Storable is an end-to-end property management software specifically designed for self-storage facilities. They serve over 33,000+ storage unit locations nationwide, and they’ve really cornered the market for property managers seeking an all-in-one solution for self-storage operations—including built-in payment processing for rent collections.

The bulk of this review will focus on Storable’s payment solution.

You’ll get our insider insights on Storable’s fees, pricing structure, pros, cons, and everything else you need to know about this provider.

Our Quick Take on Storable

Storable was born in 2018 when SiteLink, SpareFoot, and storEDGE merged to fully integrate three separate components of self-storage property management under one roof. SiteLink was one of the first platforms in the industry to provide merchant services as a PayFac directly from its self-storage system, and this laid the foundation for how Storable’s payment processing services operate today.

Processing rates are always going to be a bit higher when you can get everything you need from one truly integrated provider. But in our experience, Storable’s credit card processing rates can often be too high to justify and aren’t really competitive compared to other options on the market.

- Flat-rate and interchange-plus pricing are both available.

- Pricing isn’t always uniform for multi-location self-storage companies—with rates varying from one facility to another.

- ACH payment processing is available.

- Reporting is very straightforward but not completely transparent.

- They’re open to negotiations, particularly for storage businesses that handle a high volume of payments.

We have several clients using Storable to process payments. So our team has lots of experience auditing these statements and negotiating directly with Storable on behalf of those businesses.

We’ll use real examples and statements to guide the rest of this review based on those experiences.

Storable Pricing and Credit Card Processing Rates (With Real Statement Examples)

Storable’s pricing varies drastically for each business. They offer multiple contract structures, including interchange-plus and flat-rate pricing.

Flat-rate pricing starts around 2.89% + $0.25 per transaction, and the interchange-plus rates are fully customized for each merchant.

We strongly recommend that you get on an interchange-plus contract, as this is the best way to save money on credit card processing.

However, it’s worth noting that just because you’re onboard to Storable on an interchange-plus plan it doesn’t automatically mean that you’re getting low rates.

Let’s look at some examples of each so you can see what I mean.

