Discover Interchange Rates (2024)

Last Updated 1/28/2024

Discover updates its interchange fees on a regular basis. But they don’t publicly post these rates.

Fortunately for you, our team did some digging to keep pace with the Discover’s merchant acquirer fees.

This post explains how Discover differs from other card networks and covers the latest updates, fees, and rate increases imposed by Discover.

Discover Interchange Fees: Credit Card Processing Fees Explained

Discover is unique compared to other card providers. Rather than issuing cards through third-party banks, Discover issues cards directly to consumers. Credit card brands like Visa, Mastercard, etc. use third party card issuers (like Wells Fargo Bank).

Consequently, the interchange fees aren’t split between the card network and issuing bank; Discover fills both roles. Instead, Discover is paid directly through the merchant’s credit card processor for each transaction.

As a result, the interchange fees and processing costs imposed by Discover are actually easier to understand compared to other card networks. In terms of the categories for these fees, Discover places a greater emphasis on the transaction environment and card type. The business type and merchant category code (MCC) holds little weight in determining the fees.

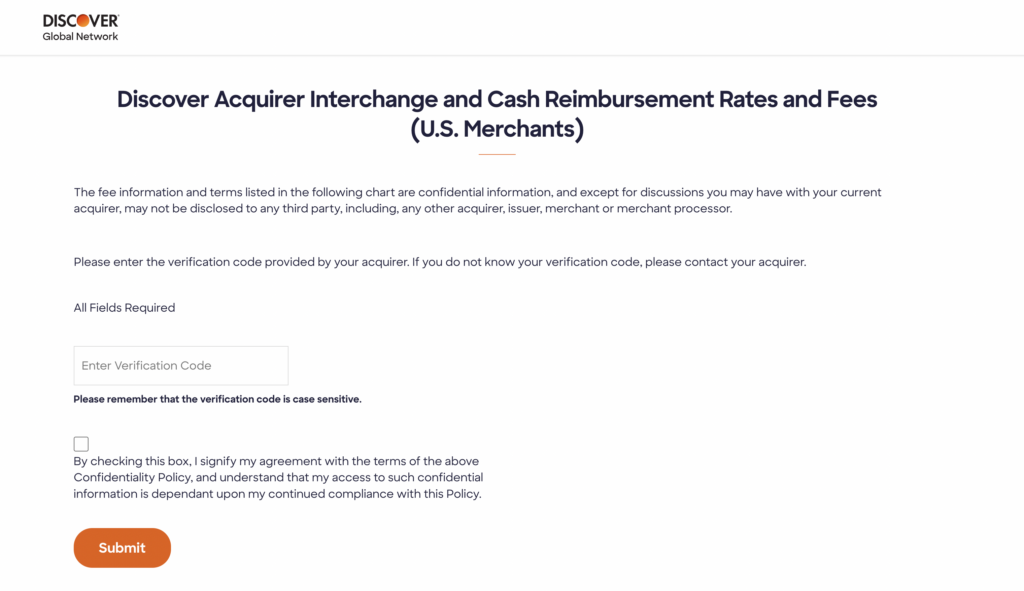

Unlike Visa and Mastercard, Discover doesn’t actually publish their interchange fees online. If you visit the Discover website and try to find the interchange rates, you’ll stumble across this page:

The only way to view the fees is by getting a verification code from your acquiring bank. This lack of transparent pricing can be frustrating for merchants who accept Discover cards.

But through some in-depth research on third-party platforms and other resources, I’ve been able to identify some of the most common Discover interchange rates by category.

Discover Interchange Updates (Effective January 2024)

Discover is updating and modifying its current interchange structure and introducing new program fees for credit card processing. These changes are going into effect as of January 2024. Keep a close eye on your January and February statements to see how these changes are impacting your processing rates.

We’ll publish additional details as they become available.

Discover Program Integrity Fee Increase

Effective April, 2023, Discover is increasing its Program Integrity Fee to $0.10. This is double the previous fee of $0.05.

