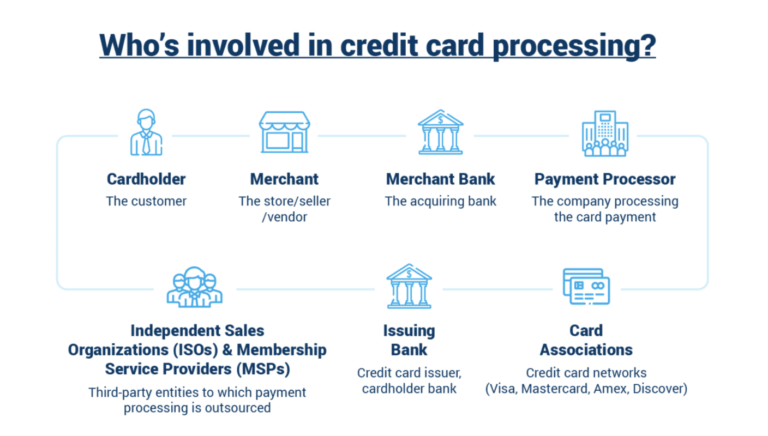

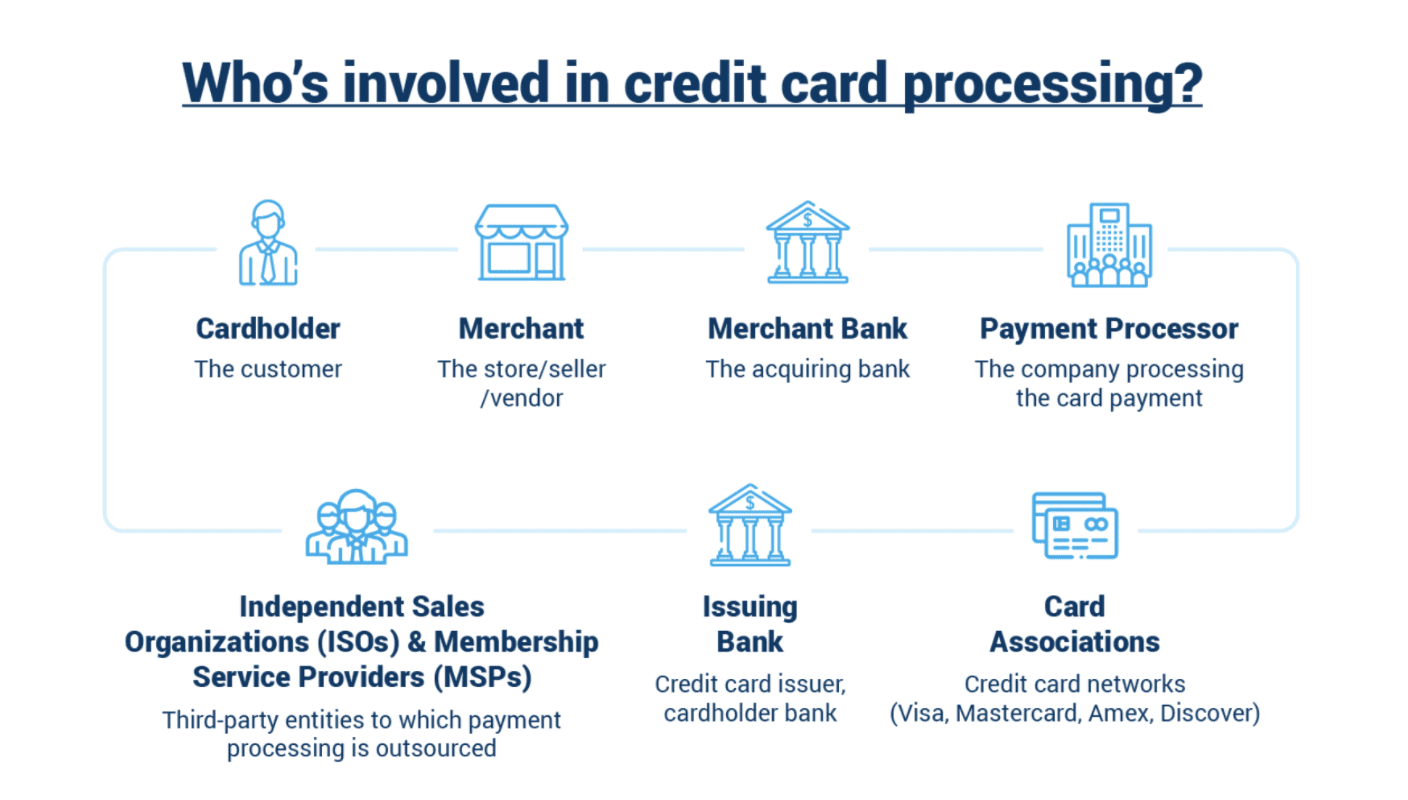

Keeping track of all the moving parts associated with credit card processing can be challenging. There are so many different parties involved with every transaction, and each one needs to get paid.

