Square credit card processing starts at 2.6% + $0.10 per transaction for most businesses.

But the exact price you’ll pay to use Square depends on a wide range of factors, including the transaction environment, business type, and plan you sign up for.

We created this guide to clarify Square’s pricing and credit card processing costs once and for all. Rather than writing a Square review, we’re simply going to focus on the facts and help you better understand Square’s rates for your business.

Square Pricing Explained

Square offers payment technology, payment processing, and other financial solutions to businesses.

The total cost of using Square is broken down into three different parts:

- Monthly subscription fee to use Square

- Processing fees for each transaction

- Square hardware and other add-on services

When you sign up for Square, you’ll know exactly what your processing fees cost for that specific plan type. Every plan has three different processing rates that vary based on the subscription you choose. The rates vary for in-person transitions, online transactions, and manually keyed transactions.

With Square, the card you accept does not impact your processing rates. The rates are solely dictated by your plan and transaction environment. So it doesn’t matter whether you accept Visa, Mastercard, Amex, or Discover—the processing fees are the same for everything.

Square Processing Fees

Here’s a closer look at Square’s processing fees:

- Card Present — 2.6% + $0.10 per transaction. This applies to all taps, dips, and swipes for in-person transitions.

- Card Not Present — 2.9% + $0.30 per transaction. CNP processing rates apply to online store transactions, Square ecommerce API transactions, and payments made through a Square online invoice.

- Keyed and On File — 3.5% + $0.15 per transaction. All manually keyed transactions or transactions made using a customer’s card stored on file are assessed with this rate.

Card present transactions are always the least expensive because they’re considered the safest of the three. Some businesses may be eligible for lower processing rates if they sign up for a higher Square plan tier or meet a certain annual volume threshold.

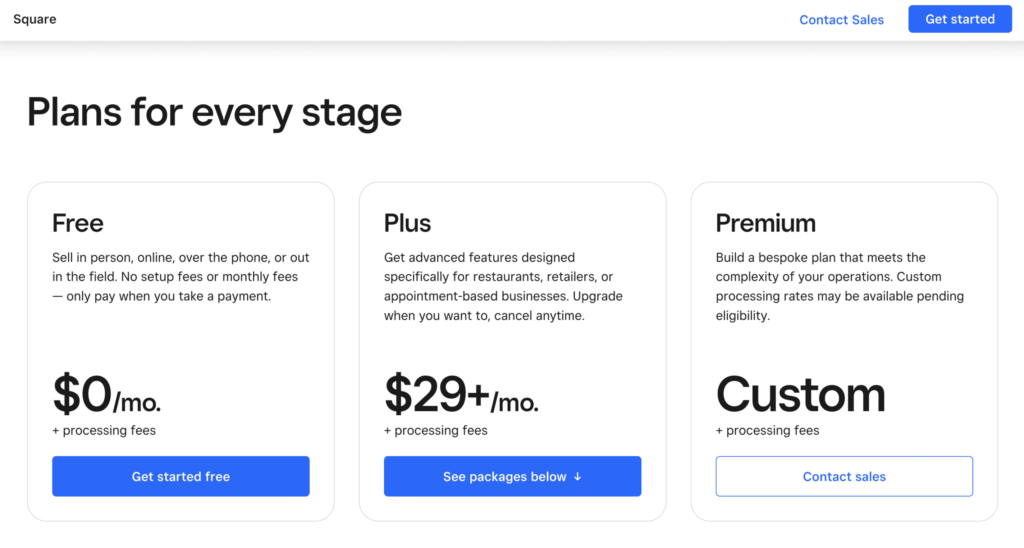

Square Plans and Pricing Options

Square has three different subscription plans to choose from—Free, Plus, and Premium.

Every Square plan comes with the following features:

- Free Square POS app

- Live phone support

- Active fraud prevention

- End-to-end payment encryption

- Transfers eligible as early as the next business day

- Account takeover protection

Square also offers industry-specific plans for different types of businesses. Each comes with unique features, pricing, and processing rates. We’ll take a closer look at each of those below:

Square For Retail Pricing and Credit Card Processing Fees

Square for Retail plans are designed specifically for businesses selling in-person and online. These plans come with features like low-stock alerts, barcode printing, saved carts, cross-location returns, gift cards, and more.

These are the plans and processing rates for Square Retail:

Free — $0

- In person payments — 2.6% + $0.10 per transaction

- Square Invoices — 2.9% + $0.30 per transaction

- Online — 2.9% + $0.30 per transaction

- Card on file — 3.5% + $0.15 per transaction

- Manually keyed — 3.5% + $0.15 per transaction

Plus — $60 per month per location

- In person payments — 2.5% + $0.10 per transaction

- Square Invoices — 2.9% + $0.30 per transaction

- Online — 2.9% + $0.30 per transaction

- Card on file — 3.5% + $0.15 per transaction

- Manually keyed — 3.5% + $0.15 per transaction

Eligible businesses that process more than $250,000 per year may be eligible for a Premium plan with customized pricing and processing rates.

