There’s a lot of misinformation on the web about the credit card surcharging laws in Texas. Some sources say it’s legal, while others say it’s illegal.

Whether you’re a merchant or consumer, these types of contradictory statements can be frustrating, which is why we published this guide.

Disclaimer: This information is for reference only, and it does not constitute legal advice. Consult with an attorney with any legal-specific questions.

Texas Law Prohibits Credit Card Surcharging For Most Businesses, But Federal Courts Rules in Favor of Merchants

So, is it legal for a business to add a surcharge fee for credit card transactions in Texas?

If you’re going just based on Texas law, the answer is no—technically, it’s illegal in most circumstances to impose a credit card surcharge fee surcharge in Texas.

However, merchants can likely add a surcharge fee without fear of penalty. That’s because the US District Court for the Western District of Texas ruled that these laws are unconstitutional. This effectively made the state’s ban on surcharge fees unenforceable.

State Law vs. Federal Law

To be clear, the US federal government does not prohibit credit card surcharges, although it does limit them to a 4% maximum.

But the state of Texas had a specific lawsuit, Rowell v. Paxton, which ruled that parts of Texas state law were unconstitutional. This ruling is specific to Texas, and doesn’t have anything to do with how surcharges are enforced nationally at the federal level.

Based on this court order by Judge Lee Yeakel in 2018, the state of Texas cannot enforce parts of its credit card surcharge law.

A Closer Look at Texas State Law For Credit Card Surcharging

Again, most of what you’ll read below is deemed unenforceable by federal courts. But you should still talk to an attorney if you’re considering imposing a credit card surcharge at your business, and you should also be aware of whether you’re technically breaking the law in Texas—even though you probably won’t be penalized for it.

Without going too far back in the history books, we can see that Texas stood behind its surcharge ban in 2015 with Texas Finance Code 339.001, which amended acts from 1999, 2005, and 2013.

But the latest iteration of Texas surcharge law went into effect in 2017 with Title 12 Chapter 604A of the state’s Business and Commerce Code. Based on the most recent amendment, here’s how the state of Texas currently views surcharging:

- Sellers in Texas cannot charge a surcharge fee if a buyer pays with a credit card instead of cash, check, or similar payment means.

- State agencies, counties, and local government entities are exempt from this law.

- Private schools are also exempt.

- Cash discounting is allowed (where the price of an item is discounted if a buyer pays with cash).

The state of Texas defines a surcharge as, “An increase in the price for goods or services imposed on a buyer who pays with credit, debit, or stored value that is not imposed by a buyer who pays by other means.”

Penalties For Violating Texas Surcharge Laws

According to Section 604A, violations can result in civil penalties of up to $500 per offense if merchants add a surcharge fee for credit card transactions in Texas.

The law also says that both the state’s Attorney General as well as the District Attorney in the county where the violation occurs can enforce these laws and file a civil penalty lawsuit.

However, it’s unclear whether or not these penalties are being enforced after the 2018 federal court ruling. Based on my research, it looks like some businesses in Texas are imposing surcharge fees, and I don’t see any news reports of merchants being penalized for doing so.

It’s also worth noting that any civil suits brought against a merchant by the Attorney General are strictly imposed at a state level—and the AG office in Texas won’t file lawsuits on behalf of a consumer if they were charged a surcharge fee.

Texas Attorney General’s Opinion on Credit Card Surcharging

After the federal courts ruled Texas surcharge law unconstitutional and essentially rendered it unenforceable, Attorney General Ken Paxton released an opinion related to the matter.

Here’s an excerpt from his letter:

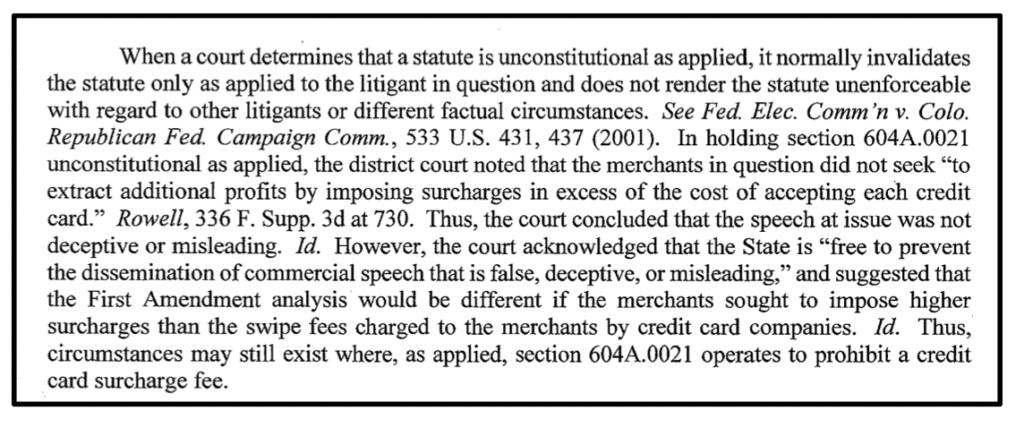

In simple terms, Paxton is saying that some parts of Texas law can still be enforced—even after the federal court ruled against the state.

The opinion also states that the ruling does not apply to counties in the state that impose a surcharge when using credit cards to collect payments owed to the county.

Again, this is just an “opinion” letter, and nothing about it is technically a law.

Final Thoughts on Surcharging in Texas

The surcharge laws in Texas are a mess. I’ve been researching the credit card surcharge laws in all 50 states, and Texas is definitely one of the most confusing.

On the one hand, state law clearly prohibits credit card surcharging in most scenarios. But on the other hand, federal courts have said that this law is unconstitutional and unenforceable.

Rather than amending the laws or making changes after the ruling, Texas hasn’t really done anything. Instead, the state’s AG has said “some parts of the law are still enforceable.”

So we’re caught in this weird gray area where the state is saying something is prohibited, but the fed is saying the state can’t do anything about it.

Overall, it looks like merchants in Texas can freely impose surcharge fees without issue. But it may not be worth the hassle. Technically, you’d still be violating the law. So talk to an attorney before making any decisions.