To help reduce the impact of this new assessment fee, merchant services providers are encouraging businesses to batch and settle all sales on a daily basis. They also recommend obtaining authorizations electronically and using an AVS (address verification service) for all transactions that were manually entered.

New Discover Interchange Rate Increases & Updates (April 2023)

Effective April 13, 2023, Discover is updating the following interchange rates:

- Commercial Large Ticket PP – 1.45% + $35 (previously 0.90% + $20)

- PSL Supermarket/Warehouse Clubs Premium – 1.65% + $0.10 (previously 1.60% + $0.10)

- PSL Supermarket/Warehouse Premium Plus – 2.10% + $0.10 (previously 1.90% + $0.10)

- PSL Restaurants DB – 1.19% + $0.10 (previously 1.14% + $0.15)

- PSL Restaurants Rewards – 1.90% + $0.10 (previously 1.95% + $0.10)

- PSL Restaurants Premium Plus – 2.45% + $0.10 (previously 2.40% + $0.10)

- PSL Retail Premium Plus – 2.25% + $0.10 (previously 2.17% + $0.10)

- PSL Ecommerce Secured Premium Plus – 2.40% + $0.10 (previously 2.35% + $0.10)

- PSL Ecommerce – 2.55% + $0.10 (previously 2.50% + $0.10)

- PSL Petroleum Core – 1.80% + $0.05 (previously 1.55% + $0.05)

- PSL Card Not Present – 2.55% + $0.10 (previously 2.50% + $0.10)

- PSL Key Entry Premium Plus – 2.55% + $0.10 (previously 2.50% + $0.10)

Discover Interchange Fees and Updates (October 2022)

Here’s a closer look at the Discover interchange fee changes for October 2022:

New Commercial B2B Interchange Program

Discover is rolling out a new B2B Commercial interchange program in the United States. Merchants can enter into a direct agreement with Discover or an issuer.

These new Discover interchange rates are determined by the IIN/BIN range of the card used for the transaction:

- IIN/BIN Range 65430000 to 65430099 (Commercial B2B Program 1) – 0% + $0

- IIN/BIN Range 65430100 – 65430199 (Commercial B2B Program 2) – 6% + $0

For additional details and participation information, contact your Discover relationship manager.

Discover PSL Public Service Program Updates

Effective 10/14/22, Discover is modifying its PSL Public Service Program. The changes will effect non-regulated consumer debit and prepaid transactions.

These are the new rates for transactions greater than $200:

- PSL Public Service Debit – 0% + $2 MAX

- PSL Public Service Prepaid – 0% + $2 MAX

All transactions less than or equal to $200 will still qualify for the existing PSL Public Service Program rates of 0.90% + $0.20 per transaction (for both debit and prepaid cards).

Discover Interchange Fees, Updates, and Changes Effective April 2022

Discover is making some significant changes to its interchange rates, fees, and categories effective 4/22/2022. The following information comes from Chase Payment Solutions.

Discover Fee Changes (April 2022)

Here’s a quick summary of the new acquirer and assessment fees:

- Account Verification Service Fee – $0.02 per request

- Address Verification Service Fee – $0.005 per request

- Digital Investment Fee – $0.01%

- Acquirer Assessment Rate 0.14% (up from 0.13%)

Discover Charity Interchange Program (April 2022)

Effective 4/22/2022, Discover is introducing a new category for “Charity US Consumer Interchange Program.” The merchant category code (MCC) is 8398.

