How Do You Calculate Processing Rates?

Processing rates can get out of control if you’re not keeping a close eye on them. But monthly statements can be complex and difficult to read, making it tough for businesses to truly understand what they’re actually paying to accept card payments.

The cost for credit and debit card processing varies per transaction. So the best way to calculate processing fees is by calculating your effective rate.

This in-depth covers everything you need to know about how credit card processing fees are calculated and how to calculate your effective rate. You’ll learn more about the importance of effective rates and discover what’s a “good” effective rate for your business.

Ultimately, this resource can help add clarity to your processing costs and help you determine if you’re overpaying for credit card processing.

How Are Credit Card Processing Fees Calculated?

Credit card processing fees are calculated in three parts—interchange fees set by the card network, assessment fees imposed by the card networks, and markups added by the payment processor.

- Average Interchange Rates: 1.25% – 3.5% per transaction

- Average Assessments: 0.10% – 0.20% per transaction

- Average Markups: 0.30% – 1.75% per transaction

Each card network (Visa, Mastercard, Discover, American Express, etc.) sets its own interchange fees for a particular transaction. These fees are based on the type of card used, the transaction environment, and other factors.

There are hundreds of different interchange rates that could be assessed for any transaction. Even if the same exact product is purchased from the same merchant by ten different customers, it’s possible that each one of those transactions could have a different interchange fee.

Card associations collect assessment fees for the use of that card brand. The exact rate paid by the merchant is typically based on each transaction and the total monthly sales of a particular brand.

Merchant services providers add markups to each transaction for their role in connecting merchants with card networks. These fees are based on the contract structure that merchants have with their processors.

What is an Effective Rate?

The effective rate is the average percentage a merchant pays to process a credit card transaction. Regardless of your contract structure or processor, your effective rate represents the true cost for a business to accept credit and debit card payments.

Effective rates in credit card processing include all of the non-negotiable interchange rates and assessments set at the card network level, as well as the markups imposed by processors.

Knowing the effective rate for different processors can help merchants compare costs as they’re shopping around for different options. But calculating the effective rate can also help businesses determine how much they’re currently paying to accept credit cards.

Monthly credit card processing statements almost seem to be intentionally deceptive. It’s difficult for businesses to know how much they’re actually paying per transaction.

But once you learn your effective rate, it’s easier to figure out if you’re overpaying for credit card processing or if you need to establish new credit card policies—such as imposing a minimum sale amount to accept card payments or adding surcharges to offset processing costs.

For example, your credit card processor might tell you that you’re getting the lowest possible rates. But if you calculate your effective rate and determine that you’re paying 4% or 5% per transaction, you can quickly discover that you’re being overcharged.

How to Calculate Effective Rate For Credit Card Processing

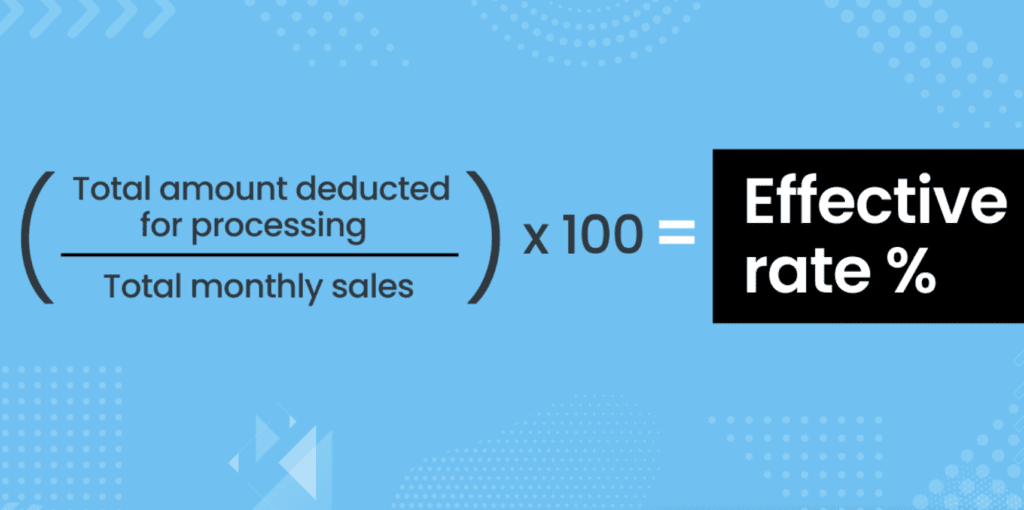

The best way to find out how much you’re paying for credit card processing is through your effective rate. To calculate your effective rate, you need to divide your total sales by total fees in a given cycle.

