The Transaction Integrity Fee (TIF) is one of many charges that a merchant might be confused to find on their monthly credit card processing statement.

What is it? Is the fee legit? Am I being ripped off?

These are all logical questions, and the fact that you’re closely inspecting the fees on your statement is already a step in the right direction. Read on to learn more.

Transaction Integrity Fee (TIF) Explained

Visa’s Transaction Integrity Fee is $0.10 and assessed on all regulated and non-regulated transactions in the US purchased with Visa debit or Visa prepaid cards that either fail to meet CPS qualification or do not request CPS qualification.

CPS (customer payment service) qualification refers to Visa’s lowest rates, which applies to both its regulated and non-regulated card transactions. In simple terms, a transaction fails to meet CPS qualification if it’s processed with incomplete data. This could happen if a card-not-present (CNP) transaction was processed without AVS data that Visa requires to qualify transactions.

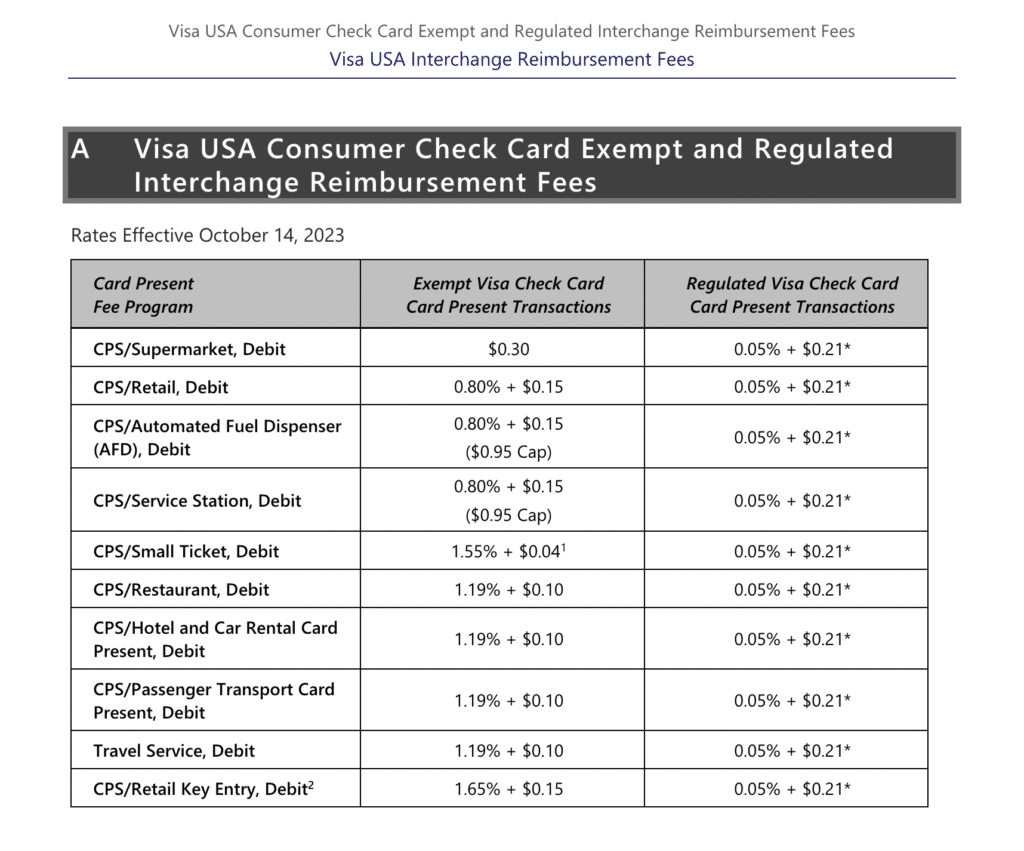

The $0.10 TIF fee is charged in addition to the interchange rate for the transaction. For example, let’s look at the latest Visa interchange rates for regulated debit transactions.

As you can see from the table above, the interchange rate set by Visa for all regulated card-present debit transactions is 0.05% + $0.21 per transaction. But if the transaction does not meet CPS qualification, then they’ll be charged an extra $0.10 for Visa’s Transaction Integrity Fee.

Are Merchants Required to Pay the Visa Transaction Integrity Fee?

Visa TIF is not a mandatory fee, but it will be assessed if you’re accepting debit or prepaid Visa cards without fully capturing the data required for CPS qualification.

To avoid this fee, make sure you always settle transactions within one day of the authorization request. (Batching your terminal, POS, or gateway at the end of each business day is something you should be doing already).

You should also make sure that you authorize and settle transactions for the same amount. For example, if a customer adjusts an order before the card is settled at the end of the day, you should void the original transaction and run a completely new one (as opposed to adjusting the first amount).

All ecommerce, keyed, and card-not-present transactions should be using an AVS (address verification system) to verify the cardholder’s address with the billing information on file with the issuing bank.

Other Notes About Visa’s Transaction Integrity Fee

- Visa first introduced the TIF fee in April 2012, at the same time as the FANF Fee.

- The TIF fee only applies to cards issued in the United States, and it doesn’t affect transactions for cards issued outside of the US.

- Transaction Integrity Fee only applies to settled transactions (not authorization transactions without a corresponding settlement).

- The TIF Fee is always a flat $0.10, regardless of how much the transaction is.

- The TIF Fee is separate from interchange rates set by Visa.

Final Thoughts on Visa TIF Fee

Lots of merchants have trouble understanding the various fees listed on their monthly processing statements. This is completely understandable, especially if you don’t recognize a charge and they’re not consistent from month to month.

Visa’s Transaction Integrity Fee is definitely one of those charges that can surprise some businesses. If you don’t typically take Visa debit/prepaid cards or you normally meet CPS qualifications, then you could go months without seeing the Transaction Integrity Fee on your statement.

Unfortunately, this is a legit fee that can’t be removed from your statement. It’s set by Visa, and it can only be avoided by taking the right steps to ensure your transactions qualify for CPS. But it can’t be retroactively removed.

However, if you’re seeing TIF Fees that are higher than $0.10 per transaction, then your processor could be inflating your rates in an attempt to deceive you. This is not ok, and it’s something that should be addressed immediately.

Our team here at Merchant Cost Consulting can analyze your statements to see if you’re being charged appropriately for TIF fees and determine if your processor is billing you for hidden fees that could otherwise be avoided. Contact us today for a free consultation.