In today’s day and age, every business must be able to access credit cards and debit cards. This statement holds true for startups, small businesses, and companies operating across all industries.

But before you can start accepting credit cards, you must first open a merchant account.

This can feel like a daunting task, especially for beginners and entrepreneurs who haven’t been through this process before.

Fortunately, you’ve come to the right place. This guide will explain what to expect when you’re opening a new merchant account. Let’s dive in.

Learn the Importance of a Merchant Account For Your Business

Let’s start with the basics—what is a merchant account?

Merchant accounts are business bank accounts that allow businesses to accept electronic payment card transactions. The business partners with an acquiring bank to facilitate all of the necessary communications required during the transaction process.

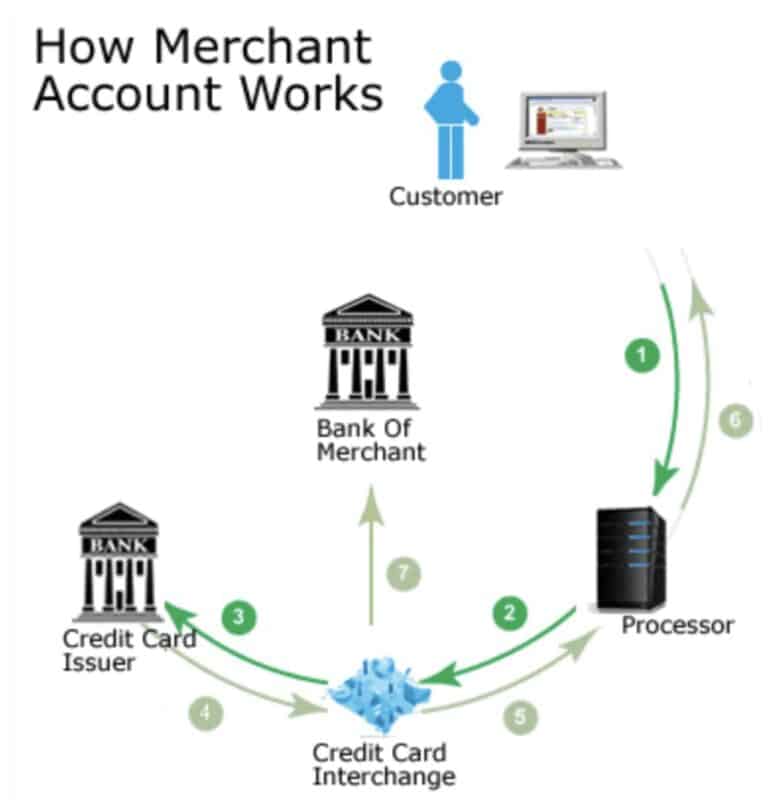

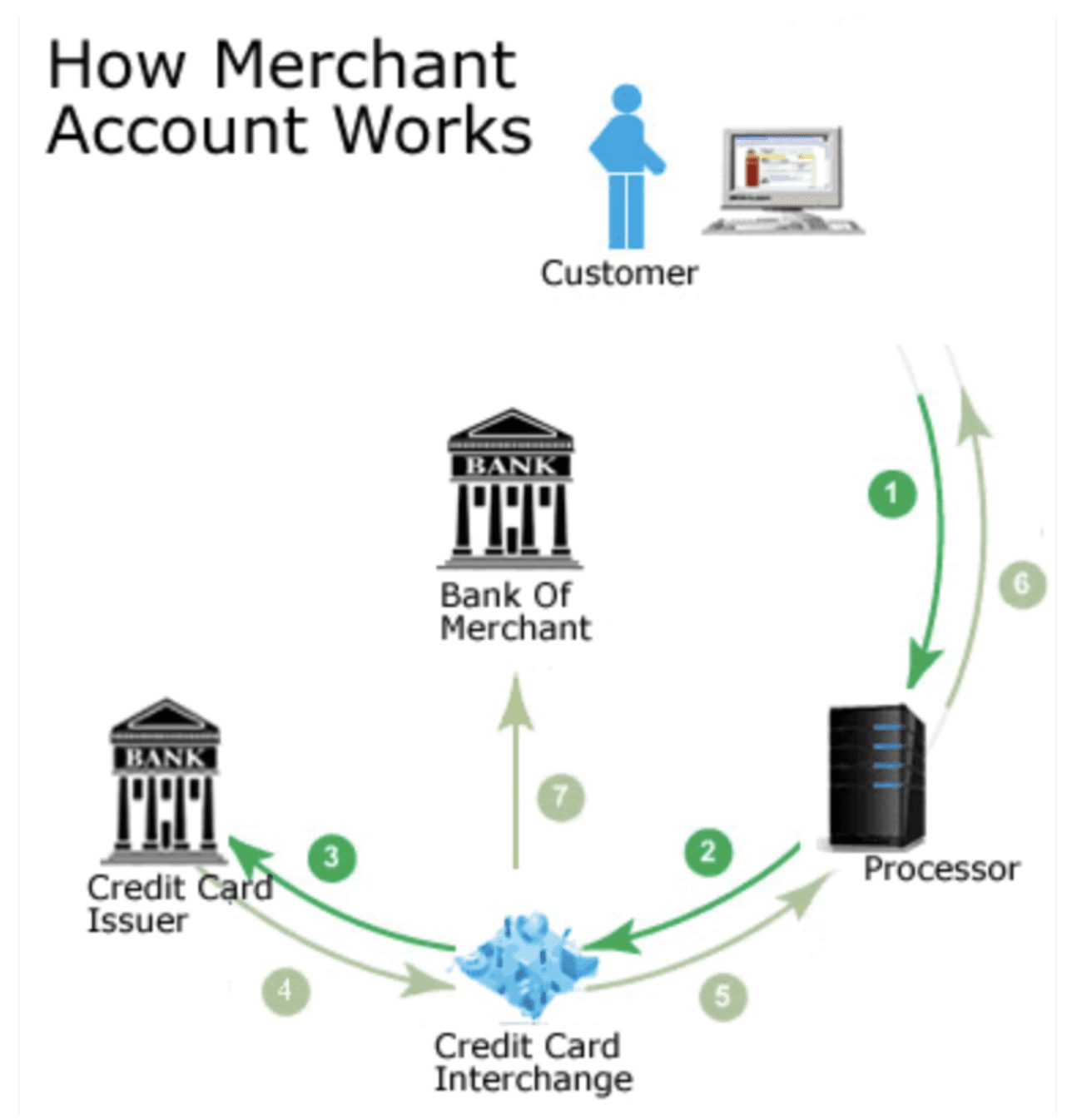

There are lots of moving parts behind the scenes of a card transaction. Whether a customer swipes their card, taps it against an NFC reader, enters their card information online, or submits card information online, there’s an entire chain of communication that takes place before the transaction gets approved.

Here’s a basic example that showcases the merchant account’s role in a typical transaction.

In short, a business could not accept credit cards or debit cards without a merchant account.

It’s also worth noting that your merchant account will likely be paying you the funds for each transaction before those consumers pay off their credit cards. So you’ll see the money in your bank account within days, as opposed to waiting a month or more.

There are fees associated with opening a merchant account, but they are necessary expenses for running a business.

Open a Business Checking Account

A merchant account is not a traditional bank account where money flows in and out. Instead, the account establishes a relationship between a business and issuing banks associated with different card networks.

The acquiring bank provides merchants with an advance of funds from each transaction, minus fees. Your merchant account won’t get paid from the issuing bank until a later time.

This is not how a traditional bank operates. So in addition to your merchant account, you’ll still need to open a business bank account.

There are solutions on the market that offer credit card processing to businesses without the need to open a merchant account. These providers bundle all merchants into a single account. Examples of these payment facilitator services include Stripe, Square, and PayPal.

While the signup process is easy and you won’t have to open a merchant account, there are several downsides to using these types of platforms for credit card processing. These services are known for higher transaction fees, slower funding times, and restricted customer service. You might even be imposed with a rolling reserve here, which is never a good thing.

Basically, a merchant account is not a replacement for your business bank account.

You’ll still need a traditional business banking solution for other transactions, including payroll, expenses, and more.

Be Prepared For an Underwriting Process

