Navigating the TMF/MATCH list can feel like a daunting task for merchants. Many businesses don’t even know about the Terminated Merchant File (TMF) or MATCH list until they’ve been told they’re on it.

This often catches merchants off guard since they’re not notified when they’re placed on the TMF or MATCH list—and they only find out after they’ve been rejected for a new merchant account application.

Hopefully, you’ve found this post before getting placed on the MATCH list. But if you’ve landed here because you’ve been TMF’d or MATCH’d, we’ll explain everything you need to know about what this means for your business and how it affects your ability to process credit and debit card payments.

What is a (TMF) Terminated Merchant File?

The TMF (Terminated Merchant File) list is a database of businesses that have previously had a merchant account terminated by a processor or bank. Banks and financial institutions use this list to keep track of merchants that have violated the rules, guidelines, and requirements for processing credit cards and accepting payments.

If a merchant has a TMF, it could blacklist them from opening a new merchant account.

The majority of banks, merchant account providers, and credit card processors avoid doing business with merchants who have a previously terminated merchant account. It’s viewed as a red flag that’s high-risk and can lead to losses for the financial institution.

What is the MATCH List and How Does it Work in Payment Processing?

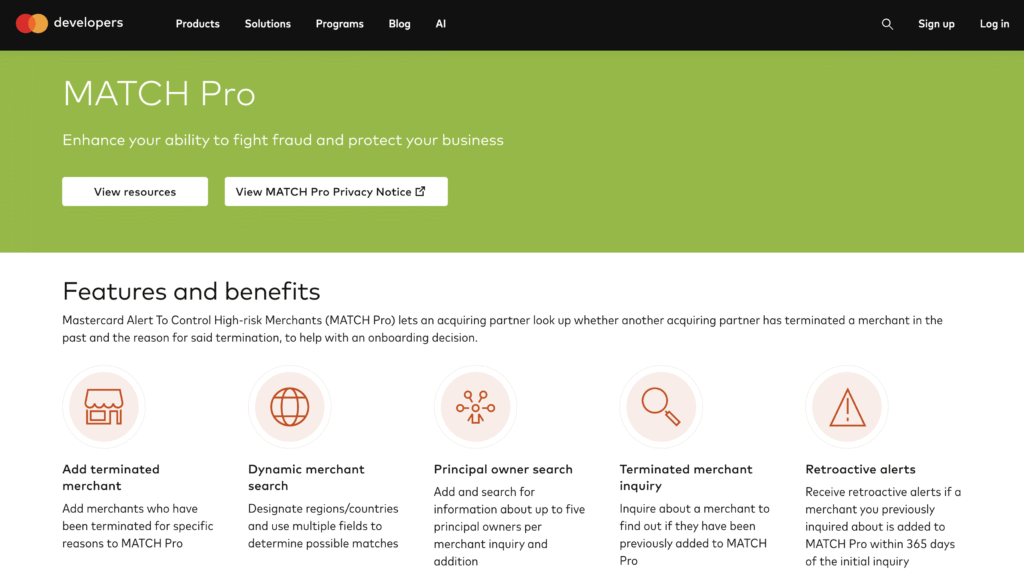

The MATCH list is an electronic database of high-risk merchants. Created and managed by Mastercard, MATCH is an acronym that stands for “Member Alert to Control High-Risk Merchants.”

The MATCH list is essentially a list of terminated merchant files (TMF) that meet specific conditions. In the world of payment processing, the terms TMF and MATCH are often used interchangeably. But TMF is more of a broad term that relates to any terminated merchant file, whereas the MATCH list refers specifically to the database that’s managed by Mastercard and accessible through Mastercard Connect.

It’s important to understand that while Mastercard manages the list, any financial institution in the payment processing space can add a merchant to this list and check to see if a new merchant account application is flagged on the MATCH list.

Mastercard’s current platform for accessing the database is called MATCH Pro (via Mastercard Connect and API). It’s the tool acquirers use to add and search records (although merchants still typically refer to it as the “MATCH list”).

If a business has its merchant account terminated by a bank or payment processor, there’s a good chance they’ll end up on the MATCH list. When this business applies for a new merchant account with a different credit card processor, that bank will see that the merchant has been flagged for a terminated merchant file.

Reasons Why Merchants Are on the MATCH List

Merchants can end up on the MATCH list for a variety of reasons, including fraud, money laundering, excessive chargebacks, or a violation of processing rules.

Historically, it was much easier for banks to add problem merchants to the MATCH list. But in recent years, Mastercard has tightened the guidelines for who can be added to the list. Today, a merchant must do something specific to land on the MATCH list in accordance with Mastercard’s Security Rules and Procedures.

We’ll take a closer look at the MATCH reason codes that explain how a merchant can end up on the MATCH list.

MATCH List Reason Codes (Updated)

There have been several changes to the MATCH List codes over the years. Here’s a summary of the most recent version from Mastercard that was last updated in February 2025:

- Code 01 – Account Data Compromise — Any occurrence that led to the unauthorized access or disclosure of account data (such as a common point of purchase).

