Acquiring Banks vs Issuing Banks in Credit Card Processing

On the surface, credit card processing seems fairly straightforward. A customer buys something from a merchant, and their money ends up in the merchant’s bank account.

But the transaction process for credit cards is far more complicated than that. The money doesn’t simply go from point A to point B—there are lots of moving parts behind the scenes.

Credit card processing wouldn’t be possible without acquiring banks and issuing banks. Yet, so many merchants are unfamiliar with these terms and don’t know how these banks work.

That’s why we created this guide. I’m going to clear the confusion once and for all between acquiring banks and issuing banks.

Even if you’re a complete beginner and you’ve never heard these terms before, you’ll be an expert by the time you finish reading this article.

What’s the Difference Between an Acquiring Bank and Issuing Bank?

An acquiring bank is the merchant’s bank. An issuing bank is the cardholder’s bank or lender.

The acquiring bank, or acquirer, maintains the merchant account for a business so they can accept card payments. The issuing bank, or card issuer, manages a consumer’s credit card account and works with credit card networks to extend credit to consumers.

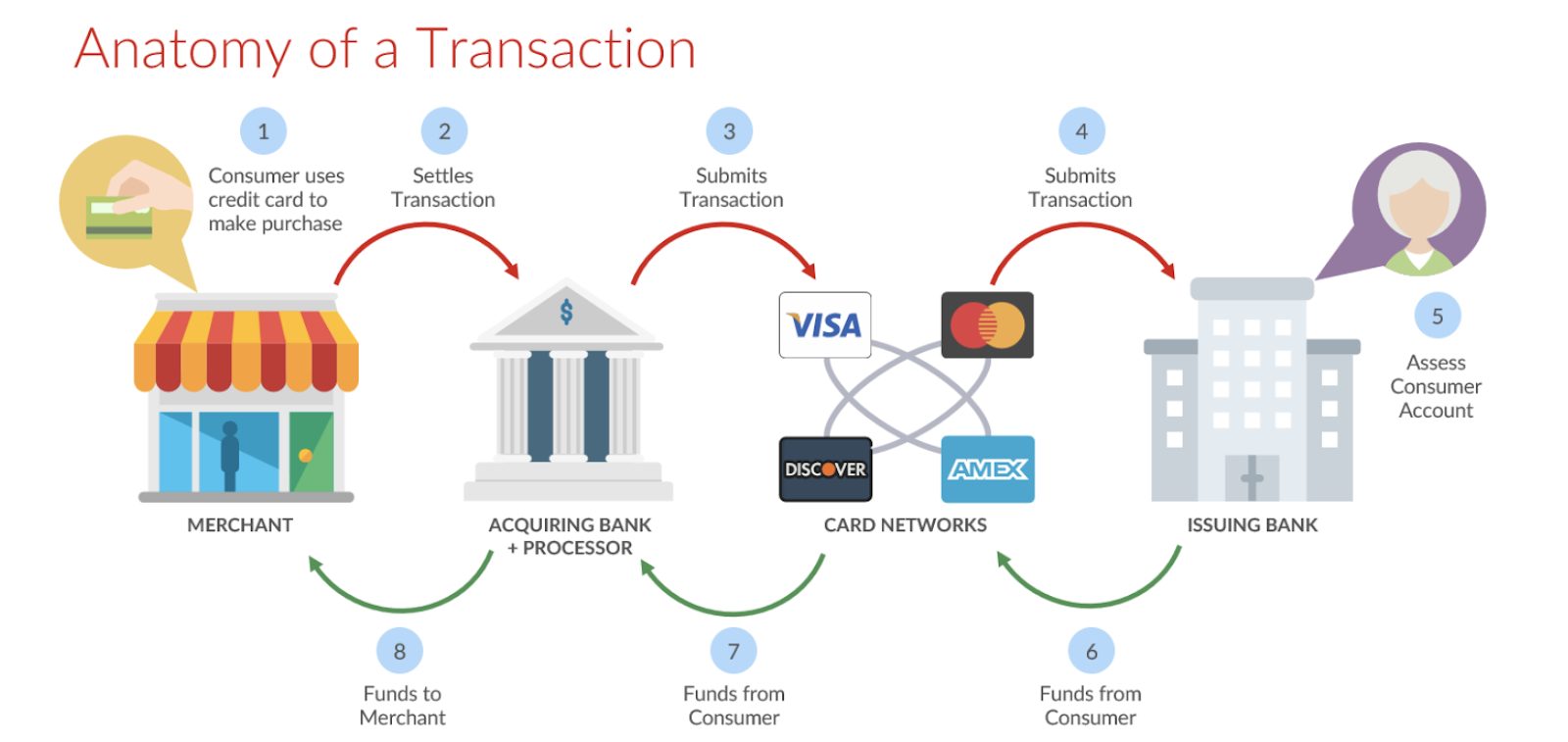

Both acquiring banks and issuing banks ensure payments are processed smoothly for both cardholders and merchants. Here’s a visual representation of the payment transaction, showing how acquiring banks and issuing banks work together but provide different roles in the process:

Both of these banks are crucial for your merchant account when it comes to processing credit and debit cards.