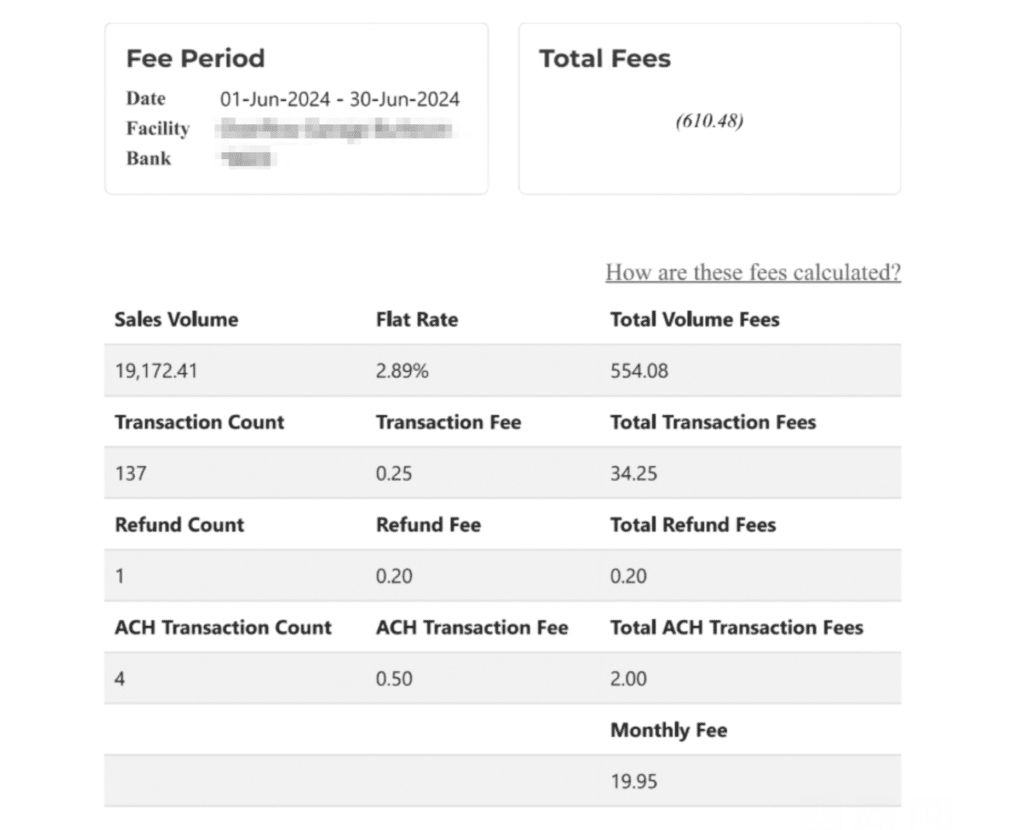

Flat Rate Pricing Statement From Storable

These statements are really straightforward. All of the interchange rates and assessment fees are baked into the flat rate, and you pay the same rate per transaction regardless of the card type accepted.

While it might be simple, paying 2.89% + $0.25 transaction isn’t cheap—even for an integrated solution.

This particular business isn’t doing a ton of volume (less than $20,000 in this billing cycle). So it’s a bit harder to leverage better rates here.

But if we take the total fees paid ($610.48) and divide that by the total sales volume ($19,172.41) we can determine that this merchant’s effective rate is 3.18%.

This is expensive, and there’s really no other way to word it.

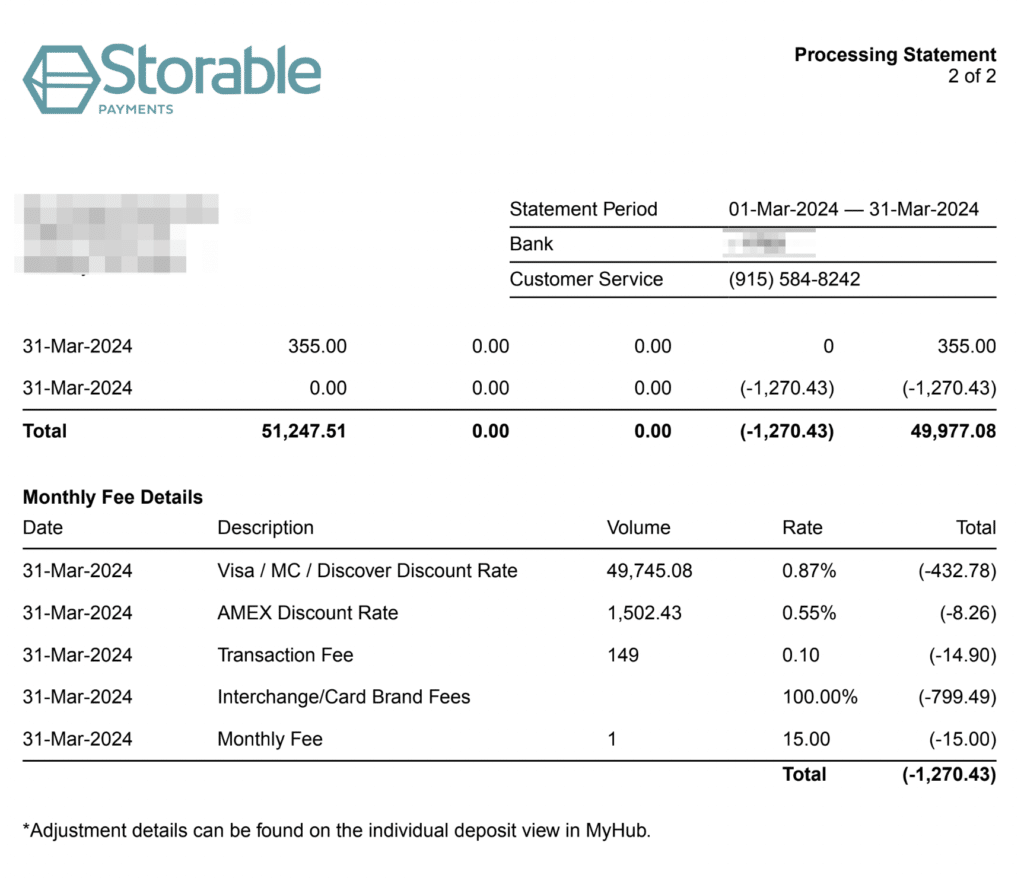

Interchange Plus Pricing Statement From Storable

Interchange plus statements are going to look a bit different. Here you’ll see a breakdown showing the discount rate for each card type (which is the markup paid directly to Storable).

