Credit Card Processing Rate Increases: Global Payments January 2020

This is the beginning of a new era to reveal how credit card processing companies are adding hidden fees, downgrading interchange rates, and implementing surcharges to charge businesses more than they should be.

This credit card processing rate increase series will also showcase card brand changes (Visa, MasterCard, Discover, American Express) that occur throughout the year.

It is strictly educational and comes from Merchant Cost Consulting’s auditing experiences every month of what we see happening in the credit card processing industry.

Global Payments and Global ISO Hidden Fees and Rate Increases

Global Payments

As Global Payments has emerged as one of the oldest and largest payment processors in the world, there has been a ton of exposure to their merchants of hidden fees, rate increases, and deceptive tactics that can be damaging to a merchant’s bottom line.

First up, our team has seen a new credit card merchant fee come onto the scene in recent months:

Global Payments will tell you this fee is mandatory, but we know it is bogus. Merchants should consider this credit card merchant fee similar to the surcharges of other payment processors in the industry.

In this instance, Global Payments is charging an additional 0.09% on their interchange fees and an additional $0.10/transaction on the 106 transactions this merchant processed.

Global Payments continued..

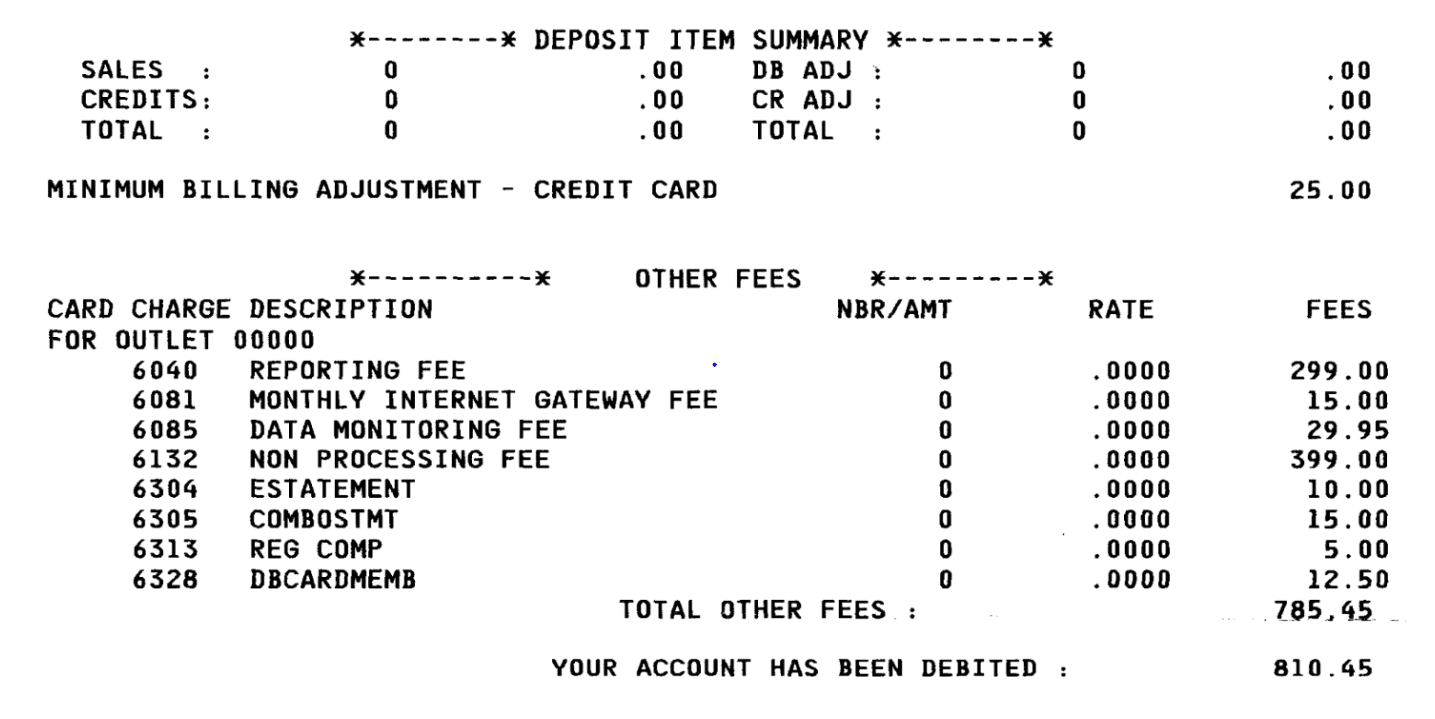

Next up, we have some of the most dubious work by Global Payments to date. This merchant had notified Global of their cancellation in June of 2018 and sent in the correct information for their account to be cancelled.

Global did not submit their request, all while the merchant was under the impression it was taken care of but was continued to charge regardless… until February 2020..

Global Payments was charging this merchant anywhere from $500 – $800 per month for inactivity use. This is some of the worst work we have seen by them to date.

Open Edge, a Global Payment’s ISO

Open Edge is a division of Global Payments that we have seen do similar deceptive merchant fee tactics to their parent company.

Below, not only do they have the “Settlement Funding Fee” we saw with Global Payments earlier, but they also are charging what is called a “Risk Assessment Fee” to some of their merchants.

The risk assessment fee is an additional 0.15% being charged to this merchant on top of their interchange fees and other mark up costs. Be aware of this as it could drastically impact your bottom line every month.

Heartland, now Global

Lastly, we have Heartland Payment Systems, who was acquired by Global Payments and is also one of the top 10 largest payment providers to date.

Heartland is adding a monthly auto enrollment fee starting April 2020 for their “Customer Intelligence Suite.” It is a product that allegedly gives better information and analytics to their merchants, however, most do not even know it exists.

This credit card merchant fee can be removed if you wish to no longer have access to this product, savings you $55/month.

Final Thoughts

Regardless of the payment processor a merchant uses to accept credit cards, there are always credit card merchant fees that can be alleviated, reduced, or refunded. Global Payments is no exception to this.

You can learn more about payment processing, merchant services, and how credit card processing rates and fee work leveraging our Credit Card Processing Complete Guide.

Take the time to understand your statements, your pricing, and the credit card processing company you are dealing with to get a true understanding of what to look out for.

0 Comments