Authorization codes are a crucial component of credit card processing.

Authorization codes help to verify important information about the transaction data, like whether the cardholder has sufficient funds and confirms that the card hasn’t been stolen.

It’s important for merchants to understand authorization codes and how they work. Even though these codes are essentially invisible during the credit card processing transaction process, they play a significant role in disputes and other customer issues.

Overall, understanding credit card authorization codes can even provide insights into how credit card processing works—allowing you to identify errors, eliminate confusion, and reduce chargebacks. This guide will explain everything you need to know about authorization codes for credit card processing.

What is a Credit Card Authorization Code?

A credit card authorization code comes in the form of five or six numbers. The code gets generated by the issuing bank, and it’s used to validate credit cards and approve the purchase when a transaction is initiated.

Authorization codes are unique to each transaction. The codes help ensure the transactions are safe for the cardholder in an effort to prevent fraud and chargebacks.

Credit card processing companies developed authorization codes as a way to reduce the number of steps required to verify credit card transactions. These codes are essentially a shorthand and simplified version of verification to streamline the transaction process.

The demand for authorization codes increased as businesses began to process a higher volume of credit card transactions. This is especially true in the ecommerce space, as businesses need a fast and safe way to authorize sales. Without authorization codes, the process required to verify funds in a cardholder’s account would be far too cumbersome.

In short, credit card authorization codes help ensure speed and flexibility for cardholders and merchants alike. Both parties benefit from a streamlined transaction process.

How Do Credit Card Authorization Codes Work?

When a purchase is initiated, the merchant’s bank communicates with the issuing bank (cardholder’s bank) to request an authorization. Rather than going through a complex back-and-forth communication process with paperwork, credit card processing companies created authorization codes to streamline the process.

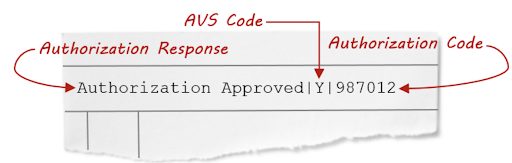

The card issuer will respond to the merchant’s bank either authorizing or declining the transaction. If the customer’s credit card has sufficient funds or credit on the account, the authorization code gets sent back to the merchant’s bank for approval. The approval code generated is considered to be an indication of a successful credit or debit card transaction.

Here’s an example of what an approved authorization code looks like:

After authorization has been approved, the credit card company puts an immediate hold on the cardholder’s account. Most authorization holds last anywhere from three to five business days, as this gives the merchant time to settle the charge.

From the customer’s account, the hold is typically shown as “pending” on their real-time statement. This is a normal for the authorization process.

While most merchants submit card payments as a batch settlement at the end of each business day, the consumer may not see the transaction marked as complete on their statement until several days after the transaction was initiated.

For online purchases, cardholders typically need to enter a card verification value (CVV) during the transaction process before the processor can generate a credit card authorization number.

The ability for merchants to verify sufficient funds available to authorize sales is arguably the number one core function of credit card processing. All merchant accounts are tied to a bank, helping the business to facilitate the transaction process, and providing authorization response codes is part of this core function.

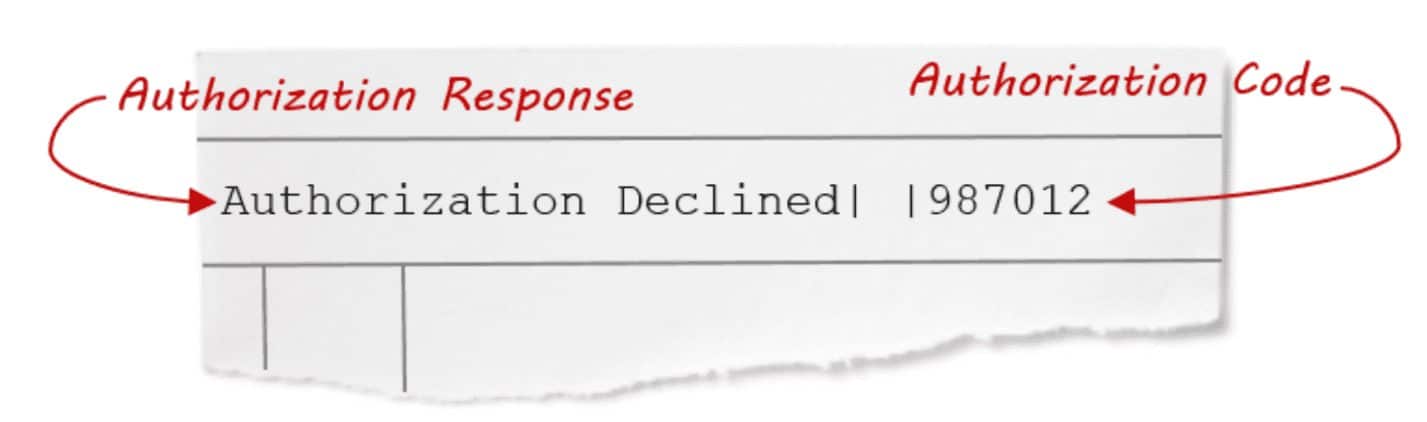

Declined Authorization Response Codes

Declined authorizations tell the merchant that the cardholder’s bank will not approve the transaction. This gives the merchant the right to ask for an alternative form of payment.

Reasons for a decline code typically include:

- The credit card has been reported as lost or stolen.

- The consumer account is not in good standing with the issuing bank.

- The consumer account does not have enough funds to cover the transaction amount.

In addition to the denial, the code might prompt the merchant to do something specific based on the authorization response. Examples include:

- Pick up card — Common if the card was reported lost or stolen.

- Invalid account number — The card account isn’t on file with the issuing bank.

- Incorrect PIN — The personal identification number on file with the bank doesn’t match what the cardholder entered at the point of sale. Merchants can retry the transaction.

- Chip card removed — Cardholder removed the card before the chip process completed. Merchant can try the transaction again.

- Duplicate transaction — The same transaction amount has been attempted twice within ten minutes.

- Call — The issuing bank requests the merchant to call them before continuing to process the transaction.

- Invalid amount — Authorization amount does not match the sale amount.

In short, if the funds aren’t available or the card was reported stolen, then the cardholder’s bank will decline the authorization. Even if the transaction has been declined, there should still be a code generated along with this response.

What if the Authorization Code Expires?

If the authorization code expires, the cardholder will need to process the transaction again.

In this scenario, the merchant needs to obtain a new authorization code the same way it was obtained the first time—starting with the merchant’s bank and getting approval from the cardholder’s bank. Similar to the first time around, the new code will expire within three or five days business days before the hold gets released.

For some businesses, it’s common to place a temporary hold on an account until the customer completes a specific task. For example, authorization holds are placed on credit cards when someone rents a car. This authorization is a security measure for the rental company, as they can charge the card if the vehicle is damaged. Hotels do this as well, in case the customer charges additional purchases to the room or damages something in the room during their stay.

However, most businesses don’t need to place this type of hold on a transaction because it’s confusing for the cardholder. In the majority of cases, holds are placed for the full amount of the sale until the transaction is settled.

Final Thoughts on Credit Card Authorization Response Codes

Credit card processing transactions seemingly happen in the blink of an eye. Your customers swipe, dip, tap their credit cards or enter the information online, and boom—the payment gets processed. But there’s a lot of moving parts happening behind the scenes to make sure every credit card transaction goes smoothly.

Of those moving parts, authorization codes are crucial for credit card processing.

So it’s important to take the time to understand how authorization codes work. This can really help streamline your payment transaction process and reduce the risk of fraud. By reading this guide, you’ve already taken a step in the right direction.