Square Restaurants Pricing and Credit Card Processing Fees

Square’s restaurant POS software and plans offer tools for table management, open checks, floor plan customization, kitchen reporting, and more. There are solutions for bars, breweries, quick service, fast casual, and full-service restaurants.

Here’s a breakdown of the Square Restaurant plans and processing rates:

Free — $0

- In person payments — 2.6% + $0.10 per transaction

- Invoices — 2.6% + $0.10 per transaction

- Online — 2.9% + $0.30 per transaction

Plus — $60 per month per location

- In person payments — 2.6% + $0.10 per transaction

- Invoices — 2.6% + $0.30 per transaction

- Online — 2.9% + $0.30 per transaction

The Plus plan includes one countertop POS device per location. Additional countertop devices cost $40 per device per month. There’s also a $50 per month per location fee to use the Mobile POS for restaurants.

Restaurants that process more than $250,000 per year may be eligible for a Premium plan with custom pricing and credit card processing rates.

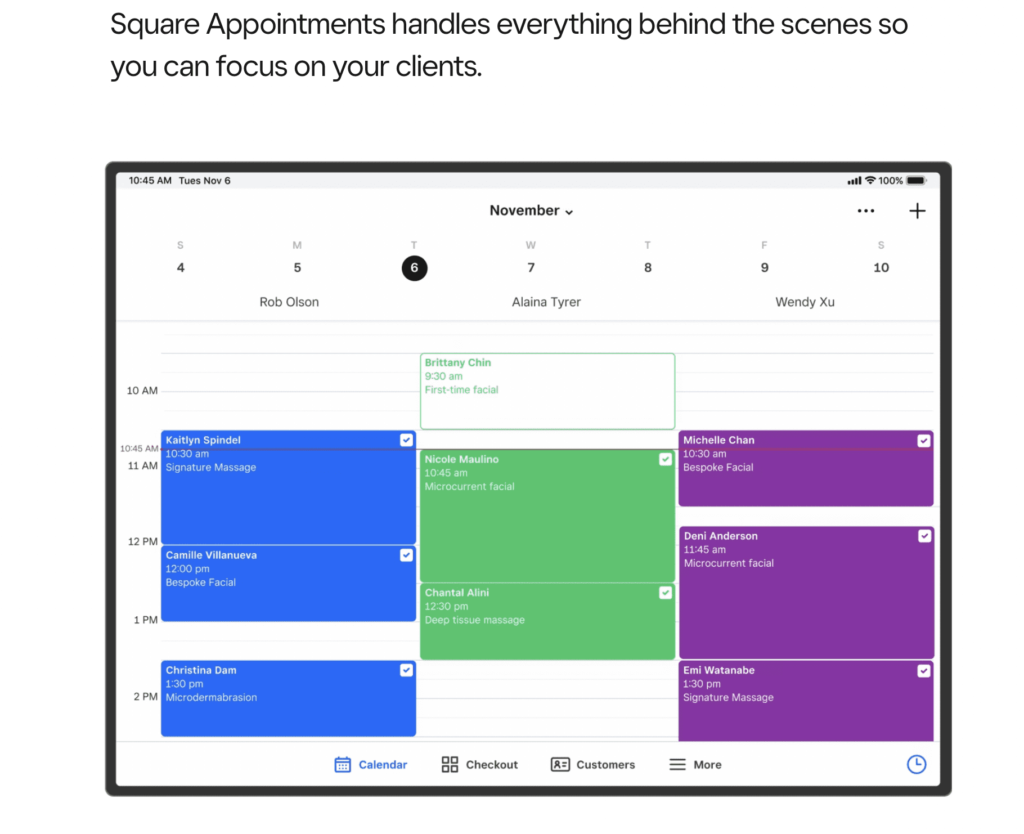

Square Appointments Pricing and Credit Card Processing Fees

The Square Appointments plans are designed for any business that needs to facilitate bookings and appointment management with an integrated payment processor and POS system. Examples include barbershops, nail salons, and construction businesses.

Here are the plans and processing rates for Square Appointments:

Free — $0

- In person payments — 2.6% + $0.10 per transaction

- Online (prepayments & no-show) — 2.9% + $0.30 per transaction

- Card on file — 3.5% + $0.15 per transaction

- Manually keyed — 3.5% + $0.15 per transaction

Plus — $29 per month per location

- In person payments — 2.5% + $0.10 per transaction

- Online (prepayments & no-show) — 2.9% + $0.30 per transaction

- Card on file — 3.5% + $0.15 per transaction

- Manually keyed — 3.5% + $0.15 per transaction

Premium — $69 per month per location

- In person payments — 2.5% + $0.10 per transaction

- Online (prepayments & no-show) — 2.9% + $0.30 per transaction

- Card on file — 3.5% + $0.15 per transaction

- Manually keyed — 3.5% + $0.15 per transaction

Businesses that process over $250,000 per year may be eligible for customized pricing and add-ons.

