Businesses have several different options to consider when evaluating ways to accept credit card payments. Square is one of those options that I’m sure you’ve heard of (since you landed here), and it has exploded in popularity in recent years.

But unlike other payment processors, Square doesn’t require you to set up a traditional merchant account. While this definitely makes it easy for small companies to start accepting cards as quickly as possible, it comes at a significant trade-off—cost.

Read on to compare Square against merchant accounts for payment processing to determine which path is right for your business. Spoiler alert: it’s probably NOT Square.

How is Square Different From a Merchant Account?

Square is a payment facilitator, also known as a PayFac. They operate as a third-party processor, which means Square doesn’t require you to set up a merchant account to accept card payments.

With Square, businesses simply sign up by providing some basic information and can be up and running right away.

Merchant accounts are a bit more complicated. You can apply for a merchant account directly with a payment processor, which establishes a relationship between your business and the acquiring bank. You’ll be given a unique merchant ID number but typically have to go through a lengthy application and underwriting process to get set up.

How Square Works

Square is not a bank, nor does it provide any banking services. As a payment service provider, Square processes payments on behalf of merchants under a master aggregate merchant account.

Instead of merchants having a direct relationship with the acquiring bank, Square acts at the middleman between businesses and banks for payment processing.

The major advantage here is simplicity. But because merchants haven’t gone through the traditional vetting and underwriting process that’s required to obtain a merchant account, Square assumes more risk.

To offset these risks, Square charges higher rates than other processors. Businesses may also be subject to rolling reserves, account freezes, funds on hold, and other clauses that they normally wouldn’t have to deal with from a regular merchant account provider.

How a Merchant Account Works

Merchant accounts are full-service payment processors. Businesses get a unique merchant ID number and establish a relationship with an acquiring bank.

When you accept a credit or debit card payment, the funds get settled in your merchant account. Processing fees get deducted, and the difference is transferred to your regular business checking account within a day or two.

Getting approved for a merchant account takes some time because the processor wants to evaluate your risk ahead of time. But these extra steps often translate to lower fees and faster access to funds.

Cost Comparison: Square vs. Merchant Account

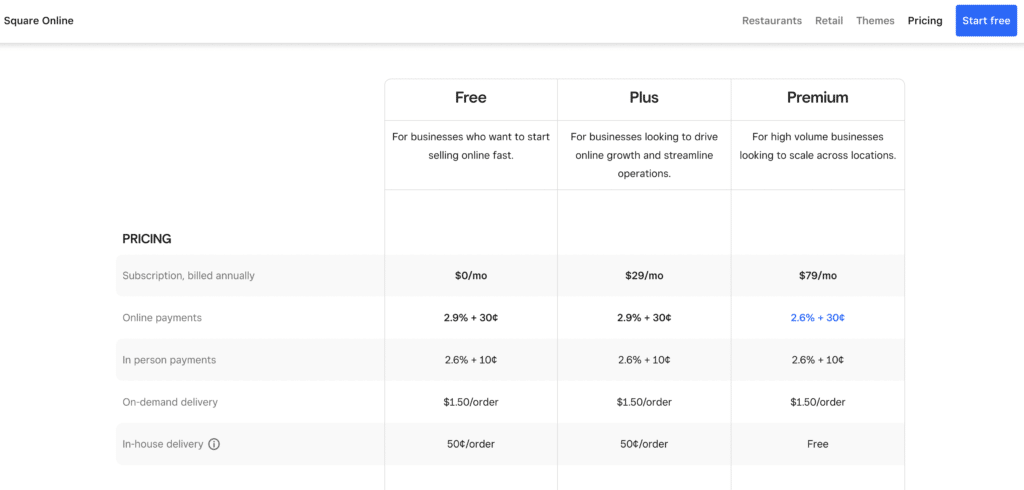

Square offers flat-rate pricing starting at 2.60% + $0.10 per transaction.

This rate is significantly higher than the rate you’ll get from a merchant account provider, and it only applies to in-person swipe, dip, and tap transactions. You’ll pay 2.9% + $0.30 for online transactions and up to 3.5% + $0.15 for manually keyed transactions and cards stored on file.

Square also charges monthly subscriptions for different services—ranging from $29 to $79 per month, billed annually. POS systems and other hardware cost extra.

