Part of helping businesses save money on credit card processing means keeping our ear to the ground on all news in the payments world. Every month, we recap some of the biggest headlines, noteworthy announcements, and otherwise interesting news in the industry.

Here’s a summary of what happened in November.

Cyber Week 2023 Trends and Statistics

Holiday spending kicked off with Cyber Week, and Salesforce just reported some jaw-dropping statistics:

- Cyber Week sales eclipsed $298 billion worldwide, up 6% year-over-year.

- 9% year-over-year increase in online sales on Black Friday in the US.

- Digital wallet payments grew by 53% in the US.

- Credit card usage for Cyber Week grew by just 1% in the US, but it’s still the most popular method—responsible for 69% of all US Cyber Week sales.

Federal Reserve Announces 1.8% Rise in Payment Services

On November 17, the Federal Reserve announced new pricing for payment services that goes into effect on January 2, 2024. Based on the new rates, the Fed expects a 1.8% average price increase for services related to check clearing, ACH transactions, and wholesale payment settlements.

Fees for FedNow, however, will remain unchanged.

Mastercard’s Joint Venture Entity Announces Domestic Payment Processing in China

Mastercard’s joint venture entity, Mastercard NUCC Information Technology Co, Ltd., has officially received regulatory approval from the People’s Bank of China to set up a domestic clearing institution in China.

This will ultimately help both foreign and domestic cardholders benefit from a smoother payment experience while traveling throughout China.

For more information, read the full press release here.

Visa Launches Real-Time Account Updater in New Markets

Visa is expanding its Real-Time Account Updater (VAU) to new markets in the Asia-Pacific region. This technology helps simplify payments for merchants relying on card-on-file transactions.

When a card expires and a new card is issued, the new account numbers and expiration dates will update between participating card issuers and acquirers.

This ultimately helps prevent declined transactions and enhances the experience for customers and merchants alike.

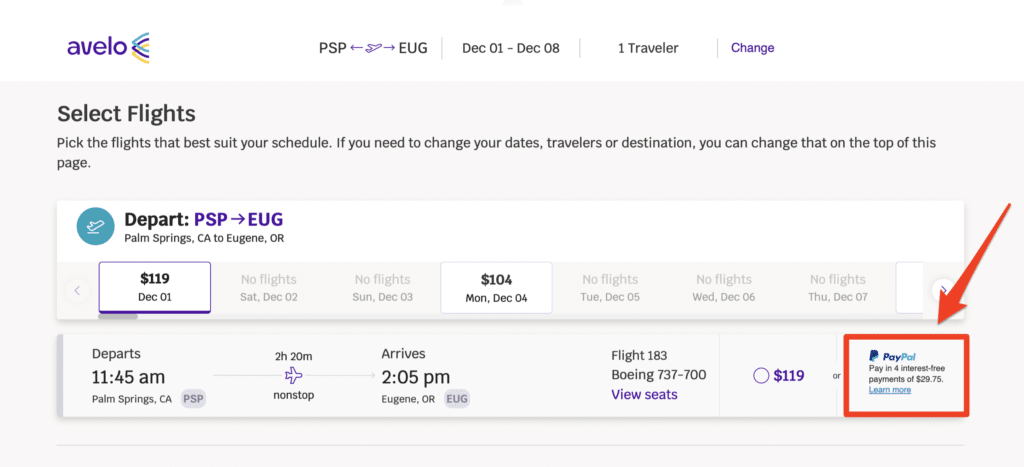

Avelo Airlines Announces Strategic Partnership With PayPal

Avelo announced a multi-year strategic partnership with PayPal—making it the first US airline to offer PayPal’s “Pay in 4” service for travel purchases.

When customers select “PayPal Pay in 4” at checkout, they have the option to split up purchases between $30 and $1,500 into four interest-free payments.

