Visa Interchange Rates (2024)

Last Updated 3/1/2024

Visa is one of the most commonly accepted credit cards in the globe. Cardholders view Visa as a safe and reliable payment method.

Like every major card network, Visa imposes an interchange fee for each transaction paid with a Visa card. These fees vary based on a wide range of circumstances, such as the card type, merchant category code, data level, and more.

Unlike Discover, Visa is very transparent about its interchange fees and publishes the rates online. In fact, the entire list of every Visa interchange reimbursement fee can be viewed here.

With that said, this resource can be difficult to understand. It’s 23 pages long, and it’s comprised of more than a dozen different charts. To make things easier for you to understand, we created this guide as a quick resource to cover the most common Visa interchange fees.

Visa Interchange Fee Updates (Effective March 2024)

Beginning March 1, 2024, Visa will assess a $15 fee for any incoming chargeback reason code 1040 CNP that meets the Visa/Interlink pre-arbitration remedy conditions on behalf of the merchant.

Visa will also assess a $5 fee for each Visa/Interlink pre-arbitration CNP remedy for reason code 1040 processed by the merchant service provider to Visa.

Visa Interchange Fee Updates (Effective January 2024)

Effective January 2024, Visa is introducing new interchange fees and modifying existing interchange structures. Keep an eye on your monthly statements to see if these changes have affected your business. More details to follow.

New Visa Interchange Fee Updates Effective October 2023

According to an announcement by JP Morgan Chase, Visa is making significant changes to its interchange fee program—including new fee names and increased rates across various categories.

The following rates and new fees go into effect on October 13, 2023.

New Visa Small Ticket Interchange Fees

- Small Ticket Signature – 2.20% (minimum of $0.04)

- Small Ticket Infinite SNQ – 2.20% (minimum of $0.04)

New Visa Service Station and Government Small Ticket Fees

A rate of 1.65% + $0.04 per transaction will apply to the following new fee names:

- Small Ticket Traditional Rewards Sign Fuel Government

- Small Ticket Inf SNQ Fuel Government

New Visa Supermarket Interchange Rates and Fee Names

1.65% + $0.07 per transaction will apply to these new Visa supermarket categories:

- Supermarket Signature

- Supermarket Small Ticket Sign

- Supermarket Infinite Spend Non Qualified

- Supermarket Small Ticket Infinite Spend Non Qualified

Other new fees and increases for Visa Supermarket include:

- Supermarket Tier 0 Traditional / Traditional Rewards – 1.18% + $0.05

- Supermarket Tier 0 Signature / Infinite SNQ – 1.55% + $0.05

- Supermarket Tier 0 Signature Pref / Infinite SQ – $1.65% + $0.05

- Supermarket Tier 1 Traditional / Traditional Rewards – 1.20% + $0.05

- Supermarket Tier 1 Signature / Infinite Spend Non Qualified – 1.55% + $0.05

- Supermarket Tier 1 Signature Pref / Infinite Spend Qualified – 1.65% + $0.05

New Visa Taxi Fees and Interchange Rates

- Taxi Signature / Preferred MIN CNP – $0.08

- Taxi Signature / Preferred CNP – 2.70%

- Taxi Infinite SNQ MIN – $0.08

- Taxi Infinite SNQ CNP – $2.70%

- Taxi Signature / Preferred MIN – $0.04

- Taxi Signature / Preferred – 2.60%

- Taxi Infinite SNQ MIN – $0.04

- Taxi Infinite SNQ – 2.60%

New Visa Restaurant Fee Names and Interchange Rates

- Restaurant Signature / Preferred MIN CNP – $0.08

- Restaurant Signature / Preferred CNP – 2.70%

- Restaurant Infinite SNQ MIN – $0.08

- Restaurant Infinite SNQ CNP – $2.70%

- Restaurant Signature / Preferred MIN – $0.04

- Restaurant Signature / Preferred – 2.60%

- Restaurant Infinite SNQ MIN – $0.04

- Restaurant Infinite SNQ – 2.60%

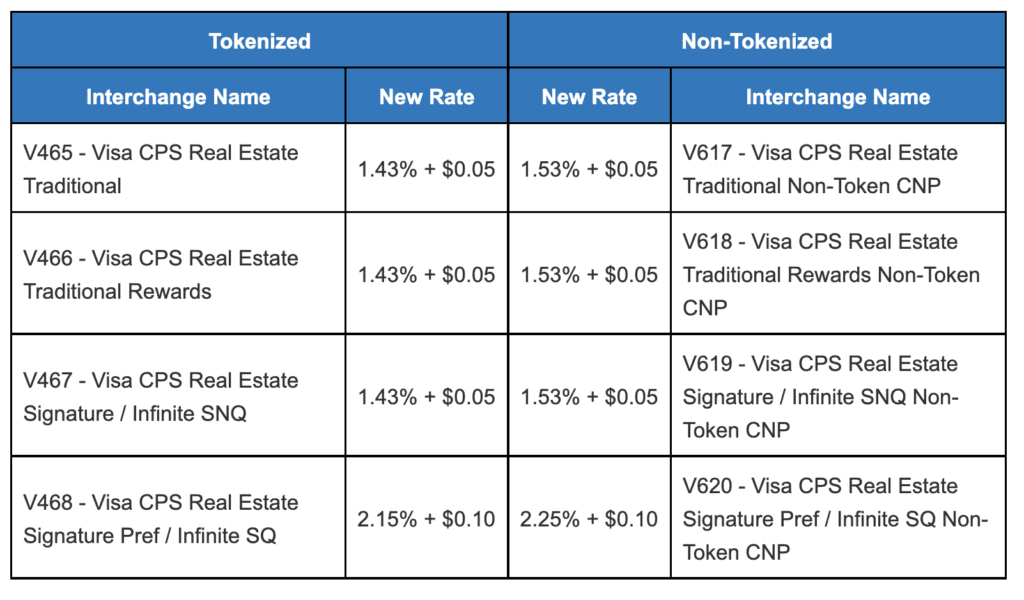

New Visa Real Estate Interchange Fees

- Real Estate Signature – 1.43% + $0.05

- Real Estate Infinite SNQ – 1.43% + $0.05

- Real Estate Signature CNP Non-Token – 1.53% + $0.05

- Real Estate Infinite SNQ CNP Non-Token – 1.53% + $0.05

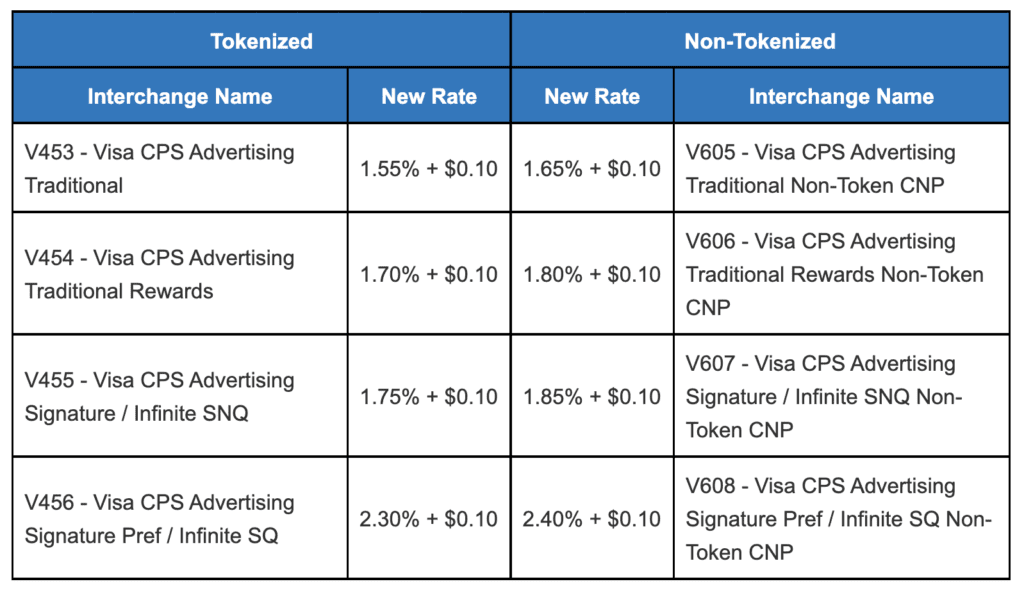

New Visa Advertising Interchange Fees

- Advertising Signature – 1.75% + $0.10

- Advertising Infinite SNQ – 1.75% + $0.10

- Advertising Signature CNP Non-Token – 1.85% + $0.10

- Advertising Infinite SNQ CNP Non-Token – 1.85% + $0.10

New Visa Healthcare Interchange Fees

- Healthcare Signature – 1.43% + $0.05

- Healthcare Infinite SNQ – 1.43% + $0.05

- Healthcare Signature CNP Non-Token – 1.53% + $0.05

- Healthcare Infinite SNQ CNP Non-Token – 1.53% + $0.05

New Visa Telecom and Cable Interchange Fees

- Tele/Cable Traditional Rewards Sign – 1.43% + $0.05

- Tele/Cable Infinite SNQ – $1.43% + $0.05

- Tele/Cable Infinite SNQ Non-Token CNP – 1.53% + $0.05

New Visa Education Interchange Fees

- Education Signature – 1.43% + $0.05

- Education Infinite SNQ – 1.43% + $0.05

- Education Signature CNP Non-Token – 1.53% + $0.05

- Education Infinite SNQ CNP Non-Token – 1.53% + $0.05

New Visa Insurance Interchange Fees

- Insurance Signature – 1.43% + $0.05

- Insurance Infinite SNQ – 1.43% + $0.05

- Insurance Signature CNP Non-Token – 1.53% + $0.05

- Insurance Infinite SNQ CNP Non-Token – 1.53% + $0.05

New Visa Small Merchant Interchange Fees

- Small Merchant Product 1 Signature CNP – 1.73% + $0.10

- Small Merchant Product 1 Infinite SNQ CNP – 1.73% + $0.10

- Small Merchant Product 2 Signature CNP – 1.43% + $0.10

- Small Merchant Product 2 Infinite SNQ CNP – 1.43% + $0.10

New Visa Travel Interchange Rates and Fee Names

- Travel Signature – 2.25% + $0.10

- Travel Infinite SNQ – 2.25% + $0.10

- Travel Infinite SQ – 2.55% + $0.10

New Visa Retail Interchange Rates and Fee Names

- Retail Tier 1 Signature – 1.65% + $0.10

- Retail Tier 1 Infinite Spend Non Qualified – 1.90% + $0.10

- Retail Tier 1 Signature Pref – 2.10% + $0.10

- Retail Tier 1 Infinite Spend – 2.30% + $0.10

- Retail Tier 2 Signature – 1.65% + $0.10

- Retail Tier 2 Infinite Spend Non Qualified – 1.90% + $0.10

- Retail Tier 2 Signature Pref – 2.10% + $0.10

- Retail Tier 2 Infinite Spend – 2.30% + $0.10

- Retail Tier 3 Signature – 1.65% + $0.10

- Retail Tier 3 Infinite Spend Non Qualified – 1.90% + $0.10

- Retail Tier 3 Signature Pref – 2.10% + $0.10

- Retail Tier 3 Infinite Spend – 2.30% + $0.10

Other New Visa Fees and Interchange Rates

- Product 1 Signature CNP – 2.05% + $0.10

