Whether you’re currently using Rectangle Health or considering this provider for payment processing, this in-depth review will provide everything you need to know to make an informed decision.

We have multiple clients processing payments via Rectangle Health, which means our team has access to monthly statements and contracts that aren’t publicly accessible.

Our team also has years of experience negotiating directly with Rectangle Health on behalf of our clients. So we have a unique perspective and insider information that you won’t find anywhere else on the web.

MCC Quick Take on Rectangle Health

Rectangle Health is branded practice management software, but the company is best known for its built-in payment solutions for healthcare providers.

While they provide all of the client-facing onboarding and support, they don’t actually process payments in-house. Instead, Rectangle Health uses Vantiv as its backend processor (which is owned by Worldpay).

This structure, plus the practice management software, definitely makes Rectangle Health a bit more expensive than other payment processing services. So unless you really want their practice management system, you can most likely get cheaper processing elsewhere.

What We Like About Rectangle Health

- Processing rates and fees can be negotiated.

- Interchange plus pricing is sometimes available, although it’s generally reserved for larger accounts).

- PCI-DSS compliance and HIPAA compliance is included.

- Easy to set up patient cards on file for automatic and recurring payments.

- Rate increases aren’t as frequent as other processors.

Where Rectangle Health Falls Short

- They typically offer flat rate pricing, which isn’t the best way to get the lowest rates.

- Rectangle tries to upsell its “Bridge” on top of payment processing services.

- Inconsistent fees and differences in reporting between clients.

- We’ve seen Rectangle try to lock healthcare companies into a three-year contract.

- There’s a liquidated damages clause hidden in most of their contracts.

Rectangle Health Pricing and Credit Card Processing Rates

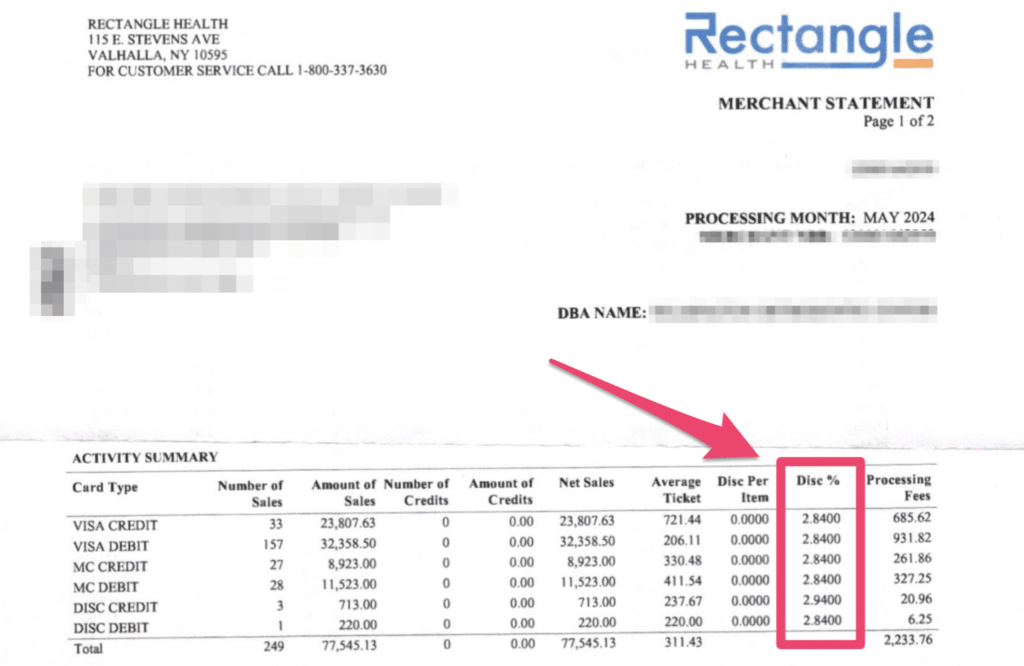

Rectangle Health charges between 2.60% and 3.08% per transaction—based on the most recent statements we’ve seen from our clients using Rectangle Health.

These rates reflect a fixed-rate pricing structure, which means Rectangle Health is charging the same amount for all transactions.

While this sounds simple and makes it easy to predict your costs and read your statements, it’s not ideal if you want to optimize your rates. We’ve been able to negotiate much better deals for healthcare providers that opt for an interchange plus pricing plan instead of a flat-rate contract.

