Paya was initially founded in 2006 as Sage Payments Solutions. After being acquired by GTCR in 2017, the company was rebranded to Paya—and has since grown to process over $40 billion in payment volume annually for over 100,000+ businesses worldwide.

They serve a wide range of industries, specializing in verticals like B2B payments, insurance, healthcare, and education.

Nuvei acquired Paya in 2023, and today, new Paya accounts are being directed to Nuvei for onboarding. But all merchants currently using Paya will continue to see Paya’s branding on their statements (at least for now).

Our Quick Take on Paya

Paya is a typical payment processor and merchant acquirer. We don’t typically see any tiered pricing or gouging on the statements we’re auditing (which is a good thing), but there are definitely some added fees that Paya uses to increase their profit margins (which we don’t love).

One unique standout of Paya is its ability to integrate with Sage accounting solutions. Any business that uses Sage has limited options for integrated credit card processing, and Paya is one of them.

This is largely due to the fact that Paya was originally part of Sage. The integrated capability continued to get support even after Sage sold Paya.

Pros

- Fairly competitive pricing.

- Solid technology and customer service.

- One of the few processors that offers integrated processing with Sage accounting systems.

Cons

- They try to increase rates 1-2x per year.

- Some extra fees are just an added markup to increase profits.

- Early termination fees.

Paya Pricing and Credit Card Processing Rates

Paya’s pricing varies by merchant account. Your rate will be customized based on factors like your MCC code, volume, and technology needed to support your payments.

Generally speaking, Paya’s pricing can be competitive. They offer interchange plus pricing and are willing to make concessions if you call them out and know how to negotiate.

We’ve caught them padding interchange rates within an integrated payment system (ECI). But this isn’t something we typically see from Paya or Nuvei.

That said, it’s a good idea to read your statements carefully to ensure the true interchange cost is actually being passed through to you at the correct rate.

Other Paya Fees to Look Out For

Beyond the standard IC+ pricing that Paya offers, there are a few other fees that you need to be aware of.

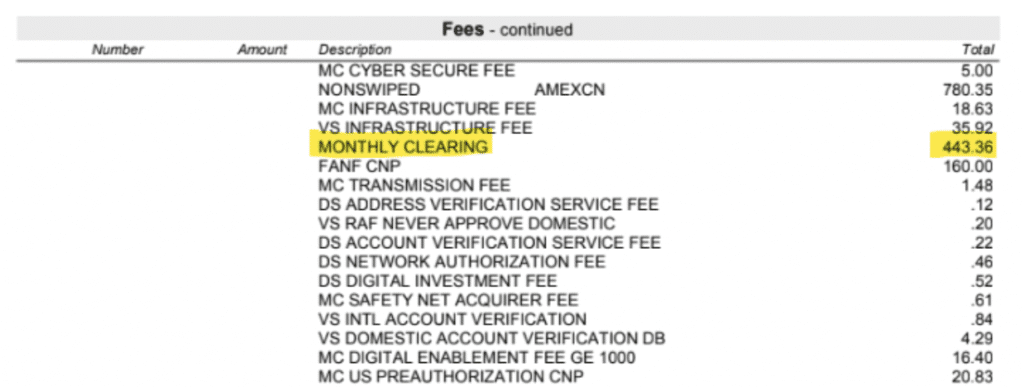

Paya’s Monthly Clearing Fee is something that we constantly see when we’re auditing statements for our clients.

While it’s listed with other assessments coming directly from the card networks, this is NOT an assessment fee.

This is just another markup that Paya is using to increase their profit margins (similar to how Global has a settlement funding fee that they use to inflate profits).

The exact rate of Paya’s Monthly Clearing Fee varies by account, but they’ll try to get it as high as possible until you push back and question it.

It’s also worth noting how Paya charges merchants whenever a credit or refund is issued to a cardholder. Some processors just charge the entire amount of the interchange rate to process it, and others don’t charge at all.

Paya takes an aggregate approach, which you can see in this example:

They’re charging 2% + $0.15 to process four credits totalling $426.01.

Now if we look at another statement, we can see Paya charging a completely different rate for this credit/refund:

In this second example, the merchant is paying 3% + $0.15 for the refund.

This just illustrates how the fees ultimately can depend on your specific account and contract terms—and Paya isn’t universally charging everyone the same rates.

Should You Switch to Paya?

Switching credit card processors is rarely beneficial for merchants. Even if you’re interested in changing processors and think it makes sense for your business, I probably wouldn’t switch to Paya amidst its transition to Nuvei.

This is nothing against Paya or Nuvei—but I’m actually not even sure that Paya is offering new accounts right now. If you go to Paya’s website and try to sign up or submit a form, it looks like you’re being redirected to Nuvei and onboarded there.

Before you consider switching, try to negotiate a better rate directly with your current processor. This is something we can help you out with if you’re not sure where to start.

Should You Cancel Your Paya Merchant Account?

There’s no reason to terminate your Paya merchant account. Despite the transition to Nuvei, your account should continue getting serviced as promised, and you likely won’t see any major changes (maybe just Nuvei’s name on future statements).

You could experience some rate hikes down the line if you haven’t already. But that alone isn’t enough of a reason to terminate your account.

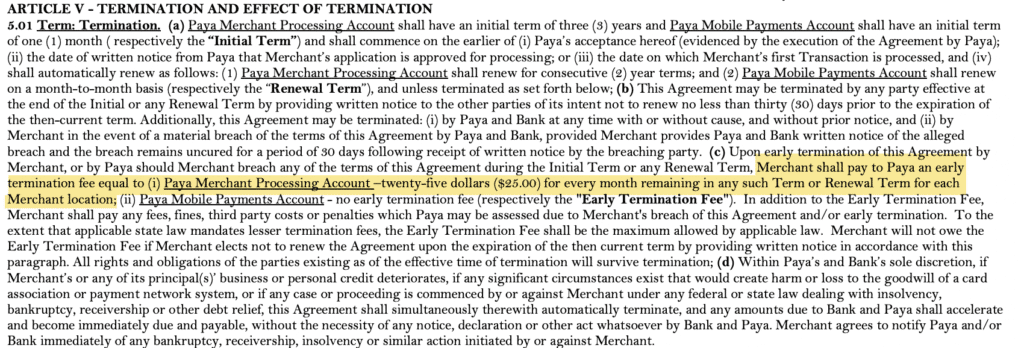

It’s also worth noting that we’ve found some early termination fees in Paya contracts.

This particular clause states that the merchant will be charged $25 per month per location for every month remaining on the contract.

These terms vary by account. Some of you might have it, others might not.

$25 per month per location isn’t the end of the world (especially if you only have one or two locations).

But let’s say your clause has this fee set at $75 per month, and you have 18 months remaining with 12 locations. This would cost you $16,200 just to cancel early.

You’re better off sticking with Paya/Nuvei and negotiating better terms.

Final Verdict on Paya

Paya is a fairly average payment processor.

The best part about Paya is its ability to integrate with Sage’s account solutions. Since so few providers offer this, Paya is probably the best option for handling this need.

But since this is such a use-case-specific perk that doesn’t apply to every business, there’s not a ton else that should make you consider Paya over another provider.

Rates can be fairly competitive, but Paya does add some extra fees, which isn’t ideal.

Whether you’re a current Paya customer or thinking of switching, contact our team here at MCC if you need assistance. We can audit your statements and make sure you’re getting the best possible deal.