- Product 1 Infinite SNQ CNP – 2.20% + $0.10

- Product 1 Infinite SQ CNP – 2.60% + $0.10

- Product 1 Signature Token CNP – 1.95% + $0.10

- Product 1 Infinite Token SNQ CNP – 2.10% + $0.10

- Product 1 Infinite Token SQ CNP – 2.50% + $0.10

- PRoduct 2 Signature – 1.65% + $0.10

- Product 2 Infinite SNQ – 1.90% + $0.10

- Product 2 Infinite SQ – 2.30% + $0.10

New Visa Network Fee Effective October 2023

Visa is introducing a new Digital Commerce Service Fee on card not present transactions. The fee is 0.0075% with a $0.0075 minimum per transaction.

Visa Interchange Updates Effective April 2023

Visa is introducing a new Card Verification Value 2 fee that will go into effect on April 1, 2023. This new assessment fee is $0.0025 and will be assessed whenever the CVV2 results code displays a match (M) or no match (N).

Increased Visa Merchant Response Fees For Disputes

Visa is increasing its Merchant Response Days fee, which is assessed based on when a merchant responds to a dispute. Valid responses include a response that a credit has been issued, evidence has been provided, or a rebuttal has been submitted.

Merchants that respond within 21-25 days will be assessed a $1.75 fee per item (up from $1.35). Merchants responding in 26-30 days will be assessed a $2.15 fee per item (up from $1.65).

Visa is also increasing its dispute no acceptance fee to $1.00 (up from $0.75). This fee will be assessed per item when merchants accept liability of a dispute after the 30-day cycle.

A $5 fee per dispute case will be assessed if pre-arbitration is initiated for a qualified remedy responses. The new Visa case filing fee is increasing to $12.50 (up from $10.00) for all outgoing compliance cases and arbitration cases.

New Visa Surcharging Rules

Visa has recently implemented a new rule regarding its credit card surcharging policies. Effective 4/15/2023, the maximum allowable surcharge for Visa transitions in the US and US territories is decreasing to 3% per transaction.

This only applies to states and locations where credit card surcharging is legal, and it’s the merchant’s responsibility to comply with all local laws.

Additional Visa Rate Increases and Fee Updates Effective April 2023

Other changes to Visa’s interchange rates and fees effective April 2023 include:

- $0.15 – For each manual cash transaction at cash advance merchants

- $0.10 – For each magstripe data contactless transaction

- $0.0025 – For each “no match” result when CVV2 verification is performed

- 0.02% – Per approved estimated authorization

- 0.02% – Per approved incremental authorization

New Visa Interchange Rates and Updates

Visa is introduced new interchange rates and program changes effective 10/1/2022. We’ll take a closer look at these updates below:

B2B Virtual Payments Program Updates

Visa’s B2B Virtual Payments Program is made for wholesale travel purchases. Here’s a look at the new program IDs and rates:

- Program 8 (A8) – 0.90%

- Program 9 (A9) – 1.10%

- Program 10 (B1) – 1.30%

- Program 11 (B2) – 1.50%

- Program 12 (B3) – 1.70%

- Program 13 (B4) – 1.90%

The following 11 MMCs (merchant category codes) are eligible for the program:

- Taxi & Limo Service (4121)

- Local Commuter Passenger Transportation (4111)

- Transportation Services (4789)

- Restaurants (5812)

- Drinking Places (5813)

- Fast Food (5814)

- Florists (5992)

- Movie Theaters (7832)

- Ticketing Agencies (7922)

- Public Golf Courses (9399)

- Government Services (9399)

New Flexible B2B Virtual Interchange Program

In addition to the updates above, Visa is rolling out a new Flexible B2B product worldwide (except in Canada). All MCCs are eligible for the program with qualifying purchases made on Visa’s new virtual card product.

