Credit Card Verification Service For International Orders

Ecommerce businesses needs to take preventative measures to avoid fraud.

According to a recent study, 92% of fraudulent transactions online involve a credit card. This results in about $24 billion lost worldwide per year.

Roughly 37% of credit card fraud occurs in the US. So by default, over 60% of fraudulent transactions occur internationally.

While your company might be based in the US, large businesses will ultimately scale to ship products or provide services worldwide. Some of you have already reached this point.

So how can you verify credit card transactions for international orders? I’ll explain in this guide.

7 Ways to Verify Credit Card Payments on International Transactions

These are the top seven methods to securely verify cardholder information, reduce fraud, and prevent chargebacks on international ecommerce orders.

1. Address Verification Service (AVS)

I’m assuming that most of you are already using some type of address verification service (AVS). Most larger ecommerce sites implement this fraud prevention tactic from day one, and the service is offered through many merchant account providers.

An AVS simply confirms that the billing address and shipping address match. Or, at the very least, the shopper can verify the billing address associated with the card for the transaction. In the event that the billing address and shipping address do not match, it could be an indication of an unauthorized transaction.

On the merchant side, an AVS response code gets returned with the transaction. The AVS response code could be something simple, like a code on the credit card terminal for “exact match” or “no match.”

While an AVS is a great way to verify card transactions here in the US, it’s not widely supported internationally. We’ll discuss the associated AVS response code in greater detail another time.

Fortunately for merchants, all major credit card companies have an address verification service. The card issuer already has an address tied to the cardholder’s credit card account. So if the customer’s credit card brand is a Visa, the address can be easily confirmed. However, this isn’t always a guaranteed fraud prevention solution.

Visa and Mastercard address verification systems only work in the US, Canada, and the UK. The Amex AVS does work in other countries across the globe, but you can’t rely on that for all transactions.

So if you’re taking orders from other international countries, you’ll need to implement more than just an AVS to verify card transactions.

This guide will cover other fraud detection mechanisms, so you can have a multilayered fraud protection system for international orders that goes beyond the address verification service.

