There are lots of misconceptions about accepting credit cards. This is especially true for startups, small businesses, and companies that are new to accepting plastic as a payment method.

Credit cards are the most used payment method in the United States, according to a 2020 survey of POS (point-of-sale) transactions.

Fewer consumers are carrying cash, and businesses must adopt modern payment acceptance methods to stay alive.

So if you’re on the fence about accepting credit cards because of something you might have heard from an unreliable source, this guide will set the record straight. We’re going to debunk the most common myths about credit card processing.

Myth #1: It’s Hard to Keep Cardholder Data Safe

Any business that accepts credit cards must deal with PCI DSS compliance. This stands for “Payment Card Industry Data Security Standard.”

In short, PCI compliance says that businesses coming into contact with cardholder data are responsible for keeping that data safe. While PCI compliance isn’t a local, state, or federal law, there are penalties and fines assessed by the merchant’s acquiring bank for non-compliance.

Fortunately, PCI compliance is not difficult to achieve. The best payment processors will handle the vast majority of these requirements for you. So look for a processor that handles PCI compliance without any extra cost to you.

Myth #2: I Won’t Get Paid Immediately

Unlike cash, credit card payments don’t immediately put tangible funds into your register. So technically, the “immediate” part of this myth holds a bit of truth.

But it’s a misconception that your funds will be held for weeks on end, and you’ll never get paid—that’s just not how it works.

The actual amount of time it takes for your funds to be released will depend on several factors. But the biggest influence has to do with the type of processor you’re using. If you’re using a merchant account provider, your funds will typically be released sooner than if you used a processing aggregator.

Generally speaking, you should see the funds posted to your account within one or two business days if you’re using a merchant account provider.

No counting cash, making trips to the bank for deposits or worrying about safely storing cash either. When you factor this into the equation, the extra day it takes to see the funds in your account isn’t that big of a deal.

Myth #3: Credit Card Processing Fees Are Expensive

Credit card processing is a service. Lots goes on behind the scenes of every transaction.