Latest Rectangle Health Rate Increases and Updates

Rectangle Health doesn’t increase their processing rates as often as other providers. But we did just get notified of a new rate hike that went into effect on June 1, 2024.

It’s a 0.40% per transaction increase that applies to all Visa, Mastercard, American Express, and Discover cards.

You can keep tabs on all upcoming rate increases and view a history of their fees by referring to our Rectangle Health pricing page.

Our Insider Insights on Rectangle Health: What Else You Need to Know

Below, I’ve summarized the most important information you need to know about using Rectangle Health for payment processing—and I’ve even included some real statements to highlight and back up my claims.

Rates Can Vary by Practice and Even by Location

Like many processors, Rectangle Health doesn’t change everyone at the same rate. For flat-rate pricing, we’ve seen some healthcare practices charged as low as 2.60% per transaction while others are charged 2.84%, 2.94%, and 3.08%.

This honestly comes down to just how well you were able to negotiate your initial contract and renewal. We’ve also noticed that Rectangle Health tends to give slightly better rates to higher-volume businesses.

What’s also interesting to know is that multi-location practices can also have different rates at each location.

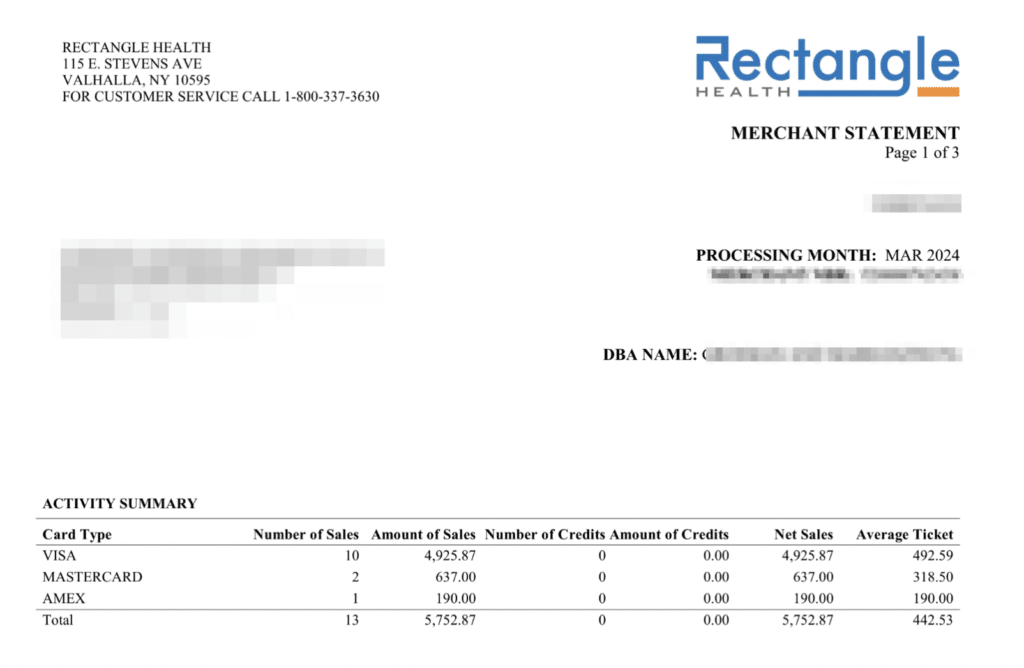

For example, here’s a look at a recent statement from an orthodontics practice we’re working with:

As you can see from the statement, this business is on a fixed-rate plan paying a discount rate of 2.84% per transaction—which is the same rate for all credit and debit cards they accepted during this billing cycle.

