If you’ve spotted a Risk Assessment Fee on your merchant statement, you’re right to question it. Processors have been adding these charges to accounts over the last couple of years, often without any explanation or justification.

This is a bogus fee that should be eliminated from your account. It’s also a red flag that you’re likely being charged other junk fees and paying higher rates on credit card processing overall.

What is a Risk Assessment Fee in Payment Processing?

A Risk Assessment Fee is an extra charge imposed by payment processors, allegedly used to cover costs associated with managing risk and fraud prevention. But unlike legitimate assessment fees that are charged by the card networks, this charge is completely made up by the processors as an additional markup that goes straight into their pockets.

Risk Assessment Fees are typically assessed as a percentage of total monthly processing volume, and often have an additional per-transaction component.

Depending on your processor, they can show up on your statement as different names, including:

- Risk Assessment Fee

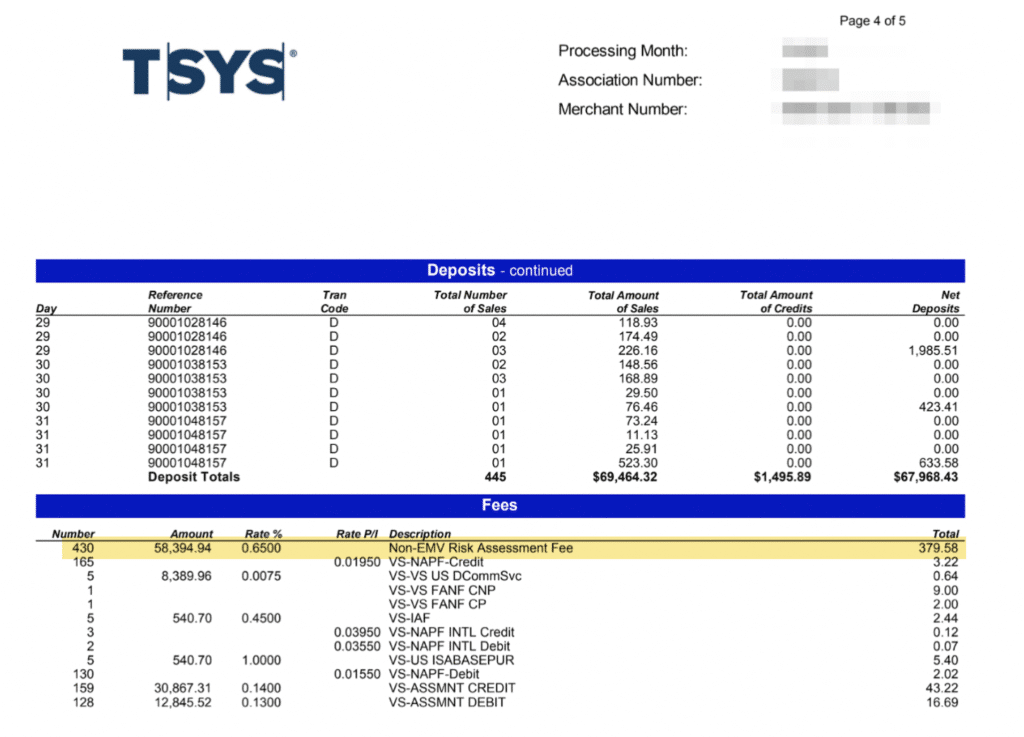

- Non-EMV Risk Assessment Fee

- Processor Transaction Risk Fee

Again, these risk fees are not charged by Visa, Mastercard, Discover, or American Express. They’re completely made up by the processor solely to inflate your costs while hoping you don’t question the charge.

How Much Do Risk Assessment Fees Cost?

The cost of Risk Assessment Fees varies significantly between merchants, with no logical consistency in how processors apply these charges. We’ve seen them as low as 0.05% and over 3%.

