PetExec is an all-in-one operations management solution for pet businesses. It handles everything from scheduling to reservations, financials, staff management, SMS marketing, and paperless contracts.

It’s a popular solution for doggy daycares, pet groomers, and boarding services of all sizes.

One standout feature of PetExec is its integrated payment processing system, which allows petcare businesses to accept card payments directly within the platform.

But PetExec’s recent acquisition by Gingr has turned its integrated payment system upside down. So this review is designed specifically for current users who are worried about rising costs, particularly in payment processing fees.

Our Quick Take on PetExec

Our experience with PetExec comes from our merchant consulting services, working directly with petcare businesses using PetExec’s integrated payments solution. We’re very familiar with Stripe, too, which has given us the unique ability to negotiate the best possible rates for our clients.

However, PetExec has taken aggressive steps in recent months. And customers who haven’t taken the subtle nudge to migrate to Gingr are not being penalized with additional fees.

Here’s what you need to know:

- PetExec was acquired by Togetherwork (Gingr’s parent company) in November 2024.

- Post-acquisition, customers using PetExec are being encouraged to migrate to Gingr.

- PetExec is no longer accepting new customers (inquiries are being sent to Gingr).

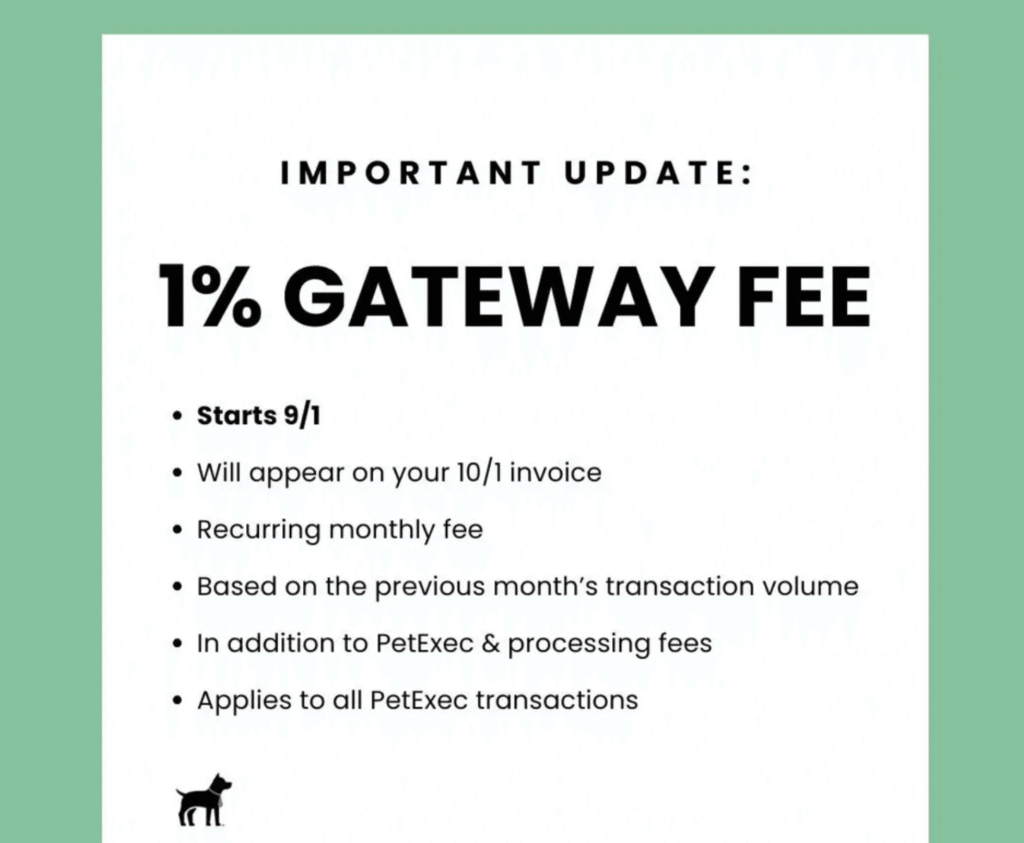

- Effective September 1, 2025, a new 1% gateway fee is being applied on total transaction volume in PetExec.

- The gateway fee is being charged in addition to the regular payment processing costs.

- Businesses can avoid this fee by migrating to Gingr.

Overall, the situation feels strange because both PetExec and Gingr use Stripe on the backend for integrated payments. So there doesn’t seem to be a huge benefit for the software provider, other than only wanting to maintain a single software (likely wanting to dissolve PetExec altogether down the road).

I also suspect that Gingr customers won’t be paying lower fees forever. Nothing is stopping Gingr from eventually adding a similar gateway fee, especially after they’ve migrated customers. Nobody will want to switch systems twice. Gingr knows this, and will likely leverage it.

PetExec Pricing and Payment Processing Fees

PetExec’s integrated payment processing system is powered by Stripe. The integration supports in-person transactions, cards on-file, online payments, mobile app transactions, and automated recurring billing.

Standard rates start at 2.7% + $0.05 per transaction for card-present payments, and 2.9% + $0.30 for all card-not-present transactions (which is aligned exactly with Stripe’s processing rates).

New PetExec 1% Gateway Fee Effective September 2025

Businesses using PetExec’s integrated processing solution were just informed of a new 1% gateway fee that goes into effect on September 1, 2025, and will first be reflected on October invoices.The 1% fee is being applied to the entire transaction volume every month and charged in addition to the regular payment processing fees.

PetExec’s new gateway fee effectively increases your total processing costs by 1% across the board.

If you process $50k per month, you’ll pay an extra $500 in processing fees. If you process $150k per month, it’s an additional $1,500 in fees. This will ultimately result in PetExec customers paying tens of thousands of dollars in extra processing fees every year.

