Level 2 Credit Card Processing Rates

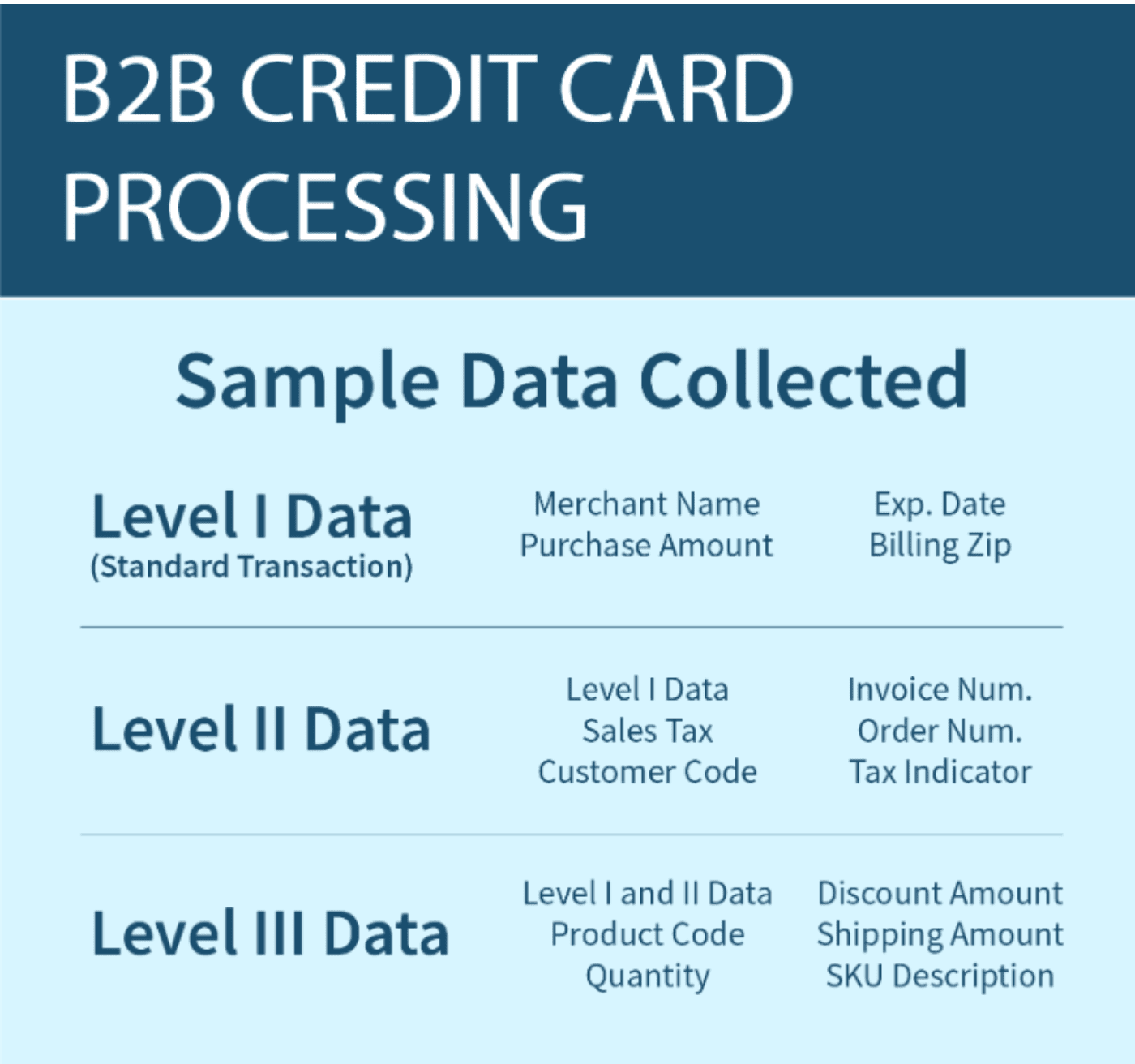

Every credit card transaction has data attached to it. The processing level refers to how much information is provided during the transaction.

