New credit card technology has made it tougher for criminals to use fraudulent credit cards at brick-in-mortar POS stations. As a result, scammers are turning to online fraud and theft with stolen credit card information.

With ecommerce on the rise, online fraud is rising with it. In fact, card-not-present fraud is 81% more common than point-of-sale fraud. The dollar amount associated with these fraudulent charges is rising as well.

But just as credit card companies tackled in-person fraud with solutions like EMV chip cards, they’re doing the same with card-not-present fraud.

Enter SRC—secure remote commerce. Visa, Mastercard, Discover, and American Express unveiled this new technology back and October of 2019. It’s designed to secure credit card transactions in remote checkout environments through platforms like websites, apps, mobile payments, and other connected devices.

Ready to learn more about SRC and why it’s important? You’ve come to the right place.

What is Secure Remote Commerce?

Secure remote commerce, better known as SRC, is a secure payments solution to protect card-not-present transactions. It’s meant to be the foundation for ecommerce credit card processing that can be replicated across every type of remote checkout experience.

SRC is supposed to work regardless of the device or checkout environment. From tablets to smartphones, computers, and other connected devices, SRC is the future of remote checkout.

Simply put, secure remote checkout aims to increase the security of card-not-present payments while streamlining the checkout process. Regardless of the device or checkout method, SRC is supposed to secure the payment and prevent fraud.

The concept of SRC started years ago. As previously mentioned, EMV technology was a big breakthrough in the financial technology space to secure in-person payments. But those efforts didn’t help remote payment fraud. SRC was born to provide the same type of security to CNP (card-not-present) payments, similar to how EMV technology improved card-present transactions at physical point-of-sale systems.

How SRC (Secure Remote Commerce) Works to Protect Payment Data

One major hurdle with implementing SRC is providing security without hindering the customer experience. If you’re currently running an ecommerce site, you likely understand how important it is to have a smooth checkout flow and consistent consumer experience.

