Some payment processors use the term “wholesale rate” when pricing their services. Your sales rep might refer to the wholesale rate during your negotiations, and some of you might even be getting charged the wholesale rate right now.

But if you’re not quite sure exactly what this means, you’ve come to the right place. Read to learn everything there is to know about the wholesale rate for credit card processing.

What is Wholesale Credit Card Processing?

Wholesale credit card processing is a type of merchant agreement in which the processor charges businesses the exact same rates set by the card networks and issuing banks for each transaction.

Every card payment accepted by a business has a corresponding interchange rate that’s established by the card networks. Interchange fees are non-negotiable and get charged directly to the processor or acquiring bank.

With other merchant agreement structures, the processor adds some type of markup fee to each transaction. But with wholesale credit card processing, there’s no markup per transaction on the interchange rate. Instead, wholesale processors charge other fees, like monthly memberships, for merchants to access the wholesale rate.

It’s also worth noting that wholesale credit card processing does not refer to payment processing for wholesalers—meaning this is not a special type of merchant agreement reserved for retailers selling items in bulk. Wholesale processing refers to the “sale” of interchange rates at the same cost that a service provider pays to the card-issuing banks.

What is the Wholesale Rate in Payment Processing?

The wholesale rate and interchange rate are the exact same thing. It’s set by the card network and passed through to merchants from the payment processor.

There is no one single wholesale rate or interchange rate. There are hundreds of potential interchange rates, and the rate for each transaction is determined by factors like:

- Card Network: Visa, Mastercard, Discover, and American Express each have their own interchange rate qualification criteria.

- Transaction Environment: The rate varies depending on whether the card was accepted in person, online, or over the phone.

- Merchant Category Code (MCC): Wholesale rates are different for every industry, which is designated by the merchant’s MCC code.

- Card Type: Rewards cards, cash-back cards, commercial cards, etc.

- Transaction Size: Sometimes the dollar amount of the transaction changes its interchange qualification.

- Merchant’s Acceptance Volume: For some industries, like supermarkets, the interchange rate can vary based on how much money a merchant accepts annually from a particular card brand.

While the exact fee varies based on these criteria, the wholesale rate itself is the same for merchants.

The wholesale processing fee is the lowest possible rate that a merchant can pay for a transaction—without any markups from the processor. It’s as if they’re going straight to the card networks without using a middleman.

How Wholesale Credit Card Processing Works (With an Example)

On the backend, the way wholesale credit processing works is ultra-simple.

- A business accepts a card payment from a customer.

- The interchange rate is set by the issuing bank and charged to the processor.

- Processors pass that fee along to the merchant without marking it up at the wholesale rate.

I know what some of you are thinking—this seems too good to be true. How is this possible?

Well, your processor is going to charge you other fees to access the wholesale rate. At a minimum, you’re going to pay a monthly or annual fee.