If you’re a B2B organization that accepts credit card payments from corporate customers, business accounts, commercial credit cards, and government agencies, Level 2 (or Level II) credit card processing can give you access to lower interchange rates.

I’ve recently spoken to several CFOs, controllers, and other executive-level positions at large businesses who have questions about Level II credit card processing.

These inquiries inspired me to create this guide. I’ll explain everything you need to know about Level 2 credit card processing and how it works.

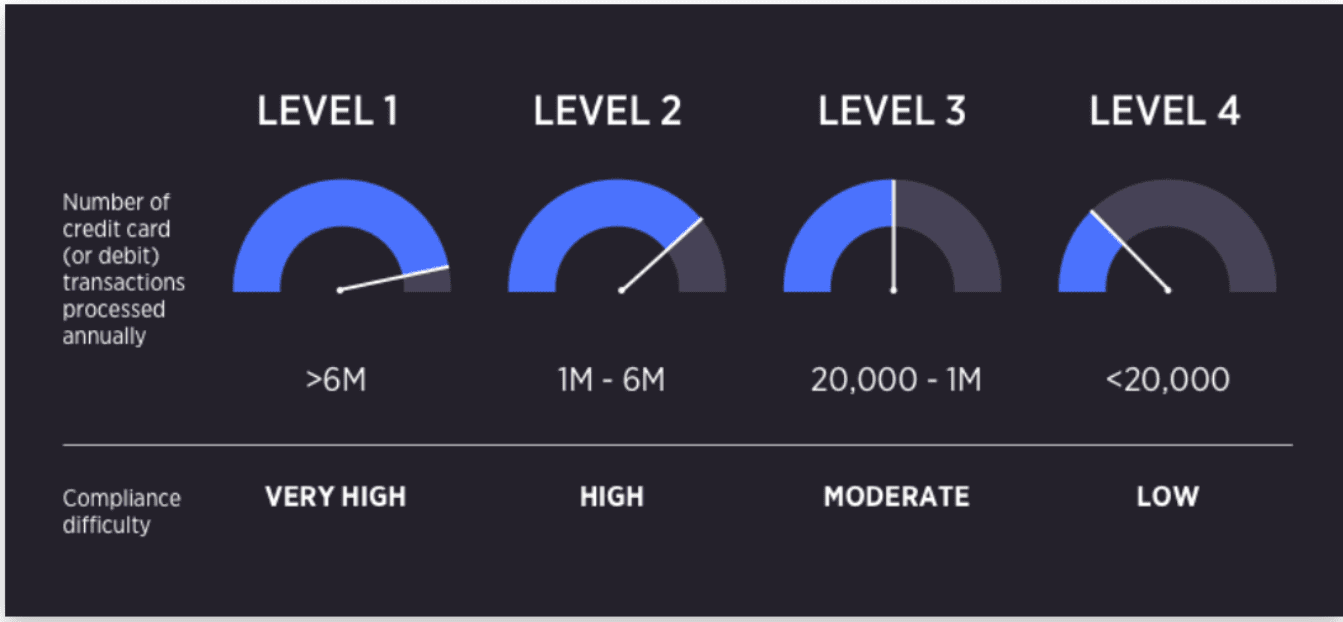

PCI Compliance Levels

There are four different levels or tiers for PCI compliance. Your merchant category for PCI compliance depends on the quantity of credit card transactions you process in a given year.

The PCI compliance level will determine how much transactional information is available to the cardholder after the sale. Let’s take a closer look at each one of these before we discuss Level 2 processing in greater detail.

Level 1

Level 1 is the highest level of PCI compliance. This is reserved for businesses that process over six million transactions for Visa, Mastercard, or Discover each year.