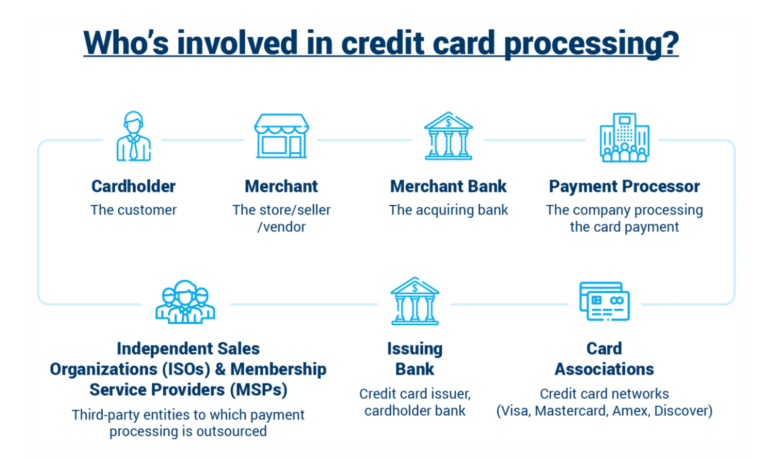

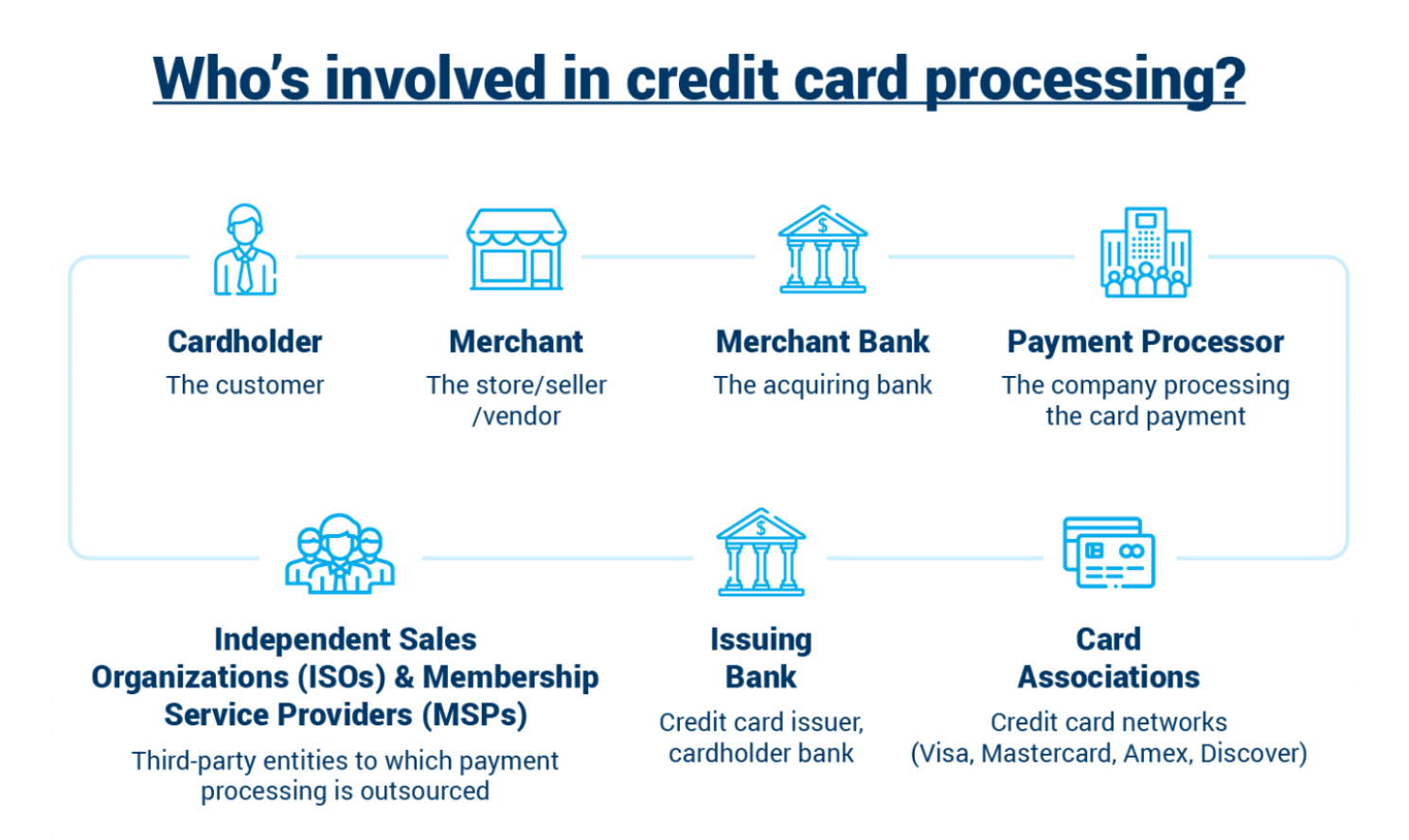

For each part of the transaction, there are different entities involved. Here’s a quick overview of the different players associated with processing credit cards:

These institutions need to be compensated accordingly for their role in the transaction. That’s where credit card processing fees come from.

As a merchant, you’re paying for a service. So it won’t be free to process credit cards. With that said, credit card processing doesn’t need to be expensive.

Lots of merchants struggle to understand the fee structure. They don’t realize that some fees are negotiable and don’t need to be paid at all. So rather than just blindly accepting the terms of your credit card processor, you should consult with a professional to make sure you’re not getting ripped off.

Credit card processors are notorious for adding extra fees on the bill, with the assumption that merchants won’t think twice about it.

Here at Merchant Cost Consulting, our team of experts can negotiate with credit card processors on your behalf to ensure you’re getting the best possible deal. Once you go through this process, you’ll quickly learn that credit card processing isn’t really that expensive—it’s just a cost of doing business.

