If you’re reading your merchant processing statement and spot a Settlement Funding Fee, it’s a red flag, and this post is for you.

Not only is this a bogus charge that should be eliminated from your account, but it’s a sign that you’re overpaying on credit card processing and likely being charged other junk fees.

What is the Settlement Funding Fee on Merchant Processing Statements?

The Settlement Funding Fee is an extra charge on top of base processing costs. It was invented by Global Payments and is used as an additional markup that goes straight to your processor.

Settlement Funding Fees are assessed on the total monthly processing volume.

To put this into perspective for you, here’s a breakdown of how this fee impacts your total costs:

- Discount Rate: This markup is a negotiable fee charged per transaction that’s paid directly to your processor for their services.

- Settlement Funding Fee: Also goes directly to your processor and gets charged on your total processing volume for the month.

For example, let’s say your processor charges you a discount rate of 0.30% + $0.10 per transaction. If you’re also being charged a 0.45% Settlement Funding Fee, then your discount rate is effectively 0.75% + $0.10 per transaction.

Both of these fees go directly to your processor as a markup.

The Settlement Funding Fee is just a way for your provider to profit more from your account in the form of a hidden charge. They’re hoping you see it as a separate line item, assume it’s legit, and just won’t question it.

How Much is the Settlement Funding Fee?

The exact cost of the settlement funding fee varies significantly for each merchant. It’s applied somewhat arbitrarily, and we’ve seen it as low as 5 basis points and higher than 160 basis points.

It’s charged as a percentage of total monthly processing volume, and often includes a per-transaction fee. Your processor will charge as much as they possibly can here until you push back and question it.

Here are some different rates for the Settlement Funding Fee that we’ve seen over the past year:

- 0.05% + $0.05

- 0.15%

- 0.30% + $0.05

- 0.35%

- 0.40%

- 1.61% + $1.24

As you can see, there’s a huge range here with no real rhyme or reason behind how these charges are applied.

Typically, processors will charge higher fees for lower volume merchants and “reward” high-volume clients with lower rates. But that’s the case here at all.

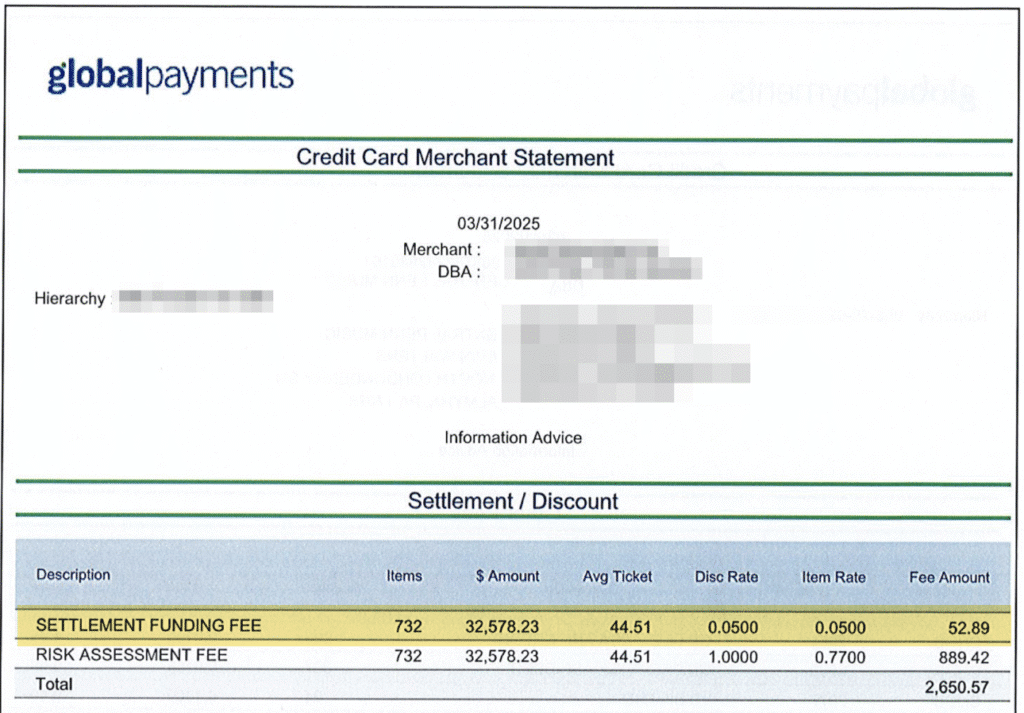

For example, here’s a business that processed $32,500 in March 2025 that was charged a Settlement Funding Fee of 0.05% + $0.05 per transaction on total volume (the lowest rate we’ve seen):

It ended up costing this merchant about $50, which isn’t the end of the world.

