If you’ve spotted a Network Security & Compliance Fee on your monthly merchant statement, it’s normal to question it and wonder what you’re being charged for.

And as you may already know, lots of the fees charged to your account are pure processor markups. So distinguishing between legitimate charges and junk fees can be difficult.

Here’s what you need to know about this fee:

- This is a junk fee charged by Global Payments, TSYS, Heartland, Cayan, and EVO Payments.

- The rate ranges from $89 to $139 per month.

- It’s not a card network assessment, and it’s not for PCI compliance.

- It’s arbitrarily applied, and replaced a Compliance Service Package on certain accounts.

What is the Network Security & Compliance Fee on Your Merchant Processing Statement?

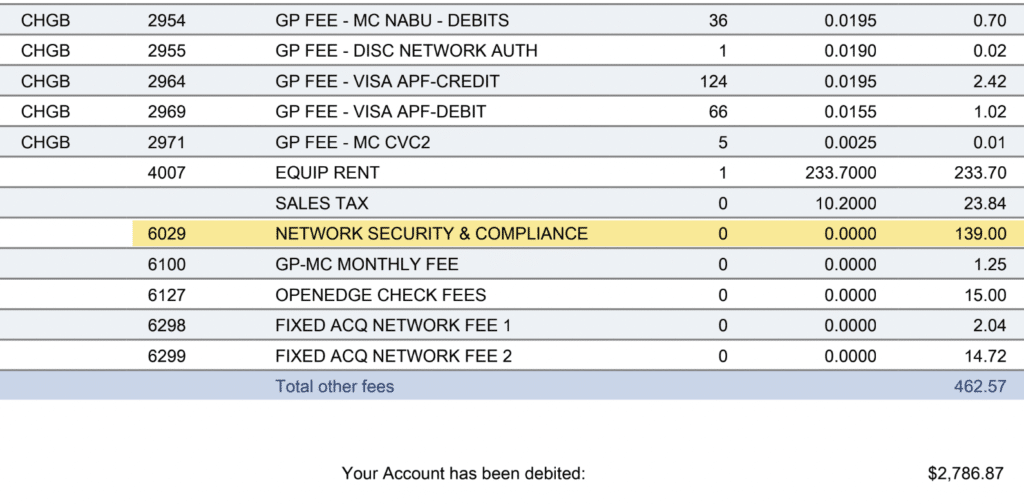

The Network Security & Compliance Fee is a monthly fee that’s applied to select merchant accounts. We commonly see this fee charged by Global Payments and its subsidiaries, including TSYS, Heartland, OpenEdge, Cayan, and EVO.

The rate varies, and we’ve seen it assessed at:

- $89 per month

- $109 per month

- $139 per month

Global used to sell some merchants “Compliance Service Package” for $139 per month. But as people opted out or chose not to sign up, we noticed that Global quietly started rolling out its Network Security & Compliance Fee on statements for the exact same price. $139 per month.

Is it Legit?

No, this is a junk fee.

There are no extra benefits or tangible services associated with the Network Security & Compliance Fee.

- It’s NOT charged by the card networks (Visa, Mastercard, etc.)

- The fee goes directly to your processor

- Rates are arbitrary, and not applied equally across all accounts

- Some merchants paying for this are still charged PCI compliance fees

The fact that most merchants started seeing this fee pop up on their statements shortly after Compliance Service Packages were phased out just proves that Global was trying to recoup the cost of another junk fee.

Despite the Name, It’s Not a Card Network Fee

Like other random processor fees, the name of this particular charge is intentionally deceptive. Starting the fee with the word “Network” is particularly interesting because businesses can look at this quickly and assume it’s related to Visa, Mastercard, Amex, and Discover.

But it’s not.

While the card networks do have their own network assessments that are tied to security, they have nothing to do with this particular fee from Global Payments.

- If it were a legitimate card network fee, then it would be charged to every single merchant (regardless of their processor).

- The amount would also be consistent in every instance.

We have the privilege of seeing merchant statements from basically every processor on the market. And we don’t see this charge anywhere else.

It’s Not Related to PCI Compliance, Either

Using the word “Compliance” in the fee name is also a tricky move because it implies the fee has something to do with PCI compliance. Let me make one thing clear. Processors are NOT required to charge merchants for PCI compliance.

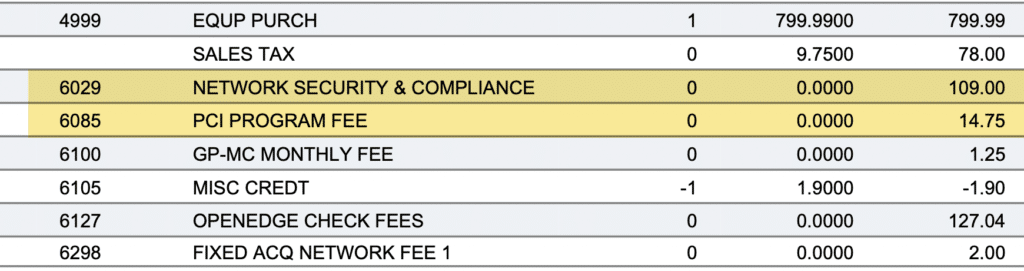

And how do I know this has nothing to do with PCI compliance? We see PCI fees charged separately on the same statements being hit with a Network Security & Compliance Fee:

The example above shows one of our clients being charged $109 for Network Security & Compliance, and an additional $14.75 for a PCI Program Fee.

