The credit card processing industry is constantly evolving. New technology, consumer habits, and other trends all play a factor here.

As a merchant, it’s your responsibility to keep an eye on these trends and updates to ensure you’re offering customers as many payment options as possible. Not only will this help improve customer satisfaction, but it also allows you to improve your checkout process.

NFC credit card processing payments have been a hot topic in the payment space in recent years. In terms of convenience, speed, and security, it’s worth diving into this topic in greater detail.

Lots of merchants and business owners are confused about NFC payments and how NFC payments work. So we created this guide to clear up any confusion—let’s dive in!

What Are NFC Payments?

Let’s begin with the basics. NFC is an acronym for “near field communication.”

The technology allows consumers to pay with credit cards and debit cards in-person without physically swiping or dipping the plastic in a card reader. In fact, the physical card doesn’t even need to be present if the customer has a mobile wallet.

With NFC payments, cardholders can use contactless chip cards, smartphones, or wearables (like an Apple Watch) to pay for goods and services at an NFC-enabled terminal.

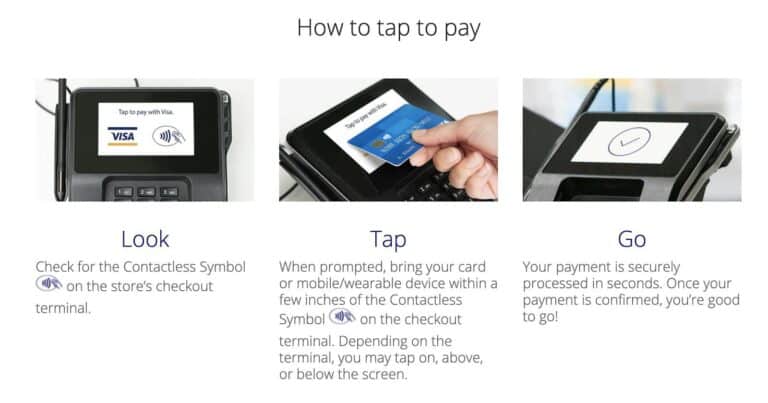

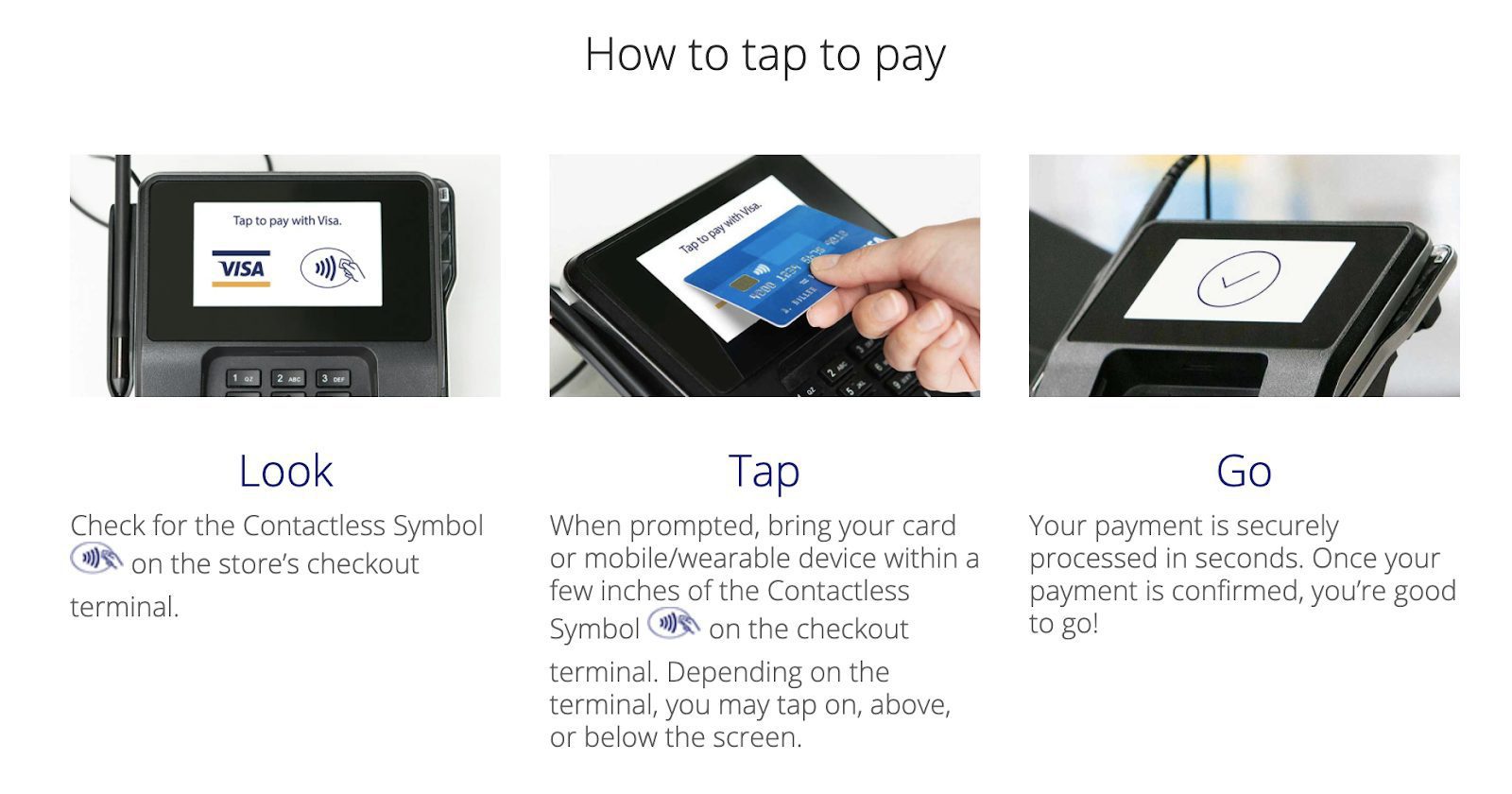

Contactless chip cards have a contactless indicator on the card itself, and any card reader with the corresponding contactless symbol can accept these payments. Here’s a visual representation from Visa showing the indicator:

Even cards without a contactless chip indicator can be used for NFC payments if the cardholder uploads that card into a digital wallet on a payment-enabled device.

While “NFC” is the technical term for these types of payments, the average person refers to NFC as “tap to pay.” As a merchant, if you tell a customer, “go ahead and pay using near field communication,” they’ll likely have no idea what you’re talking about.

How NFC Payments Work

So how can a card reader process a transaction without any physical contact with the card or smartphone? Let’s take a closer look at how this technology works.

Without getting too technical, NFC payments work using RFID (radio-frequency identification).

When the payment device (either the card or a mobile wallet) and card reader are both activated, and in close proximity, the NFC chips in both devices exchange encrypted data to process the transaction.

NFC payment readers can only connect with one chip at a time. Typically, the two chips must be within two inches of each other for this to work. So you won’t have to worry about accidentally processing a credit card in another customer’s wallet while they’re standing in line.

In terms of the checkout flow, the process is extremely simple. Payments are securely processed in a matter of seconds without any contact between the customer and employee.

To accept contactless credit card payments, you must have updated credit card processing equipment with NFC capabilities enabled.

If you don’t have this or you’re unsure, just contact your credit card processing company or merchant services provider. They can get you the right equipment, or at least make a recommendation on what equipment you need. It won’t be too expensive, and the investment will pay off in the long run—especially as mobile wallets and contactless payments continue to trend upward.