How PetExec’s Acquisition is Impacting its Customers

PetExec’s acquisition by Togetherwork in late 2024 immediately changed the platform’s trajectory. While existing PetExec customers could continue using the software, new inquiries have been redirected to Gingr, and the company began hosting PetExec to Gingr Migration webinars on a regular basis to encourage the switch.

On the surface, both PetExec and Gingr handle similar operational needs (scheduling, reservations, client communications, staff management, etc.), so the migration push might not seem urgent. But the biggest shift has been on the payments side.

PetExec users sticking with the platform are getting hit with a 1% gateway fee, on top of the software fees and payment processing rates. This decision clearly indicates that Togetherwork wants to consolidate all customers to Gingr’s payment stack, even though both platforms are powered by Stripe.

Togetherwork has made 17+ acquisitions in the last decade (including Gingr back in 2017). So they definitely understand what they’re doing, and this new 1% fee on PetExec customers is a pressure tactic to force migrations. I’m assuming that they’ll eventually want to phase out the PetExec name altogether (although this hasn’t officially been announced).

PetExec vs. Gingr

PetExec and Gingr are extremely similar. They were actually direct competitors until the acquisition brought them under the same parent company.

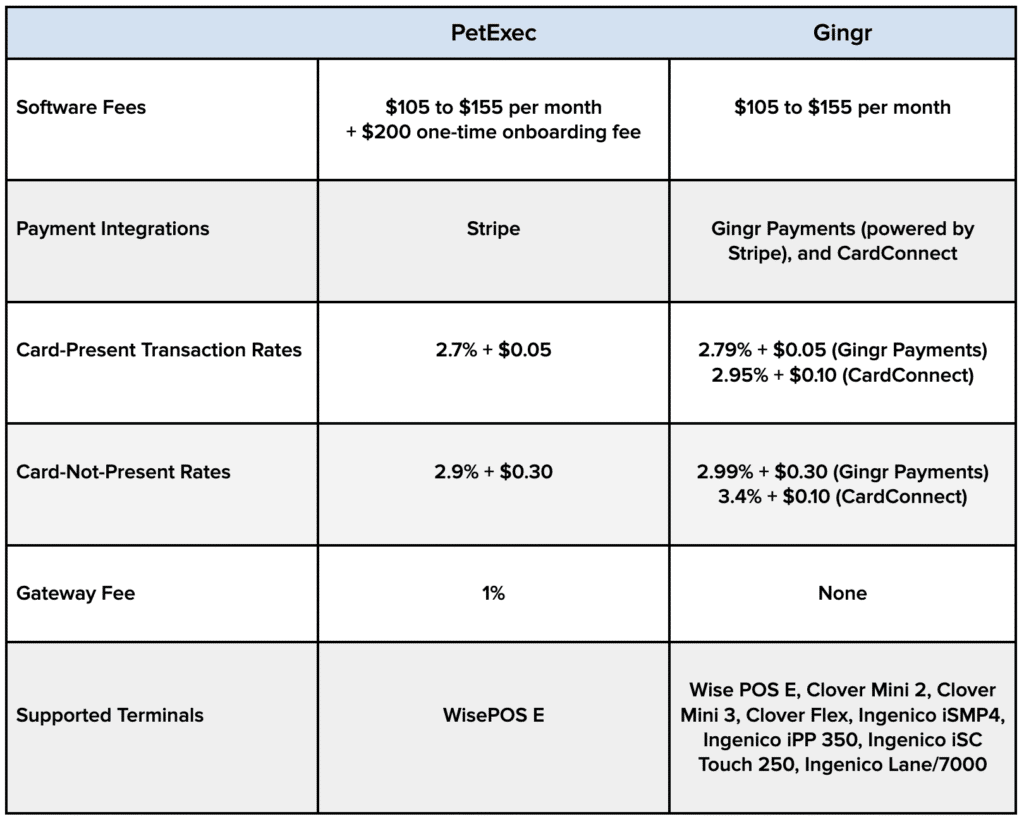

The most notable differences between these two pet software companies are all related to integrated payment processing. Here’s a quick comparison:

Read More: Gingr Payments Review

From a cost perspective, the rates were similar enough that the new PetExec 1% gateway fee clearly eliminates any small pricing advantage that PetExec once had.

Moving forward, Gingr will almost always be the cheaper option (unless Gingr decides to make its own pricing changes down the line).

It’s also worth noting that the integrated payments setup is slightly different between the two providers.

PetExec directly integrates with Stripe for payment processing. While Gingr has its own integrated payments system, called Gingr Payments (which is powered by Stripe on the backend).

Businesses using Gingr also have the option to integrate with CardConnect (a super ISO of Fiserv). The advertised CardConnect rates on Gingr’s website are higher than Gingr Payments. However, Gingr doesn’t control your rates with CardConnect. So you could actually get lower fees than advertised. Check out our CardConnect review to learn more.

Final Thoughts: What Should PetExec Customers Do?

Businesses using PetExec are faced with a tough decision—pay an extra 1% on card transactions through the same platform they’re used to, or move to Gingr.

It’s unfortunate to be put in the spot because it feels forced. And while we rarely (almost never) recommend switching payment processors, this is a unique situation that requires extra consideration.

Beyond the payments side, you have to ask yourself whether PetExec software will continue to be supported down the road. New features and updates will likely be going to Gingr. But if you switch, what’s to stop Gingr from increasing your rates after you switch?

Whether you stick with PetExec or migrate to Gingr, you need a merchant consultant at your side to ensure you get the best possible rate. Contact our team here at MCC for a free consultation. We’ll help weigh your options based on what’s best for your business, and ensure you don’t get ripped off by either provider.