For a short month, February has still been buzzing with news and updates in the payment processing world. From new fees and rate increases to expansions, new technology, and partnerships, here’s a summary of the biggest news stories we’ve seen this month:

New Fees, Rate Increases, and Program Changes

Card networks and processors both announced some changes this month that will go into effect as of March 1, 2024. Most notably, we’re seeing updates from Mastercard, Visa, and Elavon.

Mastercard

- Increasing its Network Case Ruling fee to $575 (up from $400)

- Increasing its Network Case Filing Withdrawal fee to $325 (up from $150)

- $3.50 fee per dispute refund request for Tier 1 MCC codes

- $20.00 fee per dispute refund request for Tier 2 MCC codes

- $0.25 fee per collaboration adjustment

- $1.00 fee per Incoming Refund Request

- $7.50 fee per Mastercard Refund Request

Visa

Visa will start assessing new fees ($5 or $15, depending on the circumstances) for chargeback code 1040 CNP. Read more here.

Elavon

- Elavon is automatically enrolling merchants into its Commercial Card Optimization program

- Increasing rates by 0.10% + $0.20 per transaction for Visa, Mastercard, and Discover

- Increasing rates by 0.20% per authorization for Visa, Mastercard, and Discover

- Increasing rates by 0.30% per transaction for American Express

- Assessing a 0.06% monthly billing fee based on total monthly processing volume (for merchants who continue to stay on a monthly billing)

Nuvei Rolls Out Global Omnichannel Solution and Embedded Payments Platform

Nuvei, a Montreal-based payment processor, had two major announcements in February.

First, they announced the launch of an enhanced omnichannel payments system to support a wider variety of use cases—including hospitality, restaurants, consumer retail, travel, and online gaming. The new platform is designed to improve the checkout for customers for each channel for however people want to pay.

Nuvei also announced the release of its new modular embedded payments system, NMI Payments. It’s designed to integrate with software companies and ISOs for online, in-store, in-app, and mobile payments.

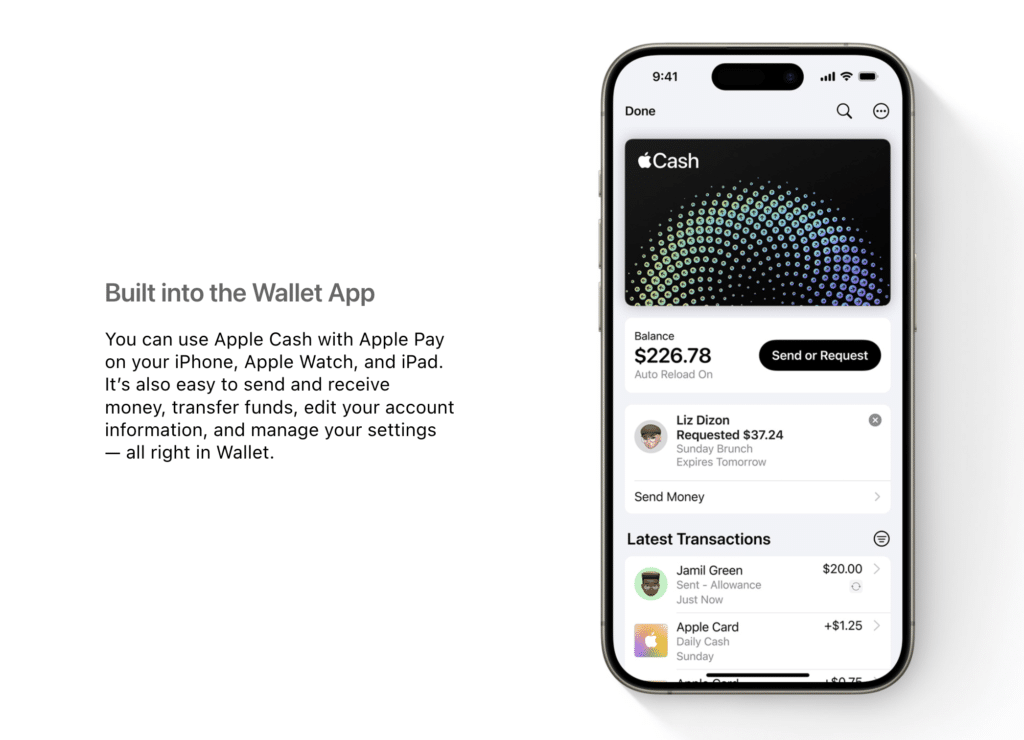

Apple Cash to Offer Virtual Card Numbers?