Here are actual examples of Risk Assessment Fee rates we’ve seen in the last 18 months:

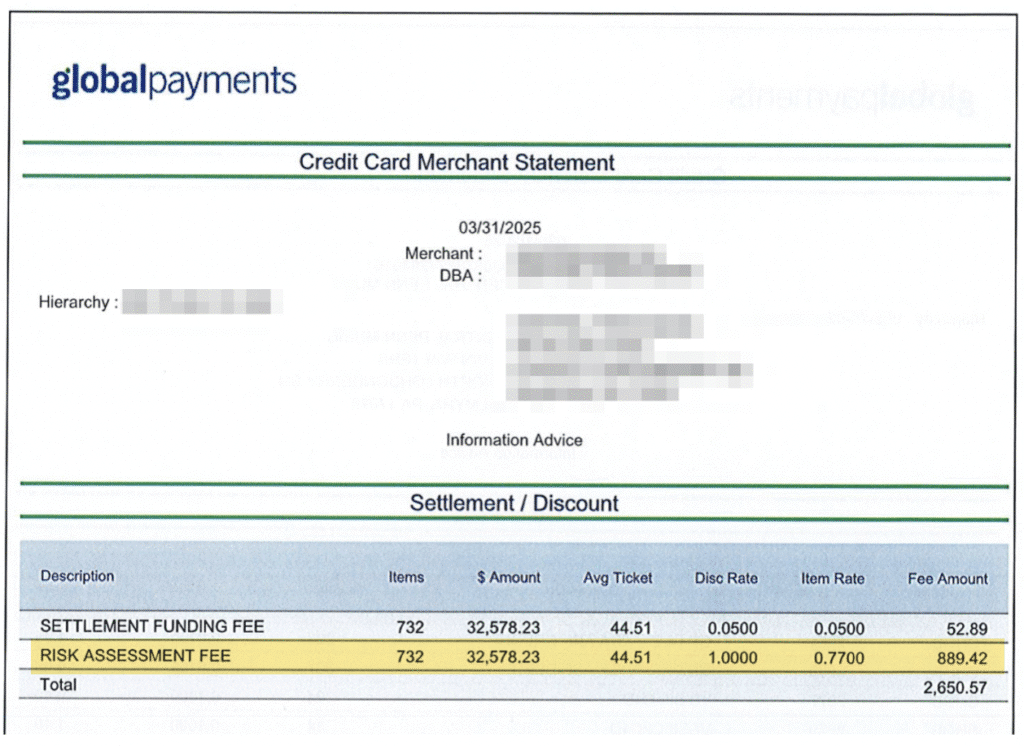

- 0.05% + $0.05 per transaction

- 0.15% + $0.15 per transaction

- 1.00% + $0.77 per transaction

- 0.65% on total volume

- 3.14% + $1.85 per transaction

The lack of any consistent standardization further proves that these fees are applied arbitrarily. Processors charge whatever they think they can get away with until merchants push back.

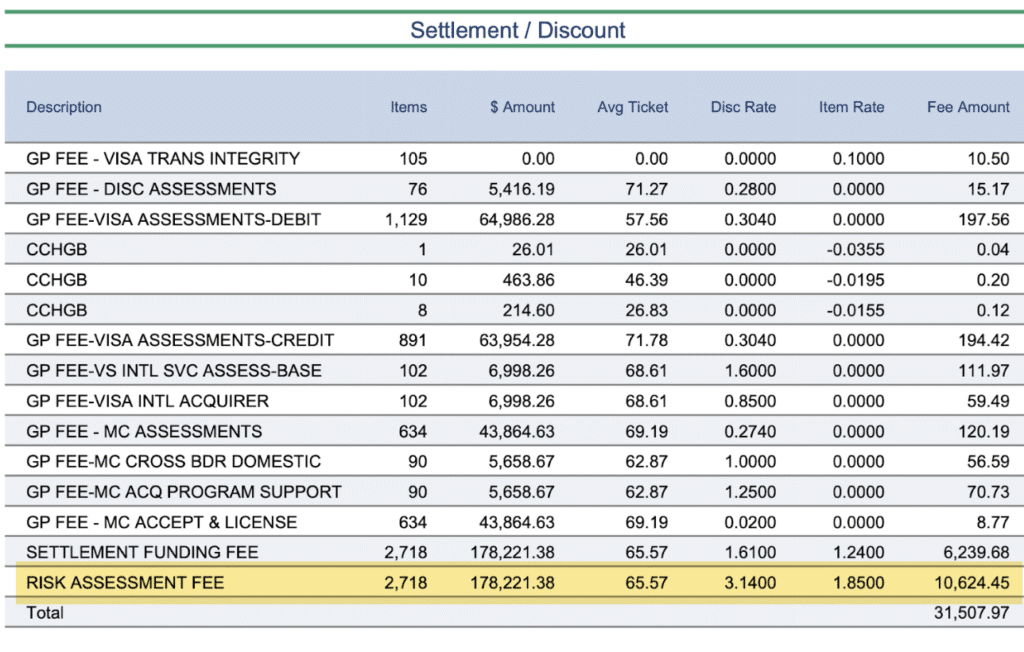

By far the craziest example we’ve seen is Global Payments charging 3.14% + $1.85 per transaction on $178k in volume—resulting in the merchant paying over $10,000 in Risk Assessment Fees in a single month.

