As the year comes to a close, we’re still keeping a close eye on the latest happenings in the payments space. This month, we’ve highlighted some new partnerships, new technologies, expansions, and some noteworthy changes to expect in 2024.

Here’s a recap of the biggest stories:

Amazon to Drop Venmo Payments in January 2024

Effective January 10, 2024, Amazon will no longer be accepting Venmo as a payment option at checkout. This announcement comes roughly 14 months after Amazon first added Venmo for payments back in October of 2022.

Payroc Launches a Single API for PayByBank in US and Canada

Payroc—a global merchant acquirer, processing company, and encryption support company—just launched a new single API that supports its PayByBank solution in the US and Canada. Prior to this new API, clients using Payroc needed separate interfaces to support PayByBank in each country, and this new release eliminates the need for multiple integrations and complex workarounds.

Banked Expands Operations to the US

Banked, a UK-based fintech organization founded in 2018, is expanding its pay-by-bank services to the United States in 2024. They’ve already done a soft beta launch, but the full rollout will come throughout the new year.

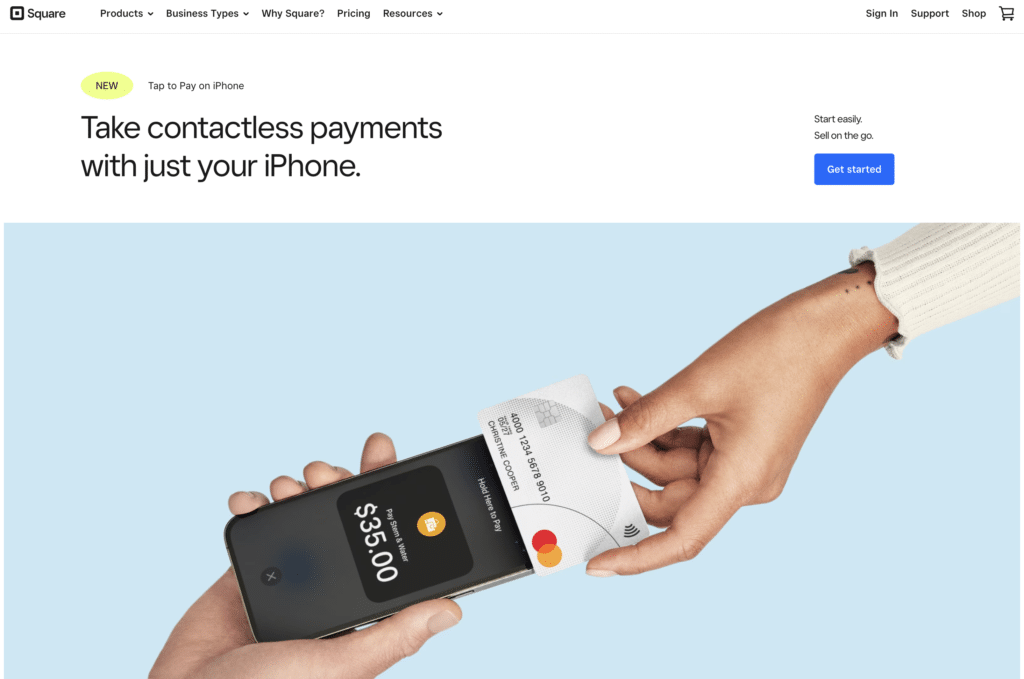

Square Launches Tap-to-Pay for iPhone in the UK

Square officially launched its tap-to-pay for iPhone compatibility in the UK. This marks the third region in which Square offers tap-to-pay technology for sellers. The launch will allow sellers to accept contactless payments from their iPhones without requiring any additional hardware or investment.

BentoBox Releases 2023 Restaurant Trend Report

BentoBox, a restaurant software company, just released its 2023 Restaurant Trend Report. Key highlights include:

- US consumers spent 7% more in restaurants in 2023 than in 2022.

- The national average check total in the US was $22.46.

- The average restaurant gift card purchased had a value of $132.25.

- 10,608 new restaurants opened in the US.

Adyen Partners With S Group

Adyen announced a long-term strategic partnership with Finland’s largest retail organization—S Group. The partnership will put Adyen’s technology at more than 1,900+ locations in Finland and Estonia, including physical and online channels.

Adyen and Klarna Expand Global Partnership

Adyen and Klarna are expanding their global strategic partnership—making Adyen one of Klaran’s core acquiring partners. Adyen’s acquiring services will be serving Klarna throughout North America, Europe, and Asia in 2024.

