Every company, including B2Bs, should always be looking for ways to reduce costs, increase revenue, and boost sales.

Selling online has changed the way that B2Bs operate in the modern era. With online ordering and payment processing, B2Bs across the globe have been able to drastically improve the efficiencies of outdated processes.

Whether you’re new to selling online or if your B2B has been selling online for years, there is always room for improvement.

I’ll walk you some of the best online payment processing advice, tips, and best practices for B2Bs.

Understand the Basics of B2B Payment Processing

B2B and B2C credit processing are not the same. In addition to the different end-users of the products or services that you’re offering, the payment methods and fees are structured differently as well.

Business customers have different types of credit cards than a general consumer.

In some instances, you might need to process business transactions at a higher data level. As a result, your B2B transactions could potentially be cheaper than a B2C transaction. Some credit card companies offer discounted interchange fees for high ticket transactions as well.

To learn more about the differences between B2B and B2C payment processing, as well as different payment methods and interchange fees, check out our complete guide to B2B payment processing.

It’s important that you have all of this information at your disposal. In some cases, you might need to upgrade your software in order to comply with specific data level standards.

Switch to Online Invoicing

The days of generating paper invoices and sending them to your clients via snail mail are long behind us. Faxing invoices is an outdated invoicing method as well.

Today, and moving forward, you need to establish an online invoicing system.

The modern B2B buyer is changing. Just like traditional consumers, they want everything to be as quick and easy as possible. Going digital is the only way to accommodate those needs.

In addition to making things more convenient for your business customers, online invoicing will also benefit your company. It’s the best way to keep your average collection period as low as possible. Since paying for invoices online is so easy, your customers are more inclined to pay immediately.