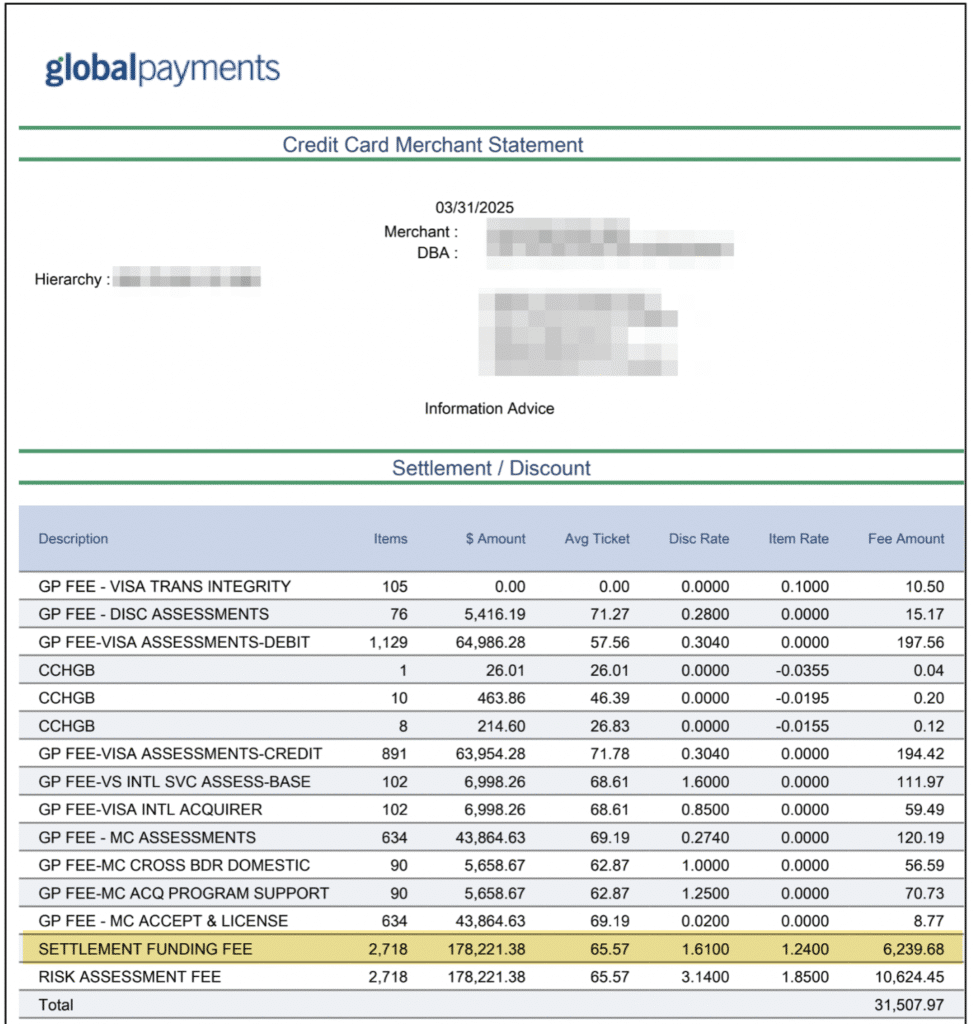

Now let’s look at a different business, also in March 2025, except this merchant processed significantly more—$178,000. Global charged them a Settlement Funding Fee of 1.61% + $1.24 per transaction on this volume:

This is one of the most absurd charges I’ve ever seen in my life (and I’ve audited thousands of statements).

1.61% + $1.24 per transaction would be high as a regular processor markup. Charging it on top of the regular markup should be criminal.

At this rate, Global will be getting an additional $70,000 per year in overages from this merchant on a phantom charge that shouldn’t exist in the first place.

