Despite this being one of the most highly covered topics in the payment processing space, we still get merchants asking tons of different questions about the differences between surcharge fees, cash discounts, and other fee programs.

Here’s the bottom line:

- All of these programs make it more expensive for customers to pay with credit cards.

- Surcharge fees are the most regulated at the state and federal levels.

- Card networks also have rules for surcharging, convenience fees, and service fees.

- There are slight legal differences and compliance nuances between these terms, but at the end of the day you’re still passing the fee to the customer.

Read on for the full breakdown.

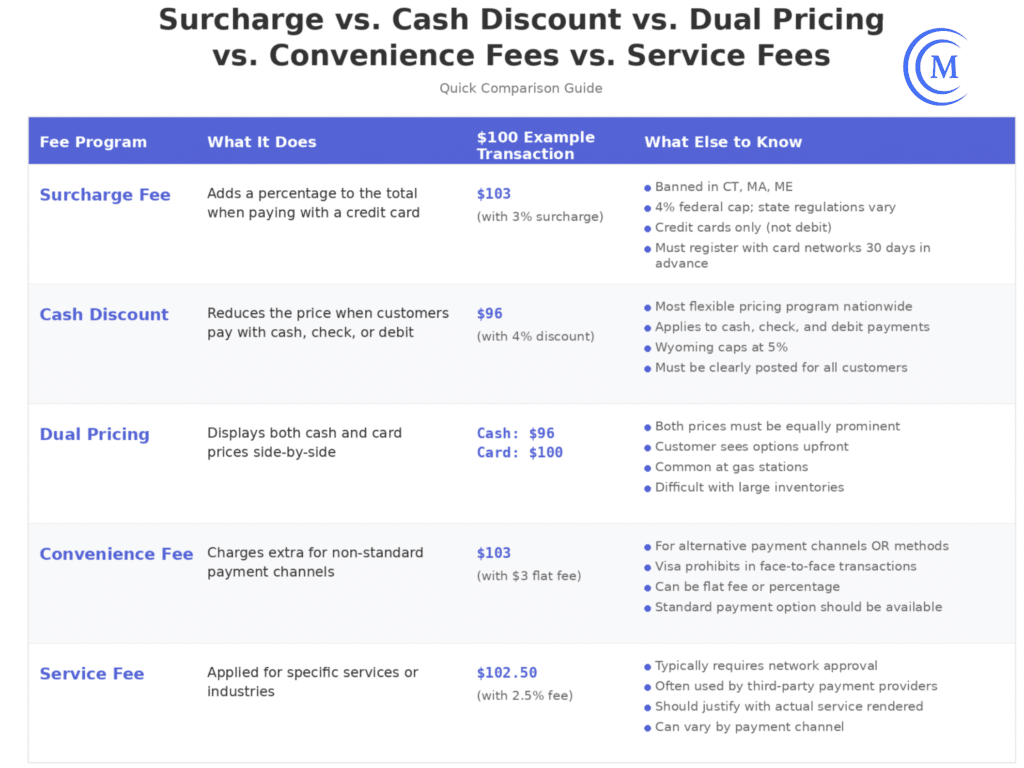

Side-by-Side Comparison of Surcharge Fees, Cash Discounts, Dual Pricing, Service and Convenience Fees

I put together a simple table to help you compare these different fee programs at a glance:

- Surcharges: Add a percentage to credit card transactions.

- Cash Discounts: Reduce the price when customers pay with cash, check, or debit.

- Dual Pricing: Displays separate prices for cash and card payments side-by-side.

- Convenience Fees: Charge extra for non-standard payment methods or channels (like phone vs. online or in-person).

- Service Fees: A type of convenience fee for specific industries, when an actual payment-related service is provided, or a third party is involved.

Surcharge Fees

Surcharges increase the total transaction amount by a percentage (typically 3-4%) when a customer pays using a credit card.

- Surcharge fees can only be applied to credit cards.

- It’s illegal to surcharge debit cards in all 50 states.

- 4% is the maximum allowable surcharge fee according to federal law.

- Certain states impose their own surcharge caps, as low as 2-3% or the merchant’s cost of acceptance, whichever is lower.

For example, if your business implements a 3% surcharge on credit cards and the total transaction amount is $100, the total charged to the customer will be $103.

Even in states where surcharging is legal, clear disclosure is one of the most important compliance stipulations nationwide. It’s the merchant’s responsibility to make sure the customer is clearly aware of the surcharge, that it applies if they pay with a credit card, and how much the fee is prior to the sale.

Essentially, you can’t bait and switch your customers by advertising one price and charging them something else, and they shouldn’t be surprised with the surcharge when it’s time to pay.