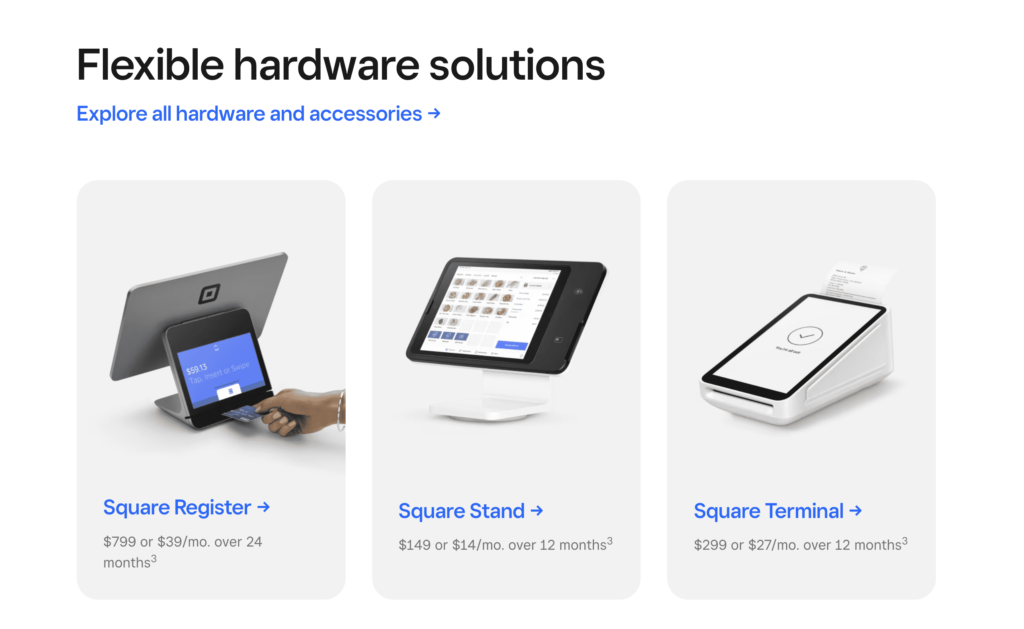

Square Hardware Fees

Every Square plan includes the free POS app. This means that you can use your own smartphone or tablet to process payments.

But if you need something more advanced, Square also sells different hardware solutions and accessories. These can be purchased outright or financed.

Here’s an overview of the hardware pricing and fees:

- Square Stand — $149 or $14 per month for 12 months

- Square Stand Mount — $149 or $14 per month for 12 months

- Square Register — $799 or $39 per month for 24 months

- Square Terminal — $299 or $27 per month for 12 months

- Square Reader — $49

- Square Reader for Magstripe — $10 per reader (first reader is free)

- Restaurant Mobile POS Kit — $249

- Square Stand Kit — Starting at $659

- Square Register Kit — $1,479

- Square Stand Restaurant Kit — Starting at $1,139

- Square Stand and Terminal Restaurant Kit — Starting at $1,439

- Rest Stand for iPad Mini Kit — Starting at $539

- Rest Stand for iPad Mini 2 Kit — Starting at $659

- Infinite Peripherals Mobile Kit for Square Reader — $625

You can view all of Square’s hardware options here.

Other Square Fees

In addition to payment processing, POS software, and hardware, Square also offers add-on tools for your plan. Here are some of those options and the corresponding fees:

- Payroll — Starting at $35 per month + $5 per employee paid

- Email Marketing — Starting at $15 per month

- Text Message Marketing — Starting at $10 per month + messaging rates

- Loyalty — Starting at $45 per month

- Afterpay — 6% + $0.30 per transaction

Eligible businesses can also obtain interest-free loans from Square for a flat fee.

Updates to Square Credit Card Processing Fees (March 2023)

As of March 1, 2023, Square increased same-day transfer fees and changed the way processing fees are handled for returns.

- Same-day and instant transfer rates are increasing from 1.5% to 1.75% per transfer

- Square is no longer returning processing fees when merchants issue full or partial returns to customers

These updates came shortly after Square consolidated and increased its monthly subscription fees. The “Professional” plan (which used to be $12 per month) was eliminated. The Performance plan increased from $26 to $29 per month, and the Premium plan increased from $72 to $79 per month.

Final Thoughts on Square Credit Card Processing Costs

In summary, most businesses will pay 2.6% + $0.10 per transaction to process in-person payments from Square. Online transactions start at 2.9% + $0.30 per transaction.

Beyond the processing costs, you may also have to pay a monthly Square subscription fee.

I hope this in-depth guide of Square’s credit card processing costs helped clarify Square’s pricing.

If you’re currently using another payment processor and you’re thinking about switching to Square, don’t switch yet. Reach out to our team here at Merchant Cost Consulting to find out how you can save money on credit card processing without switching processors.