Payment gateways connect businesses with payment processors to facilitate online transactions. This is a necessary payment technology for ecommerce websites, as it’s required to accept credit cards, debit cards, and other digital payment methods.

But not every payment gateway is created equally. In fact, there are several different types of payment gateways to choose from—each with its own pros and cons.

Whether you’re accepting online payments for the first time or you’re looking for an alternative solution, this guide is for you. This information can also help existing ecommerce websites decide if their current payment gateway is the best option for their needs.

4 Types of Payment Gateways

Generally speaking, there are four types of payment gateways for credit card processing:

- Hosted Payment Gateways

- Self-Hosted Payment Gateways

- API Hosted Payment Gateways

- Local Bank Integrations

We’ll cover each one in greater detail below, including the benefits, potential drawbacks, and top use cases for each.

1. Hosted Payment Gateway

Hosted payment gateways direct online shoppers away from a website’s checkout page. When a site visitor clicks on the payment link, they’re redirected to another page that’s provided by the site’s PSP (payment service provider).

From here, the customer fills out their payment information, and once the payment is processed through the hosted gateway, the customer gets redirected back to the ecommerce site to finalize the checkout process.

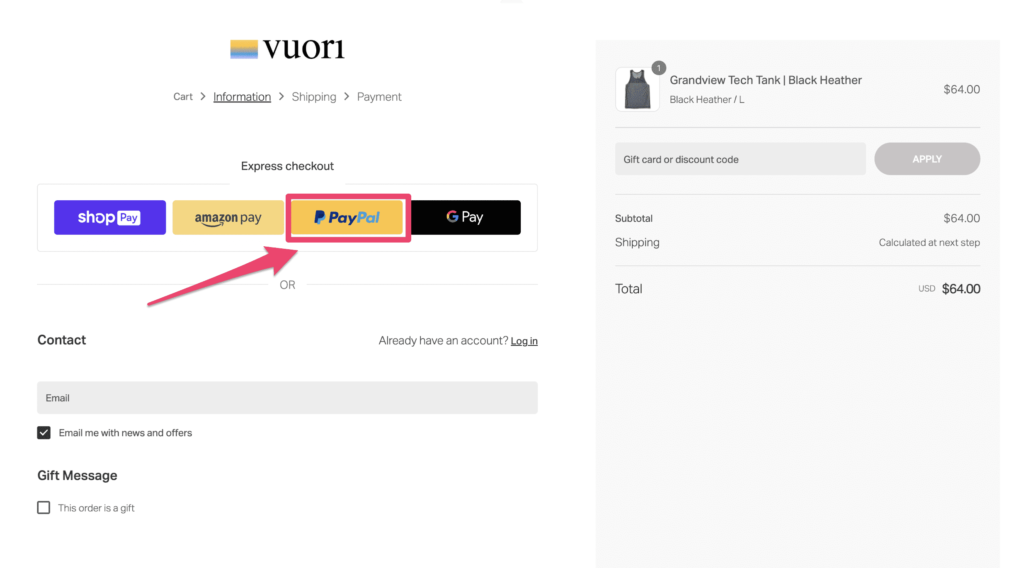

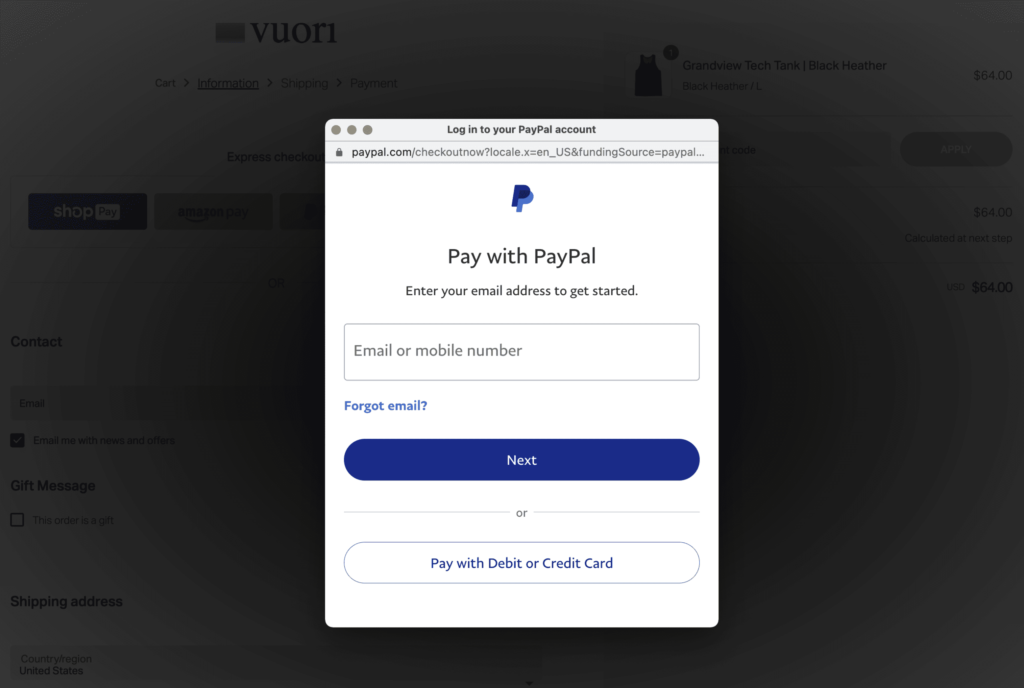

PayPal is a common example of a hosted payment gateway, and here’s an example of what this looks like. On this checkout page, the customer has the option to pay using PayPal.

Once the customer clicks the link, a new window opens—prompting them to log into their PayPal account or via PayPal using a debit card or credit card.

Once the payment is verified by the hosted gateway (in this case, PayPal), the customer can add their shipping address and finalize the order back on the ecommerce checkout screen.

Pros of Hosted Payment Gateways

- Easy to set up

- Secure and PCI compliant

- Most consumers are familiar with this process

Cons of Hosted Payment Gateways

- Can’t always be customized

- The redirect adds a step to the checkout process

2. Self-Hosted Payment Gateway

Self-hosted payment gateways allow the customer to enter payment details into the merchant’s checkout page. But once the details are entered, the data gets sent to the gateway URL.

The key difference between hosted and self-hosted payment gateways is where the payment information gets collected. With self-hosted gateways, the information is collected directly on the commerce site before the data gets encrypted and for authorization with a third-party gateway.

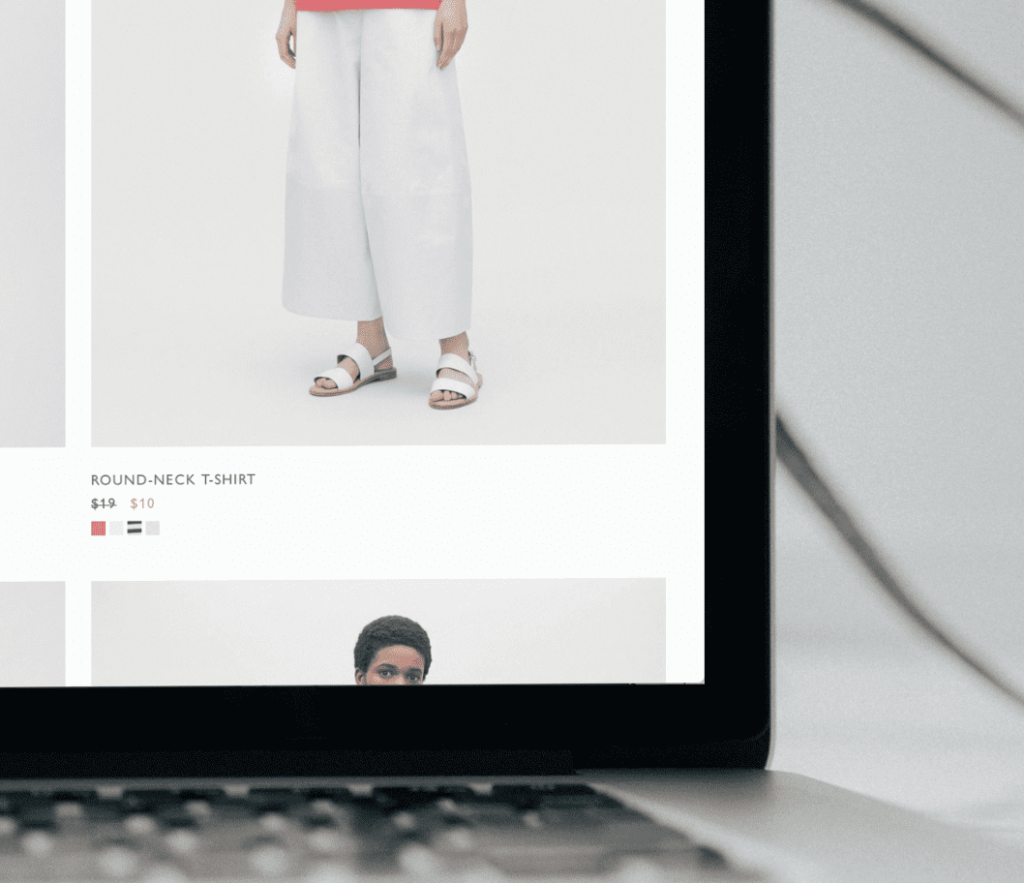

Shopify Payments is an example of a self-hosted gateway.

