Whether you’re thinking of using Versapay for payment processing or you’re a current Versapay customer, this in-depth guide covers insider information that you won’t find anywhere else on the web.

Read on to learn more about Versapay, including fees and real examples of statements—plus tons of added tips based on our experience working with Versapay on behalf of our clients.

Our Quick Take on Versapay

Versapay is a super ISO of Wells Fargo that leverages acquiring services from Fiserv, Elavon, and Worldpay to process payments on the backend.

Working with multiple processors puts Versapay in a unique position to provide a range of services to merchants with specific requests. So you should be able to negotiate pretty hard and demand the best possible rates—as Versapay has plenty of options to pull from behind the scenes.

- Interchange-plus pricing is available.

- Versapay focuses on B2B payment solutions.

- They have an automated Level 2 and Level 3 enhanced data rate gateway (which is awesome).

- We mostly see merchants using Versapay for its direct integration with NetSuite.

- But they also integrate with other business tools, like Microsoft Dynamics and Sage Intact.

- Your monthly merchant statement will look different depending on which processor Versapay uses to handle your account on the backend.

Overall, Versapay is solid for B2B use cases.

Their discount rates are a bit higher compared to their competitors, but Versapay justifies this by providing integrated solutions and automated enhanced data rates (so merchants are still saving money, even though Versapay’s markup is higher).

Versapay Pricing and Credit Card Processing Rates

Versapay offers customized pricing for every merchant account. The exact rate you’ll pay depends on lots of factors, like your contract structure, business category, and which acquiring service Versapay is using for your account.

While Versapay offers several different types of fee structures (including flat-rate processing and tiered processing), we only recommend going with an interchange-plus pricing plan.

This is the best way to get the lowest possible rate. It’s flexible, and you’ll save money in the long run (despite its perceived complexity compared to flat-rate pricing).

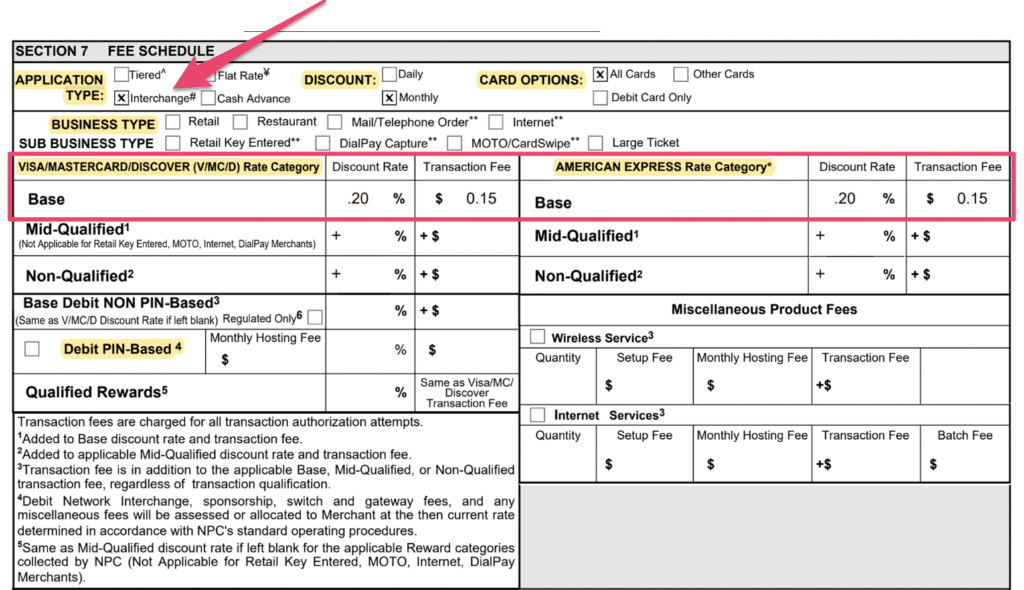

The rates are honestly all over the place. But here’s a recent example that Versapay offered to one of our clients at 0.20% + $0.15 per transaction:

As you can see, this is an interchange-plus offer that includes the same 0.20% + $0.15 per transaction for all card types—including American Express.

It’s not the cheapest rate on the market, but it’s honestly not awful either, especially since qualifying B2B transactions will automatically get optimized rates at the interchange level.

Avoid the tiered pricing structure if it’s offered to you by a Versapay sales rep. They may dangle a lower qualified rate in front of you as a way to lure you in, but in reality, few (if any) of your transactions will actually qualify for it.