Cash Cash Discount Programs

Cash discounts lower the total transaction amount by a percentage if customers opt to pay with cash, check, or debit cards instead of a credit card.

This is often a loophole used by businesses in states where surcharging is prohibited.

Let’s say you offer a 4% cash discount. If the total transaction amount is $150, that’s effectively your credit card price, and cash customers would pay $144.

Cash discounting is more loosely regulated compared to surcharging. It’s allowed in all 50 states, including the states where surcharging is banned outright (Connecticut, Maine, and Massachusetts).

Wyoming is the only state that regulates cash discounts, capping them at 5% of the transaction amount.

Similar to surcharging, you need to fully disclose your cash discount program and make it available to all customers. You could get in a lot of trouble, especially with the card networks, if you only offer cash discounts to certain cards.

For example, let’s say it’s costing you more money to accept American Express cards. You can’t just wait until someone pulls out an Amex card and then discreetly offer them a discount if they pay with cash instead. The policy must be posted and available for everyone.

Dual Pricing

As the name implies, dual pricing programs list both the cash and card price side-by-side.

It’s common to see this at gas stations. Some businesses apply dual pricing programs if they have a limited number of services or products (mostly because it’s challenging to apply across dozens or hundreds of items).

A major point of emphasis here is for transparency.

You need to have clear and visible disclosure of both the cash price and card price. There isn’t always a cut-and-dry definition of what’s clear and visible. But basically, you can’t have the cash price in giant font size and the card price in microscopic print.

And just like with surcharging and cash discounts, the customer still pays more by using a credit card with dual pricing structures.

Convenience Fees

Convenience fees also add to the total transaction amount, either as a flat amount ($3, $5, etc.) or a percentage (2%, 3%, etc.).

The key difference between a convenience fee and a surcharge fee is that convenience fees are charged when customers pay using a non-standard payment channel or method.

For example, if you’re purchasing concert tickets or movie tickets in person at the box office, there’s no fee (regardless of the payment method) because that’s a standard way to pay for those items. But if you buy those tickets online, a service fee may apply.

For a tenant paying rent by credit card, there might be a convenience fee imposed instead of paying by check or through an ACH debit.

Where things get a bit tricky here is when a merchant tries to claim that a certain payment channel or method is non-standard, and there’s often a grey area here in terms of how that’s defined.

Restaurants may say that cash is their “standard” payment method. So anyone who pays with a credit card needs to pay a convenience fee. But it’s really just semantics, and both serve the same purpose: the customer pays more for using a credit card.

There’s nothing “illegal” about this. But the card networks have certain rules in place to prevent this type of manipulation. Visa, as an example, says that convenience fees can’t be charged in any face-to-face environment.

Service Fees

Service fees are a type of convenience fee. For customers and businesses, they are effectively the exact same thing: there’s an increased price for paying by card.

But the card networks have modified sets of rules to define service fees.

For example, Visa only allows service fees for certain MCC codes (like Education and Government). You don’t need to register with certain card networks to apply convenience fees, but you need to apply if you want to charge service fees.

Service fees can also be different across sales channels (one fee for phone payments, another fee for ecommerce, etc.).

Typically, there’s an actual service being provided to justify this fee. This often happens if a third-party provider is involved in the transaction.

Certain states are cracking down on how convenience fees and service fees are advertised. California is a good example where businesses are allowed to charge service fees but the fee must be included in the total advertised price.

Let’s say you’re booking an Airbnb in California. The price displayed per night would have to include all service fees. Taxes are the only item that can be added on at the final checkout screen.

Final Thoughts

Surcharges, cash discounts, service fees — whatever you call them, they serve the same purpose: you’re still passing your processing fees to your customer.

Yes, there are some legal differences and card network compliance rules between each of these terms.

But as a merchant, you can’t just change the name of your fee program to something that’s legal or less regulated as some sort of loophole. If surcharging is illegal or regulated in your area, you can’t just disguise a surcharge as a convenience fee and move on with your day.

Potential legal penalties and non-compliance fines aside, think about what you’re actually doing. You’re charging your customers more money to pay with their preferred payment method.

This isn’t 20 years ago when credit cards were uncommon. According to the latest Federal Reserve consumer payment habits, cash represents just 14% of all payments.

So it’s crazy if your business is trying to say that credit cards are some type of non-standard payment acceptance method. That’s the norm.

You need to accept that your merchant fees are part of doing business and they’re just another operating expense that shouldn’t be passed to your customers. Instead, you should look for other ways to reduce your processing costs to save money for your business.