If you’re running an ecommerce store on Shopify and using Shopify Payments to process transactions, the customer doesn’t have to get redirected to a third party. They can enter their information directly in your checkout flow, and Shopify Payments uses Stripe for authorization and processing.

Pros of Self-Hosted Payment Gateways

- Smooth checkout process

- Full control over customer experience

- Customizable checkout flow

Cons of Self-Hosted Payment Gateways

- Lack of dedicated support

- It’s on the website to handle technical issues internally

3. API Hosted Payment Gateway

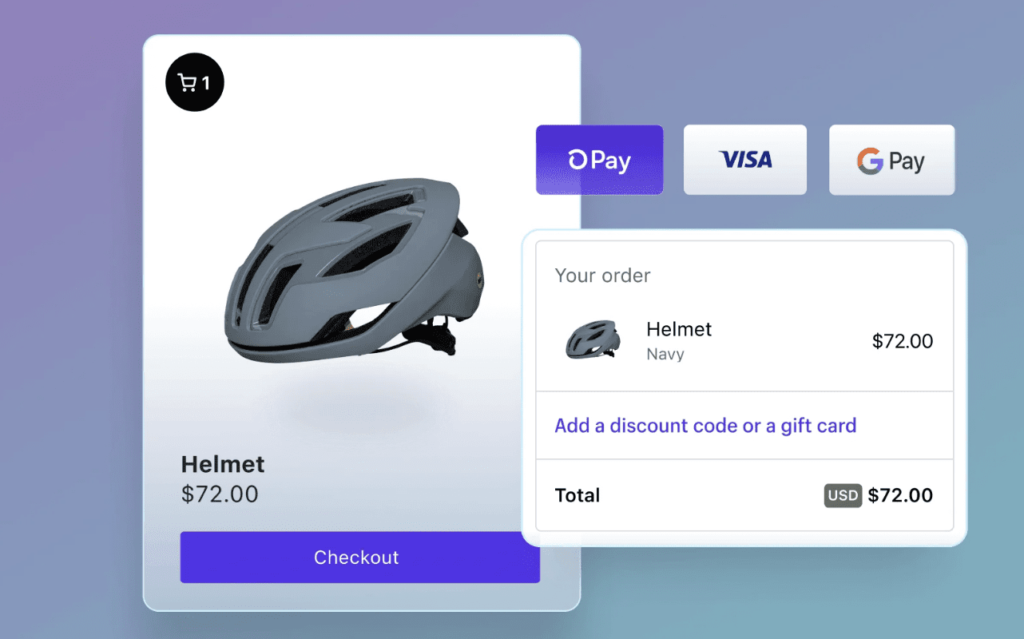

API hosted payment gateways allow customers to provide payment information directly on the ecommerce checkout page. The data gets processed, and authorization is handled using an application programming interface (API) or HTTPS query.

API payment gateways are fully integrated into an ecommerce website.

The front-end checkout screen and payment features are fully customizable, including all ecommerce branding and logos.

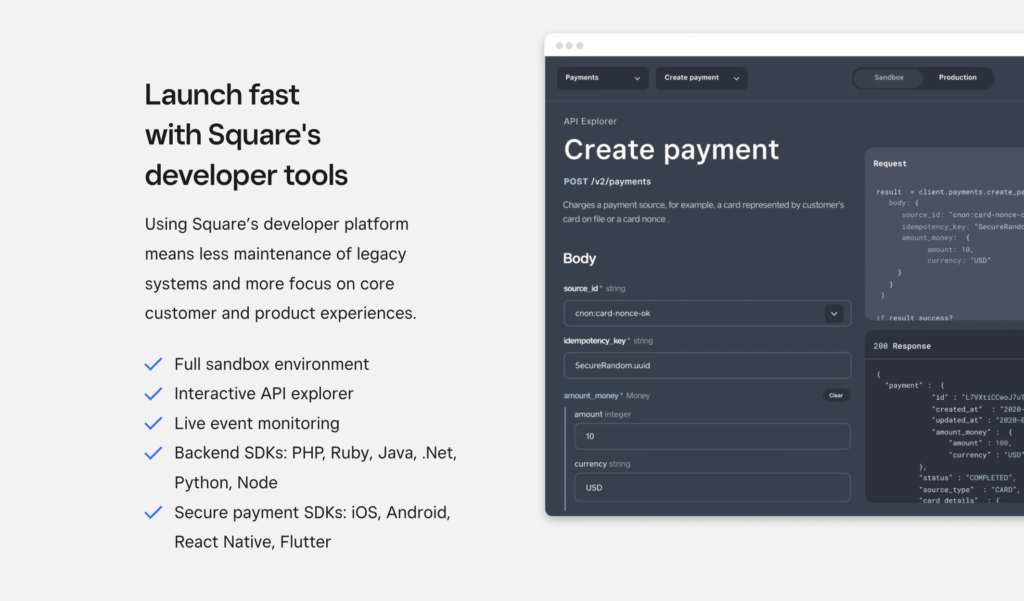

Square’s API is just one of the many examples of an API-hosted gateway.