Plus, there’s a disclosure on Versapay’s application stating that merchants on tiered plans accepting commercial cards that don’t meet the qualifications for preferred rates will be charged an additional 0.50% on those sales.

That additional charge is 2.5x higher than the base rate offered above on an interchange-plus plan.

Other Versapay Fees to Look Out For

In addition to the rates you’ll pay per transaction, Versapay may charge other one-off and monthly fees to your account.

Here are some examples of fees we commonly see on Versapay statements:

- Retrieval Fee — $15 per retrieval

- AVS Fee — $0.01 per address verification

- Chargeback Fee — $15 per incident

- Early Deconversion Fee — $375 each

- Paper Statement Fee — $10 per month

- SafePayments Basic Fee — $10 per month

- On File Fee — $154.99 per month

- Card Brand Usage Fee — $0.06 each

Let us know if you see any random fees you don’t quite recognize on your Versapay statement. Our team can let you know if they’re legit or if they can be removed or reduced.

A Closer Look at Versapay’s Monthly Statements (Real Examples From Our Clients)

What’s unique about Versapay is that the monthly statements aren’t consistent for every merchant. So if you’re comparing your monthly statement to another Versapay merchant, the format, reporting, and layout can look completely different.

That’s because Versapay uses different acquiring services on the backend. Those acquirers then provide statements to Versapay, and they’re essentially white-labeled with Versapay’s logo and delivered to the merchant.

To the untrained eye, nobody would notice this. But because we review and audit statements from dozens of different processors, we can recognize the patterns and tell who is actually providing the acquiring on the backend.

Why is this important?

If you know who is handling the acquiring for your account, then you can leverage information about that processor to your advantage when you’re negotiating with Versapay.

Example Statement 1 (Worldpay)

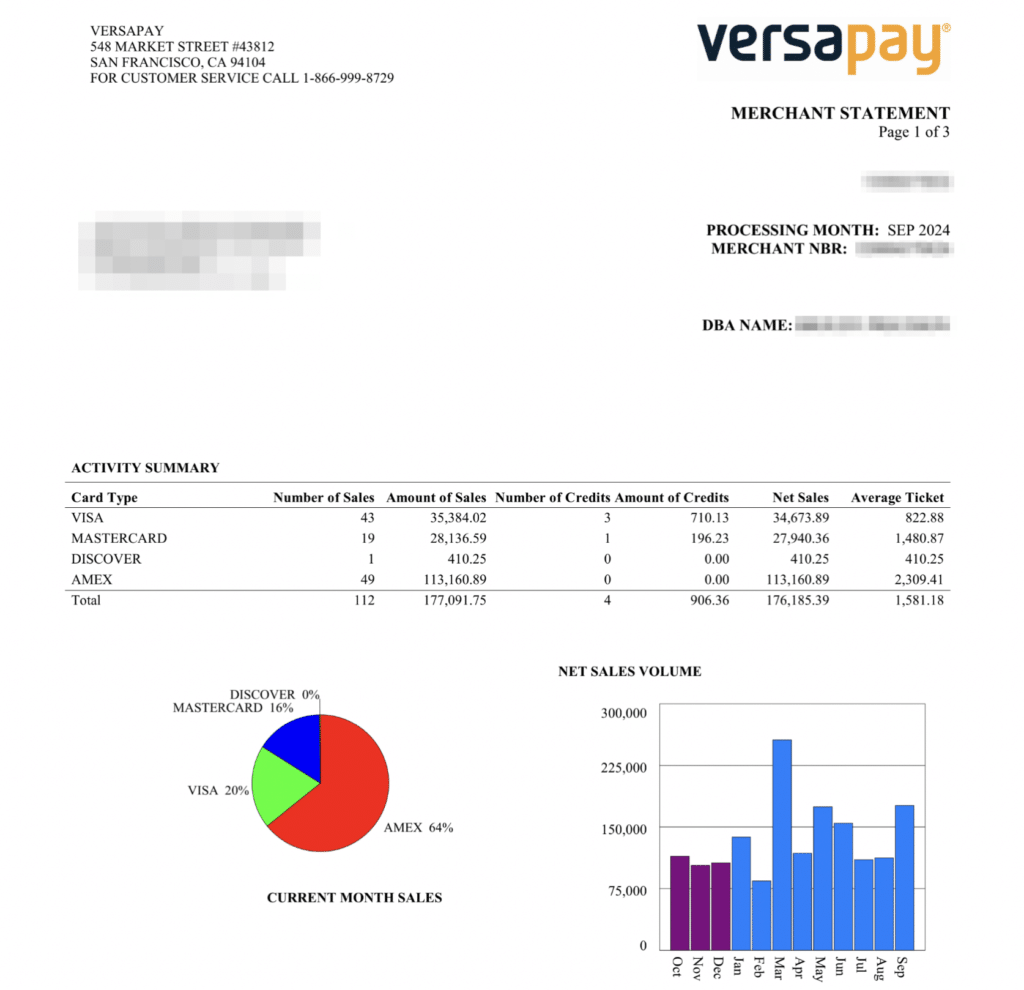

This particular Versapay statement starts with an activity summary by card network on page one and a pie chart showing the same breakdown.

