Credit card processing fees can be a tough pill to swallow. While the vast majority of merchants in 2020 understand the importance of accepting credit cards, most of them don’t realize that they can save money on credit card processing.

Every transaction isn’t assessed with the same interchange rate. The fees vary on a wide range of factors.

Interchange optimization ensures that you’re processing transactions at the lowest possible rate. Depending on your sales volume, this can save you tens or potentially hundreds of thousands of dollars per year.

How can you benefit from IC optimization? Continue below to learn more.

Credit Card Processing Fees: What is Interchange?

Let’s start with the basics. Interchange is the cost incurred by merchants for processing credit cards. IC rates are set by the card networks and change depending on different categories (such as in-person vs. online, card type, B2B vs. B2C, merchant category code, processing volume, and more).

IC rates help cover the costs and risks associated with payment processing, such as fraudulent transactions and chargebacks. You can review our complete guide to interchange fees and rates to learn more about this.

Generally speaking, interchange fees are non-negotiable. These rates are set by the card networks and collected by the issuing banks.

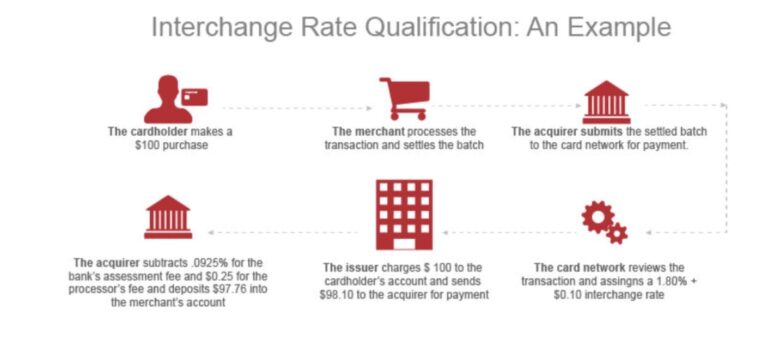

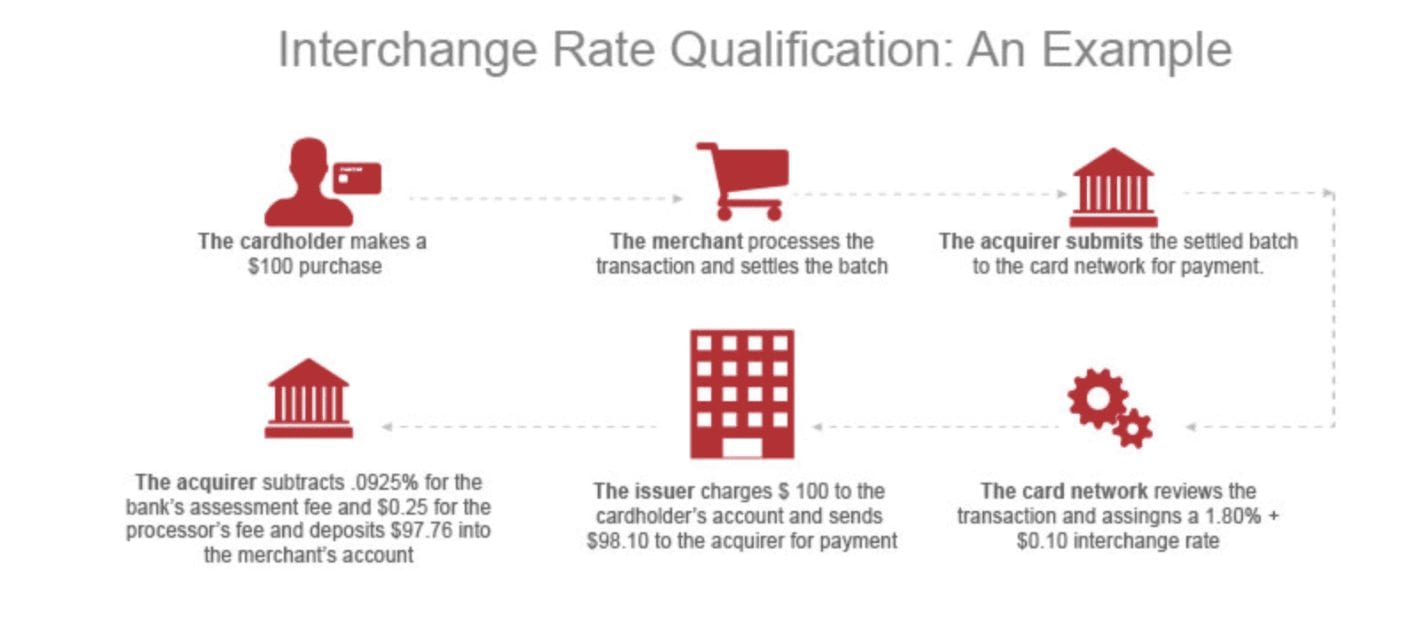

Here’s an example that shows how merchants are charged for interchange fees:

As previously mentioned, there are hundreds of different interchange categories. The difference between one category and another could be a full percentage point. While you can’t change the actual fees and rates, there are certain things you can do to make sure your transactions fall into a lower-rate category.

Interchange Optimization: Tips and Best Practices

Each time a transaction is processed, it’s placed in a category, determined by the card network on that particular card. Most merchants don’t realize that the way they’re processing credit card transactions is causing them to pay higher interchange fees. This can easily be prevented if you follow certain steps.

For starters, you need to make sure that your staff is properly trained to process transactions. When cards are accepted in-person, some employees might skip through prompts on the credit card terminal as an attempt to speed up the transaction process.

This can be a costly mistake. Make sure you follow every prompt, including address verification. If you skip a prompt, you can expect to pay a higher rate.

Another way to ensure lower interchange fees is by settling batches daily. If you don’t settle batches within 24-48 hours, the transaction will “downgrade.” What do I mean by this?

Every transaction has a target interchange category, which represents the lowest possible rate. If specific criteria are not met (such as a late settlement), the transaction will automatically “downgrade” to a more expensive category.

For more information on these downgrades, including the actual fees, check out our guide on the most common interchange downgrades. This is crucial to understand in terms of interchange optimization.

What Merchants Qualify For IC Optimization?

Any merchant can follow the tips and best practices that were outlined above. However, it’s easier for some merchants to benefit from interchange optimization compared to others. In many cases, this could be out of your hands, just based on the type of business you run and the way that you operate.

Generally speaking, B2B (business-to-business) and B2G (business-to-government) merchants stand to benefit the most from IC optimization. You’ll be able to pay lower rates when business cards or government cards are used for transactions at your establishment.

Why is this the case? B2B and B2G businesses typically accept “P-cards” (purchasing cards). These cards capture additional card data at the point of sale.

A merchant that sells to general consumers just collects Level 1 (Level I) data, which has the customer’s basic billing information. That’s all they need to process the sale. But Level 2 (Level II) and Level 3 (Level III) card data (in B2B and B2G P-cards) provide additional information such as:

- Tax ID

- PO (purchase order) numbers

- Customer codes

- Unit measurements

- Product codes

By collecting additional data, the threat of a fraudulent transaction gets reduced. The card networks and issuing banks aren’t taking as much of a risk by processing these transactions, so they offer lower interchange fees.

Card associations offer these low IC rates as an incentive for merchants to provide the extra data. It’s a win-win scenario for everyone involved. Merchants save money, and issuing banks reduce their risks.

Level 2 and Level 3 IC Optimization

As we just mentioned, merchants with the ability to process Level 2 credit card data and Level 3 credit card data can save money on credit card processing. With that said, this is not the case for merchants on a flat-rate processing plan (offered by companies like Stripe and Square).

Is flat rate pricing useful? In many cases, yes. It’s easy to understand, especially for smaller businesses.

But your company cannot benefit from IC optimization on a flat-rate plan. Even if you’re processing Level II and Level III card data, your rates will remain the same (hence the name).

To benefit from IC optimization, you must be on an interchange-plus pricing plan (our complete guide to credit card processing outlines some of the different cost structures available).

In addition to the interchange optimization aspect of interchange-plus pricing, this type of plan also gives you the ability to negotiate the markup fees with your processor.

Final Thoughts

How can you save money on credit card processing fees? Interchange optimization is a great first step, especially for B2Bs, B2Gs, and businesses that capture Level II and Level III card data.

You can also reduce the processor markup fees if you’re on an interchange-plus pricing plan. Here at Merchant Cost Consulting, we can negotiate those rates on your behalf. It’s what we do on a daily basis, so we know exactly how to get those fees slashed for you.

Contact us today to get a free audit and analysis. We’ll help you determine how much you can save on credit card processing.