Pros of API Hosted Payment Gateways

- The most customizable type of payment gateway

- Can be fully integrated with websites, mobile apps, tablets, and more

- Total control over the user experience

Cons of API Hosted Payment Gateways

- Require development resources and technical expertise to configure

- Merchants must maintain PCI DSS compliance

- Merchants need to get their own SSL certificates

4. Local Bank Integration

A local bank integration is handled similarly to a hosted gateway. The shopper is automatically transferred to the bank’s website, where the payment information gets submitted.

Once complete, the bank authorizes the transaction and redirects the shopper back to the ecommerce website where the purchase is finalized.

With this type of gateway, the payment infrastructure and security get handled by the merchant’s banking partner.

Pros of Local Bank Integrations

- Easy to set up

- Simple to maintain

- Bank handles security and payment infrastructure

Cons of Local Bank Integrations

- The redirect during the checkout process isn’t customer-friendly

- Not scalable for high-traffic ecommerce sites

- Lack of customization features

What is the Best Type of Payment Gateway?

There’s no one-size-fits-all answer to the best payment gateway. Each one has unique benefits and drawbacks, and there are scenarios where each type works best for different use cases.

To help you better understand the best type of payment gateway for your business, we’ll go through some common scenarios and call out the best payment gateways for each one.

You want fast and simple setups:

- Hosted payment gateways

- Local bank integrations

You want full customization over the checkout environment:

- API hosted payment gateways

- Self-hosted payment gateways

You don’t want customers to get redirected to third-party payment URLs:

- Self-hosted payment gateways

- API-hosted payment gateways

You don’t have in-house technical resources for development and security:

- Hosted payment gateways

- Local bank integrations

Key Considerations for Choosing The Right Payment Gateway For Your Business

In addition to the scenarios above, there are additional factors you should keep in mind as you’re shopping around and comparing different types of payment gateways.

- Payment Types — Ideally, you’ll want to select a payment gateway that offers a wide range of different payment acceptance methods. This includes all major credit cards, debit cards, ACH payments, digital wallets, and more.

- Customer Location and Currency — Not every payment gateway supports international payments. So if you’re currently selling to customers in other countries or you’re planning to scale internationally, make sure you use a gateway that can accommodate this need.

- Security — Maintaining PCI compliance and other data security standards is an absolute must in the world of payment processing. Find out if your payment gateway can handle this on your behalf or if it’s something you need to do on your own.

- Processing Fees — Compare the costs of different payment gateways. These fees will not only vary by type of gateway but also from provider to provider. For example, if you’re looking at two or three different local bank integrations, you’ll likely see different fees for each bank.

- Additional Costs — Beyond processing fees, you should see if your payment gateway charges additional fees for setups, service, PCI compliance, and more.

- Scalability — How big is your ecommerce business? If you want to grow into an international powerhouse, something like a local bank integration probably won’t get the job done. You’ll need a more robust solution that’s built to scale.

- Integrations — Every payment gateway lets you accept payments online. But what else can they integrate with? The best payment gateways can fully integrate with other platforms. For example, if you have a mobile commerce app, you’d ideally want to use the same gateway for your website and app. Other gateways can integrate with accounting software and business tools to simplify business reporting.

Once you’ve narrowed down a specific type of payment gateway that works best for your needs, then you can start shopping around for different gateway providers within that category.

Final Thoughts on The Different Types of Payment Gateways

What’s the best payment gateway? There’s no right or wrong answer to this question. It’s just a matter of what’s best for you and your ecommerce business.

Hosted payment gateways are the easiest to set up, and they’re well-recognized by consumers. But they do add an extra step to the checkout process, and they’re not always customizable.

Self-hosted gateways provide a seamless checkout flow and customizable user experience. However, it’s up to the merchant to maintain security, and you won’t always have dedicated support from a self-hosted gateway, either.

API hosted payment gateways offer the most flexibility and customization. Shoppers won’t have to leave the page to checkout, helping to reduce cart abandonment rates and improve the customer experience. But API hosted gateways require development resources, and they’re harder to maintain. You may have to handle PCI compliance and security on your own, too.

Local bank integrations are the least common type of payment gateway. They’re easy to set up, and you won’t have to worry about security. But they’re not really scalable or ideal for selling to international consumers.

Regardless of the gateway type you choose, you need to keep a close eye on your costs. Our team here at Merchant Cost Consulting can review your monthly statements and ensure you’re getting the best possible rates on credit card processing. Get a free audit and analysis to find out how much you can save.