How to Prepare For Cashless Payments

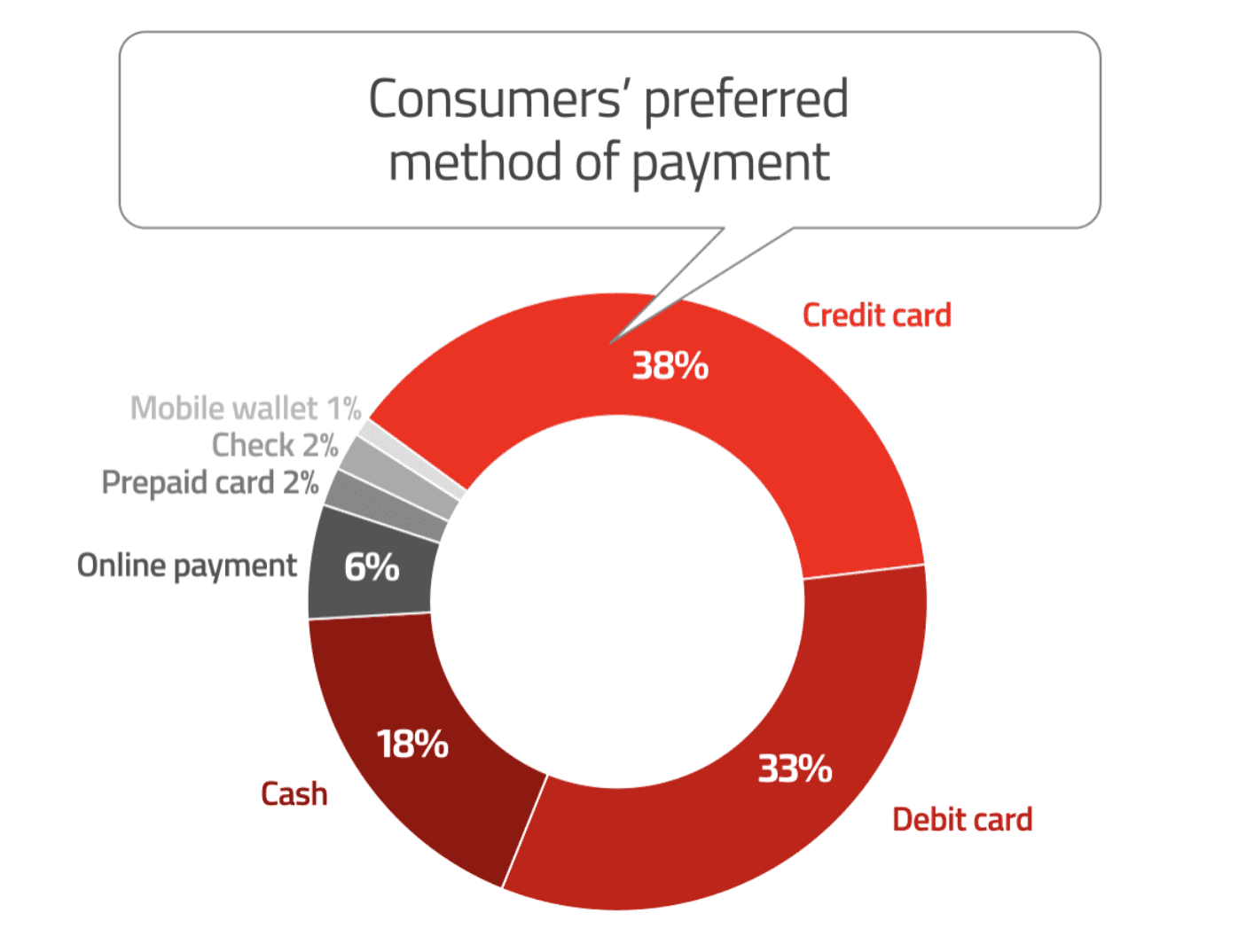

It’s no secret that our modern society has been moving away from cash. Between credit cards, debit cards, digital wallets, and online transactions, there are plenty of alternative payment options for consumers to use.

As a merchant, it’s important for you to recognize these trends, especially in the COVID-19 era.

Now, more than ever before, we’re seeing a high demand for contactless payment solutions—cash transactions do not fall within this category.

Is your business ready to go cashless? Use this guide as a resource to help you prepare accordingly.