Merchant accounts are also for-profit businesses (just like you). So they’ll want to learn more about you and your business before they approve you for a merchant account.

To reduce risks, they’ll put you through an underwriting process. Think of it like applying for insurance (business or personal), where the carrier wants to get the facts straight before offering you a rate and giving you coverage.

Here’s what you can expect a merchant account provider to request during the underwriting process:

- Business industry

- How long you’ve been in business

- How you currently accept payments

- Chargeback history

- How often you bill customers

- How you bill customers

- Monthly and annual sales volume

- Credit score

While this might seem like an intimidating process, don’t worry—most businesses get approved fairly quickly without any issues.

Merchant Account Applications and Approvals

Merchant account applications are pretty simple. Most can be completed online in less than five minutes. Just make sure you have all of the necessary information about you and your business available to ensure the process goes smoothly.

You should open your business bank account before you apply for a merchant account. That’s because many merchant account applications ask for things like the names of your banks and the routing numbers. It’s common for merchant account providers to have you fill out a preliminary form on their website before you can start the application process. Here’s an example from Merchant One:

You might be required to submit some additional documentation after the merchant account provider reviews your initial application. This is especially true for merchants with high anticipated sales volumes.

Remember, the merchant account provider will be advancing the money for your sales before they get paid by the issuing banks. So they need to make sure everything is in order.

For those of you who are just starting out and only plan on a few thousand dollars in credit card sales per month, you probably won’t have to jump through hoops to get approved. A voided check and documents confirming your business exists will likely be enough.

But large-volume merchants may need to provide bank statements, balance sheets, profit and loss statements, and more. So have a couple of year’s worth of your financials organized and prepared before you apply.

Using Your Merchant Account For Other Business Purposes

The cool part about a merchant account is that it can be used for multiple purposes.

Once approved, you don’t need to maintain separate merchant accounts for retail sales and another one for your ecommerce site. All of your electronic payment processing can be managed through a single merchant account provider.

This is convenient for businesses selling through multiple channels, including in-person, online, taking payments over the phone, mobile payments, and more. You just need one merchant account for all of this.

Final Thoughts

Opening a merchant account is an important and necessary step to accept card payments. I hope this guide provided some clarity on what to expect as you’re going through this process.

If you have additional questions and want some help getting the lowest possible rates, contact our team here at Merchant Cost Consulting. We can negotiate those rates on your behalf.