In this example, the merchant’s discount rate is 0.87% + $0.10 for Visa, Mastercard, and Discover, and 0.55% + $0.10 for American Express.

This is outrageously high and not even close to competitive.

For reference, the lowest discount rates from other processors tend to start around 5-10 basis points (0.05% to 0.10%).

While you can expect to pay a bit more for a fully integrated processing solution—a bit more would normally mean 20 basis points or MAYBE 30 bps for exceptional technology.

So Storable is charging 3x more than this if we’re being conservative. But in reality, it’s more like 5-10x more expensive than market alternatives.

All in, this merchant’s effective rate is 2.48% ($1,270.43 total fees divided by $51,247.51 total volume) for this period.

If we compare this to the flat-rate example, it’s just marginally lower (about 60 bps). It’s also worth noting that this merchant processed over 2.5x more in volume than the flat-rate business. Typically, an interchange-plus structure and higher volume would be eligible for much lower rates—but that’s just not the case here.

What Else You Should Know About Storable’s Payment Processing Services

Aside from your base processing fees, there are a few other important pieces of information that you should be aware of if you’re currently using or planning to use Storable to accept payments.

Keep a Close Eye on Your Rates For Each Storage Facility

For storage businesses with multiple locations, our team has found several instances where Storable charged different rates at each facility.

This is particularly common whenever a new facility is added and Storable “forgets” to sync that rate with the master contract. And in practically all of these instances, the rates were higher than they should have been.

They’ll correct the mistake if you find it and contact them. But don’t expect them to do this automatically without you reaching out.

Assessment Fees and Interchange Rates Aren’t Itemized

While Storable’s reporting is ultra straightforward and easy to read, this isn’t always a good thing because it lacks some transparency.

With interchange-plus contracts, we typically expect the processor to itemize all of the interchange rates and assessment fees imposed by the card networks. It’s one of the most important pieces of information when you’re reading a monthly statement.