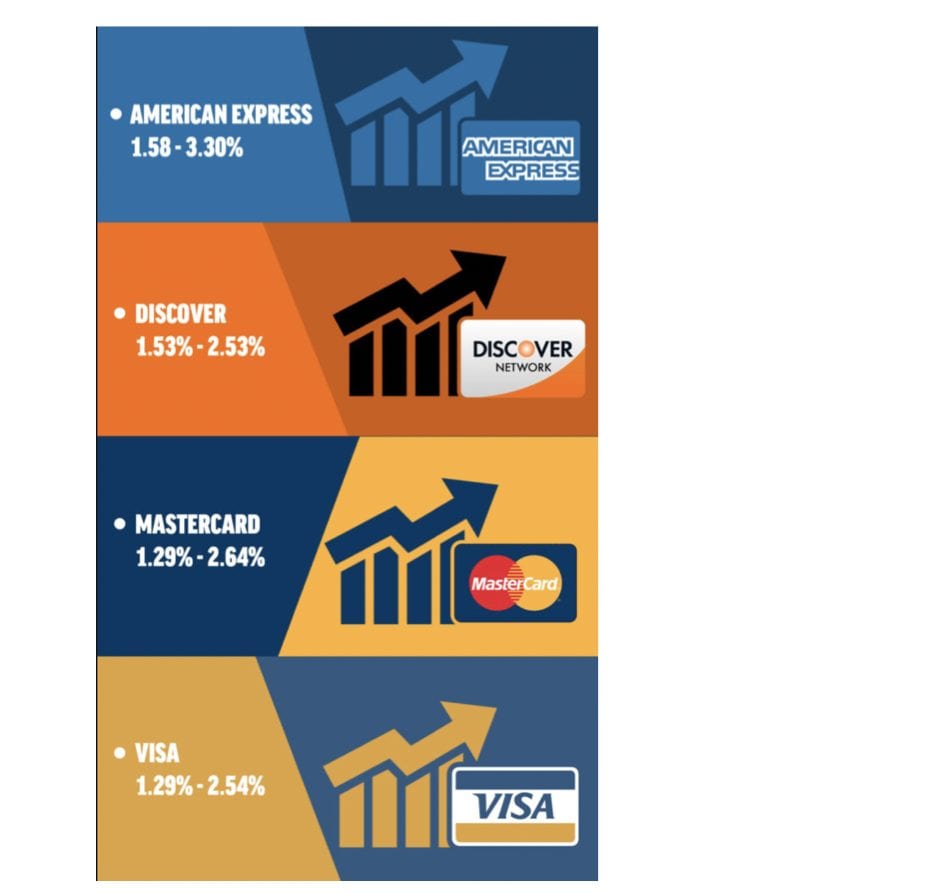

Let’s take a closer look at the average cost of credit card processing for each major card network:

Most of you can expect to pay around 2% of the transaction value, depending on how the card was accepted. For example, swipe/dip/tap transactions are cheaper than manually entering the card number into a POS terminal.

Myth #4: Credit Card Processing Equipment Is Expensive

If you’re accepting credit card payments in person, you’ll need to purchase credit card processing equipment. Things like card readers, POS stations, and even credit card processing software will be an expense for you to incur.

But in the long run, it’s a minimal investment when you consider the convenience that you’re offering customers. Depending on the size of your operation, this equipment can cost anywhere from $100 to $500 to get you up and running.

Larger businesses that need several terminals will need to pay a bit more.

This only gets expensive when businesses make certain mistakes during the setup. For example, some companies don’t buy their equipment outright. Instead, they opt for an equipment lease because they think it will save them some money.

In reality, credit card equipment leases are a terrible investment. $40 per month right now might seem more appealing than a $500 one-time fee today. But over the lifetime of your equipment, you’re going to spend way more on a lease.

Myth #5: Credit Card Companies Charge Hidden Fees to Merchants

Credit card companies do not charge hidden fees. You can access the interchange fee schedules from all major credit card networks.

Full disclosure—some of the fees might be a bit confusing. There are dozens, if not hundreds, of different categories listed on these charts.

To help you better understand the fees you’re being charged by card networks, we put together some helpful guides:

- Visa Interchange Rates

- Mastercard Interchange Rates

- American Express Interchange Rates

- Discover Interchange Rates

While the interchange rates imposed by the card networks are non-negotiable, you can always negotiate the fees imposed by your credit card processor.

Final Thoughts

Every business in today’s day and age needs to accept credit cards. This includes small businesses, boutique retailers, even Mom and Pop shops.

Don’t let a credit card processing myth keep you from taking your business to the next level. As we’ve identified in this guide, lots of these statements are just misconceptions.

Many businesses are hesitant to accept credit cards because of the cost. But as you’ve learned, credit card processing doesn’t need to be expensive.

To avoid overpaying and ensure you’re getting the best possible deal, let our team here at MCC negotiate the rates on your behalf. Just reach out to us for a free consultation.