Alaska Airlines Partners With Stripe For In-Flight Tap-to-Pay on iPhone

Alaska Airlines is partnering with Stripe to make iPhone’s tap-to-pay feature the primary payment acceptance method for in-flight purchases.

Adyen and Plaid Partner For “Pay-by-Bank” Services in North America

Adyen just announced that it will launch Pay-by-Bank services in North America, which they’re planning to offer sometime in early 2024. They’re partnering with Plaid, a digital finance technology company, to help facilitate this new offering.

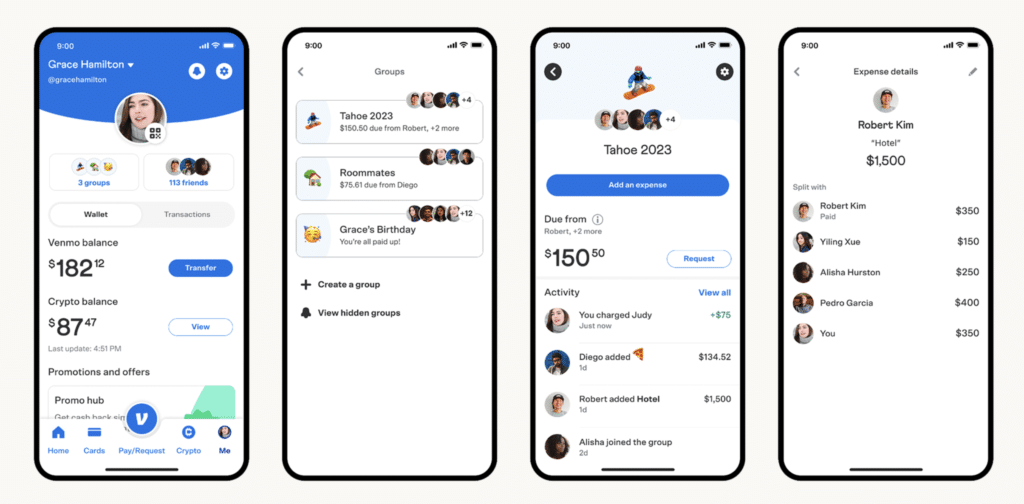

Venmo Introduces New Feature Called Venmo Groups

Venmo is simplifying the way its user can split purchases, track expenses, and manage payments with a new feature—Venmo Groups.

With Venmo Groups, the app automatically calculates the amount owed for each person in the group when it comes to splitting multiple expenses.

CFPB Proposes Federal Oversight Regulations on Digital Wallets and Payment Apps

The Consumer Financial Protection Bureau (CFPB) recently proposed a new rule that would ultimately impose additional regulations on digital wallets and payment apps.

This proposal would ensure that these large non-bank companies have to follow the same privacy, funds transferring, and consumer protection laws as banks and credit unions.

EU Takes Additional Steps in Digital Identity Wallet

The European Union previously announced its desire to create a digital wallet that’s linked to the user’s identity. These wallets can be used for digital payments and other digital documents—like driver’s licenses, travel documents, and medical prescriptions.

If approved, existing digital wallets offered by companies like Apple, Google, and Amazon would need to accept the new wallet as a way to sign into their platforms and verify user identities. It would also hold big tech firms more accountable under the EU’s Digital Services Act.

The latest step taken here was the European Parliament and Council of the EU reaching an agreement to approve payments as a feature for these digital identity wallets.

There are still some steps to formally approve the initiative, and the wallets wouldn’t be available for another two years after the formal approval.