- Discover Prime Submission Charity Debit – 0.90% + $0.20

- Discover Prime Submission Charity Prepaid – 0.90% + $0.20

- Discover Prime Submission Charity Debit Non Exempt – 0.05% + $0.21

- Discover Prime Submission Charity Prepaid Non Exempt – $0.05% + $0.21

- Discover Prime Submission Charity Debit Non Exempt Fraud Adjustment – 0.05% + $0.22

- Discover Prime Submission Charity Prepaid Non Exempt Fraud Adjustment – 0.05% + $0.22

- Discover Prime Submission Charity Core – 1.45% + 0.05

- Discover Prime Submission Charity Rewards – 1.50% + $0.05

- Discover Prime Submission Charity Premium – 1.50% + $0.05

- Discover Prime Submission Charity Premium Plus – 2.30% + $0.10

Card present and card-not-present (CNP) transactions are both eligible for Discover’s new charity program. When this new program goes into effect, MCC 8398 will be removed from Discover’s US Recurring Payments and US Emerging Markets consumer interchange programs.

Updated MCC For Recurring Payments (April 2022)

Discover is adding new merchant category codes eligible for its consumer credit Recurring Payments Interchange program. The following categories are eligible as of 4/22/2022:

- MCC 4814 – Telecommunications

- MCC 4899 – Cable Services

- MCC 5968 – Direct Marketing/Subscription

- MCC 7997 – Membership Clubs and Private Golf

- MCC 8351 – Child Day Care

Updated Discover Interchange Rates and Fees Effective April 22, 2022

Effective 4/22/2022, Discover is making changes for consumer credit cards, debit cards, prepaid, cards, and other commercial products. Here’s a summary of the new rates for each category:

Discover Domestic Interchange Rates— Consumer Debit and Prepaid

- Discover PSL Supermarket and Warehouse Clubs Prepaid – 1.12% + $0.16

- Discover PSL Retail Prepaid – 1.12% + $0.16

- Discover Prime Restaurants Debit – 1.14% + $0.15

- Discover PSL Restaurants Prepaid – 1.14% + $0.15

- Discover PSL Card Not Present Prepaid – 1.76% + $0.20

- Discover Prime Ecommerce Prepaid – 1.76% + $0.20

Discover Domestic Interchange Rates— Consumer Credit

- Discover Prime Supermarket and Warehouse Rewards – 1.62% + $0.10

- Discover Prime Emerging Markets Rewards – 1.50% + $0.05

- Discover Prime Emerging Markets Premium – 1.50% + $0.05

- Discover Prime Express Services Premium – 1.97% + $0.00

- Discover Prime Retail Core – 1.57% + $0.10

- Discover Prime Retail Rewards – 1.72% + $0.10

- Discover Prime Retail Premium – 1.74% + $0.10

- Discover PSL Retail Premium Plus – 2.17% + $0.10

- Discover Prime Hotel and Car Rentals Rewards – 1.92% + $1.10

- Discover PSL Hotel and Car Rentals Premium Plus – 2.57% + $0.10

- Discover Prime Passenger Transport Rewards – 1.92% + $0.10

- Discover Prime CNP Core – 1.91% + $0.10

- Discover Prime CNP Rewards – 2.03% + $0.10

- Discover Prime CNP Premium – 2.05% + $0.10

- Discover PSL CNP Premium Plus – 2.50% + $0.10

- Discover Prime Ecommerce Core – 1.91% + $0.10

- Discover Prime Ecommerce Rewards – 2.03% + $0.10

- Discover Prime Ecommerce Premium – 2.05% + $0.10

- Discover Prime Ecommerce Premium Plus – 2.50% + $0.10

- Discover Keyed Entry Core – 1.91% + $0.10

- Discover Keyed Entry Rewards – 2.03% + $0.10

- Discover Keyed Entry Premium – 2.05% + $0.10

- Discvoer Keyed Entry Premium Plus – 2.50% + $0.10

- Discover Base Core – $3.05% + $0.10

- Discover Base Rewards – 3.05% + 0.10

- Discover Base Premium – $3.05% + $0.10

- Discover Base Premium Plus – 3.05% + 0.10

Discover Domestic Interchange Rates— Commercial Products

- Discover Commercial Electronic Debit – 2.45% + $0.15

- Discover commercial Electronic Prepaid – 2.65% + $0.10

- Discover Commercial Electronic Program – 2.45% + $0.15

- Discover Commercial Base Debit – 3.05% + $0.10

- Discover Commercial Base Prepaid – 3.05% + $0.10

- Discover Commercial Base – 3.05% + $0.10

Common Discover Interchange Rates

Let’s take a closer look at some other Discover interchange fees based on common categories. (Note: The rates below may not reflect the most recent changes for April 2022).

