Toast is one of the fastest-growing POS systems on the market. Used by over 112,000 businesses, this restaurant-focused company also provides payment processing services to its clients.

In fact, if you’re using Toast as a POS solution, you have to use it for payment processing. It’s not possible to use your own third-party payment processor if you want to leverage Toast’s technology for your restaurant.

As a merchant consultant and payment processing expert, this will be the primary focus of my review. So if you’re thinking of using Toast or you’re currently using Toast and wondering if you made the right decision, you can use the insights below for clarity.

Our Quick Take on Toast (Key Highlights)

Toast is expensive—period. You’re going to pay upwards of 4-5x more to process payments via Toast compared to other options on the market. While you do get added benefits, like software and features to help run your restaurant, the added cost isn’t really worth it.

- Toast’s payment processing rates are higher compared to other processors.

- If you use Toast’s software or hardware, you’re forced to use their payment processing services.

- Toast is planning an ongoing cadence of small, steady rate increases beginning in the second half of 2024.

- Toast is PayFac (payment facilitator), not a direct processor.

- You should only consider Toast if you’re in the restaurant space.

Read on for an in-depth analysis of Toast’s payment processing solution.

You Should Only Consider Toast If You’re in the Restaurant Space

Let’s get one thing clear straight away—Toast is only for restaurants and businesses in the food and beverage space. So if your business operates in any other industry, Toast is not for you.

Within the food and beverage niche, Toast does work with essentially everyone, including:

- Full-service restaurants

- Fast casual dining

- Quick service food and drinks

- Bars, lounges, and nightclubs

- Food trucks

- Hotel restaurants

- Cafes and bakeries

- Fine dining

- Catering

From pizza shops to juice bars and beyond, if you serve food, drinks, or both, you can use Toast.

However, just because you can use Toast, it doesn’t necessarily mean that you should.

There are plenty of other credit card processors on the market that also work with restaurants, and you’ll likely get a better rate if you go elsewhere.

Expect to Pay a Premium For Toast’s Other Services That Go Beyond Payment Processing

Toast is more expensive than other payment processors because they do so much more. That’s their unique value proposition that allows them to charge premium pricing.

So if you’re looking for an all-in-one solution that encompasses everything from tableside ordering to menu management, online ordering, delivery, and analytics of each location, Toast has everything you need and more.

But again, you’re going to pay for it in multiple ways. First, you’ll pay a monthly fee for your software subscription and extra features. Then you’ll also pay higher-than-normal processing fees because you’re getting a suite of additional services.

Some restaurant businesses might not care. But these higher processing fees translate thousands or potentially tens of thousands of overages every month.

Don’t believe me?

My team helped a Texas-based food business save over $325,000 per year on credit card processing. And this business did not use Toast. They were using a cheaper processor and we still found hundreds of thousands in savings. Had this business been using Toast, that number would likely be closer to $500,000 in overages.

Toast is Planning Steady Rate Increases For the Foreseeable Future

On top of Toast’s already high processing rates, we’re expecting these rates to continue rising for the foreseeable future. This is more than just a hunch, Toast flat out admitted this during their Q1 earnings call on May 7, 2024.

Here’s a direct quote from CEO Arman Narang, that I found in Toast’s earnings call transcript.

“We are going to take pricing over time. It’s going to be an ongoing cadence of small, steady changes in price.”

There it is, straight from the horse’s mouth.

It’s hard to be upset at a company for increasing rates when they come out and tell you “we’re going to increase prices over time.”

Narang went on to say that the first rate hike will be with Toast’s fintech product in the second half of 2024. I’ll keep a close eye on this to announce the rate hike as soon as I find out, and I’ll share the details on our Toast credit card processing rate increases and updates page.

Toast Has Higher Credit Card Processing Processing Rates Than Market Alternatives Because It’s Hard For Businesses to Switch

Let’s stick with Toast’s pricing for a minute.

I believe that one of the main reasons why Toast thinks they can get away with steady rate increases is because they make it incredibly difficult to move away from Toast’s ecosystem.

It’s difficult enough to switch credit card processors. That’s why we rarely recommend switching to clients that we consult with. But Toast does so much more. Moving away from Toast means changing all of your front-of-house and back-kitchen operations. Not only is this expensive for restaurants, it’s also a logistical nightmare.