The data in a Level 1 card transaction includes the date, merchant category code, retailer name, and the total purchase amount. This is commonly associated with consumer card transactions for large businesses.

Level 2

Level 2 PCI compliance is for businesses that process between 1-6 million credit card transactions per year. It captures the same information as Level 1, plus some additional data such as sales tax, customer accounting code, merchant tax ID, and sales outlet zip code.

These transactions are commonly associated with commercial, corporate, and government buyers.

Level 3

Businesses that process between 20,000 and one million transactions per year fall into the Level 3 PCI compliant tier.

The data provided to a cardholder for a Level 3 transaction can be compared to an itemized invoice. It includes things like the order number, invoice number, item product codes, freight amount, unit of measure, and more.

Level 4

Level 4 credit card processing is for merchants that process less than 20,000 credit card transactions per year. It’s the most basic level and typically associated with small businesses.

What is Level 2 Credit Card Data?

Level 2 credit card data includes all Level 1 data, which consists of:

- Card number

- Expiration date

- Zip code

- Credit card billing address

There are additional elements that must be available to the cardholder to qualify for Level 2 credit card processing. This data includes:

- Sales tax

- Merchant postal code

- Merchant tax ID

- Invoice number

- Order number

- Customer code

The purpose of this additional information is to benefit the buyer. As I said earlier, in many cases, Level 2 credit card buyers are for commercial accounts and government credit cards in the B2B space.

Some retailers will encounter a Level 2 credit card when they swipe a business card. The credit card terminal will prompt them for a customer code or PO number. While this is often mistaken as a request for the CVV code, it’s not the same thing.

Benefits of Level 2 Credit Card Processing

Level 2 credit card processing can save your company money on processing costs. You’ll be subject to lower interchange rates than Level 1 processing.

The exact rates will vary depending on the credit card being used, as those are set individually by each card brand.

Since extra information is required to process a Level 2 card transaction (like the customer code), it adds an extra level of security to the transaction.

As a result, the chances of you processing a fraudulent transaction will significantly decrease. It’s also less likely that you’ll be responsible for any attempted chargebacks. So, in addition to cheaper processing rates, you’ll also save money on credit card chargeback fees.

Level 2 Data Requirements and Policies

Every credit card association has a unique set of rules, requirements, policies, and interchange associated with credit card transactions. Some brands will require merchants to get prior approval for Level 2 processing eligibility. Other cards will automatically approve transactions without prior approval.

Here’s a brief overview highlighting the data policies and requirements for Visa, Mastercard, Amex, and Discover.

Visa Level 2 Credit Card Processing

Visa does not require pre-approval for Level 2 processing. You just need to make sure that your business meets its requirements.

- 1-6 million Visa transactions across all sales channels per year

- Annual self-assessment questionnaire (SAQ)

- Attestation of Compliance form (AOC)

- Quarterly network scan conducted by an approved scan vendor (ASV)

Mastercard Level 2 Credit Card Processing

Mastercard does not require pre-approval either for Level 2 credit card processing. You just need to complete the following forms on an annual basis and meet the transaction quantity criteria.

- Combined 1-6 million of Mastercard and Maestro transactions per year

- Self-assessment form

- Onsite assessment at merchant discretion form

- Quarterly network scan by an ASV

American Express Level 2 Credit Card Processing

Amex requires merchants to get pre-approval before they accept Level 2 card data.

- Submit Level 2 merchants validation documentation

- PCI self-assessment questionnaire

- Quarterly network scan summary

Discover Level 2 Credit Card Processing

Discover only handles Level 1 credit card data. They do not offer any discounts or lower interchange rates for submitting level 2 data with a transaction.

Final Thoughts

There is significant value to Level 2 credit card data for B2B companies that process a high quantity of annual transactions.

The process is more secure, and you’ll be able to save money on interchange fees.

Want to lower your credit card processing fees even more? Request a free consultation with our team here at Merchant Cost Consulting.

0 Comments