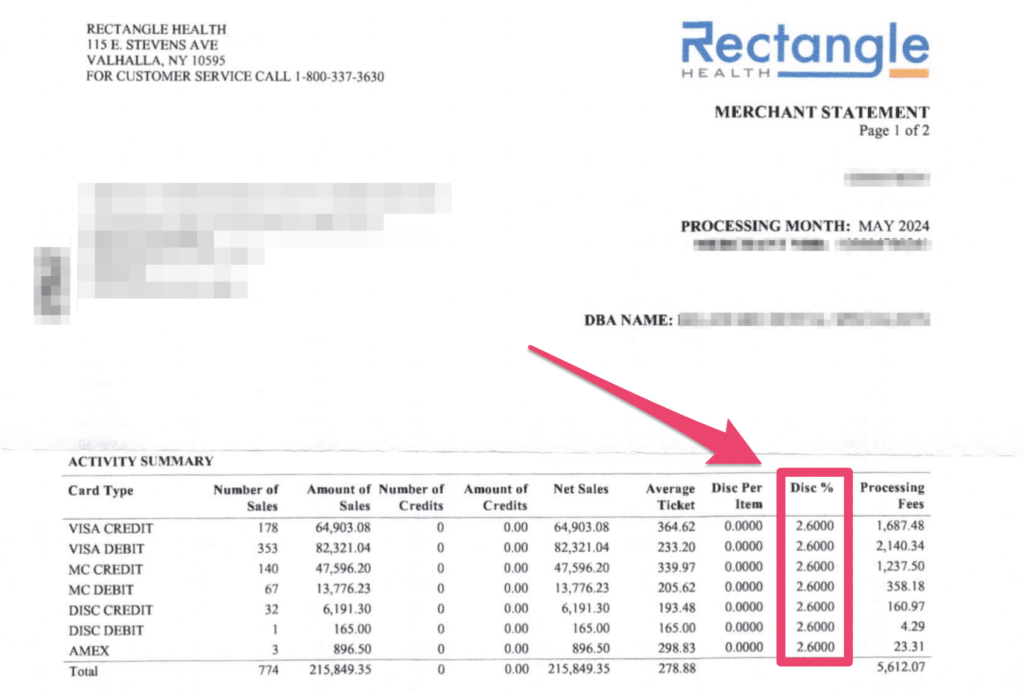

Now let’s look at another statement for another location in the same practice:

This location has a different discount rate. They’re being charged 2.60% per transaction—even though it’s the same business and the same month.

How are they able to get a lower rate?

Check out the total sales volume for each of these. The first location did roughly $77,000 in net sales, while the second location did $215,000.

So if your sales volume is higher, Rectangle Health is more willing to give you a lower rate. They took in more than double the amount of processing fees from the second location ($5,612 vs. $2,233), even though the discount rate was lower.

Don’t Be Surprised if Rectangle Health Tries to Lock You Into a Long-Term Contract

We commonly see Rectangle Health try to get businesses to commit for at least 36 months.

Personally, I don’t like these terms because they’re often iron-clad and don’t give you much room for flexibility. While we rarely recommend switching processors or canceling contracts, the problem with a 36-month commitment is that you’re locked into a rate.

If you’re able to negotiate a great deal, then fine, lock it in. But it’s rare to get a good deal on your own without getting help from a merchant consultant.

I definitely wouldn’t lock in 36 months on a fixed-rate deal. You need to at least try to get an interchange-plus contract first.

Monthly Statements and Reporting Look Different Based on Contract Structure

As previously mentioned, Rectangle Health tends to put most businesses on a flat-rate pricing plan.