Example of Wholesale Payment Processing

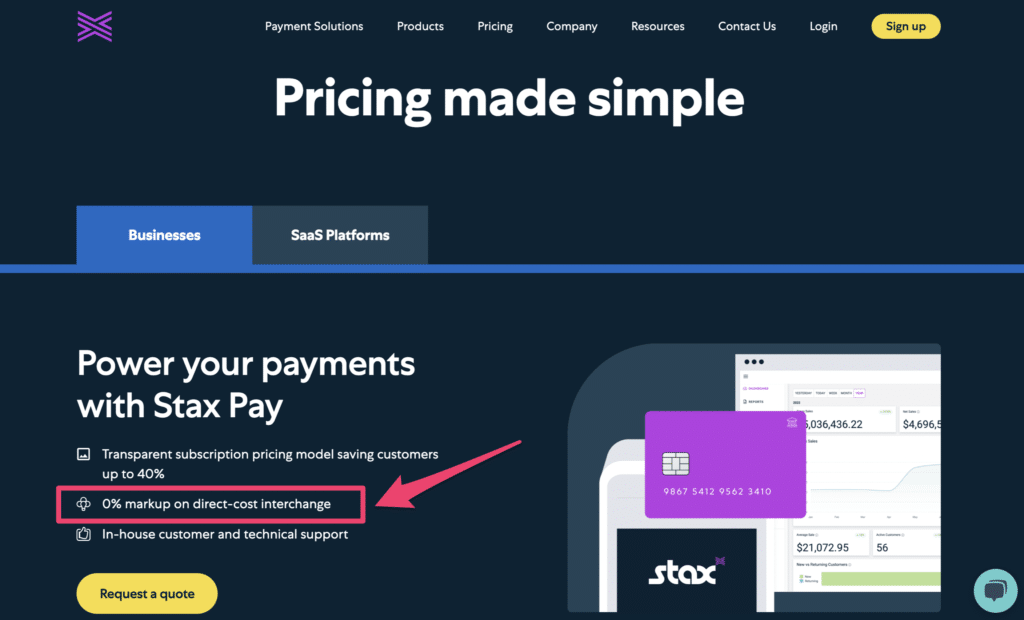

Stax is a popular payment processor offering wholesale rates to businesses. If we look at the Stax Payments pricing page, we can clearly see that they advertise a 0% markup on interchange costs:

But Stax obviously isn’t going to provide these services for free. So to access these wholesale rates, merchants must pay a monthly fee based on their annual transaction volume.

- $99 per month for processing up to $150,000 per year

- $139 per month for processing $150,000 to $250,000 per year

- $199 per month for processing more than $250,000 per year

These prices are just starting points, and the actual monthly fee will likely be higher for access to other Stax features and services.

Other Costs Associated With Wholesale Payment Processing

At an absolute minimum you can expect to pay a monthly fee or annual fee to access wholesale rates.

But that’s just the beginning. Your processor will likely charge you other monthly, annual, and one-off fees for things like:

- Equipment

- Payment gateways

- PCI compliance

- Account setup fees

- Batch fees

- Integration fees

- Statement fees

The list goes on and on here, and it really just depends on what processor you’re using and what type of setup you require to accept payments.

Wholesale Rates vs. Interchange Plus Pricing

The wholesale rate and interchange rate are the same, but wholesale processing and interchange plus are two different types of contract structures.

With wholesale processing, the interchange rate is passed through to the merchant without any additional markup. But with interchange-plus pricing, the merchant pays the interchange rate (same as the wholesale rate) set by the card network plus a markup imposed by the processor.

For example, let’s say the interchange rate for a particular transaction is 1.45% + $0.05.

If a business is on a wholesale rate contract, they’d pay exactly 1.45% + $0.05 for that transaction. They’re paying monthly subscription fees, too, but that’s the cost for the transaction.

But if a business is on an interchange-plus plan, they’d pay 1.45% + $0.05 and the processor markup—let’s call it 0.25% + $0.15 per transaction—bringing the total cost for this transaction to 1.70% + $0.20.

So, Which is Cheaper? Wholesale or Interchange Plus?

It depends. We typically recommend interchange-plus pricing as the way for merchants to get the best deal. But wholesale processing can also be appealing.

First of all, only a handful of processors actually offer wholesale rates. So you may not be able to get it.

If you can get wholesale rates, the monthly membership fees can add up quickly and potentially offset the savings you’d get compared to another contract structure, like interchange-plus. But if, by some miracle, you only had to pay a monthly membership fee, that wholesale processing could be cheaper.

For example, let’s say you Stax and pay $99 per month to process $10,000 per month. This ends up being the equivalent of a 0.99% markup to your processor.

If another processor is offering you an interchange-plus deal at anything below a 0.99% markup, then the interchange-plus deal is cheaper. If the markup starts higher than 1%, then the wholesale structure is cheaper.

So you’ll need to do some quick calculations based on how much money you think you’ll be processing and compare the two structures to determine which is cheaper for your business.

Final Thoughts

Wholesale credit card processing is mostly just a marketing ploy. While the allure of “no markups” may sound great, it’s not always cheaper once you factor in the monthly fees.

It can be worth it for some high-volume merchants. But if you process millions annually, you’re just as likely to get a good (if not better) deal on an interchange-plus pricing plan.