Read More: Global Payments Outrageous Fees Exposed

Who Charges the Settlement Funding Fee?

If you’re using any of the following processors, you need to keep an eye out for the Settlement Funding Fee on your account:

- Global Payments

- TSYS

- Heartland

- OpenEdge

- EVO Payments

The fee itself is from Global Payments, but Global owns several other processors. So any subsidiary or division of Global Payments can charge this fee, and we continue to see it added to both new and existing accounts at random times.

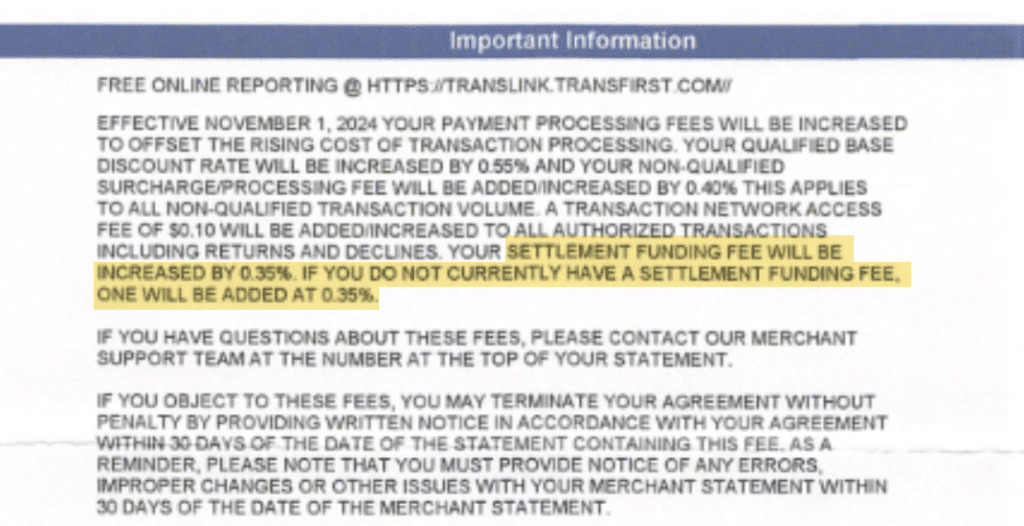

Here’s an example from a TSYS account that was notified of the fee being added in November 2024:

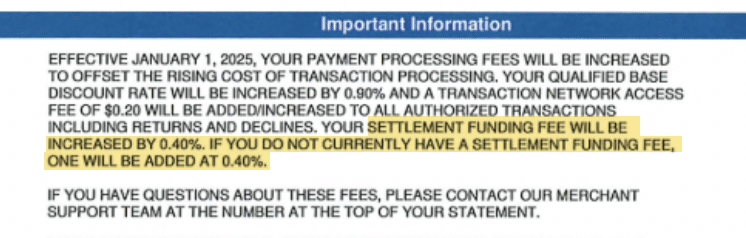

Here’s another notice sent to a different merchant, just two months later in January 2025:

Again, the rate itself is arbitrarily applied (0.35% vs. 0.40%), and the timing is random (November vs. January).

The craziest part about these notices is that the processor doesn’t even take the time to customize them for each account. They say, “If you don’t have a settlement funding fee, one will be added.” Instead, they should check to see if they’re already charging you, and then let you know this will be a new fee on your statement.

If they’re going to rip you off, they might as well be somewhat transparent about it.

Is the Settlement Funding Fee Legit or Junk?

Global’s Settlement Funding Fee is a junk fee.

Unlike interchange rates or assessments that are charged by the card networks and are non-negotiable, this fee is totally made up and just used to further inflate your processor’s markup.

It’s also incredibly deceptive because it sounds legitimate. The terms “settlement” and “funding” are both part of the payment process. Settlements occur when money moves from the customer’s account to the merchant account, and funding happens when the processor actually releases money to the business bank account.

But you don’t need to pay a separate fee for this to happen.

I also think that Global Payments strategically named this fee for another reason—it’s tough to find information about. If you run a quick Google search for “settlement funding fees” you’re going to see lots of information about loan payments and other results about lawsuit settlements.

Neither of these has anything to do with payment processing.

Obviously, this is just a hunch, and I can’t prove Global’s reasoning behind the fee’s name. But Global doesn’t get the benefit of the doubt from me anymore, as we’ve caught them in too many deceptive practices over the years (including padded assessments).