So Toast has its customers exactly where they want them. Restaurants with multiple locations are relying on Toast for every aspect of their operation. So if they increase processing rates by 0.25% once or twice a year, what are you going to do? More than likely not much.

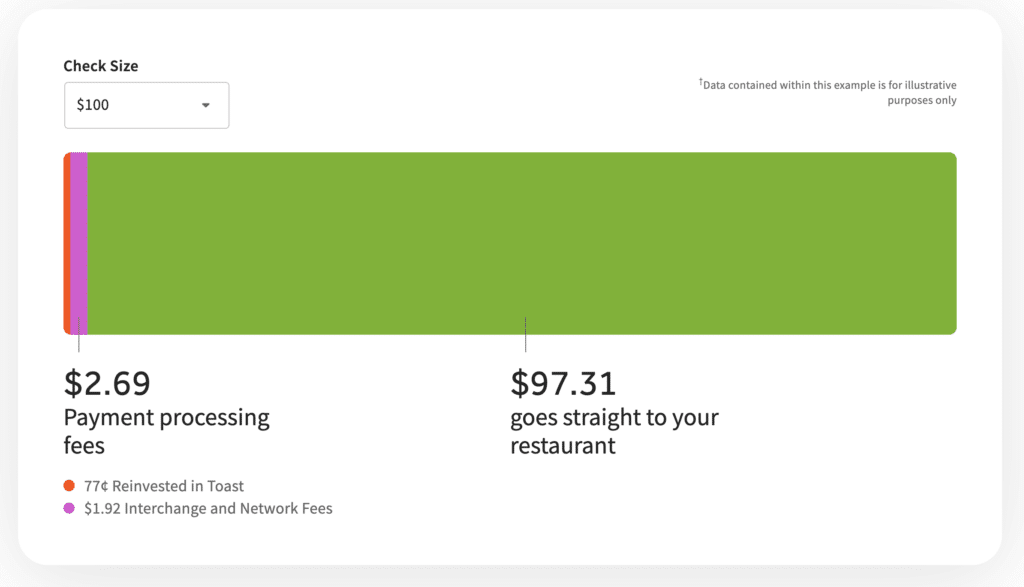

Exactly how much more is Toast charging compared to market alternatives? The answer varies for each business. But this pricing example directly from Toast’s website is a good starting point:

To clarify, this is a hypothetical example from Toast. However, even their example is astronomically higher than other processors.

The $0.77 that’s being “reinvested in Toast” is Toast’s processor markup. That’s what you’re paying them to process your payment, which is 0.77% on a $100 check.

You can get a 0.10% + $0.10 per transaction markup from other processors. On a $100 check, that’s just $0.20. Toast is charging four times as much—and they are planning steady rate increases.

Remember, this is only for payment processing.

Toast’s POS system starts at an additional $69 per month. Once you factor in hardware costs, and other accessories, a single-location restaurant can easily spend an extra $5,000 to $10,000.