Here are the new program rates:

- Flexible B2B Program 1 (A1) – 0.80%

- Flexible B2B Program 2 (A2) – 1.00%

- Flexible B2B Program 3 (A3) – 1.20%

- Flexible B2B Program 4 (A4) – 1.40%

- Flexible B2B Program 5 (A5) – 1.60%

- Flexible B2B Program 6 (A6) – 1.80%

- Flexible B2B Program 7 (A7) – 2.00%

- Flexible B2B Program 8 (A8) – 0.90%

- Flexible B2B Program 9 (A9) – 1.10%

- Flexible B2B Program 10 (B1) – 1.30%

- Flexible B2B Program 11 (B2) – 1.50%

- Flexible B2B Program 12 (B3) – 1.70%

- Flexible B2B Program 13 (B4) – 1.90%

New Commercial Large Ticket Interchange Program in Canada

Visa launched a new Large Ticket Interchange Program that strictly applies to Canada. The interchanges rates below apply to Corporate cards, Purchasing cards, Fleet cards, and Virtual B2B cards:

- Commercial Large Ticket 1 – 1.30%

- Commercial Large Ticket 2 – 1.00%

The first rate applies to transactions between $100,000 and $249,999.99 CAD, and the latter applies to all transactions of $250,000 CAD or higher.

New Visa Flexible Credential Prepaid Consumer Card

Visa’s Flexible Consumer Credential Prepaid Card is going to be issued to consumers in Asia Pacific and CEMEA. But the cards can be accepted worldwide.

All sales and refunds with the new flexible card are eligible for Visa’s current interregional interchange rates, as well as new Asia Pacific and CEMEA rates:

- Interregional Premium – 1.80%

- Interregional Mainland China In-Person – 0.45%

- Interregional UK & EAA In-Person Electronic – 0.20%

- Interregional UK & EAA Card Not Present – 1.15%

- Interregional UK & EEA Credit Voucher/Refund – 0%

- AP Regional Mainland China In-Person – 0.45%

- AP Regional Flex Consumer Prepaid – 1.88%

- AP Regional Alternative Flex Consumer Prepaid – 1.88%

- AP Regional Downgrade Flex Consumer Prepaid – 1.93%

- CEMEA Regional Flex Consumer Prepaid – 1.95%

- CEMEA Regional Alternative Flex Consumer Prepaid – 2.05%

- CEMEA Regional Downgrade Flex Consumer Prepaid – 2.10%

The MCCs below are NOT eligible for the program’s acceptance:

- Money Transfer (4829)

- Financial Institutions (6010, 6011, 6012)

- Non-Financial Institutions (6051, 6540)

- Security Brokers and Dealers (6211)

- Dating Services (7273)

- Government Lottery (7800)

- Government Lottery non-US (9406)

- Government Online Casino (7801)

- Government Horse/Dog Racing (7802)

- Betting (7995)

Visa has announced some major changes coming as of April 22, 2022. Here’s a closer look at what you can expect moving forward.

Visa Declined Transaction Fees Effective October 2022

Visa is assessing a $1 fee per declined transaction to merchants submitting authorization requests on recurring transactions if the previous three attempts on the same recurring transaction were declined.

They will also assess a $0.02 per line item fee for each merchant on the system integrity billing detailed report.

New Visa Interchange Rates and Fee Increases – Updated For April 2022

Visa announced some major changes effective April 22, 2022. Here’s a closer look at what you can expect moving forward.

Retail Keyed Entry Interchange Updates

Effective 4/22/2022, transactions with cardholder information on file will no longer qualify for the keyed entry interchange program. These will qualify for other interchange rates, based on the eligible transaction criteria.

Consumer Credit Fee Program Updates

Effective 4/22/2022, Visa is establishing new rates for the the following interchange categories:

- V481 – Card-Not-Present Restaurant Traditional / Rewards – 2.10%

- V483 – Card-Not-Present Restaurant Traditional / Rewards MIN – $0.04

- V483 – Card-Not-Present Restaurant Signature / Preferred / Infinite – 2.60%

- V48T – Card-Not-Present Restaurant Signature / Preferred / Infinite MIN – $0.04

- Non Qualified Consumer Credit – 3.15% + $0.10*

*Max $1.10 for MCC codes 5531 and 5542

Visa New Fee Changes Effective April 22, 2022

- Visa Recurring Utility Bill Payment Debit / Prepaid – $0.45

- Visa Recurring Business Utility Bill Payment Debit / Prepaid – $0.75

- Visa Utility Debit (non-recurring) – $0.65

- Visa Business Utility Debit / Prepaid (non-recurring) – $1.50

- New Address Verification Service Fee for card-not-present transactions – $0.001 per usable AVS result

Common Visa Interchange Rates and Fees

To improve the readability of this guide, I’ve segmented the common interchange fees into various categories. You can easily browse, scan, and search for the ones that you’re looking for below.

Visa Threshold Criteria for Retail and Supermarkets

Before we dive into the common fees, it’s important to understand how Visa categorizes certain transactions. Visa segments some merchants into threshold categories based on 12 months of activity.

Your transaction minimum and volume can impact your interchange rates. These are the latest thresholds for retailers:

- Threshold I — 118.7 million transaction minimum; $8.21 billion volume minimum

- Threshold II — 76.7 million transaction minimum; $4.39 billion volume minimum

- Threshold III — 17.1 million transaction minimum; $995 million volume minimum

The thresholds are clearly labeled on the interchange fee tables. If you don’t fall into one of these categories, you can use the other rates to determine your fees.

