Rolling Reserves Explained (Complete Guide)

As you’re shopping around for a credit card processor, you might come across the term “rolling reserves.” Whether it was mentioned by the sales agent or discovered in your contract, it’s an unpleasant surprise.

Rolling reserves are not ideal for merchants. But for some of you, this will be unavoidable.

If you’re not sure how rolling reserves work and you need more information, you’ve come to the right place. I’ll explain everything you need to know about rolling reserves in credit card processing.

What is a Rolling Reserve?

A rolling reserve permits credit card processors to withhold a percentage of a merchant’s gross sales. The amount of the reserve is predetermined in the merchant agreement contract.

Funds from a rolling reserve get deposited into an account for a prespecified length of time (such as 12 or 18 months).

Most merchants don’t realize this, but your processor is issuing you a credit when they distribute funds from your credit card sales. Usually, funds get deposited in the merchant’s bank account within one or two business days. But customers can file chargebacks for up to 120 days.

When a chargeback is filed, the customer is immediately refunded by the processor. While the merchant will likely end up paying eventually, the processor is still on the hook.

Reserve accounts are created to protect credit card processing companies from covering the costs of a chargeback.

The funds in a reserve account are “rolling” because they’ll eventually be released to the merchant. A percentage of new credit card transactions get added to the reserve.

Unfortunately, reserve accounts are non-interest-bearing. So your money is just sitting in an account while you’re forced to wait for it.

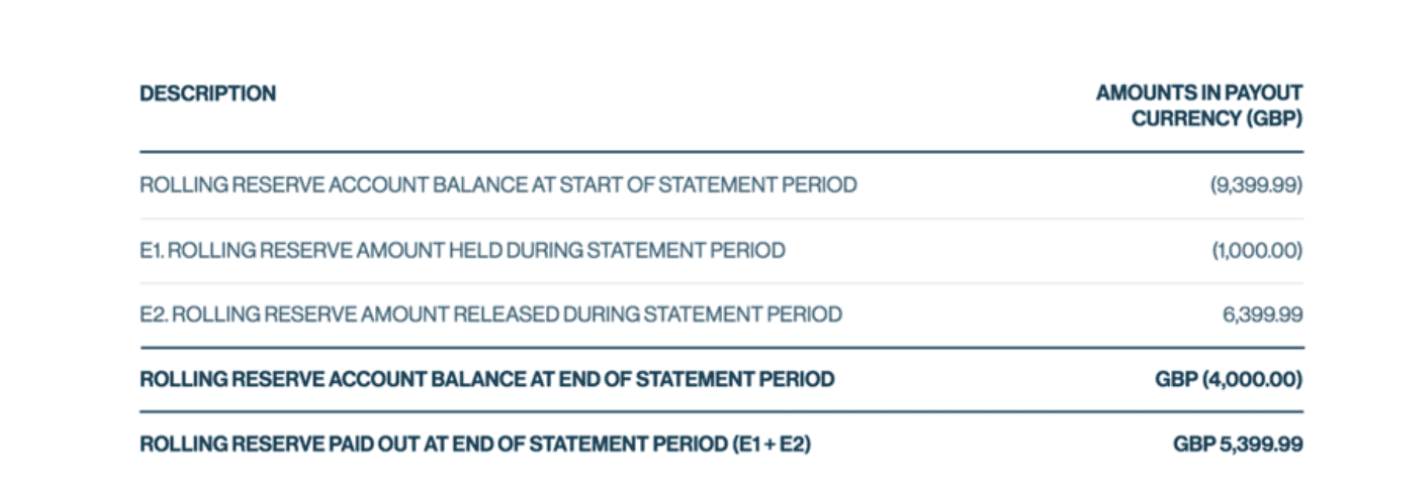

Here’s an example of how a rolling reserve might look on your processing statement.

As you can see, the description shows the amount held, amount released, and the reserve balance.

Reasons For Rolling Reserves

We already covered the rationale behind a reserve account. It’s basically to protect merchant processors for issuing credit to merchants.

But how does a processing company determine which merchants need a rolling reserve?

First of all, any processor can impose a rolling reserve requirement. So shopping around for another merchant services provider won’t necessarily eliminate this problem.

In many cases, high-risk merchants are subject to rolling reserves. Unless there are special circumstances, a low-risk business won’t have to worry about this.

A rolling reserve is normally imposed from day one when a merchant account is opened. However, this clause can be added to the contract at a later date if the merchant has a high number of chargebacks.

Not every high-risk merchant will require a merchant reserve. But generally speaking, certain high-risk industries will have to maintain a reserve account.

- Industries with higher risk of chargebacks.

- Industries selling products or services that are unregulated or poorly regulated.

Adult services, online CBD products, and dietary supplements are examples of business types that fall into these categories.

Another common reason why a processor might impose a rolling reserve is if the business owner has bad credit. When this happens, you can eventually eliminate the reserve account if you increase your personal credit score over time.

Here’s a resource from PayPal explaining what information they use to determine if a business will need a rolling reserve.

This is just a snippet of the guide. PayPal also factors things like supplier information, financial statements, personal credit, business credit, business model, and fraud prevention tools into consideration.

How Much is a Rolling Reserve?

The amount of a rolling reserve varies from processor to processor. The unique situation of your business also impacts the amount of your rolling reserve.

In most cases, a rolling reserve is somewhere in the range of 5% to 10% of credit card sales.

The balance requirement of a reserve account could be fixed or variable. In either case, the amount should never exceed 100% of your processing volume each month.

In addition to the rolling reserves, you’ll still have to pay the other costs associated with processing credit cards. I’m referring to transaction fees, monthly fees, gateway fees, POS software, and more.

For example, let’s say your processor charges you 2.6% + $0.10 per transaction for Visa and Mastercard sales. The processor also keeps 10% of your transactions in a rolling reserve account for six months.

If you process a $100 Visa sale, you’ll pay the processing fees on the full amount ($2.70), even though 10% is being withheld.

Downsides of Rolling Reserves

A reserve account can definitely have an adverse effect on your business. There are certain restrictions that you’ll need to account for if your processor imposes a rolling reserve.

Cash Flow Limitations

According to a recent study, 82% of small businesses fail because of poor cash flow management.

A rolling reserve forces you to take a closer look at your profit margins. For example, let’s say your net profit from a traditional credit card sale is 20%. If your rolling reserve is 10%, then your cash flow of profits are cut in half.

You need to make sure that you have enough cash flow to cover your operational costs, as well as an emergency fund for unforeseen circumstances.

Growth Ability

Rolling reserves can hinder your company’s growth. That’s because you’ll have less working capital to spend on your business.

Expenses related to inventory, marketing, and other business costs might not be possible while your funds are on hold.

Competitive Edge

Since a rolling reserve cuts into your profit margins, staying competitive can be challenging in price-sensitive industries. If you need to beat your competitors’ prices to get sales, it might not be realistic with a reserve account.

Final Thoughts

A rolling reserve is definitely not ideal for merchants.

But with that said, it’s not the end of the world either. In some cases, a rolling reserve will be required for you to accept credit card payments, which is something you obviously need.

It’s possible that your rolling reserve could be lifted over time. Once you raise your credit score or demonstrate that you don’t have a high chargeback rate, contact your processor about getting rid of your reserve account.

In the meantime, there are other ways to save money on credit card processing.

If you have a rolling reserve, every fraction of a percentage makes a huge difference. Reducing your processing fees can help make up for the limited cash flow from your reserve account.

Contact our team here at Merchant Cost Consulting about lowering your processing fees.

0 Comments