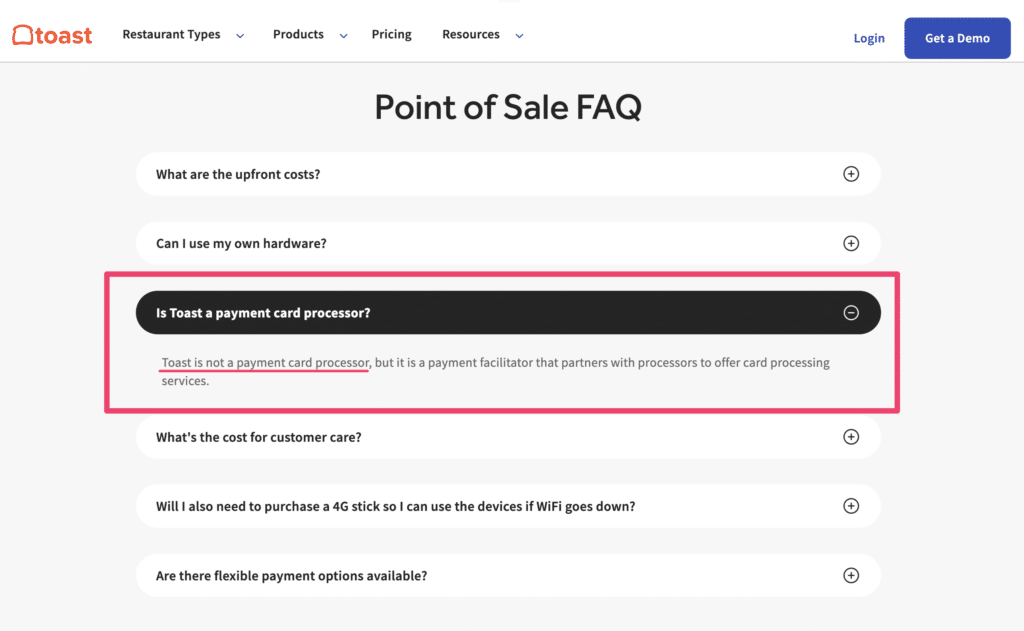

Toast is a Payment Facilitator (PayFac), Not a Payment Card Processor

I don’t want to make things too confusing, but technically, Toast isn’t a payment processor—they’re a PayFac (aka payment facilitator).

This isn’t something they’re hiding. In fact, it’s one of the first FAQs answered on Toast’s pricing page:

Any PayFac or aggregate merchant account will always cost more than direct processors. Period.

They use an underwriting bank (like Wells Fargo) to facilitate payments for merchants, so they need to account for these added costs as opposed to processors that have their own in-house banking and underwriting for processing.

So even if Toast didn’t have all of these extra services and products for restaurants, they would still be more expensive than other processors due to their structure alone.

Toast is Actively Trying to Negotiate Processor and Network Agreements

This is another really interesting tidbit I found in Toast’s latest earnings call.

Toast is looking for ways to optimize their own internal costs associated with payment processing, and they’re attacking this from multiple angles.

First, they’re trying to negotiate better processor and network agreements with Visa, Mastercard, American Express, and Discover. They’re also trying to get better deals and leverage collective bargaining with debit card networks like Accel, Start, Maestro, etc.

In addition to better deals for them, Toast wants to focus on optimization with dynamic routing to be even more cost-efficient.

If they can do all of these things, it will essentially be cheaper for them to process payments.

Theoretically, lower rates for Toast could mean lower rates for businesses using Toast. But I highly doubt that’s going to happen. Instead, I’m sure any potential cost savings from Toast will just lead to higher margins for their business.

After all, they already told us they’re planning to increase rates.

How to Set Up Credit Card Surcharging With Toast

Toast allows automatic surcharging within its system, which passes transaction costs to the customer. But to enable surcharging on your transactions, you must agree to the following flat-rate fees on your card payments:

- Swipe/Dip/Tap Visa, Mastercard, and Discover Credit Cards: 2.91% + $0.10 per transaction

- Swipe/Dip/Tap Debit and Prepaid Cards: 1.75% + $0.20 per transaction

- Manually Keyed Cards: 3.5% + $0.15 per transaction

- American Express Cards: 3.5% + $0.15 per transaction

If you set up surcharging through Toast, these rates go into effect as of December 1, 2024.

It’s worth noting that even if you enable surcharging, your processing fees won’t be totally offset. That’s because it’s illegal to surcharge debit cards and prepaid cards.

You also need to verify that it’s legal to surcharge credit cards in your area. We have a state-by-state surcharge law guide that you can use as a quick reference.

Our Final Thoughts on Toast

I wouldn’t use Toast for payment processing.

While their POS software and hardware definitely makes life easy for restaurants, it’s just not worth paying four or five times more than market alternatives.

Toast is also one of the few POS systems that force you to use they’re payment processing services. This just further entrenched your business into Toast’s ecosystem, giving them more leverage and allowing them to increase rates knowing how much you rely on them to remain operational.

That said, if you’re already using Toast—all hope is not lost.

Let my team here at MCC perform an audit for you. We’ll identify cost-savings opportunities for your business and negotiate your rates directly with Toast. So you can save money without having to switch processors or change your equipment. Get your free audit today.