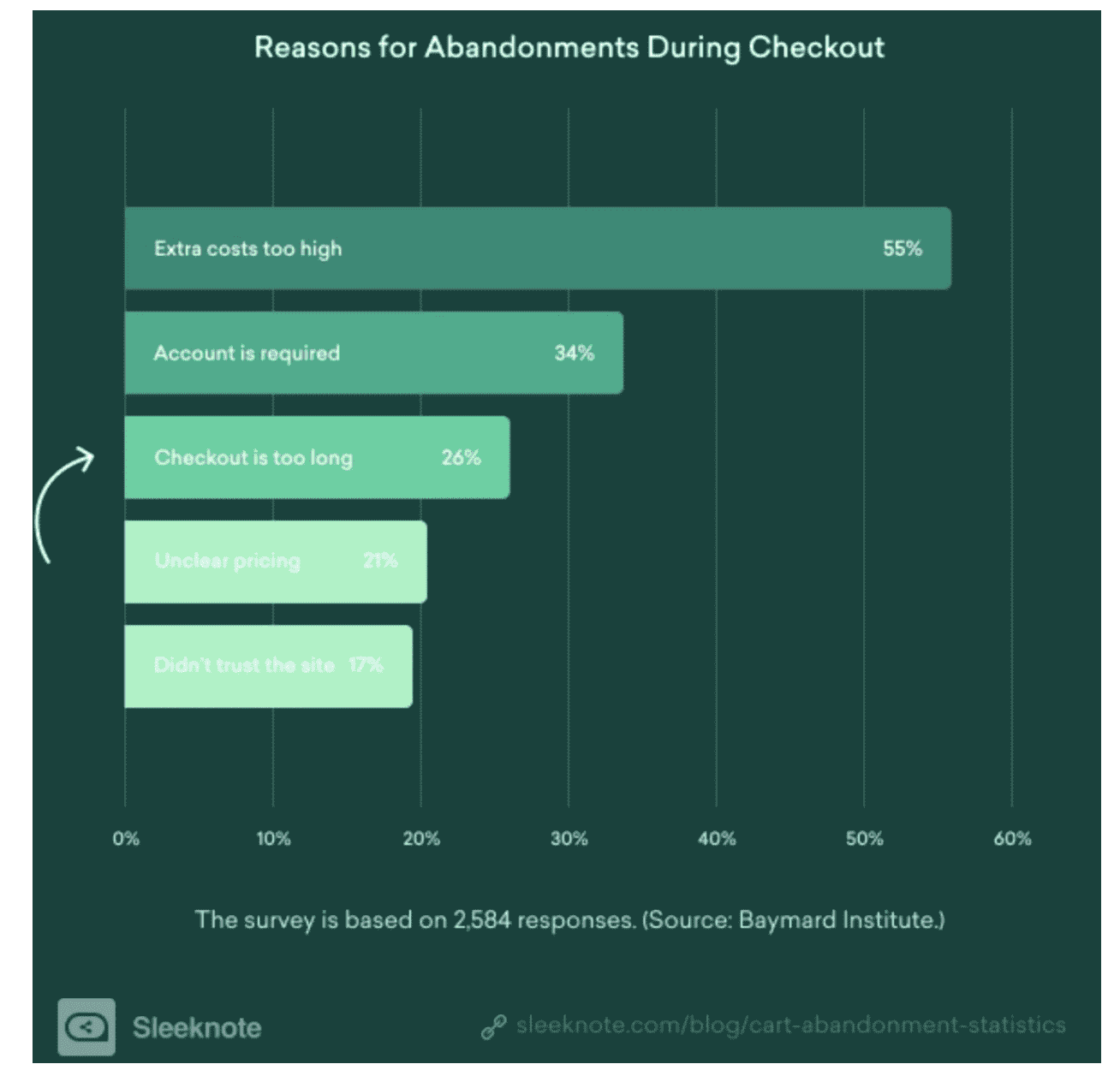

In fact, a long and complicated checkout process is one of the top reasons for shopping cart abandonment.

People don’t want to get a text alert with a unique PIN to verify their identity every time they buy something. This is just too much of a hassle.

Keeping online transactions secure is obviously important, but it can’t be done at the cost of adding extra steps to the checkout process. Otherwise, businesses would not want to adopt this new technology—customers would hate it.

That’s why SRC is such a breakthrough. It alleviates the aforementioned concerns by presenting consumers with a “universal buy button.” This button lets people choose a stored payment card without entering the payment card details for every purchase.

So not only does secure remote commerce improve payment processing security, but it simultaneously improves the customer experience for ecommerce transactions.

The Universal Buy Button and Pay Icon: Secure Remote Commerce

Right now, there are a wide range of different checkout buttons being used by ecommerce websites. It’s tough for merchants to manage these, and it can be confusing for customers as they see different options from site to site.