How to Spot the Settlement Funding Fee and What to Do if You Find it

Fortunately (and I use this term loosely), we’ve only seen the Settlement Funding Fee appear on statements under this exact name. So it’s fairly easy to spot if you’re doing a quick search via command + F on your digital statement.

For those of you with mailed paper statements or faxed statements, you’ll need to go through line by line to find the Settlement Funding Fee.

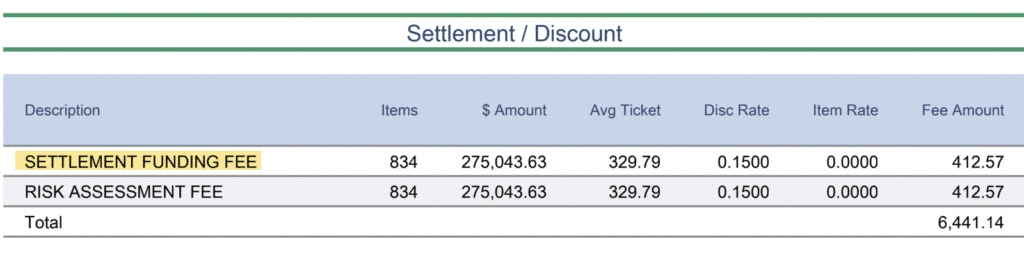

Sometimes we see it as one of the last fees on the statement, directly next to the Risk Assessment Fee (another bogus charge):

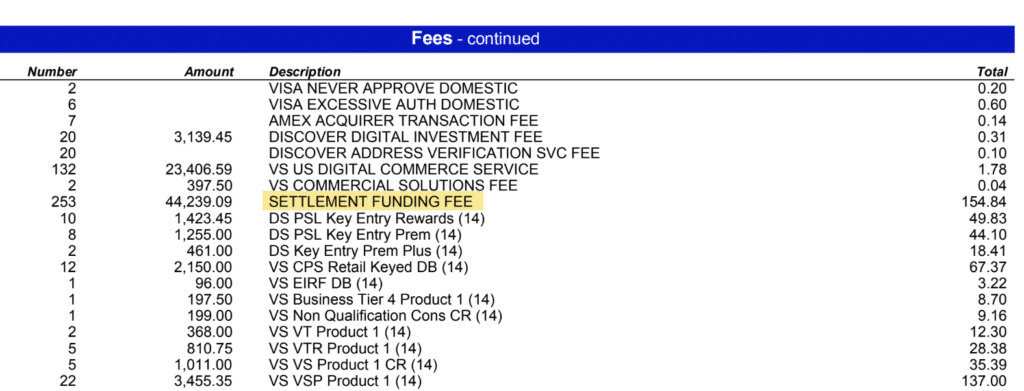

Other times it’s buried amongst card network fees and assessments:

It’s a bit more deceptive when listed like this because it’s surrounded by a bunch of legitimate charges.

If you’re looking at your statement quickly, you might think that it’s coming from the card networks because that’s where it’s listed.

This is 100% intentional, as your processor doesn’t want you to question any charges, and they want to make it as hard as possible for you to spot junk fees.

When you see this fee on your statement, you need to act as quickly as possible to get it removed.

Contact your processor and demand its removal and an immediate refund. Or at the very least, try to negotiate a lower rate.

If they’re unwilling to work with you, then contact our team here at MCC. We can negotiate directly with your processor on your behalf to rectify the situation.

Final Thoughts

You shouldn’t be paying a Settlement Funding Fee. This is a bogus charge that was invented out of thin air by Global Payments, and they’ve been slowly rolling it out across as many accounts as possible.

The Settlement Funding Fee is just the tip of the iceberg.

If this charge is on your account, it’s a sign that your processor is trying to take advantage of you—meaning there’s a high probability you have other junk fees, hidden charges, and inflated rates on your account.

It’s incredibly difficult to spot this stuff on your own. So if you want some assistance, get a free audit from MCC. We’ll review your statements for free, let you know how much we think you can save, and then negotiate everything on your behalf. You’ll end up saving money without having to switch processors or change any of your operations.

Plus, we’ll continue to monitor your statements every month to ensure no additional junk fees are added to your account down the road.