Stripe is one of the newest big players in the online credit card processing space. But is Stripe right for you and your business?

Read on for our insider take—covering its pros, cons, features, and real pricing examples from our clients using Stripe to accept card payments.

MCC Quick Take on Stripe

Stripe has some of the best technology in the payment processing space. But overall, their pricing is pretty average. You can definitely get better rates from a direct processor, and there are even PayFacs out there with similar technology offering more competitive pricing than Stripe.

While you can use Stripe to accept payments in person, it’s a better option for online merchants with complex technology needs. If you have a small, ultra-simple setup and don’t need advanced APIs with multiple integrations, Stripe is going to be overkill and probably too expensive for your business.

What We Like About Stripe

- Excellent technology and plenty of features.

- Transparent rates, with interchange plus pricing available are for larger companies.

- Pricing is negotiable, especially for high-volume merchants.

Where Stripe Falls Short

- Stripe’s reporting is flat-out bad (it’s basically a spreadsheet instead of a true merchant statement).

- Level 2 and Level 3 optimization is not automatic (although you can configure it with extra steps).

- New and smaller businesses will get stuck with high, flat-rate pricing.

Stripe Pricing and Credit Card Processing Rates

Stripe offers transparent pricing without hidden fees, which is definitely refreshing in a world that’s filled with deceptive processors.

Rates start at 2.9% + $0.30 per transaction—plus additional costs for things like manually keyed cards, currency conversion, and more.

With that said, I would NOT accept the normal, flat-rate pricing advertised by Stripe. They’re willing to offer lower and customized pricing, especially if you’re a high-volume merchant. I know this from my first-hand experience negotiating with Stripe on behalf of our clients.

Let me walk you through three different rates and contract types from three different clients here at MCC that are all using Stripe. We’ll start with the highest rates and gradually work our way to the lowest prices we’ve seen Stripe offer our clients. All of these examples are based on a 36-month initial-term contract.

Client 1 Pricing — “Blended” Credit and Debit

We have a client that sells custom sports apparel through an ecommerce store. They’re definitely not the biggest site in the world, so while Stripe was willing to negotiate their rates, they did not offer rock-bottom pricing or an interchange plus structure.

Instead, they offered a blended rate of 2.40% + $0.20 per transaction for all credit and debit cards.

Is this the lowest rate we’ve ever seen? Absolutely not. But it’s still lower than the standard 2.9% + $0.30 that they typically offer and advertise.

Client 2 Pricing — Interchange Plus

This next example is for a business offering a range of event management services. In addition to being a high-volume business, they also needed quite a few different integrations and APIs.

It’s a somewhat complex deal, so Stripe was willing to give them an interchange-plus pricing structure at 0.22% + $0.15 per transaction.

This client is also paying Stripe for support and other expert services. So while the rate is low, Stripe is getting thousands elsewhere. But again, this is obviously a much better rate than the standard 2.9% + $0.30 and even the 2.40% + $0.20 rate shown above.

Client 3 — Tiered Interchange Plus

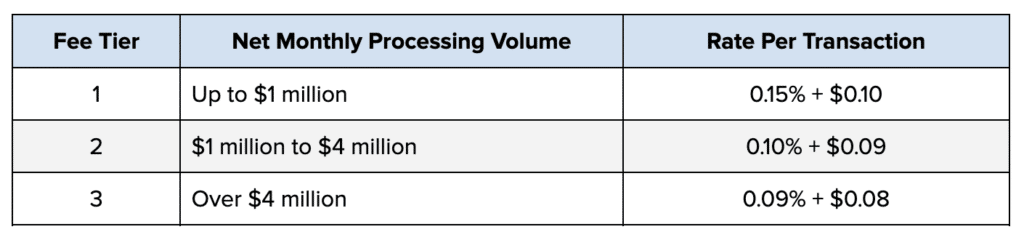

Finally, we have the lowest rates offered to a client that provides real estate software to businesses. For this deal, Stripe offered them interchange-plus rates—but tiered based on net monthly processing volume.