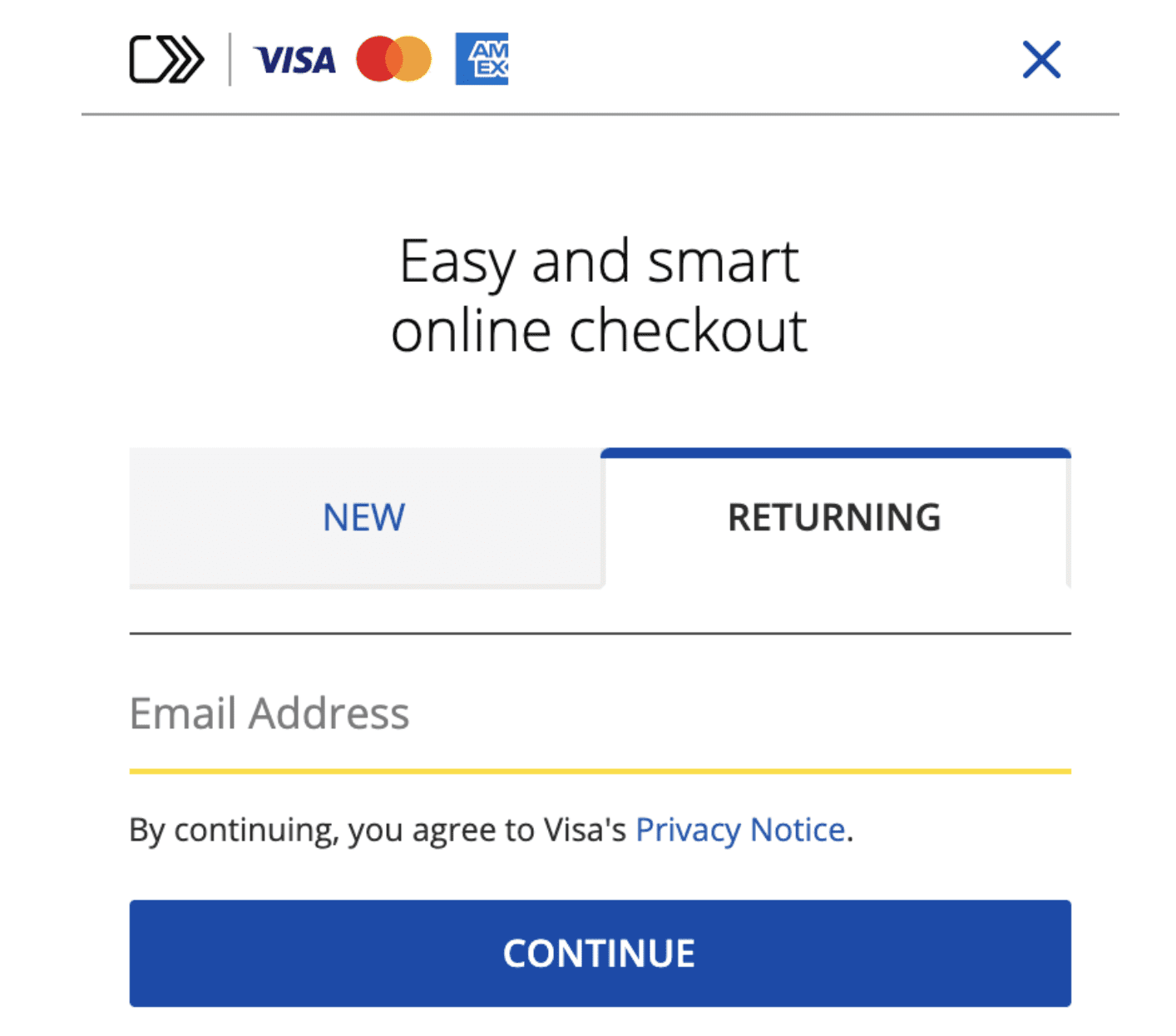

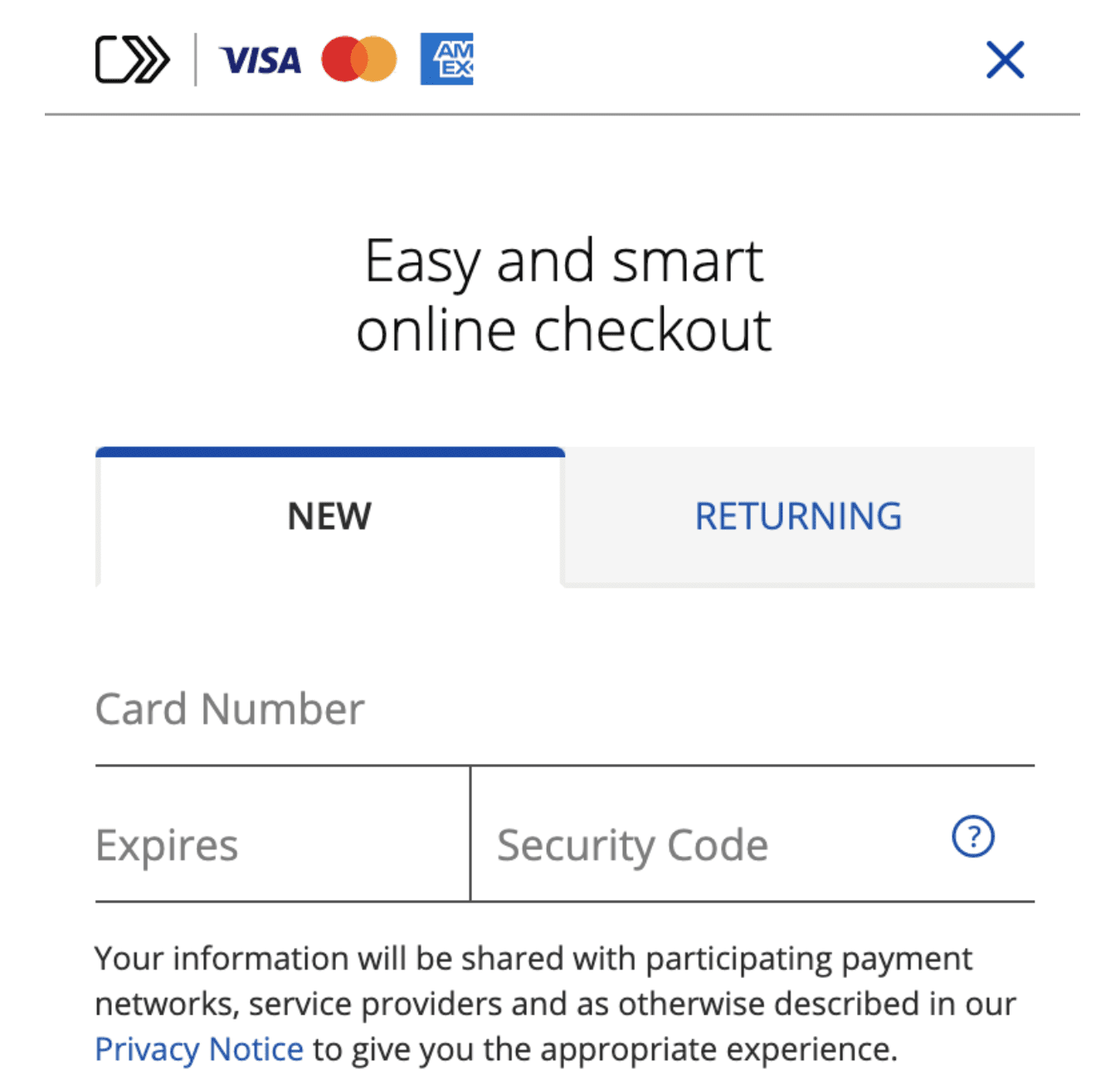

Online click-to-pay is designed to streamline this experience without the need for consumers to create an account or log in. This gives them a consistent user experience across the board, similar to the experience they have in-store at brick-and-mortar locations.

Here’s how the universal buy button is meant to work:

At checkout with participating merchants, the consumer will see a choice of payment methods on a “buy” button. This pay icon signals availability of SRC.

To complete the checkout process, the customer just needs to enter their email address, and they’ll be presented with all credit cards owned by that person—regardless of the card network brand.

From here, it’s just a matter of selecting their preferred card that’s saved on file, and they’re done.

If it’s a customer’s first time being presented with the universal buy button, they’ll have an option to create an account instead of using the guest checkout SRC system.

Once the account has been created, they can use SRC in just a few clicks for future purchases where the universal buy button is present on other websites.

SRC (Secure Remote Commerce): Benefits, Limitations, and Implementation

Now that you have a firm grasp on what SRC is and how it works, let’s take a moment to talk about it from a practical standpoint.

Aside from security, the biggest benefit of SRC is meant to be customer experience. But as of right now, this payment method still a bit unfamiliar to the masses. So it may take some time before customers actually realize how much easier it is to use SRC. Some consumers might prefer entering their cards manually for each transaction, as they are hesitant to store payment details online.

While SRC applies to the world’s largest credit card networks, it isn’t truly “universal.” For example, SRC does not support alternative payment solutions like PayPal. Roughly 88% of all online buyers use PayPal, and the platform accounts for 22% of all online transactions in the United States.

Like most new advancements in technology, it will take some time before SRC is adopted by the masses on the business and consumer ends alike.

But ultimately, SRC aims to help payment ecosystem stakeholders, merchants, and consumers alike.

How can you implement SRC and the universal buy button for your business? Get in touch with your credit card processor. You need to have an SRCi (secure remote commerce initiator) and embed a virtual terminal into your checkout application.

Final Thoughts on EMV Secure Remote Commerce

Secure remote commerce is a significant step in the right direction for securing credit card transactions online. Digital payments are the future.

However, we’re a long way from the universal buy button becoming the new normal.

As a business owner, there are other steps you can take to detect and prevent credit card fraud. It covers things like verifying billing and shipping addresses during the checkout process, payment tokenization, and EMV secure remote commerce. You can check out our guide on fraud scoring metrics for ecommerce websites as well.

If you’re not ready to implement SRC today, that’s ok. Just continue to stay educated and be prepared for rolling it out in the future. It can’t hurt to contact your processor and inquire if they support the universal buy button.