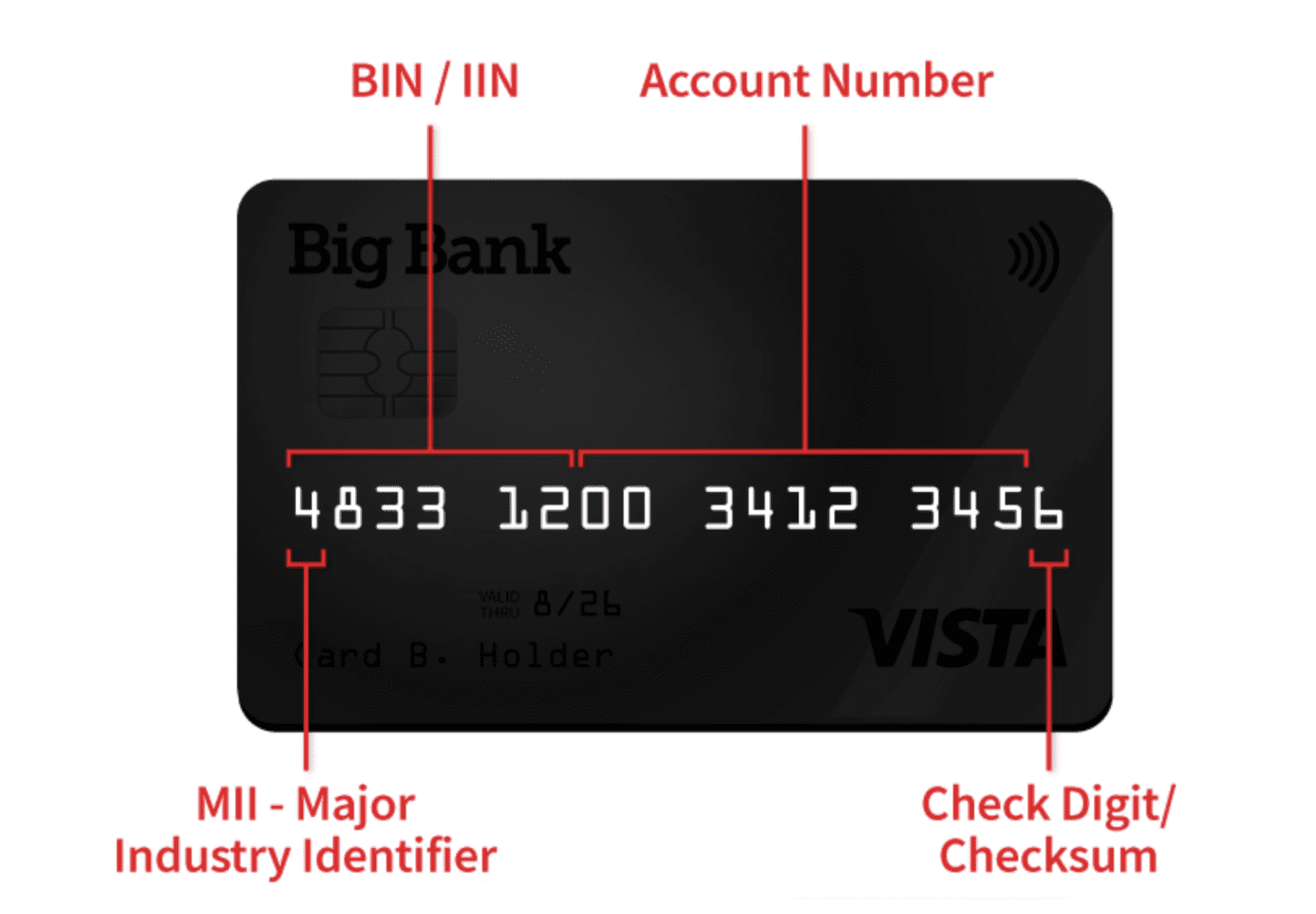

2. BIN (Bank Identification Number) Verification

A bank identification number (BIN) can be found with the first six digits of a credit card account. This is also known as the issuer ID (IIN).

The number identifies the card’s issuing bank. Tools for BIN verification allow merchants to identify the following:

- Issuing bank

- Bank location (country)

- Bank phone number

If the shipping address or cardholder’s billing address is in a different country than the issuing bank, it’s usually a good indication (but not always) that the credit card transaction is fraudulent.

BINs can also help you identify if an account is tied to a prepaid debit card. Prepaid debit cards are much harder to track and find the cardholder. It’s common for prepaid cards to be used for subscription services. The card contains enough to set up the initial trial, but not enough to pay for the subscription on an ongoing basis.

3. IP Address Verification

IP stands for “Internet protocol.” Every device that’s connected to the Internet is assigned an IP address.

Geo-IP address matching tools help merchants determine if the IP address of a device matches the billing street address and shipping street address associated with the credit card. This is a step above comparing AVS data and AVS response codes for domestic transactions.

If an IP address and shipping address are located in different countries, it could indicate that the transaction is fraudulent.

People can use tools to conceal their identity and IP address online. Some buyers might use an open proxy and anonymous IP address while shopping online. In some cases, consumers might do this just for privacy and security reasons. But this tactic is also used by criminals who are using a stolen credit card number and don’t want the transaction traced back to their IP.

4. Email Addresses

I’m assuming that you’re collecting email addresses for online transactions associated with a customer’s account. This information is ideal for sending customers receipts and updates about their orders.