If you’ve never seen another merchant statement, you might not think anything of this.

But I can look at this and immediately recognize it as a Worldpay statement. Don’t believe me?

Check out my Rectangle Health review. I know for a fact that Rectangle uses Worldpay’s acquiring services, and the Rectangle Health merchant statements are identical to the one above.

The only difference you’ll see is the logo in the top right corner.

Example Statement 2 (Fiserv)

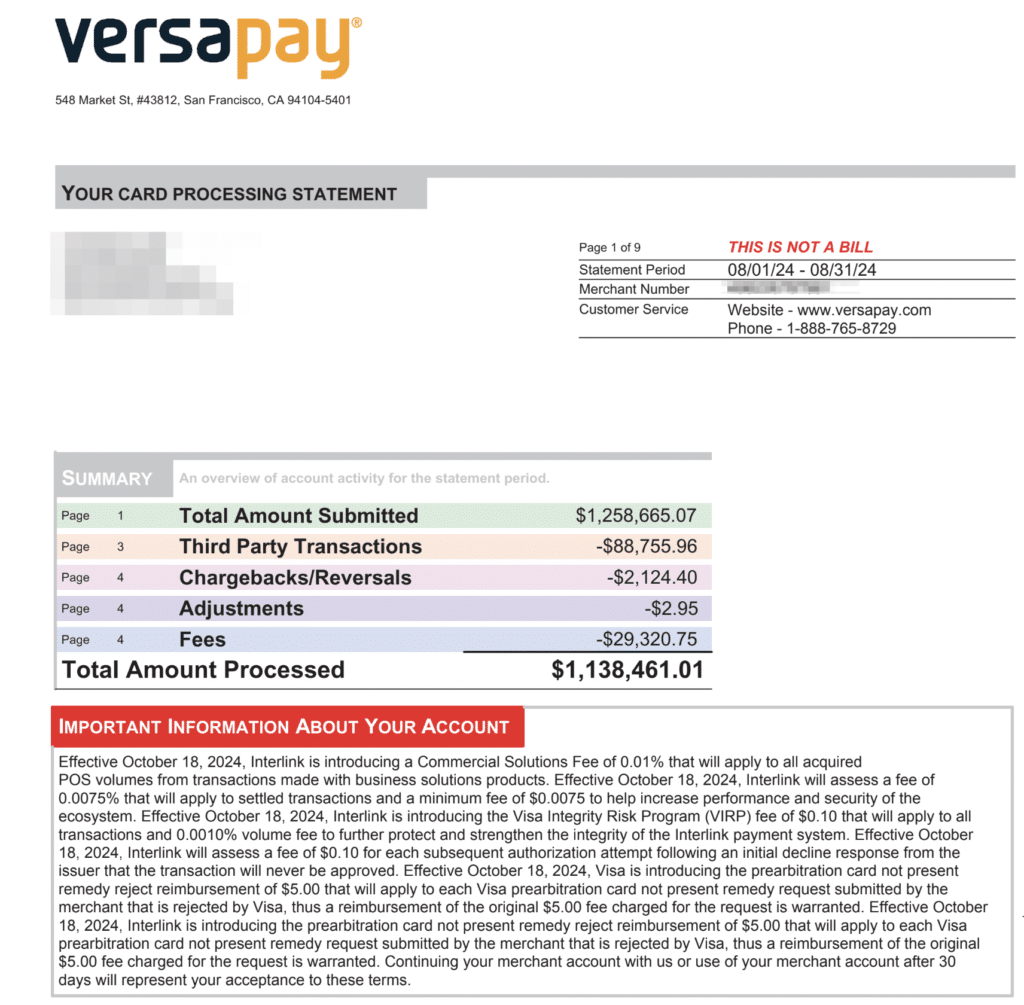

Here’s another Versapay statement from a different client. It looks nothing like the above, even though they’re both from Versapay and issued a month apart.

I recognize this as Fiserv.

The color-coded summary appears on Fiserv statements and reporting from ISOs reselling Fiserv’s services (like BOA).