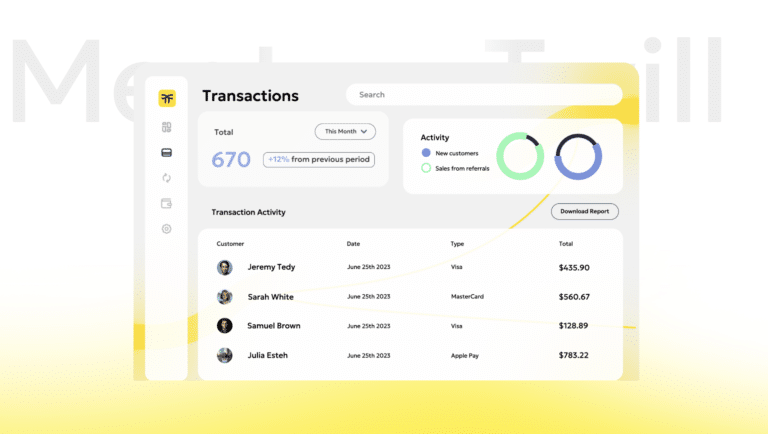

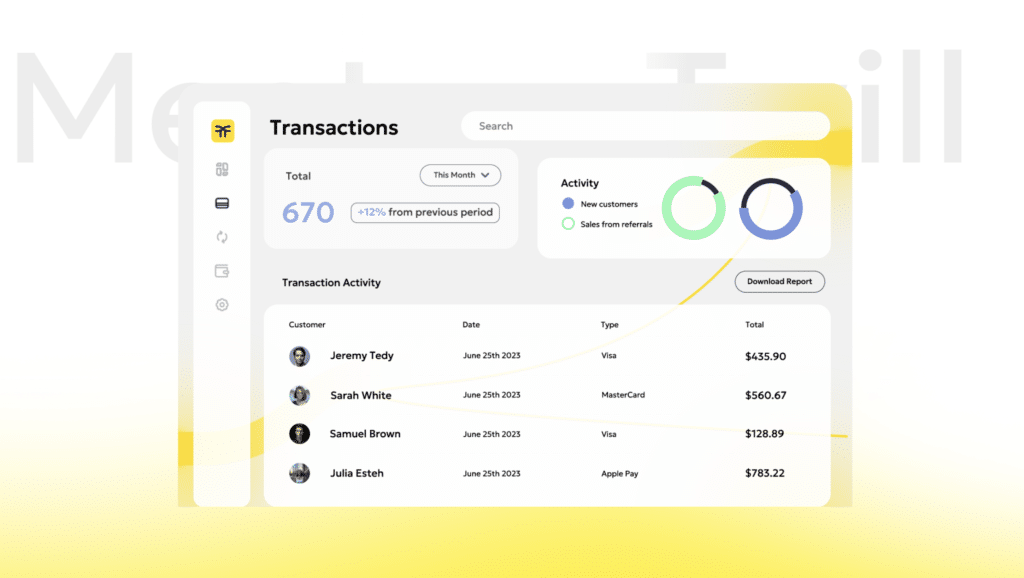

Twill Payments Goes Live

Twill Payments officially released its new payment processing solution for businesses worldwide. As an integrated payments solutions provider and payment processor, Twill Payments is focusing on innovation and advanced technology to streamline payments and insights for business operations.

Nuvei Partners With Microsoft For Global Payments

Canadian fintech company Nuvei announced its partnership with Microsoft to deliver payment experiences and technology through markets in Africa and the Middle East. This includes payments in products with recurring billing, like Microsoft 365, in those regions.

FreedomPay Announces Partnership With Citi Retail Services

FreedomPay, a payments platform as a service company, announced its partnership with Citi Retail Services. This partnership will enable Citi Pay at the point of sale for merchants seeking a broader way to accept payments. It also allows the seamless integration of installment payments into the merchant checkout flow.

Block Launches its Self-Custody Bitcoin Wallet, Bitkey

On December 7, Block Inc. launched Bitkey—a self-custody Bitcoin wallet. Bitkey is supported in over 95+ countries and six continents, allowing people to own the keys to their Bitcoin. Bitkey comes with a mobile app, hardware component, and recovery tools.

Like what you see on this page? Subscribe to our newsletter to get these headlines delivered straight to your inbox every month. In case you missed it, click here for a recap of last month’s biggest stories.