One of the most important entities in credit card processing is the acquiring bank.

For those of you who want to learn more about acquiring bank fees and where they come from, you’ve come to the right place. I’ll explain everything you need to know about this subject below.

What is an Acquiring Bank?

Let’s start with the basics. Before we get into the fees associated with an acquiring bank, it’s important to define exactly what the acquiring bank is.

The acquiring bank is your bank. It’s commonly referred to as the “acquirer” or the “merchant bank.” Acquiring banks process credit and debit card transactions on behalf of the merchant.

Acquiring banks are licensed members of credit card networks, like Visa and Mastercard. The acquirer helps approve the sale whenever a merchant processes a credit or debit card transaction based on the cardholder’s data.

Cardholder data is provided at the time of the sale by the card network and the issuing bank (the bank that provided the card to the consumer).

You can see that the acquiring bank is just one of many different players involved in credit card processing.

Let’s say a customer pays for your goods or services using a Mastercard. The cardholder’s issuing bank makes the card data available to the acquirer.

Once the acquiring bank verifies that everything is in order and the funds are sufficient, they approve the purchase and put the sale amount into your account.

In some instances, payment processors can double as acquiring banks. They can have direct contracts with businesses to provide merchant services for payment processing. With that said, not every payment processor is an acquiring bank.

The Role of Acquiring Banks in Credit Card Processing

To get a better understanding of where acquiring bank fees come from, you need to recognize the role an acquirer plays in processing payments.

Acquiring banks authorize credit and debit cards. They also connect with issuing banks on behalf of the merchant. So whether you’re processing a debit card transaction or credit card payments, you need a merchant acquirer.

In short, the acquiring bank can be viewed as a middleman between the cardholder’s financial institution and the merchant. It’s the acquirer’s job to ensure funds are transferred.

The acquiring bank assumes some financial risk for its role in this process, which is where acquiring bank fees come into play.

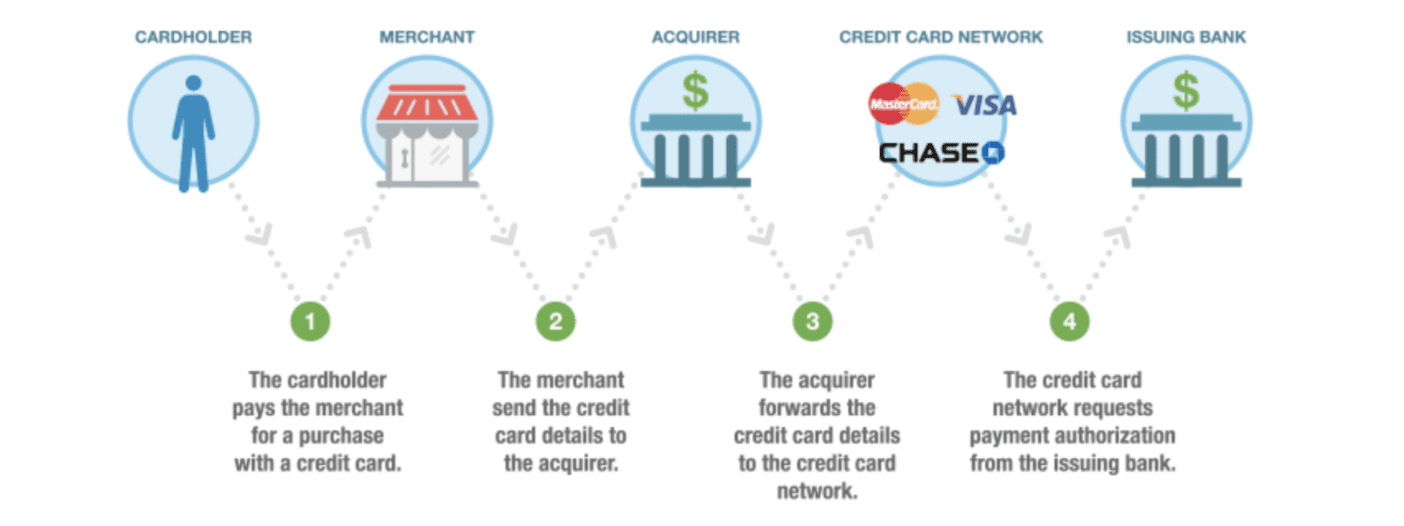

Let’s look at a simple five-step process to give you a better understanding of what the acquiring bank does for each credit card transaction:

- Step #1 — The issuing bank provides the customer with a credit card. When that customer is ready to buy something from a merchant, they present that card at a POS system, virtual terminal, or enter the card details online.

- Step #2 — Transactional data and card data pass between the payment processor, acquiring bank, card network, and issuing bank.

- Step #3 — Once the authorization has been approved, the issuing bank charges the cardholder for the purchase amount.

- Step #4 — The issuing bank transfers the purchase amount to the acquiring bank.

- Step #5 — The acquiring bank deposits the purchase amount (minus any fees) into the merchant’s account.

Here’s a visual representation to explain the process:

Again, the terms “acquiring bank” and “payment processor” cannot always be used interchangeably. While some acquirers are also payment processors, that’s not always the case.

Acquiring Bank Fees

Now that we’ve covered the basics, it’s time to talk about what matters most to you—transaction fees.

Why do acquiring banks charge fees? As you’ve seen in the previous sections, the acquiring bank plays a pivotal role in the transaction. Without the acquiring bank, merchants would not be able to get paid.

The acquiring bank assumes some financial risk when they transfer funds during the payment processing procedure.

It’s also important to understand that the acquiring bank has to deal with sensitive cardholder data. This means they must follow strict security standards and practices for payment processing.

With all of this in mind, the acquiring bank charges merchants to cover risks and other investments during the process.

When the issuing bank sends funds to the acquiring bank, the card network fees have already been deducted. So the merchant ends up paying for the interchange fees, plus the processor or acquiring bank markup.

The payment service provider needs to get compensated for their role too. So each transaction fee is really made up of interchange fees, assessment fees, and more.

Note: To learn more about interchange reimbursement, review our Complete Guide to Interchange Fees and Rates.

How to Reduce Acquiring Bank Fees

The interchange fee imposed by the credit card companies are non-negotiable.

But believe it or not, the fees and rates imposed by the credit card processor and acquiring bank can be negotiated. Most merchants don’t realize this and end up overpaying for credit card processing.

Every acquiring bank is different. Sometimes you’ll pay a flat fee, but usually the fee depends on the transaction type, transaction volume, and card used.

For example, you’ll pay a different rate for Visa cards compared to Amex cards. PIN debit transactions may not have the same assessment fee or network fee as an ecommerce credit transaction going through a payment gateway.

The best way to lower your acquiring bank fees is by consulting with professionals who can negotiate this rate on your behalf. If you try to do this on your own, you likely won’t get the result that you’re looking for.

What is the Difference Between Acquiring Banks and Issuing Banks?

The difference between an acquiring bank and an issuing bank is that the acquiring bank works for the merchant, and the issuing bank works for the customer.

Merchant acquirers maintain merchant accounts for businesses to accept credit card payments. Card issuing banks work directly with the credit card networks (Visa, Mastercard, etc.) and issue credit to consumers.

For more information, refer to our guide on acquiring banks vs. issuing banks.

What is the Difference Between a Merchant Acquirer and Payment Processor?

Merchant acquirers and payment processors provide different roles in the payment processing infrastructure. Payment processors work directly with the merchant to provide hardware, software, technology, and customer support for accepting card transactions. Merchant acquirers maintain bank accounts for card acceptance and maintain merchant accounts for businesses.

Some financial institutions double as merchant acquirers and payment processors—offering both services under one roof.

Check out our guide on credit card processors vs. acquiring banks to learn more.

Final Thoughts on Credit Card Processing Fees

Here at Merchant Cost Consulting, we can help lower your credit card processing fees. We’ll communicate with your acquiring bank on your behalf to negotiate lower rates.

We have the knowledge and experience to get you the best possible deal.

Depending on your processing volume, this can save you tens of thousands of dollars per year. Contact us today for a risk-free audit and assessment.

Continue to check back to our blog as well. We’re constantly updating this resource with information about bank fees, credit card fees, card networks, and lots of other helpful insight related to credit card processing.