We’ve also found instances of Global increasing another merchant’s Risk Assessment Fee from 0.05% to 1% overnight. You can read more about examples of outrageous fees from Global Payments that we’ve exposed here.

Who Charges Risk Fees in Credit Card Processing?

Risk Assessment Fees are charged by payment processors, not card networks. More specifically, they come from Global Payments and its subsidiaries.

Since Global Payments has acquired several processors over the years, this junk fee appears across multiple brands:

- Global Payments (Risk Assessment Fee)

- TSYS (Non-EMV Risk Assessment Fee)

- Heartland Payment Systems (Risk Assessment Fee)

- OpenEdge (Risk Assessment Fee)

- Cayan (Non-EMV Risk Assessment Fee)

- EVO Payments (Risk Assessment Fee)

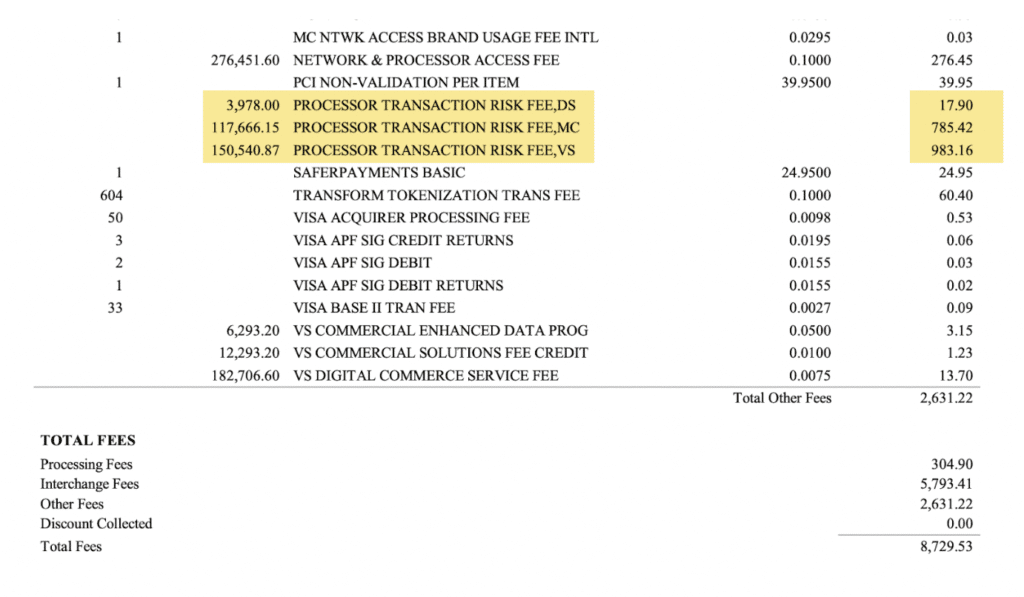

- Worldpay (Processor Transaction Risk Fee)

Interestingly enough, Worldpay’s Processor Transaction Risk Fee is something that they’ve been applying to accounts even before they were acquired by Global. This deceptive practice of adding bogus fees fits in perfectly with how Global operates, and it’s one less fee they need to add to their newly acquired Worldpay merchants.

Are Risk Assessment Fees Legit or Junk?

Risk Assessment Fees are 100% junk fees.

Despite having “assessment” in the name, these are not mandatory fees charged by the card networks. I’m convinced that Global strategically named this fee to deceive merchants who quickly scan their statements into thinking these are card network assessments (fees that are normally legitimate and non-negotiable).

While it’s an official-sounding name and the idea of needing to pay to fight risk may sound legitimate on the surface, this is just an additional markup imposed by your processor.

Also, I want to quickly debunk the idea that your processor needs to charge extra fees for “risk” on your account.

Risk assessment is already part of your normal processing costs. When your processor onboarded your merchant account, they conduct a thorough risk assessment during the underwriting process. This helps them set your rates initially, and ongoing risk monitoring is just a standard cost of doing business as a payment processor. It’s not something that justifies a separate fee.

The way these fees are arbitrarily applied to accounts is also an indicator of a junk fee.

