Trying to make sense of your credit card processing statement can be frustrating. Between the industry jargon, multiple pages of line items, and fees that seem to come out of nowhere, it’s no surprise that most businesses just give these statements a quick glance and move on.

But hidden in those pages are often random fees that make no sense. And in many cases, they’re complete junk that can be removed from your account.

Many of these mysterious charges might have official-sounding names like “Risk Assessment Fee” or “Settlement Funding Fee.” Don’t let that fool you. Most of these random fees are bogus charges designed to pad your processor’s bottom line.

This guide will help you understand the difference between legitimate processing costs and junk fees, plus give you a step-by-step approach for getting those random charges removed and refunded to your account.

Understanding Your Credit Card Processing Statement

Aside from the summary of your monthly activity and deposits, most merchant processing statements have four main types of fees:

Interchange Fees

Interchange fees are charged directly by the card networks (Visa, Mastercard, American Express, and Discover). Every transaction has a corresponding interchange category that’s based on factors like card type, MCC code, and transaction environment.

For example, a Mastercard rewards credit card processed online will have a different interchange rate than a Visa debit card swiped in-person.

These fees are legitimate, non-negotiable, and definitely not random.

Processor Markup

Also known as the discount rate, this is your credit card processor’s fee for their service. It’s charged on top of the interchange, often as a percentage amount plus a small flat fee (like 0.10% + $0.05 per transaction).

Discount rates are legitimate but completely negotiable.

The rates aren’t random, though many processors charge way more than they should. This is where most businesses can find significant savings by negotiating better terms.

Assessment Fees

Similar to interchange, these fees are set by the card network. They’re charged to the processor and typically passed through to you as the merchant.

While some assessment fees sound random, they’re legit and non-negotiable. These fees might seem random because they aren’t always applied to your total volume. Instead, they’re often charged based on certain transaction categories or other variables.

It’s rare, but worth mentioning that some unethical processors artificially inflate these fees to pad their margins. This is known as assessment padding, and something you should keep an eye out for.

Other Fees

This is where things can get messy. These “other fees” are the random charges that we typically get the most questions about.

Some of these fees are legitimate, like a chargeback fee when a customer disputes a transaction. But 90% of these other random fees are completely bogus charges.

We’re talking about fees like Settlement Funding Fees, Risk Assessment Fees, Monthly Statement Fees, Reputation and Analytics Management Fees, and dozens of other made-up charges that are either one-off line items or assessed as a percentage of your total monthly volume.

Learn More: How to Read Your Merchant Processing Statement

How to Tell the Difference Between Legitimate Charges and Junk Fees

Credit card processors have gotten really good at disguising junk fees, making them all sound very official and necessary. But once you know what to look for, it becomes much easier to separate the legitimate charges from the garbage.

Here’s the general rule: legitimate charges almost always come from the card networks (interchange and assessments), while the junk fees come from your processor (anything other than the markup/discount rate).

Legitimate network fees are typically:

- Percentages based on transaction volume or count.

- Clearly labeled with network names or abbreviations (VS for Visa, MC for Mastercard, DS for Discover, etc.).

- Consistent with the published interchange rates and assessment schedules.

- Applied based on specific transaction criteria (card type, processing method, etc.).

On the other hand, junk fees are usually:

- Single line items with flat dollar amounts.

- Percentages applied to your total monthly volume with no clear connection to card networks.

- Vaguely named fees that sound important but serve no actual purpose.

- Charges that suddenly appear on your statement without any explanation.

- Processors that are buried amongst other legitimate charges, inserted in the middle of card network fees (in the hope that you glance over them).

In short, if you see a random fee that doesn’t clearly fall into an interchange or assessment category, there’s a good chance that it’s a junk fee that can be removed.

Examples of Bogus Random Fees

Over the years I’ve personally seen hundreds of different junk fees from practically every processor in existence. Here are some of the most common random fees that we regularly get removed for our clients:

- Settlement Funding Fee — Often charged a percentage of your monthly volume, supposedly for faster funding? But it’s complete nonsense.

- Risk Assessment Fee — Charged by Global Payments and its subsidiaries for “monitoring your account’s risk” but it’s a made-up charge.

- Reputation Analytics Management Fee — Sounds sophisticated, but it’s not.

- Monthly Statement Fee — This means your processor is charging you for the privilege of receiving a statement.

- Infrastructure Upgrade Fee — A catch-all fee for processor system improvements without any improvement to your service. You shouldn’t be paying for this.

- Auto Enrollment Fee — Random fee, and the name constantly changes. It’s literally just something your processor invents to charge you more money.

- Bank Deposit Service Fee — More charges to send you deposits. But your processor’s markup should already cover this.

I could honestly list dozens of other random fees here. But I think you get the idea.

The one thing that all of these fees have in common is that they sound legitimate, but they’re just randomly charged by your processor for no real reason. Or the reason doesn’t make sense, as it should already be included in your base service fee.

Imagine dining at a restaurant but they charge you a flat fee for sitting in a chair and then charge a percentage of your bill to help cover their costs associated with cleaning the napkins. These are the types of random fees that credit card processors creatively invent to pad their profits.

Other Red Flags

Even if you’re still struggling to identify a specific random fee on your statement, there are a few other common signs that your processor is adding junk fees to your account.

Frequent rate increases are a red flag. If your processor is constantly raising your rates, there’s a really good chance that they’re also adding random fees to your monthly statements.