Beyond the quick differences mentioned above, we’ll take a closer look at each of these banks as we continue through this guide.

What is an Acquiring Bank?

Before a merchant can accept credit card payments and process debit card transactions, they need to have an agreement with an acquiring bank. Acquiring banks are often referred to as just an “acquirer” for short.

This financial institution is responsible for maintaining the merchant bank account.

As the merchant’s acquiring bank, it’s their responsibility to pass along payment card transactions to appropriate issuing banks so the merchant can ultimately receive payment.

Many acquirers are traditional banks that contract services out to payment processing companies. But it’s also possible for credit card processing companies to act as an acquiring bank, even if they don’t offer traditional banking services.

An acquiring bank will provide organizations with merchant accounts and unique ID numbers required to process credit cards.

As a merchant, you need to pay fees to an acquiring bank for their services and role in the credit card processing transaction.

The acquiring bank will exchange funds with different issuing banks each time a customer buys something, returns something, or issues a chargeback.

Acquiring banks then issue a net balance (gross sales minus fees and reversals) to the merchant for transactions during the period.

What is an Issuing Bank?

An issuing bank is a financial institution that provides credit cards to consumers on behalf of the credit card networks.

Card issuing banks are essentially intermediaries between the credit card networks and the cardholders.

Issuing banks extend the cardholder a line of credit on the card. Then the customer can use that card to make purchases and pay back the issuing bank with interest.

Any easy way to remember this is that issuing banks issue credit (hence the name).

Each time a cardholder makes a purchase using a credit card, the acquiring bank and issuing bank communicate with each other to verify the credit and transfer the funds.

Once verified, the funds will move from the issuing bank to the merchant’s account via the acquiring bank, less any fees or charges.

If a cardholder has a problem, needs assistance, wants to freeze their card, or requests a chargeback, they’d contact the issuing bank.

What Does an Acquiring Bank Do?

Here are some common responsibilities of acquirers:

- Set rules for merchant accounts

- Maintains merchant accounts

- Records all merchant account activity (fees, deposits, withdraws, etc.)

- Sends authorization requests to issuing bank

- Deposits funds in merchant’s bank account after successful processing

- Receives and reviews chargeback reason codes

What Does an Issuing Bank Do?

Roles of responsibilities of an issuing bank include:

- Consumer credit card applications

- Maintains consumer credit and debit card accounts

- Issues payment cards to cardholders

- Approves or denies transactions

- Releases funds to acquirers for approved transactions

- Initiates chargebacks on behalf of cardholders

Credit Card Networks as Issuing Banks

Some credit card networks also serve as their own issuing banks.

You can get a credit card directly from American Express or Discover. Both of these financial institutions issue cards directly to the consumer. But you couldn’t go to Visa or Mastercard for a credit card—those can only be offered from an issuing bank.

For example, check out this image of the Wells Fargo Platinum Card:

Look at the branding on this card. As you can see in the bottom right corner, it’s a Visa credit card.

But in the top right corner, you’ll see the Wells Fargo logo as well. In this example, Visa is the card network, and Wells Fargo is the issuing bank.

Any consumer with this credit card would not contact Visa for customer service; they’d communicate directly with Wells Fargo.

This is not the case with an American Express card.

Amex handles all of the card issuing, credit lines, and customer service on their end—without a third-party bank.

For more information, refer to our in-depth guide on understanding credit card networks.

How Acquiring Banks and Issuing Banks Work Together

Acquiring banks and issuing banks are both key players in credit card processing—transactions wouldn’t be possible without each bank.

Steps for Processing Credit and Debit Cards

Here’s a simple explanation of how the credit card transaction flow works, so you can see the role each bank plays in this process:

- The customer (cardholder) receives credit from an issuing bank, and the merchant enters a contract with an acquiring bank to process credit card transactions.

- When a cardholders use their credit and debit cards for payment (in-person, online payments, over the phone, etc.), the transaction goes from the payment processor to the acquiring bank.

- Then the acquiring bank routes the transaction through the card network to the issuing bank.

- The issuing bank assesses the cardholder’s account to confirm the transaction and then pulls funds from the cardholder’s credit line.

- Assuming the cardholder has available credit and the account is active, funds are then sent from the issuing bank to the acquiring bank.

- Once the authorized transactions are settled, the acquiring bank will accept the funds and place the money in the merchant’s account, minus any fees and service charges.

As you can see, even though the roles of each bank are very different, both are integral to the payment process for merchants, payment processors, and cardholders alike.

You can’t accept credit cards without all of these players working together in the payment chain.

Final Thoughts on Acquiring Banks vs. Issuing Banks

Acquiring banks and issuing banks both take a fee for their role in the transaction. The credit card networks also take a cut, known as the interchange fees.

As a merchant, it’s really important for you to understand how these fees work since they can directly impact your costs associated with credit card processing.

Did you know that some of these fees are actually negotiable?

Contact our team here at Merchant Cost Consulting, and we’ll negotiate those rates on your behalf. It’s what we do every day for businesses of all sizes across every industry—so we’re happy to give you a free consultation.

0 Comments