensive interchange category.

- Audit Your Monthly Statements – Look at the interchange charges on your merchant statement to see how much you’re paying in interchange downgrades. This will help you understand whether it’s an ongoing problem or a one-off mistake.

There’s also the possibility that your processor isn’t being 100% truthful with your charges.

If you’re on a tiered or bundled pricing arrangement, they may say that your transactions are falling into a non-qualified bucket (the most expensive category).

There’s a huge difference here. Interchange downgrades come from the card networks and can’t be negotiated. But if your processor is determining the qualification, the categories are basically arbitrary and 100% negotiable.

You can have a professional merchant consultant review your statements to help you figure out exactly where the downgrade is coming from. If it’s your processor, you may be entitled to refunds or reduced rates moving forward.

Final Thoughts on Interchange Downgrades

Interchange downgrades are something that every business owner need to understand. Yet they are rarely talked about.

Downgrades can be a complex subject. Especially with the credit card brands and merchant account providers adjusting their fee schedules and making changes.

But these fractions of a percentage are significant. Interchange downgrades can be costly for merchants that process credit cards.

To learn more about how much money your business can save on credit card processing, contact our team here at Merchant Cost Consulting. We’ll review a recent credit card processing statement and give you a free audit. Our team has extensive experience working with merchant accounts in different categories and industries.