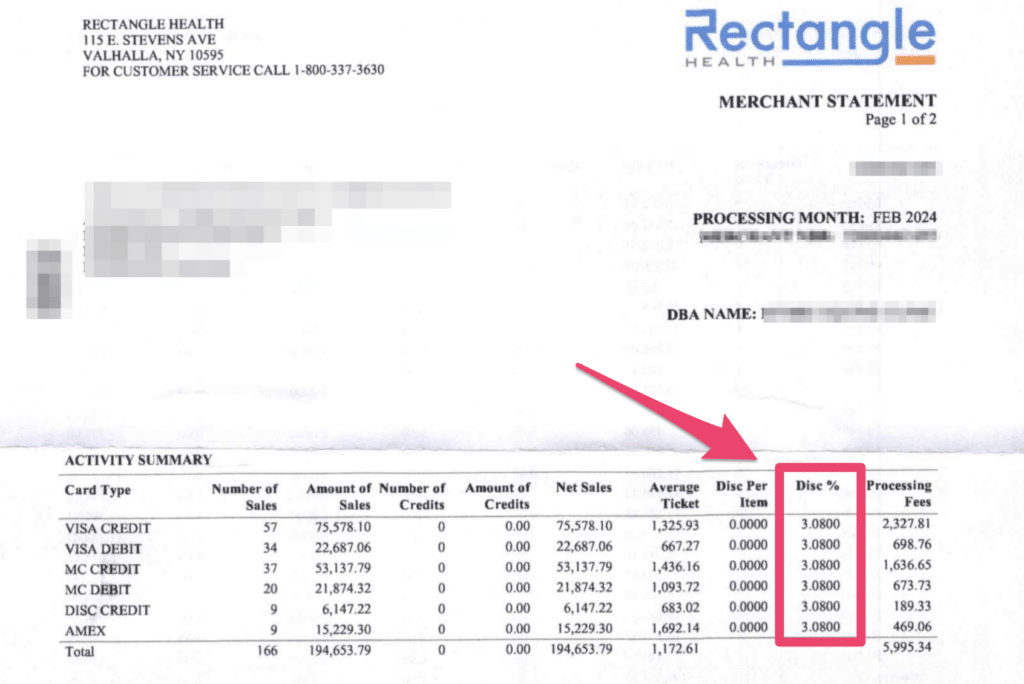

Here’s another look at a completely different merchant statement where Rectangle Health is charging 3.08% per transaction:

The reporting here is identical to the other two statements we looked at earlier. But I’m using this one as an example just to reiterate how much the discount rate can vary across different merchant accounts.

Now let’s look at another business that’s on an interchange plus pricing plan from Rectangle Health (the first we’ve seen so far in this review):

It’s completely different from the others. The activity summary here doesn’t even include any of the fees yet—only a summary of the sales and average ticket per card type.

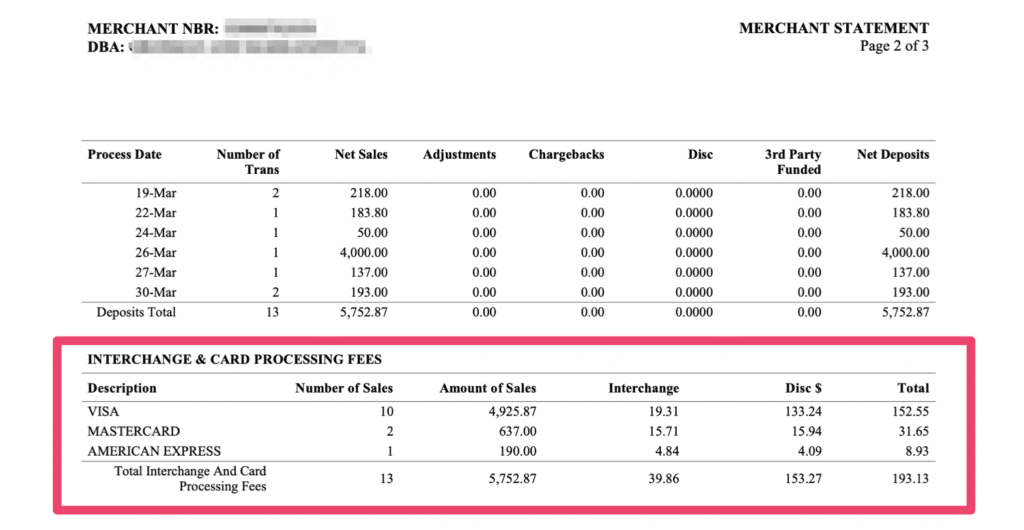

Let’s continue to the next page so you can see the actual fees:

Here, we can see that the discount rate is reported as a dollar amount (Disc $), whereas every other time, we saw it as a flat-rate percentage (Disc %).

And if you do the math on these, you’ll see that the rate actually varies for each card network (as it should because they all have unique interchange rates).

If we divide the “Disc $” column by the “Amount of Sales” column, we can calculate Rectangle’s markup for each card type:

- Visa — 2.70%

- Mastercard — 2.50%

- Amex — 2.15%

It’s also worth noting that these rates are really high, particularly for an interchange-plus plan. But it’s interesting to see how different this looks compared to the fixed rate of 3.08% per transaction that was applied for all card types.