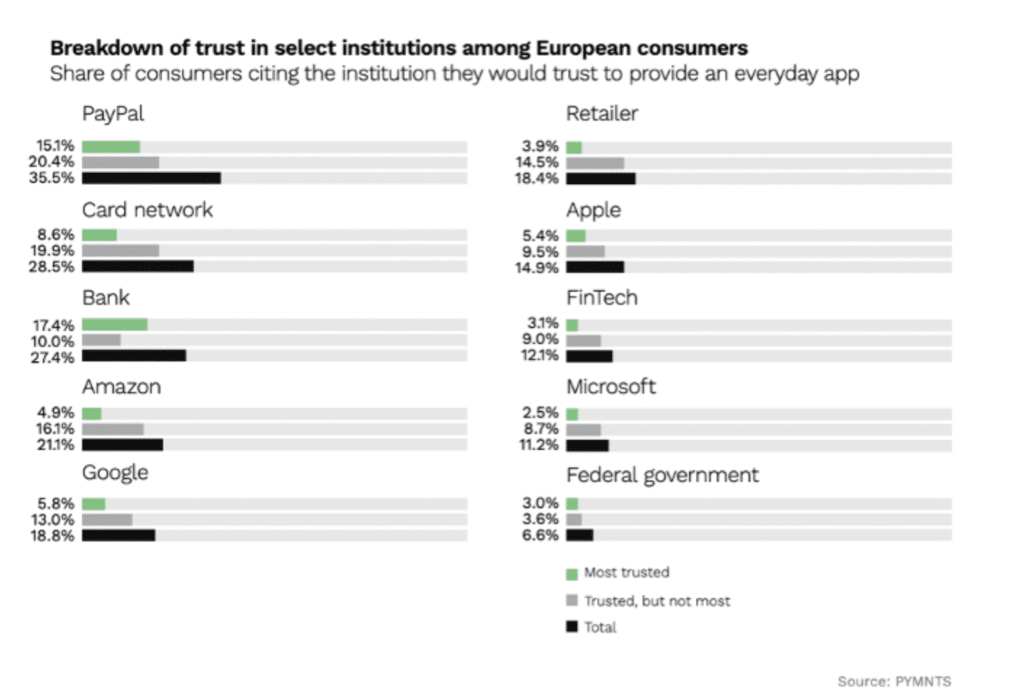

New Research Says EU Consumers Trust PayPal More Than Banks

According to a recent survey of more than 10,000 consumers, PayPal was named the most trustworthy option for an app that would integrate digital activities for shopping and banking.

36% of those surveyed said they trust PayPal the most, ranking ahead of card networks (29%) and banks (27%).

Paysafe Plans Launch of Digital Wallet For SMBs

Paysafe, a UK-based payments company, plans to launch a digital wallet that’s specifically built for small and midsize businesses.

The wallet would be used for collecting merchant acquiring settlements.

Key Takeaways From the Latest Payment Industry Investor Meetings and Q3 Results

Lots of major players in the payments industry held investor meetings and released quarterly earnings results this past month. Here are some highlights and key takeaways from those reports.

Square Q3 Results

- Total Q3 revenue up 24% (excluding Bitcoin) vs. 25% in Q2

- Transaction value up 10% in Q3 vs. 11% in Q2

- Cash App revenue was up 26% in Q3 vs. 39% in Q2 (excluding Bitcoin)

PayPal Q3 Results

- FXN revenue increased 9% vs. 8% in Q2

- US revenue increased 7% vs. 9% in Q2

- Global revenue increased 10% vs. 5% in Q2

FIS Q3 Results

- Organic revenue up 2%

- Banking organic revenue up 3%

- Merchant segment revues down 1% (vs. up 1% in Q2)

Adyen Investor Day

- Processing volume up 21% in Q3

- Constant currency net revenue up 26% in Q3

- Unified commerce volume up 25%

Fiserv Investor Day

- Beginning Q1 2024, Fiserv is organizing the business into two distinct segments—Merchant Solutions and Financial Solutions (with each representing about 50% of the company’s revenue mix).

- Organic revenue is expected to grow by 11% to 13% in 2024.

- Fiserv expects Glover’s revenue to reach $4.5 billion by 2026.

Want to catch up on more payment news? Subscribe to our newsletter, and check out last month’s biggest headlines.