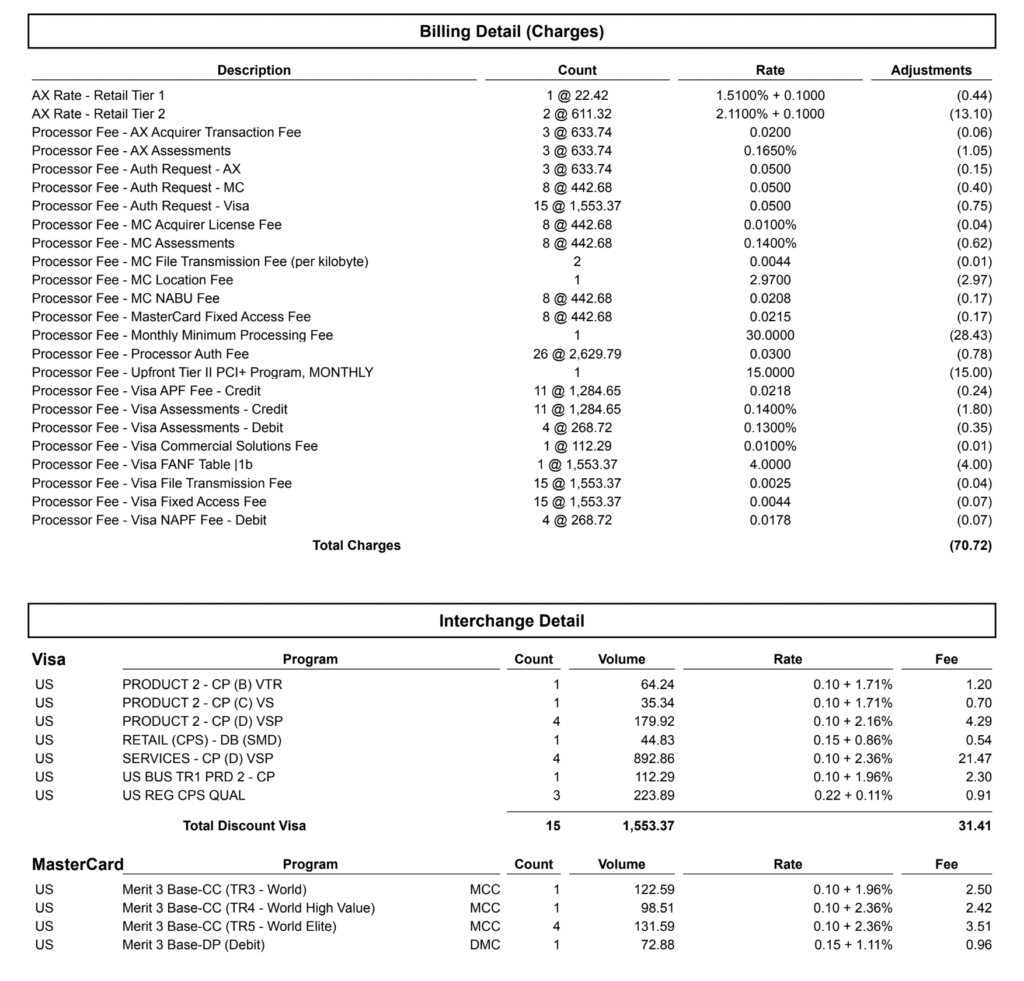

Here’s an example of what this normally looks like using a statement from another processor:

This is fully transparent, and you can see exactly how you’re being charged at the interchange level.But Storable doesn’t do this.

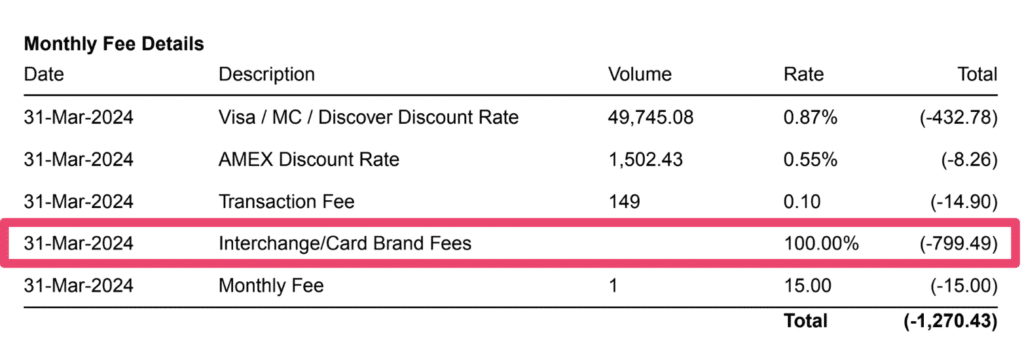

Instead, what would normally be itemized across multiple pages is consolidated to a single line item.

Why is this a problem?

Well, it’s impossible to tell if Storable is padding your assessments.

I can’t make assumptions here because I don’t have the full breakdown. But some processors unethically tell merchants that certain fees are coming from the card networks when, in reality, they are inflating those rates and pocketing the difference as extra profits.

The only way to rule this out is by seeing the itemized breakdown of the $799.49, which isn’t a standard component of Storable’s monthly statement.

Expect to Pay Higher Rates For the Convenience of Using a Fully Integrated System

If you’re considering Storable, you need to understand that your payment processing rates are going to be higher than normal because you’re getting multiple solutions from a single provider.

Storable knows it’s easier for you to work with them to get property management tools like CRMs, an online marketplace to list your units, remote access controls, and more—all within one system that can also handle your payments.

So if you want this level of convenience, you need to pay a premium for it.

Our Final Thoughts on Storable

Higher-than-average pricing is normal in the integrated payments space. That said, Storable’s processing rates are often on another level and not even close to competitive.

They can command these higher prices because they’re practically the only game in town for this particular market.

That said, you don’t need to accept these rates at face value. There’s tons of room for negotiation—and you could potentially cut your rates in half while still leaving Storable with plenty to profit from.

If you need help negotiating with Storable, contact our team here at MCC for assistance. We can help you lower rates while ensuring you don’t have to switch providers—so you can continue using a fully integrated solution for everything associated with your storage unit business.