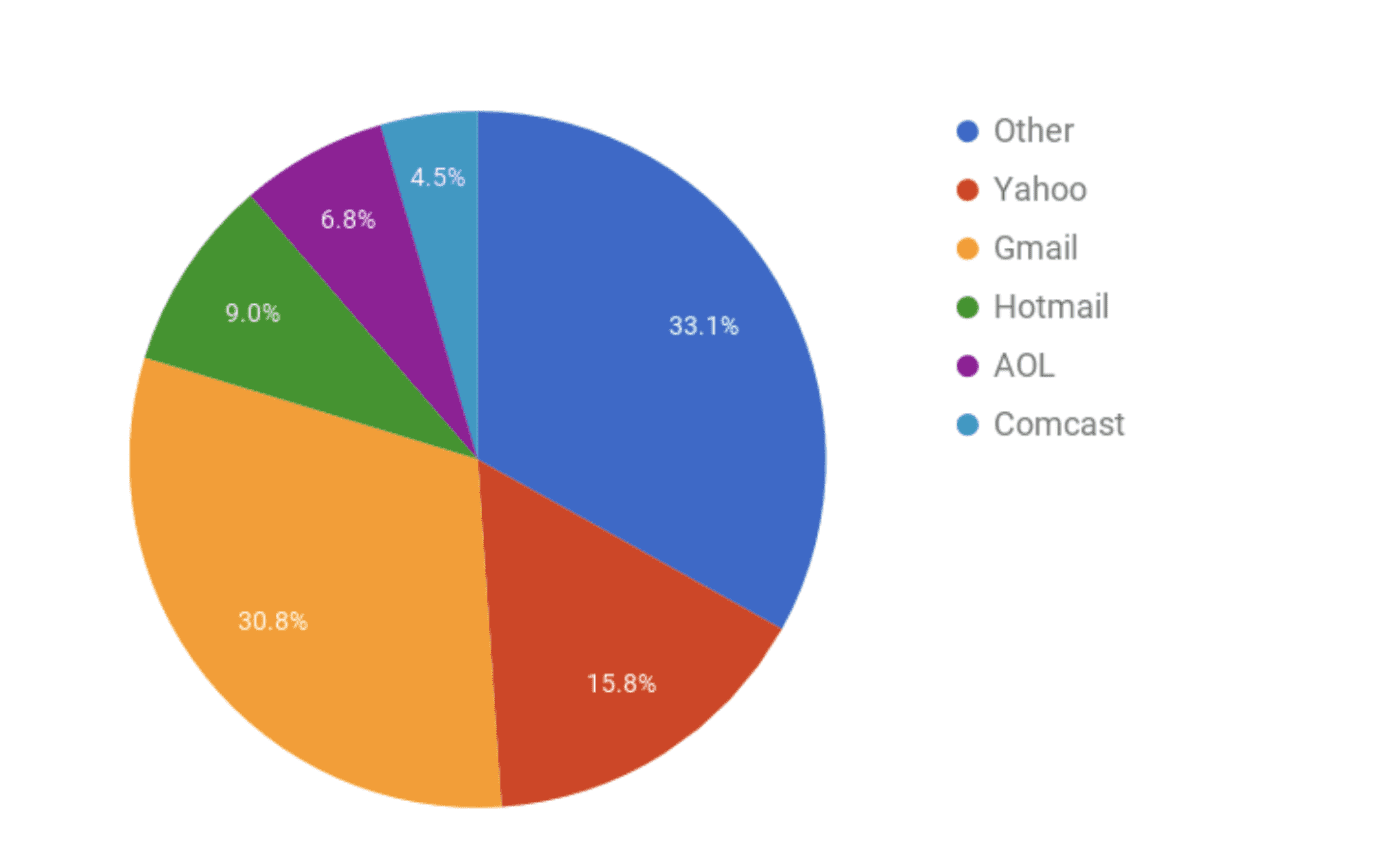

But you can also use an email address in your fraud scoring method. Free email addresses can’t be traced to a user. Anyone can set up accounts on free mail services like Gmail, Yahoo, or Hotmail. Here’s a look at the most popular email account providers based on a survey of 8 million email addresses.

As you can see, free email addresses are very popular. But there are paid providers like AOL, Comcast, and additional paid services that fall into the “other” category.

So if someone is using Gmail or Yahoo to buy something online, does it mean it’s fraudulent?

No. I’m not saying that you should decline all international transactions from these addresses. But it’s safer if the customer is using a paid email service. This is generally a good sign that the transaction is legitimate since the email used can be traced back to a paid user.

5. Phone Numbers

Similar to free email addresses, prepaid phones and mobile numbers are tough to trace. A prepaid phone does not require any user registration for activation.

If possible, avoid processing international orders with mobile numbers used in the form field. Ask your customers to provide a landline to verify their order.

Just be aware that this could cause some lost sales. Lots of people are eliminating landlines in their homes.