Another dead giveaway that this is a Fiserv is the “Important Information About Your Account” section. This red header and subsequent text are identical to every Fiserv alert we’ve seen attached to monthly statements.

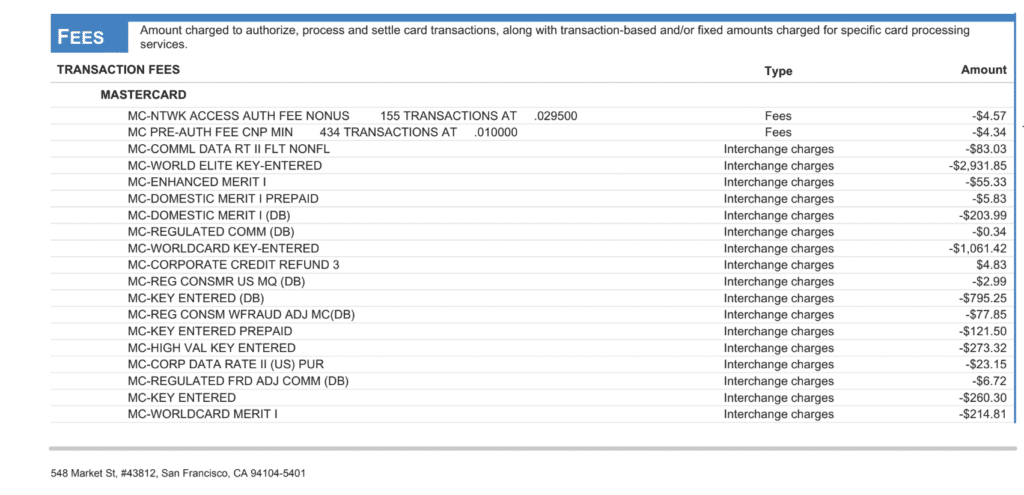

And if we scroll down a bit to the fees, it looks exactly the same as how fees are reported on Fiserv’s statements.

You can check my Fiserv review and just quickly scroll through the statement screenshots and you’ll instantly recognize the similarities between them.

What Else You Should Know About Versapay

Based on our experience working with Versapay, here are some factors to keep in mind as you’re weighing your options and potentially considering their payment processing services.

Versapay is Best For B2B Payments

Versapay’s payment processing service is specifically designed for B2B transactions.

So if the vast majority (if not all) of your customers are other businesses, Versapay should be on your radar. Otherwise, you probably shouldn’t be using them.

They Support ERP Payment Integrations

Another standout of Versapay is its ability to integrate payment acceptance from any sales channel within your ERP (Enterprise Resource Planning) software.

It’s best known for its integrations with NetSuite, Microsoft Dynamics, and Sage Intact, but Versapay’s flexible API allows for custom integrations into other solutions—like IBM, SAP, Epicor ERP, and more.

Versapay’s Automated Level 2 and Level 3 Enhanced Data Gateway is Great

We love that Versapay automatically optimizes your rates when Level 2 and Level 3 data is captured on commercial transactions.

For example, let’s say you accept a corporate card that normally costs 2.95% to process. Versapay’s gateway automates the optimization and reduces it to the lowest possible rate, sometimes as low as 1.95% (in this particular case).

Discount Rates Are Higher, But You’re Still Saving Money Because of the Automated Optimization

Versapay’s markup is slightly higher compared to other payment processors.

Earlier, we looked at an example of a client that was being charged 0.20% + $0.15 per transaction. Other processors might offer 0.10% + $0.10 per transaction to a similar business.

However, higher discount rates can be justified because of the cost savings associated with Versapay’s automatic rate optimization.

Let’s use a $500 commercial card transaction as an example. If the interchange rate is 2.95% and the markup from another processor is 0.10% + $0.10, you’d pay $15.35.

Versapay might be charging you a 0.20% + $0.15 markup, but the optimized data can bring the interchange rate down to 1.95% and your total cost to $10.90.

This simple example represents a 29% reduction in processing costs—even though Versapay’s discount rate is higher.

Final Thoughts on Versapay

Versapay is ideal for B2B payment processing, particularly if you want your payments system integrated in your ERP software.

We have several clients using Versapay, and we’ve had a good experience negotiating with Versapay on behalf of our clients.

Versapay’s rates are slightly higher compared to other processors. But it’s not bad for an integrated payments solution, and it’s totally justifiable if you’re getting the optimized Level 2 and Level 3 rates.

Whether you’re currently using Versapay or thinking of switching, let our team here at MCC audit your statements first. We’ll help you get the lowest possible rates—without having to switch providers.