Here’s a visual example of the effective rate formula for credit card processing:

The easiest way to find this information is by looking through your monthly processing statements. While it’s unlikely that you’ll find the effective rate on the statements, you should be able to locate your total sales and total feels for the monthly.

Some merchants may have to total these figures on multiple statements or sections of the statements to find these numbers. For example, your American Express fees and total Amex sales may not be on the same statement or line total as the rest of your monthly credit card transactions.

The total amount deducted for processing must include all processing fees, including authorization fees, statement fees, interchange fees, PCI compliance fees, and all other fees shown on your statement.

Let’s say your net total processing fees for the month are $7,210.90 and your total sales were 108,619.04 for the same period.

To calculate your effective rate, you’d run the following calculation:

($7,210.90 / $108,619.04) = 0.06638

0.06638 x 100 = 6.64%

In this scenario, your effective rate would be 6.64% (which is high).

What is a Good Effective Rate For Processing Payments?

Typically, a good effective rate for credit card processing is around 3%. If you’re hovering closer to 3.5% or more, your effective rate is likely too high.

Your effective rate will also be higher than your per-transaction processing rates. That’s because your effective rate also encompasses other monthly fees you pay to process credit and debit card payments.

For example, you might be paying the exact same interchange rates, assessments, and markup fees as another business. But if your processor is also charging you a gateway fee, PCI compliance fee, and monthly statement fee, your effective rate will be higher. If you’re paying a monthly equipment lease to process card payments, your effective rate will also be inflated.

Don’t panic if you discover that your effective rate is above 3%. While you’re likely overpaying to accept credit cards and debit cards, there’s likely plenty of room for you to save money on credit card processing.

There’s a good chance you’ll be able to save money on processing without having to switch processors.

Here at Merchant Cost Consulting, we negotiate with credit card processing companies on behalf of our clients every day. We help you get the lowest possible processing rates, without having to switch. Contact our team for a free audit and analysis to find out how much you can save.

Check out our recent case studies to see how we’ve saved some businesses $250,000 to $500,000 in the first year.

Factors That Impact Processing Costs

Some businesses pay higher processing rates than others. To truly understand whether your effective rate is too high or if there’s room to save money, there are other factors that must be taken into consideration.

Card Type

Each credit card brand has its own interchange rates that are further broken down into unique categories and rates. There are hundreds of these categories, and your rates will fluctuate if you accept or your customers use certain card types over others.

For example, if the majority of your customers are paying with Visa debit cards, your processing rates will be lower than customers paying with American Express rewards cards.

Transaction Environment

Cards processed in person are considered lower risk compared to cards accepted online or over the phone. Manually keyed transactions are also considered to be high risk.

So ecommerce shops will typically have higher processing rates than brick-and-mortar businesses. If your customers are using NFC tap cards, it’s going to be less expensive than if you were to save their card information on file.

Average Transaction Size

If you’re selling small ticket items that cost under $5 or $10, you might have a higher effective rate—especially if you’re paying a flat fee or minimum. Conversely, businesses with larger ticket sizes may have access to even more discounts.

Transaction Volume

In many cases, the more cards you process the greater the chance you have of accessing discounts. A small business that processes $500,000 per year in credit card payments likely won’t be paying the same rate as a restaurant group with six locations processing $15 million annually.

Industry

Certain industries are considered to be “high risk” for credit card processors.

For example, if you’re running a pawn shop or selling CBD online, you’ll automatically fall into a high-risk processing category. This means that your base interchange fees and per-transaction fees will be higher. But you can still lower your effective rate by eliminating hidden fees and junk fees from your monthly statements.

Final Thoughts

Calculating your processing rates is crucial if you want to take control of your finances and keep costs low. Look beyond your per-transaction rate, and calculate your effective rate to see how much you’re truly paying to accept card payments.

You can use the formula in this guide to calculate your effective rate (total processing fees / total net sales x 100).If your effective rate is higher than 3%, there’s a good chance you’re overpaying. Contact an expert here at Merchant Cost Consulting for a free consultation. We’ll take a look at your statements for free and let you know how much money you can save on credit card processing—without changing your processor. We’ll even help negotiate those rates on your behalf.

0 Comments