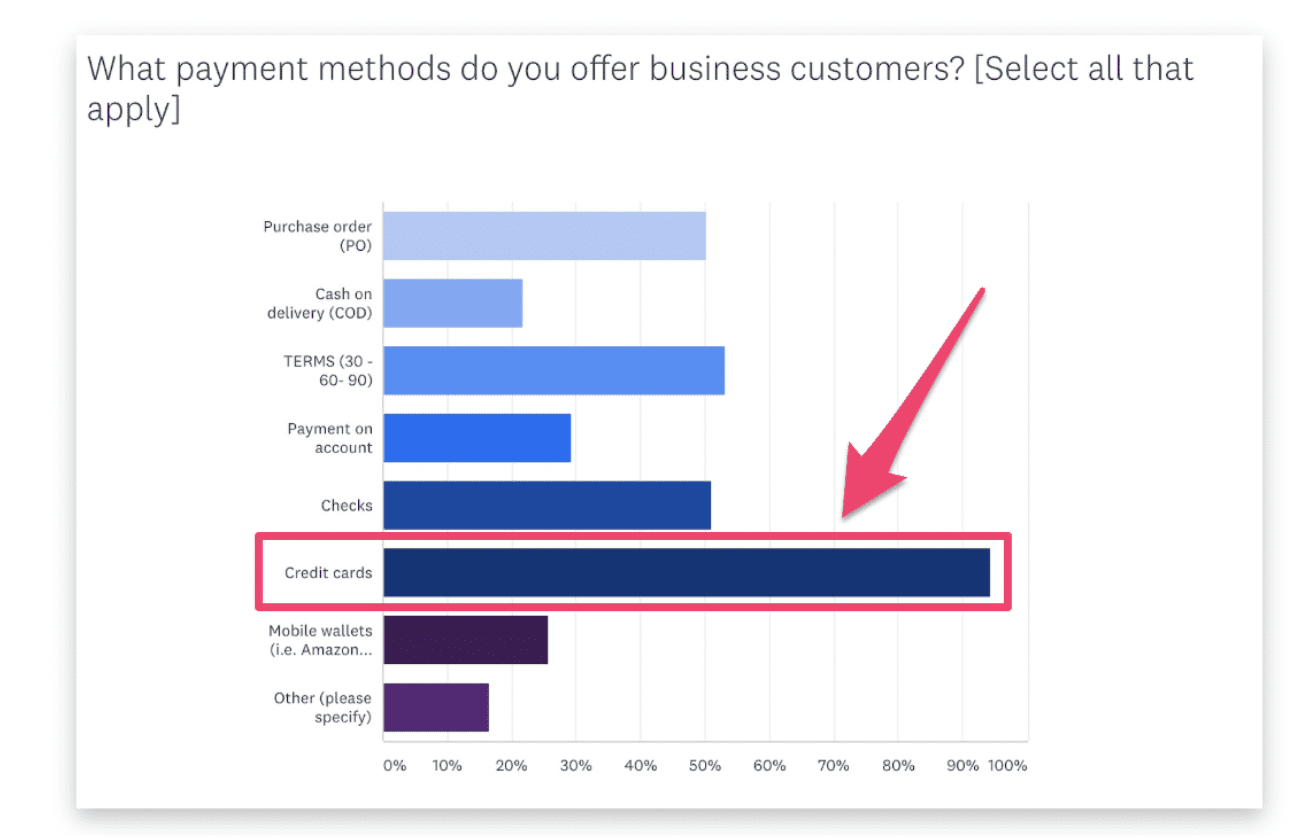

94% of B2Bs offer credit cards as a payment collection method for customers.

For those of you who aren’t currently accepting credit cards as a payment method, you’re quickly falling behind the competition. This is something that your customers have grown to expect.

Set Up Online Ordering

In addition to getting paid online, you also need to make sure your business customers can order products on your website.

78% of B2Bs have been accepting online orders for at least two years. For the 22% that don’t currently sell online, more than eight in ten plan to do so within the next 24 months.

Again, this has just become something that B2B customers expect from vendors in the modern era. Behind vendor regulations, price, and customer loyalty, ease of online ordering is the top selling point for B2B companies. In fact, 39% of B2Bs say that an easy online ordering process is the top factor for driving B2B sales.

71% of B2Bs focus on setting up an easy site navigation, which reiterates the importance of selling online.

Optimize B2B Subscriptions

Software is a common B2B service. So if your organization is in the SaaS space, you need to optimize the way you manage client subscriptions.

Customer churn is one of the top reasons why SaaS businesses fail. You can’t afford to lose clients because the payment method isn’t customer-friendly.