Legitimate assessments are applied uniformly across all accounts. Every merchant pays the same rate, period. But these Risk Assessment Fees from Global are charged to some accounts and not others, with widely varying rates ranging from 5 to 300+ basis points.

How to Spot Risk Assessment Fees on Your Merchant Statement

Depending on your processor, Risk Assessment Fees can appear in different sections of your processing statement. The easiest way to find them is by using your keyboard’s search function (Command + F) on a digital statement.

Since they’re often buried amongst legitimate charges, this is the fastest way to identify them amongst hundreds of other line items.

Just search for terms like:

- Risk Assessment

- Transaction Risk

- Non-EMV Risk

- Processor Risk

- Risk Fee

If you’re looking at a printed statement or physical copy, you’ll need to look through every line item. Lately we’ve seen Global putting Risk Assessment Fees as one of the last charges before the fee breakdown and totals.

And it’s commonly found directly above or below Global’s Settlement Funding Fee.

What to Do if You Find Risk Assessment Fees on Your Statement

If you identify a Risk Assessment Fee on your statement you need to take immediate action to avoid getting hit with this fee again in the future.

First, review your last few statements to see if the fee is new or if you’ve been getting charged consistently. Next, contact your processor immediately and demand that it be removed and refunded.

If they push back (they likely will), you can continue to escalate things. Keep calling back, keep sending emails, keep reaching out to different reps.

It helps to have a merchant consultant on your side during this process. We’ve negotiated this fee with Global dozens of times on behalf of our clients—helping to save thousands of dollars every month. So if you want some help, just reach out and we’ll handle the negotiation for you.

Why Risk Assessment Fees Are a Major Red Flag

Risk Assessment Fees are often a sign of bigger problems with your merchant account. If your processor is willing to charge you one bogus fee, there’s a high probability that there are other junk fees on your account.

When you start to read your merchant statements with a bit more scrutiny, you’ll likely find other high charges and strange names that just don’t quite look right.

For example, if you have a Risk Assessment Fee on your statement, then there’s a good chance Global is also charging you a Settlement Funding Fee, which is also bogus.

It’s also common for unethical processors to pad your assessment fees, which involves inflating the legitimate assessments from the card networks and passing them to you without disclosing the markup.

So if you’re being charged a Risk Assessment Fee or any similar variation, you should get your statements audited by a professional to help you identify other hidden fees that could be costing you tens of thousands of dollars.

Real Examples of Risk Assessment Fees

Let’s look at some actual examples from merchant statements that we’ve audited so you can see how much money these fees can cost you.

Global Payments Risk Assessment Fee

Here’s one from Global Payments, assessed at 1% + $0.77 per transaction:

At $32,578 in sales on 732 transactions, this Risk Transaction Fee totaled $889 for this statement period.

Paying an extra 1% on top of your standard discount rate is absurd and an absolute rip-off.

But it’s not even close to the worst one we’ve seen from Global. Check this out:

That’s a $10,624 Risk Assessment Fee charged in a single month.

The rate here is insane—3.14% + $1.85 per transaction, which would be high enough on its own for flat-rate rate processing. But this is charged on top of the merchant’s regular discount rate, interchange fees, and other bogus fees from Global (like the $6,200 Settlement Funding Fee directly above it).

When you process over $178k in a month like this business does, you should be getting better deals from your processor, not getting ripped off.

Worldpay Processor Transaction Risk Fee

Worldpay’s risk fees look a bit different.

They’re called Processor Transaction Risk Fees, and they’re assessed on volume from each card network. Here’s how it appears on statements:

The rate itself isn’t displayed—just the volume per card type and the total fees.

But if we do some quick math, we’ll see that Worldpay charged 0.45% for Discover and about 0.65% for Visa and Mastercard.

TSYS Non-EMV Risk Assessment Fee

TSYS calls this fee a Non-EMV Risk Assessment Fee, implying the “risk” has something to do with the processor using outdated equipment. But we’ve seen it charged even if the processor is using a modern chip-enabled terminal.

This practical Non-EMV Risk Assessment Fee from TSYS is charged at 0.65% on $58,394 in total volume, resulting in $379 in extra fees charged this month.

Final Thoughts

Risk Assessment Fees are junk fees that should be removed from your merchant account immediately. These fees are purely processor markup with no added value to your service.

You’re essentially giving your processor free money just because they added a random line item to your account.

If you need help getting your Risk Assessment Fees removed, reduced, or refunded, contact our team here at MCC. We’ll negotiate directly with your processor to get you the best possible deal and ensure all bogus fees are removed from your account.