The benefit of a fixed-rate structure is that it’s predictable and easy to understand. But Square is rarely going to be the cheapest option, especially compared side-by-side with a merchant account.

There’s no single fixed cost for a merchant account. Rates vary by provider, but they’re typically much cheaper than what’s being offered by PayFacs like Square.

Some merchant account providers offer flat rates per transaction, but we never recommend that. Instead, the best way to get the lowest possible rate is with interchange-plus pricing.

With this structure, you pay the interchange rate set at the card network level, plus a small markup fee to the processor.

We’ve seen these markups as low as 0.06% + $0.06 per transaction and upwards of 0.85% + $0.10 per transaction. Most markups tend to fall somewhere around 0.20% to 0.30% per transaction.

Once you factor in the interchange fee, merchant account rates are at least a full percentage point less than what you’d pay with Square—saving tens of thousands, if not hundreds of thousands, every year.

You just need to keep a close eye on your contract and statements, as not all merchant account providers are as transparent as Square. Some throw in bogus fees and hidden charges each month to try and make even more money on your account. But even with these fees, it’s still most likely going to be cheaper than using Square.

When it Makes Sense to Use Square

- You’re starting a small business and need to accept payments ASAP.

- You have a small side hustle and just want a simple mobile card reader (like a food truck or barber).

- You’re a high-risk merchant who can’t get approved for a merchant account elsewhere.

- You process less than $60,000 annually in credit card payments.

- You handle lots of small ticket transactions.

- You want predictable, flat-rate pricing (and don’t mind paying a higher rate).

When it Makes Sense to Use a Merchant Account

- You have a stable business with an established history of payments.

- You don’t mind complex statements if it means you’re getting thousands in savings.

- You can wait a week or so to apply for the account and go through the underwriting process before approval.

- Your average transaction size is greater than $25.

- You process a high volume of corporate cards or B2B transactions.

- You need a fully customized payment acceptance solution, like payments integrated into a specific software.

Other Factors to Consider

Price is obviously important, and it should probably be the deciding factor for most businesses when deciding whether to use Square or a merchant account. That said, there are a few other things you can take into consideration as you’re weighing your options.

Your Industry and Most Common Type of Transaction

Some merchant account providers don’t work with particular industries. Same goes for Square.

For example, even if you wanted to use Square, you couldn’t do so if you wanted to sell alcohol and/or tobacco online. If your business operates in the gaming or gambling space, you won’t be able to use Square and you may also have issues getting approved for merchant accounts from certain providers.

I wouldn’t use Square if you take tons of orders over the phone. I definitely wouldn’t use them for on-file transactions. 3.5% + $0.15 per transaction is criminally high, and your effective rate will likely be half of that if you go with a merchant account instead.

Your Perceived Risk Level

If merchant account providers think you’re a high risk for fraud or lots of chargebacks, they either won’t approve your application or they will only charge you high rates.

You could also be rejected if you’re on the TMF and MATCH list, after having your merchant account terminated in the past.

In these types of scenarios you might be forced into using Square or another PayFac. It’s easier to get approved because there’s virtually no underwriting process.

Contract Structure and Rates Offered by the Merchant Account Provider

Merchant account providers still want to make as much money as possible.

So if you’re uninformed, they may try to get you committed to a flat-rate deal with prices similar to what Square is charging. Push back to negotiate a lower rate and demand an interchange-plus deal.

If you can’t get them to budge and you’re not getting a better rate from any other processor, you could just go with Square to keep it easy. Otherwise, contact our team here at MCC and we can help negotiate those rates on your behalf.

Final Verdict: Merchant Accounts Are Better for 90% of Businesses

The fact that over four million businesses use Square is really just a testament to Square’s marketing. In terms of cost, there’s really no debate—Square is significantly more expensive than a merchant account.

While Square might be fine for a small business or solopreneur operating once a week at their local farmer’s market, it’s terrible for bigger and well-established businesses.

We have clients in nearly every industry using dozens of different payment processors. If those clients were using Square instead of a merchant account, they’d all be paying at least $50,000 more per year in processing fees.

Are you willing to flush $50,000 down the drain every year just because Square is slightly easier to set up and apply for?