- Code 03 – Laundering — Merchant engaged in money laundering activity.

- Code 04 – Excessive Chargebacks — The number of chargebacks in any money exceeded 1% of card transactions during the same money, and the chargebacks totaled $5,000 or higher.

- Code 05 – Excessive Fraud — Fraud-to-sales dollar ratio is greater than 8% in a month or fraudulent transactions exceed $5,000 or more in a month.

- Code 06 – Coercion — Transaction was processed due to a threat of physical harm to the cardholder or an immediate family member.

- Code 08 – Questionable Merchant Audit — Merchant matched the criteria set forth in Mastercard’s Security Rules and Procedures section 8.4.

- Code 09 – Bankruptcy, Liquidation, or Insolvency — The merchant is currently or likely unable to meet financial obligations.

- Code 10 – Violation of Standards — Merchant violated one or more standards set forth by card networks and banks, such as not honoring all cards or ignoring minimum or maximum transaction restrictions.

- Code 12 – PCI Data Security Standard Noncompliance — Merchant failed to comply with Payment Card Industry (PCI) security standards.

- Code 13 – Illegal Transactions — The merchant engaged in illegal transactions.

- Code 14 – Identity Theft — The acquiring bank believes that the merchant or owner unlawfully assumed an identity to enter into a merchant agreement.

What Happens When You’re on the MATCH List?

There are two conditions that must apply for a business to end up on the MATCH list. First, the processor must terminate its relationship with the merchant, and the acquiring bank must have reason to believe that the termination corresponds with a MATCH reason code.

So a merchant cannot end up on the MATCH list just because they’ve had a terminated merchant file or because they’ve done something wrong; both conditions must occur.

If you’re on the TMF/MATCH list, you may have a hard time getting a new merchant account. In fact, learning that you’re on the TMF/MATCH list is a good indication that you’ve already been denied a new merchant account application.

In this scenario, you might be forced to work with a high-risk merchant account provider or a processor that’s willing to accept applications for merchants on the MATCH list. However, these terms can come with consequences, including:

- Long-term contracts

- Higher setup fees

- Higher credit card processing rates

- Higher chargeback fees

- Reserve accounts

- Strict fraud monitoring

- Strict chargeback management guidelines

- Early termination fees and liquidated damages

Getting added to the MATCH list doesn’t prevent you from processing payments. It’s the processor and acquiring bank’s discretion on whether or not they want to work with businesses on the TMF/MATCH list.

How Do You Check If You’re on the MATCH List?

You cannot check to see if you’re on the MATCH list. Merchants are not sent any official letter or notification if they’ve been added to the MATCH list.

Only acquiring banks and authorized users can access the MATCH Pro portal. Merchants can’t self-search, which is why most businesses only learn that they’re on it after submitting a new merchant account application.

It’s up to the processor or acquiring bank that added the merchant to notify them. But this is optional, and many financial institutions simply don’t do it.

Most merchants find out that they’re on the MATCH list if they’ve been rejected for a new merchant account application.

How Long Do Merchants Stay on the MATCH List?

Businesses typically stay on the MATCH list for five years. After five years, you’ll automatically be removed from the list.

Some merchants are on the MATCH list for less than five years if they can convince the bank to remove them. In rare cases, a merchant could be added to the MATCH list in error, which would result in them being removed from the list as soon as the mistake was found.

How to Get Off the MATCH List in 5 Steps

Only the processor or financial institution who added a merchant to the MATCH list has the power to remove them. So here’s the fastest way to get your business removed:

- Contact the payment processor or acquiring bank that added you to the MATCH list.

- Ask why you were added, and see if you can resolve the issue.

- If you still owe a balance to your processor, you’ll likely need to pay for them to honor your removal request.

- Document everything, and be prepared to provide proof that any problems have been resolved.

- Request your removal, and continue to follow up to confirm your processor actually submitted the request.

Otherwise, you’ll need to wait five years until they’re automatically removed from the MATCH list (unless it’s determined that you were added by mistake)

For example, if you have any outstanding debts with a payment processor that caused them to add you to the MATCH list, pay off those debts. This is a common occurrence if the merchant account was canceled and then a new fraud case or chargeback was opened—but the processor could not relinquish funds from the merchant, and the merchant ignored requests to settle the balance due.

Another common reason why a merchant gets placed on the MATCH list is related to PCI non-compliance. If you’ve been added to the MATCH list for reason code 12, you can request removal once you’ve become PCI compliant. In this instance, merchants are entitled to seek removal directly from Mastercard.

Final Thoughts on the TMF/MATCH List

Getting added to the TMF/MATCH list is not good. But it’s not the end of the world, and it doesn’t prevent you from accepting credit cards.

You’ll just need to work with a high-risk processor or merchant account provider that’s willing to accept applications from merchants on the MATCH list.

If you’re currently working with a high-risk processor because you’re on the MATCH list, there’s a good chance you’re paying higher processing fees. In this scenario, reach out to our team here at Merchant Cost Consulting. We can audit your monthly statements and merchant agreement to help eliminate fees and lower your total cost of payment processing—without having to change providers.