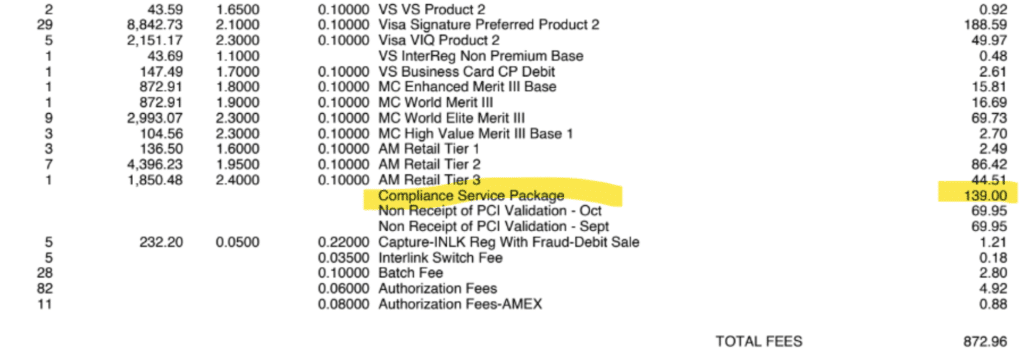

How it Compares to the Compliance Service Package

Lots of processors offer upsells and add-ons when you sign up for payment processing with them.

Most of these are bogus ways for them to inflate their margins, especially if they tell you that you can pay an extra fee for some type of enhanced security or compliance. All of your transactions are secure by nature, and it’s not like they will all of a sudden route your cards through a “more secure” or “more compliant” path if you pay extra.

But nevertheless, we used to see lots of Compliance Service Package charges applied on TSYS and Cayan accounts. Here’s an example.

As you can see, it’s $139 per month.

There is no coincidence that Global’s Network Security & Compliance fee is also charged at $139 per month.

Once businesses stopped paying for this add-on, Global simply renamed the fee and started applying it to other accounts for the exact same amount.

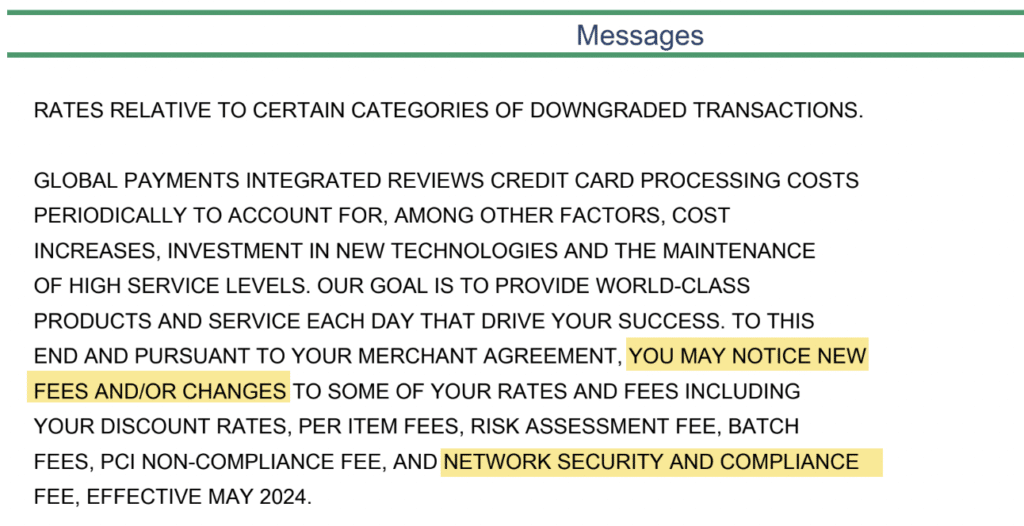

The Fee Was Quietly and Arbitrarily Applied to Select Accounts

We started seeing this a couple of years ago.

Here’s an example from one of our clients that was told they may see “new fees and/or changes” in May 2024, with Network Security & Compliance explicitly mentioned here:

This fee was NEVER on their account prior to this notification.

And once the fee was applied, nothing changed about how their transactions were processed.

They didn’t get some type of improved security, speed, compliance, or anything. It’s just a way for Global to collect an extra $1,668 per year on the account.

Why This Matters and What You Can Do About It

It’s easy to just dismiss a $139 charge as a non-issue. Even if it’s junk going straight to your processor, it’s a drop in the bucket compared to your processing volume and total merchant fees.

But it’s never just one fee, especially with Global Payments.

If you have a Network Security & Compliance charge on your statement, you also need to watch out for fees like:

- Risk Assessments

- Settlement Funding

- VPN Fees

- Infrastructure Upgrades

- Analytics and Reputation Management

This is how your processor can charge you tens of thousands of dollars in extra fees every single year.

So you need to be hyper vigilant when looking at your statements. If you notice any processor fees that aren’t clearly tied to a specific service, you need to fight to get them removed.

Trust me, there’s a lot more hiding in your statement than most businesses realize.