Here’s a look at the latest Visa’s Supermarket Performance Tiers:

Visa Card Present Credit Interchange Fees for Supermarkets

- Supermarket Credit Tier 0 Signature Preferred / Infinite — 1.40% + $0.05

- Supermarket Credit Tier 0 Signature / Infinite — 1.40% + $0.05

- Supermarket Credit Tier 0 Traditional Rewards 1.15% + $0.05

- Supermarket Credit Tier 0 Other — 1.15% + $0.05

- Supermarket Credit Tier I Signature Preferred / Infinite — 1.55% + $0.05

- Supermarket Credit Tier I Signature / Infinite — 1.50% + $0.05

- Supermarket Credit Tier I Traditional Rewards— 1.15% + $0.05

- Supermarket Credit Tier I Other — 1.15% + $0.05

- Supermarket Credit Tier II Signature Preferred / Infinite — 1.65% + $0.05

- Supermarket Credit Tier II Signature / Infinite — 1.55% + $0.05

- Supermarket Credit Tier II Traditional Rewards — 1.22% + $0.05

- Supermarket Credit Tier II Other — 1.22% + $0.05

- Supermarket Credit Tier III Signature Preferred / Infinite — 1.75% + $0.05

- Supermarket Credit Tier III Signature / Infinite — 1.60% + $0.05

- Supermarket Credit Tier III Traditional Rewards — 1.22% + $0.05

- Supermarket Credit Tier III Other — 1.22% + $0.05

Visa Card Present Credit Interchange Fees for Retail

- Retail Credit Performance Threshold I Preferred / Infinite — 2.10% + $0.10

- Retail Credit Performance Threshold I Signature / Infinite — 1.65% + $0.10

- Retail Credit Performance Threshold I Traditional Rewards — 1.43% + $0.10

- Retail Credit Performance Threshold I Other — 1.43% + $0.10

- Retail Credit Performance Threshold II Signature Preferred / Infinite — 2.10% + $0.10

- Retail Credit Performance Threshold II Signature / Infinite — 1.65% + $0.10

- Retail Credit Performance Threshold II Traditional Rewards — 1.47% + $0.10

- Retail Credit Performance Threshold II Other — 1.47% + $0.10

- Retail Credit Performance Threshold III Signature Preferred / Infinite — 2.10% + $0.10

- Retail Credit Performance Threshold III Signature / Infinite — 1.65% + $0.10

- Retail Credit Performance Threshold III Traditional Rewards — 1.51% + $0.10

- Retail Credit Performance Threshold III Other — 1.51% + $0.10

- Product 2 Signature Preferred / Infinite — 2.10% + $0.10

- Product 2 Signature / Infinite — 1.65% + $0.10

- Product 2 Traditional Rewards — 1.65% + $0.10

- Product 2 Other — 1.51% + $0.10

- Small Ticket Signature Preferred / Infinite — 2.20%

- Small Ticket Signature / Infinite — 2.20%

- Small Ticket Traditional Rewards — 1.90%

- Small Ticket Other — 1.90%

*there is a $0.04 minimum on all small ticket transactions in this category

Other Common Visa Interchange Rates

Let’s take a closer look at some industry-specific categories for Visa credit cards.(Rates and screenshots courtesy of Chase Payment Solutions and Visa USA Interchange Reimbursement Fees)

CPS/Recurring Payments — MCCs 4184 (Telco) and 4899 (Cable)

- Visa Signature Preferred / Infinite — 2.20% + $0.05

- Visa Signature / Infinite — 1.43% + $0.05

- Visa Traditional Rewards — 1.43% + $0.05

- Other — 1.43% + $0.05

The following Telco and Cable Interchange rates for Card-Not-Present transactions:

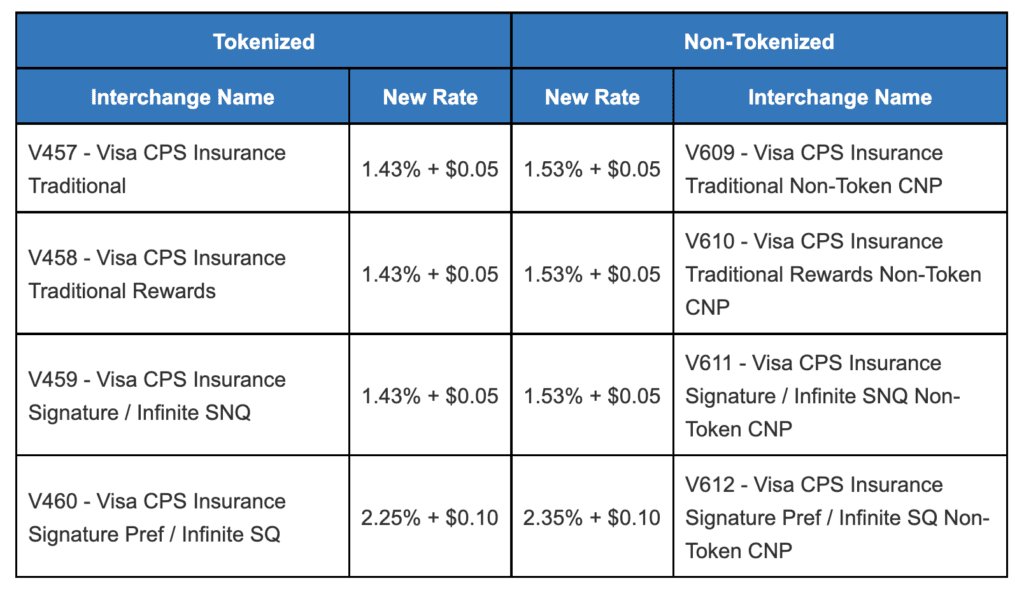

Insurance

- Visa Signature Preferred / Infinite — 2.25% + $0.10

- Visa Signature / Infinite — 1.43% + $0.05

- Visa Traditional Rewards — 1.43% + $0.05

- Other — 1.43% + $0.05

Rates for Insurance Card-Not-Present transactions:

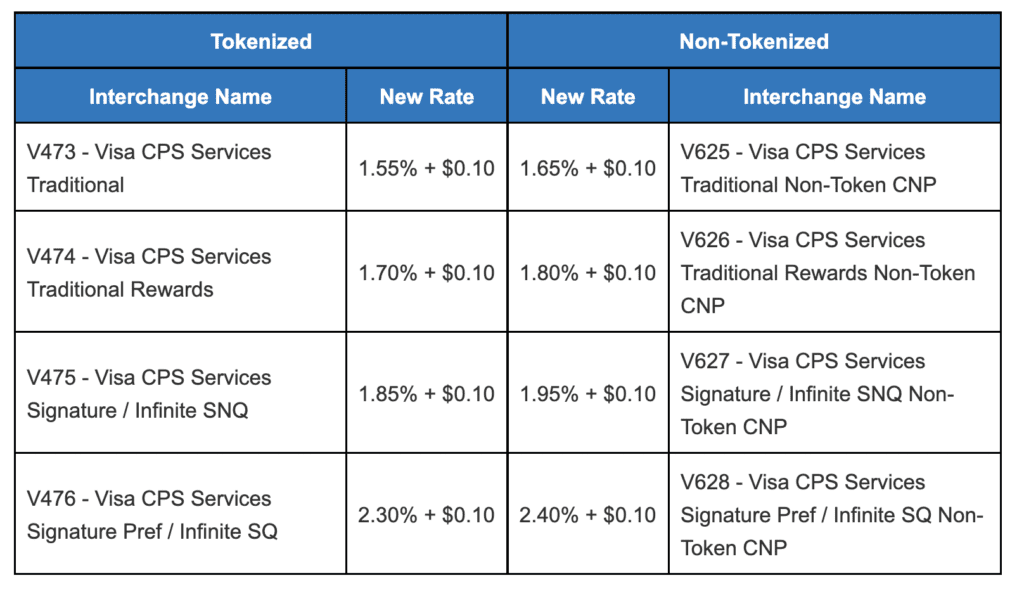

Services

- Visa Signature Preferred / Infinite — 2.30% + $0.10

- Visa Signature / Infinite — 1.85% + $0.10

- Visa Traditional Rewards — 1.70% + $0.10

- Other — 1.55% + $0.10

*these rates apply to transactions >=$100

Services Card-Not-Present transaction rates:

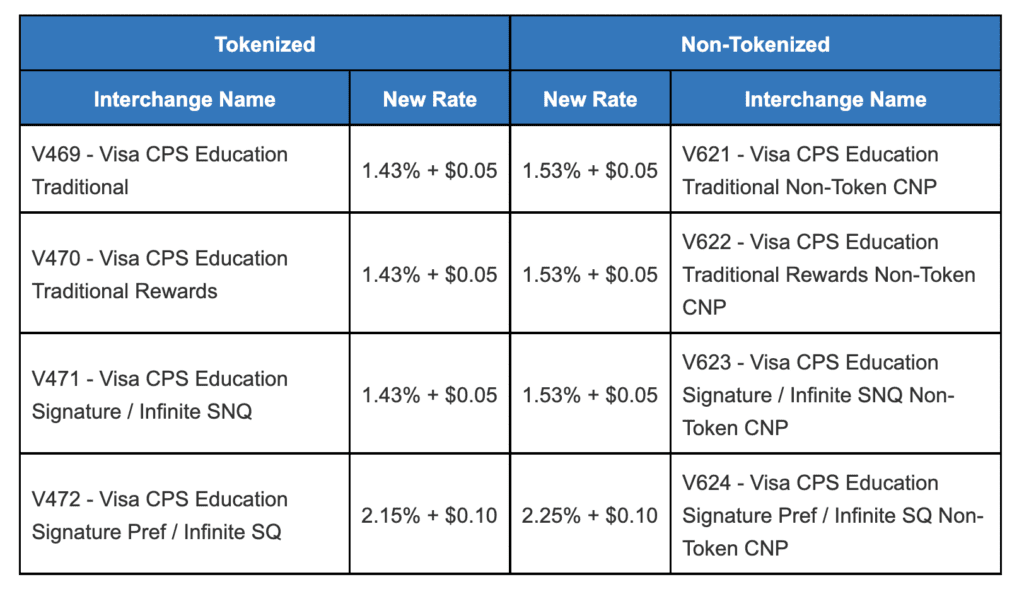

Education

- Visa Signature Preferred / Infinite — 2.15% + $0.10

- Visa Signature / Infinite — 1.43% + $0.05

- Visa Traditional Rewards — 1.43% + $0.05

- Other — 1.43% + $0.05

*these rates apply to transactions >=$500

Education Card-Not-Present transaction rates:

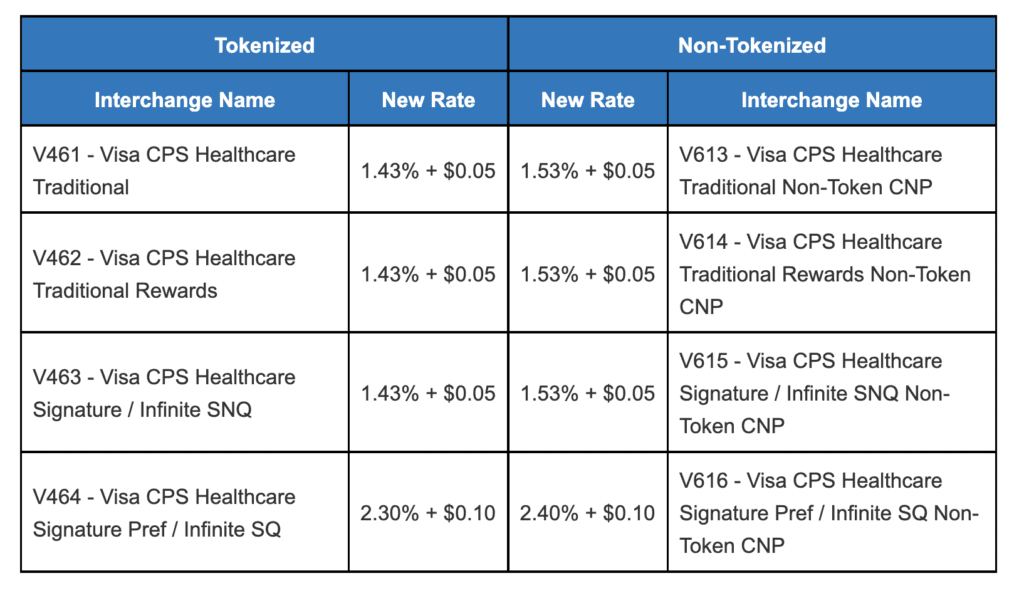

Healthcare

- Visa Signature Preferred / Infinite — 2.30% + $0.10

- Visa Signature / Infinite — 1.43% + $0.05

- Visa Traditional Rewards — 1.43% + $0.05

- Other — 1.43% + $0.05

*these rates apply to transactions >=$500

Healthcare Card-Not-Present transaction rates:

Real Estate

- Visa Signature Preferred / Infinite — 2.15% + $0.10

- Visa Signature / Infinite — 1.43% + $0.05

- Visa Traditional Rewards — 1.43% + $0.05

- Other — 1.43% + $0.05

*these rates apply to transactions >=$500

Updated Real Estate Card-Not-Present Transactions Rates:

Advertising

- Visa Signature Preferred / Infinite — 2.30% + $0.10

- Visa Signature / Infinite — 1.75% + $0.10

- Visa Traditional Rewards — 1.70% + $0.10

- Other 1.55% + $0.10

Rates for Visa Advertising Interchange Card-Not-Present transactions:

CPS/Charity and Religious Organizations

- All Visa Credit Cards — 1.35% + $0.05

CPS/Government

- All Visa Credit Cards Products — 1.55% + $0.10

Fuel

- All Visa Credit Cards — 1.15% + $0.25

*there is a $1.10 cap on all Fuel transactions

Service Station and Government Small Ticket

- All Visa Credit Cards — 1.65% + $0.04 1.65% + $0.04 1.65% + $0.04

CPS/Utility

- All Visa Credit Cards — $0.75

Travel

- Signature Preferred / Visa Infinite — 2.40% + $0.10

- Signature / Visa Infinite — 2.25%+$0.10

- Traditional Rewards — 1.95% + $0.10

- All Other Products — 1.75% + $0.10

Taxi 2

- Signature Preferred / Visa Infinite — 2.60%

- Signature / Visa Infinite — 2.60%

- Traditional Rewards — 2.10%

- All Other Products — 2.10%

*there is a $0.04 minimum on all Taxi 2 transactions

Taxi 1

- Signature Preferred / Visa Infinite — 2.70%

- Signature / Visa Infinite — 2.70%

- Traditional Rewards — 2.20%

- All Other Products — 2.20%

*there is a $0.08 minimum on all Taxi 2 transactions

Restaurant 2

- Signature Preferred / Visa Infinite — 2.60%

- Signature / Visa Infinite — 2.60%

- Traditional Rewards — 2.10%

- All Other Products — 2.10%

*there is a $0.04 minimum on all Restaurant 2 transactions

Restaurant 1

- Signature Preferred / Visa Infinite — 2.70%

- Signature / Visa Infinite — 2.80%

- Traditional Rewards — 2.20%

- All Other Products — 2.20%

*there is a $0.08 minimum on all Restaurant 1 transactions

Product 1

- Signature Preferred / Visa Infinite — 2.40% + $0.10

- Signature / Visa Infinite — 1.95% + $0.10

- Traditional Rewards — 1.95% + $0.10

- All Other Products — 1.80% + $0.10

Non-Qualified Consumer Credit

- All Visa Credit Cards — $2.70 + $0.10

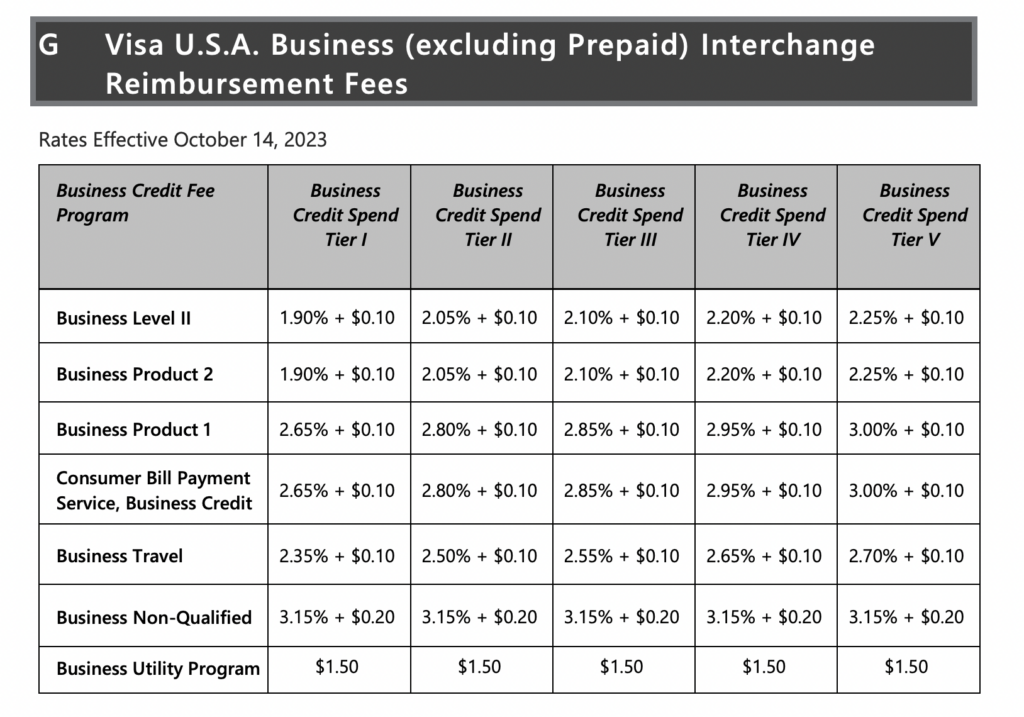

Visa Corporate, Purchasing, and Visa Business Interchange Fees

Here are the interchange rates for commercial credit transactions:

There are other interchange rates specifically for USA Business transactions. Those are segmented into credit and debit categories.

Business Credit Interchange

Visa Debit Business Interchange

The debit transactions are segmented even further into two additional categories—exempt business debit and Visa debit business regulated. The fee schedule is as follows:

Other Visa Interchange Rates

Here are some miscellaneous Visa interchange categories, for things related to passenger transportation, money orders, and mail or phone orders for ecommerce:

How Can Merchants Lower Credit Card Processing Rates?

These changes implemented by Visa are non-negotiable. Depending on your merchant services contract structure, it’s safe to assume that your rates will go up as a result—especially for anyone on an interchange-plus plan. Visa also charges FANF fees (fixed acquirer network fee).

While you can’t do anything about the rates at the card network level, you can still reduce your processing fees.

Contact our team of experts here at Merchant Cost Consulting. We’ll give you a free audit and analysis to find out how much money you can save on credit card processing—without switching processors.

Our team will even negotiate with your processor on your behalf to get you the best possible rate.

Final Thoughts

These are just a handful of the most common Visa interchange rates. As I said earlier, Visa’s interchange is a complex subject. They have special rates for business cards, commercial credit, corporate purchasing, prepaid cards, debit cards, and more.

In short, all of Visa’s interchange fees are based on three main factors—card type, merchant category code, and transaction environment.

That’s why you’ll see a different interchange rate for visa debit CPS compared to visa keyed rewards signature, visa keyed business, Visa debit keyed CPS, online transactions, international Visa, and more.

Don’t get overwhelmed if you’re accepting Visa cards. As previously mentioned, there’s nothing you can do to change the interchange rate imposed at the card networks level. You also wouldn’t stop a customer from using one type of rewards card over another.

Some categories have higher interchange fees. Visa and Mastercard both offer lower debit card transaction rates. But if you accept Visa cards, just be prepared to pay a variety of different interchange rates. The total fees collected will ultimately be imposed by your credit card processor.

For more information on how interchange works, check out our complete guide to interchange fees and rates.

0 Comments