Discover Credit Interchange Rates— Card Present Transactions

- Discover Basic Credit — 1.56% + $0.10

- Discover Rewards Credit — 1.71% + $0.10

- Discover Premium Credit — 1.71% + $0.10

- Discover Premium Plus Credit — 2.15% + $0.10

- Discover Commercial Credit — 2.30% + $0.10

Discover Credit Interchange Rates — Card Not Present Transactions

- Discover Basic Credit — 1.87% + $0.10

- Discover Rewards Credit — 1.97% + $0.10

- Discover Premium Credit — 2.00% + $0.10

- Discover Premium Plus Credit — 2.40% + $0.10

- Discover Commercial Credit — 2.30% + $0.10

Discover categorizes card not present transactions as any sale where the card was provided remotely. This includes online transactions, phone orders entered into a virtual terminal, or keyed transactions at a physical terminal (even if the card was technically present).

Discover Debit Card Interchange Rates

- Discover Debit Card Present — 1.10% + $0.16

- Discover Debit Card Not Present — 1.75% + $0.20

- Discover Debit Card Regulated — 0.05% + $0.22

A regulated debit card has been issued by a bank with at least $10 billion in assets. There is actually a federally regulated cap on how much processors can charge for debit card transactions. Learn more about the difference between credit and debit transactions.

Discover Recurring Transaction Interchange Rates

- Recurring Discover Debit Transaction — 1.20% + $0.05

- Discover Debit Regulated Recurring — 0.05% + $0.22

- Discover Basic Credit Recurring — 1.35% + $0.05

- Discover Rewards Credit Recurring — 1.35% + $0.05

- Discover Premium Credit Recurring — 1.35% + $0.05

- Discover Premium Plus Credit Recurring — 1.80% + $0.05

- Discover Commercial Credit Recurring — 2.30% + $0.10

Discover offers discounted credit card processing for the majority of recurring transactions, like memberships and subscriptions. If you compare these interchange rates to the other tables on this guide, you’ll see that most of these ones are cheaper. In addition to the payment method, the actual cost you’ll end up paying depends on how your merchant account is set up. As we’ve discussed in the past, some processors are better than others (lots of processors add a cancellation fee and extra costs to your contract).

Discover International Credit Card Interchange Rates — Card Present

- Discover International Basic Credit — 1.20% + $0.00

- Discover International Rewards Credit — 1.65% + $0.00

- Discover International Premium Credit — 1.65% + $0.00

- Discover International Premium Plus Credit — 1.65% + $0.00

- Discover International Commercial Credit — 1.90% + $0.00

Discover International Credit Card Interchange Rates — Card Not Present

- Discover International Basic Credit — 1.70% + $0.10

- Discover International Rewards Credit — 1.70% + $0.10

- Discover International Premium Credit — 1.70% + $0.10

- Discover International Premium Plus Credit — 1.79% + $0.10

- Discover International Commercial Credit — 1.90% + $0.10

Final Thoughts

While Discover doesn’t publish interchange rates online, the fees are actually quite easy to understand. The rates are largely based on the card type; basic, rewards, premium, premium plus, and commercial.

Beyond those card types, the interchange is calculated based factors card present, card not present, credit, debit, or international transaction.

While interchange fees are non-negotiable, there are still other ways to get lower credit card processing rates. As a merchant, these aren’t the actual fees that you’re being charged. Your processor adds a markup to each transaction for their role in the process.

The processor’s markup is one of the fees that can be negotiated. Here at Merchant Cost Consulting, we can negotiate those rates on your behalf.

Contact us today to find out how much money you can save on credit card processing for Discover and all of the other cards accepted by your business.

0 Comments