Credit card surcharging is a topic that affects both merchants and consumers in New Hampshire. Since credit card surcharge laws vary by state, it’s common for people to hear conflicting information and have different experiences between locations.

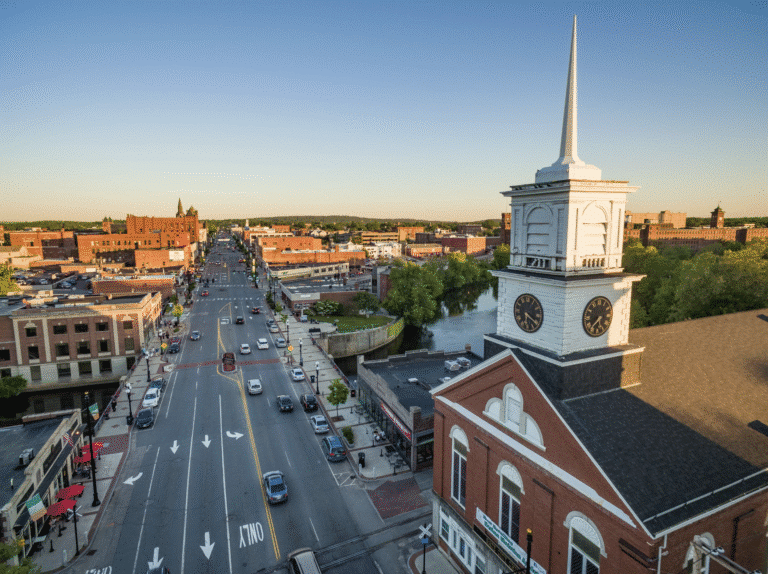

New Hampshire is definitely one of those areas where people get confused since neighboring states around New England have different rules.

So whether you’re a business owner looking to offset processing costs or a consumer wondering if a surcharge you encountered is legal, this guide will clarify everything you need to know about New Hampshire’s stance on credit card surcharges.

Disclaimer: This information is for reference only. It is not legal advice, and you should consult with an attorney before implementing a surcharge. Rules are constantly changing, and you should verify the accuracy of surcharge laws directly with your state.

Is it Legal to Surcharge Credit Card Transactions in New Hampshire?

Yes, credit card surcharging is legal in New Hampshire.

New Hampshire doesn’t have any state-specific laws that restrict a merchant’s ability to impose a surcharge fee. This is quite straightforward and makes it easier for everyone involved to understand.

For merchants to legally impose a surcharge fee, they can simply follow federal guidelines and card network rules to ensure compliance.

Is it Legal to Surcharge Debit Cards in New Hampshire?

No, debit card surcharging is illegal in New Hampshire.

This is a federal regulation that applies to all 50 states. The Durbin Amendment to the Dodd-Frank Act governs this rule—regulating debit card interchange fees, prohibiting card networks from restricting merchants on alternative payment discounts, and not allowing merchants to surcharge debit cards or prepaid cards are all part of this law.

Even if a debit card is processed as a “credit” (signature-based rather than PIN-based), it still cannot legally be surcharged.

Maximum Allowable Surcharge in New Hampshire

Since New Hampshire doesn’t have state-specific caps on surcharge amounts, merchants can default to federal regulations. This means that legally, surcharge fees on credit card transactions cannot exceed 4% of the transaction amount.

However, card networks typically impose their own limitations:

- Visa caps surcharges at 3%.

- Mastercard caps surcharges at 4%.

- Amex allows surcharges but requires them to be applied equally across all card brands.

- Discover also allows surcharges but says they must be consistent with competitor brands.

When you zoom out and look at these card network rules holistically, you’re effectively capped at a 3% maximum. Technically, you could go up to 4% without breaking the law. But non-compliance penalties from the card networks can still lead to fines and other penalties (just not legal trouble).

How New Hampshire Surcharge Laws Compare to Other Nearby States

The Northeast is interesting compared to the rest of the country because there are drastically different laws as you cross state lines in a relatively small area. So residents of New Hampshire will commonly see surcharges applied differently when traveling nearby.

Similarly, out-of-state residents visiting New Hampshire may be surprised to see a surcharge fee on a receipt because it’s illegal where they’re from.

Here’s a summary of what to expect from neighboring and nearby states:

- Massachusetts: Surcharging credit cards is MA completely illegal.

- Maine: Similar to Mass, surcharging in Maine is prohibited entirely.

- Vermont: Like New Hampshire, Vermont allows credit card surcharging without state-specific restrictions.

- Connecticut: While not directly bordering New Hampshire, Connecticut is another New England State where surcharging is illegal.

Even if you cross state borders just outside of New England, you’ll find the surcharge laws different in areas like New York or New Jersey, where businesses can impose a surcharge as long as the fee doesn’t exceed the merchant’s cost of acceptance.

As someone who lives and works in Massachusetts, I can totally relate to residents and businesses based in New Hampshire. No matter what direction you head, you’re likely going to experience varying laws and regulations throughout the Northeast.

How to Report Illegal Surcharging in New Hampshire

While surcharging is legal in New Hampshire, merchants could still be breaking the law if they’re surcharging debit cards, surcharging credit cards at a rate that exceeds 4% of the transaction, or failing to provide proper disclosure.

In these cases, you can file a complaint online or file a written complaint directly with the New Hampshire Consumer Protection and Antitrust Bureau.

Just click the link above, and all of the instructions are there—including forms and where to mail them.

Here at MCC, we don’t offer any consumer-specific services. But we’d still love to hear your opinions about credit card surcharging in New Hampshire. So drop a comment, and we’ll pass that feedback along to any of our clients in New Hampshire.

Final Thoughts on Credit Card Surcharges in New Hampshire

Just because it’s legal to surcharge credit card transactions in New Hampshire, merchants should still weigh the pros and cons of surcharging before making a decision.

While surcharges might seem like an easy way to offset processing costs by passing your fees to customers, it’s a decision that could potentially backfire—as you may end up losing customers and sales in the process.

I suggest you consider alternative options first. Try negotiating a lower rate directly with your current processor. This is an easier way for you to save money without burdening your loyal customers, and it’s something our team can help you achieve.

Get a free audit and statement analysis to find out how much you can save without switching providers or implementing a surcharge program.