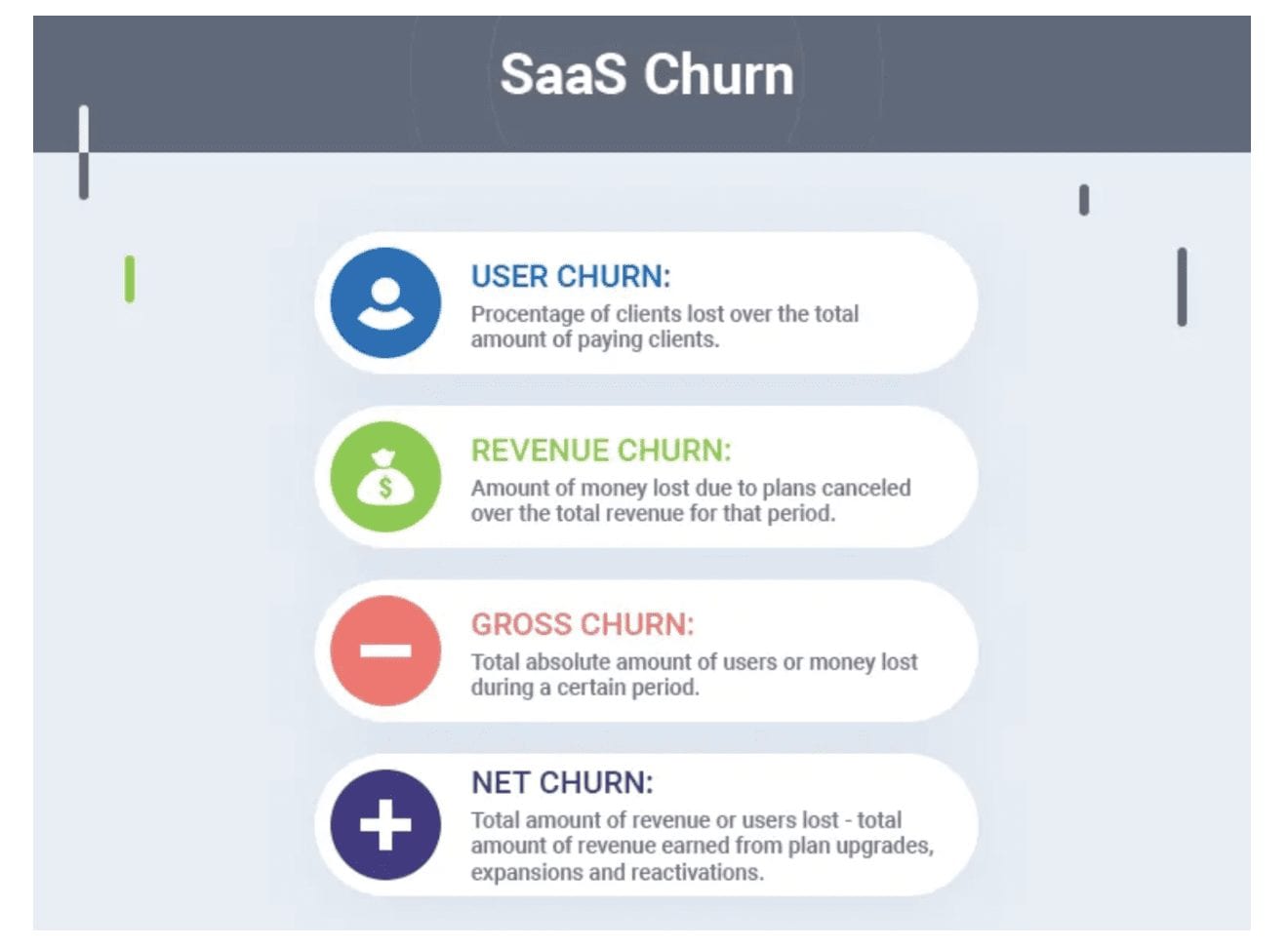

Here are some of the different SaaS churn metrics that you should be monitoring:

The easiest way to reduce churn is by allowing your clients to pay with their credit card and set up automatic renewals.

With this setup, you can charge them automatically on a monthly, quarterly, or annual basis. This is so much easier than having to give them a call or send a paper invoice for each billing period.

Prevent Fraud and Chargebacks

Unfortunately, fraud is an inevitable part of accepting credit cards, especially if you’re selling online.

The costs associated with fraud and chargebacks can add up quickly, particularly for ecommerce sites that sell products in bulk with higher average ticket prices.

While your fraud and chargeback rates will likely never drop to 0%, it’s important that you keep these numbers as low as possible. In doing so, you’ll be able to prevent wasted revenue, avoid hefty chargeback fees, and loss of COGS.

For more information about this, check out our guide on how to prevent friendly fraud. I also recommend our insightful article on fraud scoring methods for ecommerce websites.

Understand Your Payment Processing Costs

How much does it cost you to process your B2B transactions? If you don’t know the answer to this question, you need to find out.

This is an underrated method for saving tons of money. By optimizing your payment processing, you can save tens of thousands of dollars per year.

Based on my experience in the payment processing industry, the vast majority of B2Bs are overpaying for credit card processing. There are lots of opportunities to save money in this space, but most people don’t realize it.

The best part? You can increase your net profits without changing your sales volume.

Final Thoughts

These are some of the top tips, tricks, and best practices for B2Bs to boost sales online.

If you follow the advice I’ve outlined above, you’ll keep your customers happy, get paid faster, and increase your profit margins as a whole.

For those of you who want to learn more about saving money on credit card processing costs, contact us here at Merchant Cost Consulting. As experts in the payment processing industry, our team can negotiate the fees with your processor.

Get a free audit and analysis to find out how much you can save.