Benefits of NFC Payments

Don’t think you need to accept NFC payments? Before you make this decision, I want to quickly cover some of the top advantages of using this technology.

Speed

Speed is one of the most important parts of an in-person transaction. You want to keep lines moving and serve as many customers as possible without having them wait. We’re living in an era where the consumer expects instant results. Any delay at your register can cause frustrations and leave a bad taste in the customer’s mouth.

NFC technology solves that problem. According to Mastercard, contactless payments are up to ten times faster than other in-person payment methods.

Cleanliness and Safety

For obvious reasons, people have been prioritizing cleanliness more than ever before. We’re all thinking twice before we touch something out in public. Even as things return back to normal, lots of these health precautions are sticking with us.

Contactless credit card processing payments are germ-free. The cardholder doesn’t need to physically exchange anything with an employee, keeping them both safe during the transaction; the credit card processing hardware doesn’t need to be touched either.

That same Mastercard study mentioned above found that 82% of people found contactless payments as a “cleaner way to pay.”

Consumer Adoption

As a merchant, you need to follow consumer payment trends. 51% of Americans are now using some form of contactless payments.

Furthermore, it’s estimated that the mobile wallet adoption rate will reach 75% by 2025. The current rate is hovering around 25%, meaning it will triple in the next four years.

Trends like this cannot be ignored. Clearly, consumers like the idea of tap to pay, contactless payments, and mobile wallets. If you’re not offering them the option to pay using these methods, it’s going to be a problem for your business.

Security

NFC payments are secure—plain and simple.

In fact, NFC payments have reduced credit card fraud in comparison to swiped card payments, according to a recent article published by the New York Times.

Payment security and compliance can’t be overlooked whenever you’re making a decision like this. So it’s nice to know that NFC payment acceptance can actually improve your security standards, protecting your business and customers alike.

Affordability

Most modern card readers are NFC-equipped. So it’s not like you need to get some new fancy terminal to accept these payments.

Typically, a terminal or card reader that can accept NFC payments will fall into the $50 to $150 range. Terminals on the higher end of that range will also be able to accept chip and magstripe payments, so you won’t need different equipment for each method.

Final Thoughts

NFC payments are fast, secure, and here to stay.

If you were confused about NFC payments five minutes ago, hopefully, this article has painted a clearer picture for you.

For those of you who still have questions or want more information on the credit card processing fees associated with these transactions, reach out to our team here at Merchant Cost Consulting. We can help you save money on credit card processing without switching credit card processing companies.