It’s also a red flag if you get random notices from your processor about “changes” to your account that are ambiguous and non-specific. This almost always means that your rates are either changing or you’re going to have new junk fees added to your account.

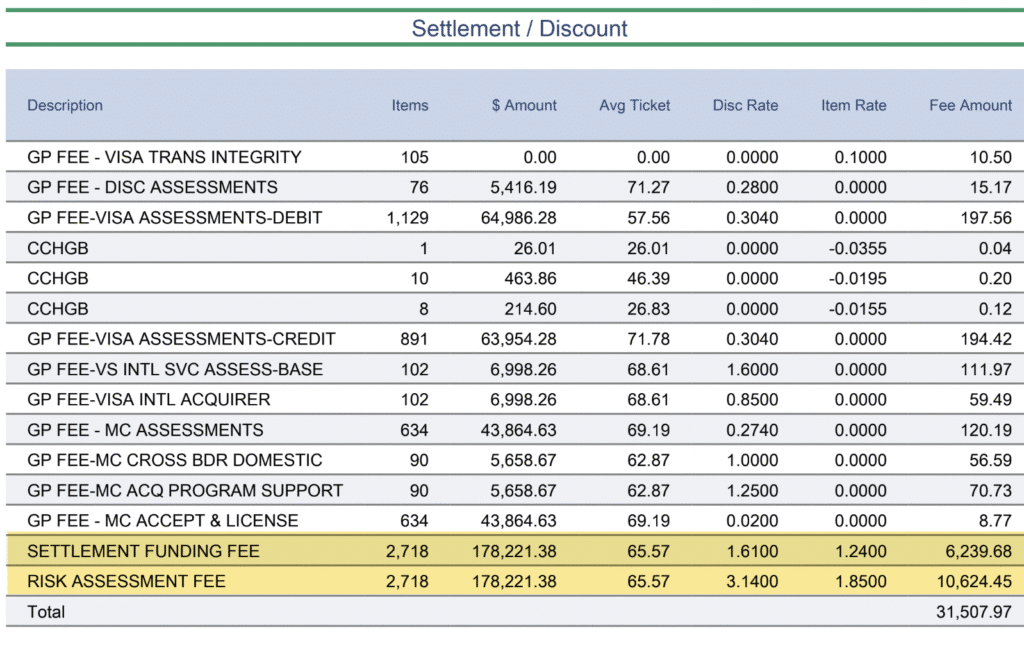

You should also investigate any fee that results in a substantial dollar amount charged to your account. For example, check out these two charges I’ve highlighted on a Global Payments statement:

I wouldn’t lose sleep over a random charge for $0.20 or $8. But what two numbers instantly jump off the page?

The Settlement Funding Fee resulted in $6,200 charged to the merchant and Risk Assessment Fee resulted in an additional $10,600 in charges.

Anything like this needs to be investigated further.

In this case, both are junk fees. The processor literally charged this business nearly $17,000 in extra fees in a single month for two made-up charges.

What to do if You Have Random Fees on Your Merchant Statement

If you’re reading through your statement and you’ve come across a random fee, here’s a step-by-step guide on how to handle it:

Step 1 — Figure out if it’s legit or junk

Compare the name of the fee to known interchange categories and assessment charges. If you can’t find the name of the fee from the interchange schedule published by the card network, it’s safe to assume it’s been randomly created by the processor.

Step 2 — Verify the correct rate

Next, check the fee against published rates. For example, the Visa Misuse of Authorization Fee (a legitimate assessment) is supposed to be $0.15 per transaction. If your processor billed you $15 for this, it means they’re overcharging you and pocketing the difference.

Step 3 — Compare the fees against previous statements

For the random fee in question, pull out your statement from last month and see if the fee is also on there. While card networks do introduce new fees, most of those should be fairly consistent, and you typically get advance notice. But if it’s the first time you’re seeing the fee on your statement and you weren’t given a heads-up, it’s likely been invented by your processor.

Step 4 — Contact your processor for an explanation

If you’re unsure about the charge, contact your processor directly. Ask them where the fee came from. Is it an interchange rate or an assessment charged by the card network? Or is it a processor fee? For processor fees, ask them to explain exactly what the fee is for. There’s a good chance the explanation will confirm your suspicion that the fee is bogus.

Step 5 — Demand a removal and refund

Anything other than interchange fees and assessments is 100% negotiable. Any fee that comes from your processor can be negotiated, removed, and potentially refunded to your account. Ask them to do this for you. They’ll likely say no, but keep pushing back and don’t give up so easily.

How a Merchant Consultant Can Help

Reviewing merchant processing statements and identifying junk fees takes time and expertise that most business owners simply don’t have.

That’s where Merchant Cost Consulting comes in.

Our team has reviewed thousands of statements from hundreds of different processors, so we know exactly what to look for. We can quickly identify bogus random fees, inflated rates, and other deceptive practices that might be costing your business thousands of dollars every single month.

More importantly, we handle all the heavy lifting. All you need to do is send us your statements.

We’ll contact your processor directly to handle all of the negotiations, working on your behalf to get them removed and refunded. So you won’t have to spend hours on the phone or deal with the back-and-forth.

We work on a success-based model, which means we only get paid when you save money. Our fee is a percentage of the savings we generate, so there are no upfront costs or monthly charges. If we don’t find savings, you don’t pay anything.

Ready to find out how much you can save? Submit your statements for a free audit or simply reach out to our team and ask about a specific random fee. We’ll let you know whether it’s legit or if it requires further investigation.