New Jersey recently changed its surcharge laws for credit card transactions.

Previously, there was no specific legislation governing if and how merchants could impose surcharge fees. But that changed when Governor Phil Murphy signed AB284 on August 18, 2023.

Since New Jersey’s surcharge laws are relatively new compared to the surcharge laws in other states, merchants and consumers all have lots of questions navigating what’s legal and what’s not.

So whether you’re a merchant who’s trying to stay compliant or a customer who’s wondering if you got ripped off by a business, this guide will answer all of your questions.

Disclaimer: This information is for reference only. It is not legal advice, and you should consult with an attorney before implementing a surcharge. Rules are constantly changing, and you should verify the accuracy of surcharge laws directly with your state.

Is it Legal to Surcharge Credit Card Transactions in New Jersey?

Yes, credit card surcharging is legal in New Jersey—as long as the surcharge fee does not exceed the merchant’s cost of acceptance for the transaction.

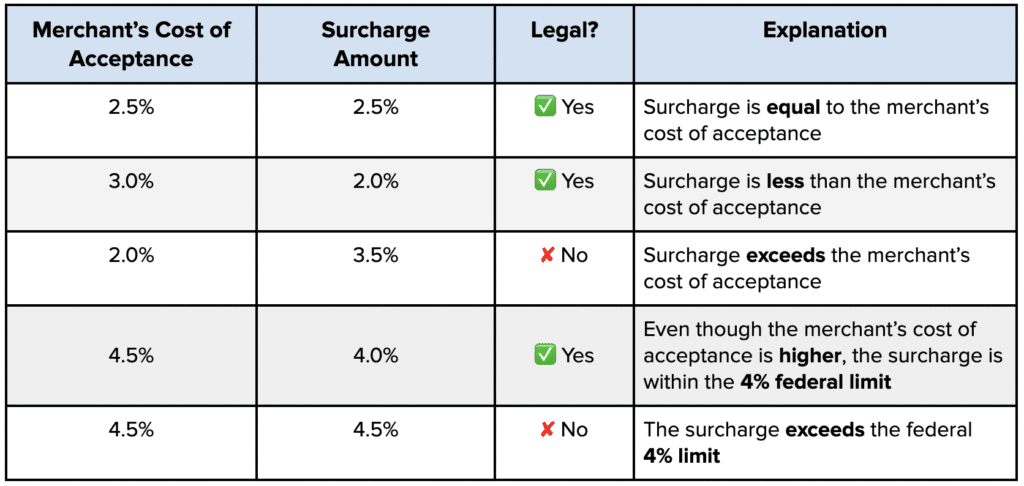

Other than exceeding the cost of acceptance, the law doesn’t specify an exact figure as the maximum allowable charge. However, federal law prohibits credit card surcharges from exceeding 4% of the transaction.

Here are some examples to illustrate how this law is applied in practice:

It’s also worth noting that New Jersey’s surcharge laws only apply to credit card transactions.

Adding a surcharge fee to debit cards is illegal in all 50 states.

Surcharge Disclosure Requirements in New Jersey

While surcharging is legal, merchants in New Jersey must follow strict disclosure laws to remain compliant. Here’s what the law says:

- Sellers must notify consumers of the surcharge prior to incurring any charges for goods or services.

- The amount of the surcharge must be on all disclosure statements.

- For in-person transactions, the disclosure statements must be posted at the entrance and at the point of sale.

- For transactions made online, through a mobile app, or a self-service kiosk, merchants must provide a clear and conspicuous notice of the surcharge on the checkout page.

- For telephone transactions, the seller must provide verbal notice to the consumer before processing their credit card.

The disclosure notices are all about transparency.

While other states have similar laws requiring merchants to post notice, New Jersey’s laws are somewhat unique in the sense that “prior to incurring charges” is specified.

This is particularly important for service-based businesses—as merchants are prohibited from just adding a surcharge at the point of sale without prior notice after services have been rendered. Customers must be made fully aware that the service they’re purchasing will incur a surcharge fee if they pay by credit card.

For example, let’s say you’re a mechanic who collects payments after the car has already been serviced. Your signage must be posted in plain sight at your entrance so that the consumer understands the policy, as opposed to surprising them with an extra fee when they pick the car up.

New Jersey Surcharge Laws For Restaurants

Restaurants, bars, and food service businesses in New Jersey must follow all of the same laws covered above in terms of the allowable amount and disclosure statements.

However, there are a few other contingencies for restaurants that are explicitly outlined by the New Jersey Division of Consumer Affairs, including:

- Surcharge disclosures must be posted in customer service areas and on menus.

- This includes menu boards, online menus, and digital menus accessible via QR codes.

- The amount of the surcharge must be clearly and conspicuously displayed to the customer prior to the transaction.

- Disclosure statements must also be posted on self-ordering kiosks or tablet stations (if applicable).

It’s worth noting that New Jersey doesn’t require certain types of signage—just as long as the fees are clearly and conspicuously posted.

For example, hand-written signs, homemade signs, and stickers are all considered to be appropriate under New Jersey law.

Can Merchants in New Jersey Impose Different Surcharge Amounts For Each Card Type?

New Jersey is one of the few states that recognizes the fact that credit card processing fees can vary by card type. In doing so, New Jersey says it’s legal for merchants to surcharge different card types at different rates.

For example, merchants in New Jersey could legally impose a 2% surcharge on Visa transactions and a 3% surcharge on American Express transactions (assuming neither of these is greater than their cost of acceptance).

However, this is one of those situations where you need to navigate legality against your processor agreements. In most cases, the card networks prohibit merchants from charging unequal amounts for different card types.

For example, American Express has a non-discrimination policy that requires merchants to impose equal access across payment products—meaning you’d be violating Amex’s rules by charging different amounts for different card types.

Visa doesn’t have these “level playing field” rules. However, if you’re surcharging Visa and Mastercard transactions at different rates, then you wouldn’t be allowed to apply product-level surcharges for Visa cards (like charging 2% for Visa Signature cards and 3% for Visa Commercial cards).

While technically, you wouldn’t be breaking laws in New Jersey by charging varying surcharge fees to different cards based on your cost of acceptance, there’s a high likelihood that you’d be violating card network policies and subject to other fines and penalties.

How to Report Illegal Surcharging in New Jersey

Consumers in New Jersey have several options to report suspected surcharging violations.

You can write a letter to:

New Jersey Office of Consumer Protection

Division of Consumer Affairs

PO Box 45025

Newark, New Jersey 07101

You can also call either of these two numbers:

800-242-5846 (if in New Jersey)

973-504-6200 (if outside of New Jersey)

Email submissions can be sent to: askconsumeraffairs@dca.njoag.gov

Digital complaint forms can be found at: www.njconsumeraffairs.gov

Final Thoughts

Just because surcharging is legal in New Jersey, it doesn’t mean that businesses should automatically pass those charges to their customers. In fact, there are plenty of reasons why merchants should avoid surcharging altogether.

Before blindly applying a surcharge fee, you should speak to a local attorney to ensure all of your policies are fully compliant with these ever-changing laws. Talk to your processor as well to make sure you aren’t violating any card network policies.

Alternatively, you can look for other ways to lower your cost of acceptance. While you won’t necessarily offset those costs altogether, you can still find substantial savings by negotiating directly with your processor.

Reach out to our team here at MCC for a free audit, and we’ll help you determine how much money you can save without switching. It’s a win-win since your customers won’t be burdened, and you can save money without changing providers.

For consumers, we’d love to hear if you’re getting surcharged on credit card transactions in New Jersey. Drop a comment below and let us know how you feel about it, so we can pass that information along to businesses we serve.