If you’ve been looking at your monthly merchant processing statement, there’s a good chance you’ll find a Visa Acquirer Processing Fee as a line item. This might also be displayed as simply Acquirer Processing Fee, VS ACQUIRER PROC FEE, Visa APF, or another slight variation.

Regardless of how the fee is reported on your statement, if you’re unsure what it is and how much it’s actually supposed to cost, you’ve come to the right place.

I’ll explain everything you need to know about Visa’s Acquirer Processing Fee below.

What is the Acquirer Processing Fee?

The Visa Acquirer Processing Fee (APF) is an assessment fee charged on all Visa authorizations acquired in the US. Every time a business authorizes a Visa-branded credit card or debit card in the United States, the Acquirer Processing Fee will be applied.

Like all assessment fees, the Acquirer Processing Fee is set at the card network level (in this case, by Visa), and passed through to merchants from their processor.

How Much is the Acquirer Processing Fee?

Visa’s Acquirer Processing Fee costs $0.0195 for credit card transactions and $0.0155 for debit cards.

Unlike other Visa assessments, the Acquirer Processing Fee is a flat-rate fee that applies to all Visa authorized transactions (as opposed to a percentage of monthly processing volume).

If you see the Acquirer Processing Fee on your monthly statement and it’s being charged a higher rate than the two numbers above, there’s a chance your processor is padding your assessment fees.

We see this happen all of the time, and it’s a red flag that needs to be addressed right away—as it’s a sign that your processor is likely applying other deceptive billing tactics that could be costing you thousands of dollars in extra fees every month. Contact our team if you need help navigating through this process.

How to Find Acquirer Processing Fees on Your Merchant Statement

Learning how to read your merchant statement is a really important skill that many businesses simply overlook. But figuring out what you’re looking at is the first step to finding hidden fees, overages, and inflated rates that could otherwise be avoided.

Depending on your processor, every statement looks a little bit different. But the Visa Acquirer Processing Fee should be listed alongside other assessment fees and miscellaneous fees.

This is usually a bit further down on your statement after all of the summaries and card-type breakdowns.

It’s common for processors to lump assessments together by card network. So if you see one Visa assessment, the Acquirer Processing Fee shouldn’t be too far away. That said, we do see other processors that mix fees by network—so this isn’t a guaranteed shortcut to finding it.

You’ll only have the Acquirer Processing Fee on your statement if you’re on some type of interchange-plus pricing plan. If your processor charges you a flat rate for all transactions, your assessments won’t be listed as separate line items.

This just goes to show you how much of a rip-off flat-rate pricing is. Visa still charges the fee, but your processor is making such a high markup on you that they don’t need to pass through the assessment fees.

Examples of Visa Acquirer Processing Fee on Real Statements

I’ve pulled a couple of reports from our clients to show you how the Visa Acquirer Processing Fee looks on real monthly statements.

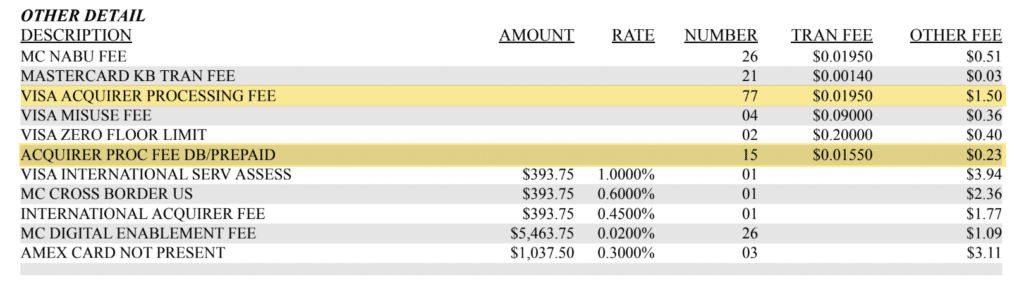

Here’s one that shows both the credit and debit fee within a few lines of each other. I’ve highlighted both so it’s easy for you to see.