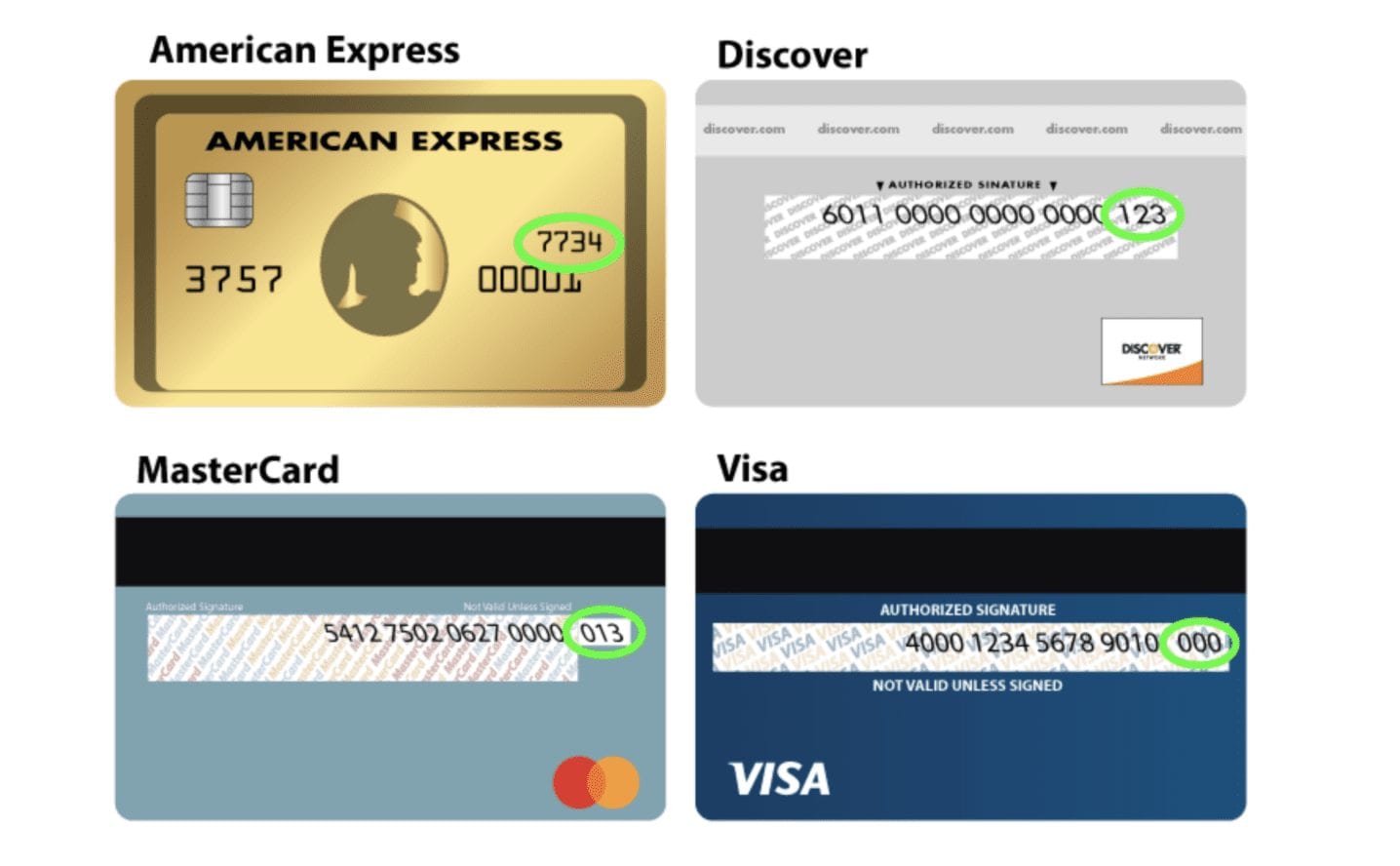

6. CVV/CVV2/CSC

Card verification values and card security codes are the three or four-digit numbers printed on the front of back of a credit card.

For credit card payments or debit card charges, this number is used in card-not-present transactions to validate that the cardholder actually has access to the card.

If the CVV or CSC is entered incorrectly, the transaction should automatically be declined.

Aside from a typo, this typically indicates that the purchaser is not in possession of the credit card. Instead, they might just have access to a stolen credit card account number.

7. 3D Secure Authentication

Some cardholders are enrolled in 3D secure authentication, which gives them the ability to verify online transactions with an added step in the checkout process.

If you use 3D secure authentication on your ecommerce site and an enrolled cardholder fails to authenticate their card using a password or PIN, there is a good chance that the transaction is fraudulent.

While this won’t be helpful for all cards and all transactions, it’s an added layer of protection that you can consider adding to your checkout process for users enrolled in this program.

Ask if your merchant services account can support this type of verification. Otherwise, you may need to get it through a third party.

How Can a Merchant Verify a Customer’s Identity?

Merchants can verify a customer’s identity through a payment gateway that validates the cardholder’s name, cardholder’s address, and payment data.

There’s also software that can verify the customer’s device, location, and IP address.

Collecting additional information at the point of sale gives you additional points to reference when you’re verifying a customer’s identity.

How Can a Merchant Verify a Credit Card?

The most common way for a merchant to verify credit cards is by matching the card with an address verification service (AVS) and card verification value (CVV) number.

Together, this verification method accomplishes two things—combining something knowledge-based (the cardholder knows their address) with something physical (the card must be in the cardholder’s hand to see the CVV number).

Final Thoughts on International Order Verification

Your credit card processor should provide you with some fraud prevention services. Some might help access address data and send back an AVS code for each transaction.

An address verification system is a great way to verify credit card transactions here in the US. But depending on the country and card being used, that won’t always work for international orders.

Use this guide as a way to prevent fraud for international transactions.

I’d recommend using as many of these tactics as possible. If someone overseas is using a Gmail address, does it mean that the order is fraudulent? No. But a free email combined with other red flags like a prepaid phone number, BIN that doesn’t match, or IP address in a different country than the billing address, the transaction should be terminated.

It’s also worth noting that using a merchant credit card verification phone number or other techniques in this guide are strictly to verify that the customer’s card matches the identity of the buyer. This is not the same for verifying sufficient funds to receive payments from a card issuing bank. So don’t confuse these types of verification.

0 Comments