Benefits of Going Cashless

Cash is dirty. No, this isn’t a pun or attempt at a joke—it’s actually filthy. In fact, studies suggest that 94% of dollar notes harbor bacteria. This includes germs that cause serious infections like pneumonia, E.coli, salmonella, and more.

Furthermore, 80% of US paper money contains traces of drugs like cocaine. Dirty bills typically stay in circulation for 15 years, and coins remain in circulation for roughly 25 years.

Think about how many hands have touched that money during that time. By accepting cash, you’re putting your staff and customers at risk.

Compared to cash, credit cards are more convenient and secure. This makes it more appealing for consumers to pay with plastic. Lots of people don’t even carry cash with them anymore for this exact reason. In fact, 50% of Americans say they carry cash with them less than half of the time they leave the house. When people do have cash in their pockets, 76% carry fewer than $50.

Credit cards allow people to buy goods and services without actually paying for it at the time of the purchase. This gives your customers the flexibility to buy something today and pay their credit card balance at a later time.

Credit cards, debit cards, and digital wallets are also easier to process in-store. These payment methods keep your lines moving quickly, and your employees won’t have to count change. Any merchant that accepts cash knows that there are always some discrepancies at the end of the day between how much cash you’re supposed to have and how much cash you actually have.

Plus, eliminating cash reduces the risk of theft. Whether it be from employees or a robber, if there’s no cash on-site, then there’s nothing to steal.

Challenges and Drawbacks of Going Cashless

With all of that in mind, going cashless isn’t necessarily a “no-brainer.” There are definitely some challenges and potential problems with completely eliminating cash as a payment acceptance method.

COVID-19 prompted many retailers and restaurants to go cashless. However, many cities and states have implemented laws prohibiting certain businesses from denying cash for specific types of transactions.

According to the National Law Review, states like New Jersey, Massachusetts, and Rhode Island have enacted bans on retailers refusing cash. At least 21 other cities and 10 states have plans to do the same.

So before you go cashless, make sure you’re in compliance with local laws. Some of you might not be able to do so.

By eliminating cash as a payment acceptance method, you’re potentially turning away customers. Roughly 20% of consumers still prefer to pay with cash.

74% of people surveyed say they see no reason to change their preferred payment methods. Can you afford to alienate one-fifth of your customers? Probably not.

Roughly 30% of Americans do not have a credit card. So you can’t assume that all of your customers can pay using this method.

How to Prepare Your Businesses For Cashless Payment Acceptance

To go cashless, there are certain things your business must do to ensure a smooth transition away from accepting cash.

For starters, make sure your POS systems and credit card terminals are up to date and PCI compliant. If your hardware and software are old and outdated, it’s worth the small investment to get ones that are newer. Just reach out to your merchant services provider to inquire about your options.

Get equipment that is compatible with NFC payments. This will allow you to accept contactless payments like digital wallets and mobile payments.

Train your staff accordingly. If you’ve been a cash-heavy business, your employees might not have a ton of experience using card readers and terminals.

Understand the costs associated with going cashless. It’s definitely cheaper to accept cash since there aren’t any transaction fees associated with those purchases.

To keep your credit card transaction fees as low as possible, consult with our team at Merchant Cost Consulting. We’ll review your contracts, statements, and negotiate with your processor to get you the lowest possible rates.

Is Going Cashless Right For Your Business?

Should your business go cashless? It depends on a number of factors.

First and foremost, if you’re in a city or state that prohibits merchants from denying cash payments, then the answer is obviously no.

Assuming your local area allows you to refuse cash, then turn to your customers. What percent of your transactions are currently cash? Will you lose those sales completely by eliminating that payment acceptance method? Do your customers have access to alternative payment options?

In many cases, you can still eliminate the majority of your cash transactions without going completely cashless. Encourage your customers to pay by using credit cards and mobile wallets.

A simple sign at your POS stations saying something along the lines of “We prefer to not handle cash due to COVID-19 and sanitary reasons. Thank you for understanding,” should be enough to do the trick.

Final Thoughts

Are we heading towards a completely cashless society? Probably not.

While cash is definitely not as popular as it once was in the past, it’s still here to stay for the foreseeable future.

With that said, many businesses are opting to go cashless. Depending on your unique situation, this could be a viable option for you to consider. Just make sure you follow the tips and best practices described in this guide to prepare accordingly.

0 Comments