The beta version of iOS 17.4 may allow users to shop online—even when Apple Pay isn’t available. Currently for Apple Pay to work, merchants must be set up to accept it. But if Apple Cash provides a virtual card number (in beta), then that card can be used to shop online. We’ll keep you updated on this story as more details emerge.

Nium Obtains Principal Approval For Two New Payment Licenses in India

Nium, a Singapore-based cross-border payments company, has received provisional approval from the Reserve Bank of India for a Prepaid Payment Instrument license and Payment Aggregator license.

With the PPI license, Nium will be able to pre-fund and pre-load cards for distribution within India, and the PA license will allow Nium to serve as an end-to-end processor and acquirer in India—including the ability to connect with India’s Unified Payments Interface to facilitate real-time payment offerings.

FIS Announces Milestone in Secure Open Banking

In a February 8th press release, FIS announced its agreements with data networks like Okoya, Envestnet/Yodlee, MX, and Plaid to integrate with the new Open Access banking solution from FIS. This is designed so consumers can securely share financial information with more third-party financial apps in a way that’s more streamlined and controlled.

Amex Anticipates Stricter Bank Requirements in 2024

Amex’s recent growth is moving the company closer to additional federal regulations based on its assets. Based on its recent annual filing and Q4 earnings, Amex is anticipating that it will fall into the category of banks with over $250 billion in assets but less than $700 billion in consolidated assets (based on a four-quarter trailing average).

This comes after American Express had $261 billion in assets in Q4 2023 and $251 billion in Q3 2023.

If Amex becomes a Category III bank, it will be subject to annual stress tests and other stricter requirements imposed by the Fed.

ConnexPay Announces New Payment Category

ConnexPay, a payment gateway for online marketplaces, announced a new payment category on February 6th—ConnexPay Exclusives. It’s a dynamic suite of payment capabilities built to optimize payment outcomes, simplify acceptance, and lower the total cost of payments.

Initially, ConnexPay Exclusives will roll out four different capabilities in Q1 of 2024. But the first option is already available—ConnexPay Global Travel card, which is a virtual card designed for travel companies across the globe.

PNC Bank to Invest $1 Billion for Expansion

PNC Bank announced plans to open more than 100 new locations and renovate over 1,200 existing locations between now and 2028—a $1 billion investment.

Currently, the bank has about 2,300 locations and over 60,000 ATMs nationwide.

Some notable cities for the proposed new locations include Dallas, Austin, Denver, Miami, Houston, and San Antonio.

Fyle Announces New Integration with American Express

Fyle, an expense management solution that uses consumer credit cards, just announced a new integration with American Express. Fyle is also participating in the Amex Sync Commercial Partner Program—allowing the issuance of on-demand virtual cards through Fyle’s platform.

Visa Enhances B2B Payment Solutions For Virtual Corporate Cards

Visa is expanding its suite of B2B payment solutions—allowing corporate cardholders to issue virtual cards to employees. This will allow CFOs to control corporate spending and improve flexibility and convenience for users.

Shift4 Launches AI-Powered SkyTab Builder

In an effort to expand and improve upon its payment processing solutions for restaurants, Shift4 has improved its SkyTab website builder with AI-powered capabilities. It’s a free tool for any business that’s already using Shift4’s SkyTab POS system. Businesses just need to provide a few details, and the AI takes care of the rest.

Partnerships, Mergers, and Acquisitions

- Adyen partners with Bill.com for advanced card issuing capabilities. (Read more)

- FIS completes sale of majority stake of Worldpay to GTCR. (Read more)

- Electronic Merchant Systems (EMS) acquires PaymentCloud. (Read more)

- ACI Worldwide announces collaboration with RYVYL EU. (Read more)

- Toast to become the tableside and in-room dining platform for Choice Hotel brands Cambria and Radisson. (Read more)

- Fiserv is expanding its CheckFreePay network to include NCR Atleos Corporation’s ATM network. (Read more)

- FIS announces strategic partnership with Banked to widen access to open banking. (Read more)

Like what you see on this page? Subscribe to our newsletter to get these headlines delivered straight to your inbox every month. In case you missed it, click here for a recap of last month’s biggest stories.