The more money they process via Stripe each month, the better the rate is. Additional discounts here start at $1 million in monthly card volume. I created a simple table to illustrate how the discounts work:

As you can see, the best Stripe rate we’ve negotiated is 0.09% + $0.08 per transaction.

I realize that not every business processes over $4 million per month in card transactions. But it just goes to show you that you shouldn’t be taking Stripe’s advertised prices at face value.

There is plenty of room to negotiate, especially if your business processes a high volume of card sales.

Other Stripe Fees and Services

In addition to the transactional fees, Stripe charges extra for different services. Here are some of the other fees we see from Stripe, which come straight from the three contracts that we used in the pricing examples above.

- 3D Secure Authentication — $0.03 per lookup

- Card Account Updater Fee — $0.20 – $0.25 per automatic update

- Radar (Standard) Fraud Scoring — $0.05 per screened event

- Radar For Fraud Teams — $0.06 – $0.07 per screened event

- Stripe Tax — 0.10% – 0.35% of volume

- Stripe Tax API — $0.12 per lookup

Not all of these will necessarily apply to your business. It just depends on what types of services you need. We have a separate page on our site that covers all of Stripe’s latest rates and fees that you can refer to for more information.

There are also some one-time setup fees for complex integrations. For example, Stripe offers an integration review service that’s available for up to six weeks during your setup. Experts walk you through your custom integrations, offering solutions, technical Q&A, and things of that nature. They charged one of our clients $7,900 for this service.

If you want premium 24/7 support from Stripe—including 1 minute chat responses, 3 minute phone responses, and elevated technical support, it could run you upwards of $1,800 per month.

You can also refer to Stripe’s developer documentation for a full look at the seemingly endless possibilities of this payments platform.

Comparing Stripe to Similar Payment Processors

Stripe is a PayFac (payment facilitator), which means businesses can get set up with Stripe without having to get a traditional merchant account—and they offer additional functionality in addition to just payment processing.

Due to this setup, Stripe will always be more expensive than direct processors. If you’re leaning towards using Stripe because you think you’re getting the best possible rates, you’re going to the wrong place.

Businesses turn to Stripe for robust technology in online payment processing. If you have a complex need or want the latest and greatest fraud technology at your fingertips, Stripe is as good as it gets. Just know that you’re going to pay a premium for it.

That said, I still think Stripe is a bit overpriced.

For example, Braintree is another PayFac that offers equally great technology. But Braintree’s rates start at 2.49% + $0.49 per transaction—and we’ve seen them as low as 0.03% + $0.03 per transaction for high-volume merchants on an interchange-plus contract.

Stripe’s base rate is 0.41% higher, and the lowest Stripe rate we’ve seen is 0.09% + $0.09 per transaction.

Check out our Braintree review if you’re looking for an honest take on an alternative option to Stipe.

Our Stripe Review Methodology and Why You Should Trust MCC

Most of the Stripe reviews you’ll find online are based on affiliate commissions. But that’s not how we operate here at Merchant Cost Consulting.

We don’t have any affiliate deals with Stripe or any of the other processors we’re reviewing (including Braintree, which I mentioned above as a solid Stripe alternative).

Instead, our reviews are based strictly on our first-hand experience with Stripe—negotiating with them on behalf of our clients. And since we deal with dozens of other payment processors on a daily basis (plus we have access to thousands of merchant statements and contracts), we’re more than qualified to provide expert insights you won’t find anywhere else on the web.

Our Final Thoughts on Stripe

In terms of technology, Stripe is an industry leader in the payments space. But their pricing is pretty average, and it’s definitely expensive for new and smaller businesses.

That said, Stripe is more willing to negotiate and offer lower rates to bigger companies that process a high volume of card transactions.

If you need help navigating these negotiations, contact our team here at MCC for a free audit and consultation. As you’ve seen from the examples in this review, we get our clients lower-than-advertised rates from Stripe—as low as 0.09% + $0.08 per transaction.