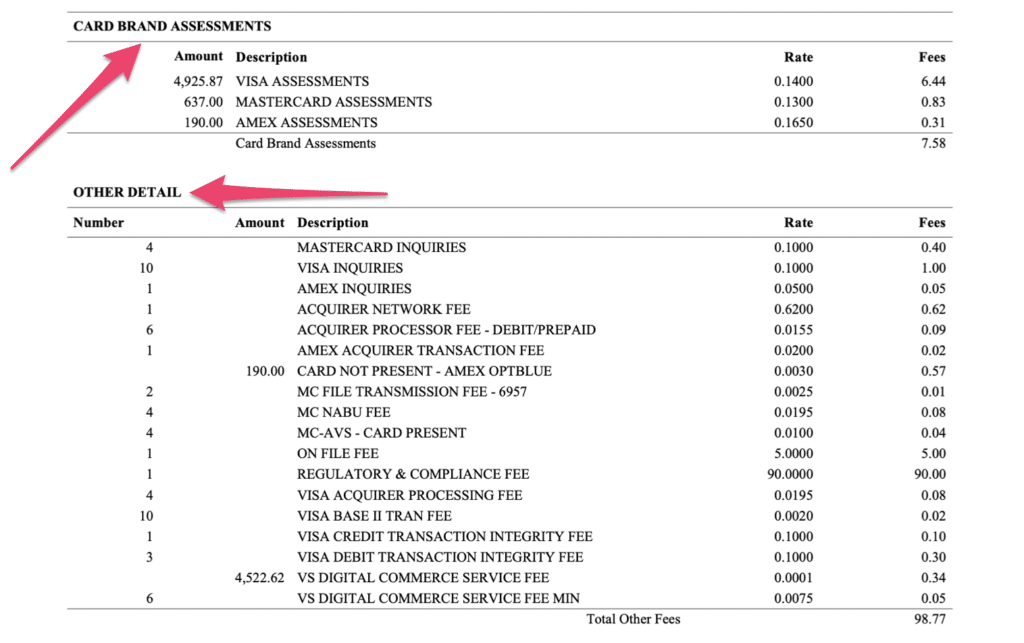

If you’re on an interchange plus plan, you’ll also notice tons of other line items that wouldn’t be shown on a fixed-rate plan:

While this looks a bit more complicated compared to just seeing a few lines, it’s much more transparent than a fixed-rate plan because you know exactly what you’re paying for.

Watch Out For Fees Associated With the Rectangle Health Payments Bridge

Rectangle Health also provides a “Bridge” which is essentially a software integration between the practice management system and payment processing service.

They typically charge this as a separate monthly fee per location.

I honestly think this is a bogus charge and you should try to get it waived or at least reduced. There’s really no reason to use Rectangle Health for practice management alone—and the whole reason you’re using them is to help process payments. So why should they be charging you extra for a service they’re already providing?

It’s just a way for them to squeeze some extra dollars out of you, and I don’t agree with it. With that said, it’s not always possible to get this fee removed. And I don’t necessarily think it’s a deal breaker or reason not to use them if you’re happy with everything else.

Read the Fine Print in Your Contract—You Might Have a Liquidated Damages Clause

Liquidated damages are the worst type of early termination fee for businesses. If you just glance through your Rectangle Health contract, you might not even notice this right away. That’s because they don’t outright call it liquidated damages. But if you read carefully, it’s as clear as day.

For example, in the “Termination Fees” section of the contract, it states that if the customer terminates the agreement prior to the end of the term, they’re responsible for all fees due to Rectangle by the end of the term. Rectangle calculates this by using the average monthly total fees from the past three months, and then multiplies it by the remaining months of the contract.

Let’s say you wanted to cancel 12 months into a 36-month contract, and you average $5,000 in fees per month. It would cost you $120,000 to terminate your agreement ($5,000 x 24 remaining months).

Every contract is different and this may or not be in yours. So just keep an eye out for it and try to get this removed before signing—especially if you’re on a long term deal.

Our Final Thoughts on Rectangle Health

Rectangle Health is a decent payment processing option to consider for healthcare providers seeking an all-in-one practice management system with PCI-compliant and HIPAA-compliant payment processing built-in.

But since they’re using a third-party processor on the backend and they’re offering software, Rectangle Health is a bit more expensive than direct processors.

Try to get on an interchange plus plan to save money, and don’t lock yourself into a long-term contract unless you’re absolutely positive you’re getting the lowest possible rate available. If your contract has a liquidated damages clause, you likely won’t be able to cancel it.

Reach out to our team here at Merchant Cost Consulting if you need help negotiating your rates with Rectangle Health. Whether you’re a new customer or currently using them to process payments, we can help you save money and lower your costs associated with medical billing.