Both are charged correctly—with $0.0195 for credit and $0.0155 for debit.

It’s interesting how the first line item actually says Visa while the second does not. If we check the math here, everything adds up correctly if we multiply the transaction fee by the number of transactions for each.

You can also see that in this particular example, the assessment fees are all mixed together and not grouped by card network. For example, we see Mastercard’s NABU Fee and MC KB Transaction Fees first, then Visa, and then more Mastercard Fees after.

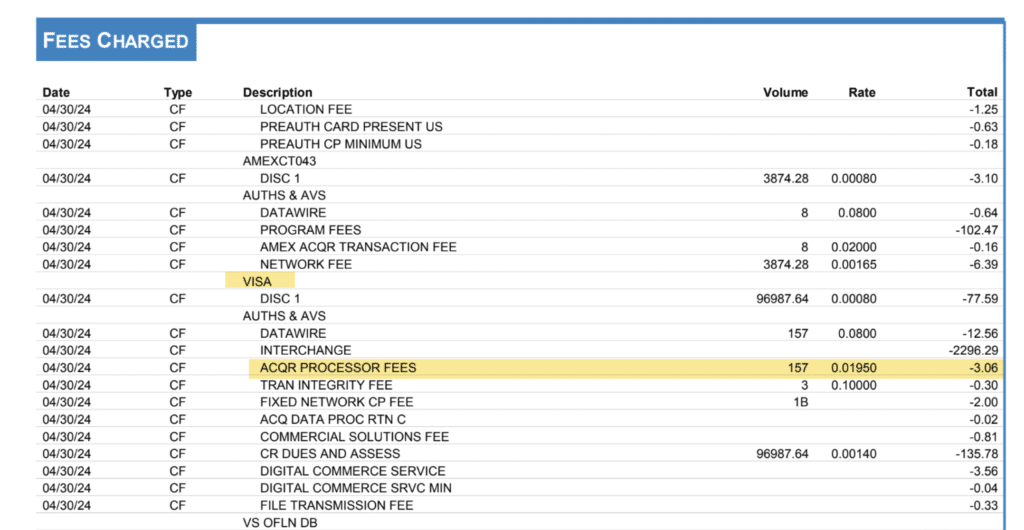

Here’s another example that looks slightly different:

This processor does break down assessments by card network.

So if we find Visa (which I’ve highlighted), we can look through line-by-line until we get to ACQR PROCESSOR FEES—and we see the same rate, $0.0195 is being charged here.

Visa Acquirer Processing Fee vs. Other Network Acquiring Fees

If you do a quick search through your statement for just the word “acquirer” or “acquiring” then you’ll likely find more than just the Visa Acquirer Processing Fee.

However, don’t let this confuse you. Other card networks also have their own versions with similar names.For example, there’s a Mastercard Acquirer License Fee and also an Amex Acquirer Transaction Fee.

These all have slightly different rates, but they’re not the same charge and not all going to the same place.

Is the Acquirer Processing Fee Legit?

Yes, the Acquirer Processing Fee is a legitimate charge. This holds true for Visa, as well as acquirer processing fees charged by the other card networks.

So it’s not a cause for concern if you see this on your statement (assuming your processor is passing it through to you at the correct amount).

Is the Acquirer Processing Fee Negotiable?

No, the Acquirer Processing Fee is not negotiable.

Like interchange rates, all assessment fees imposed by the card networks are non-negotiable. Those are the only two components of credit card processing that are set in stone.

But all of the other fees and rates charged by your processor are negotiable, and that’s where you can find cost-saving opportunities.

Final Thoughts

This is just one of the thousands of different fees that you might see on your monthly processing statement—and there’s a lot that goes into it.

So if you’re not quite ready to audit every single line item in this much depth, you can work with a merchant consultant who can handle all of this stuff on your behalf.

Our team here at MCC can audit your statements and monitor them every month to ensure your fees are being charged properly. If we catch any mistakes or room to save money, we’ll reach out to your processor to obtain any refunds you’re entitled to and make sure everything is properly applied moving forward.