Bank of America is the second-largest bank in the US in terms of total assets. With over 3,700+ locations nationwide, it’s a name that we’re all familiar with.

In addition to its traditional banking services, BOA offers payment processing solutions for businesses of all sizes.

Here at MCC, we have extensive experience working directly with Bank of America Merchant Services on behalf of our clients. We’ve audited thousands of BOA statements, dealt directly with their sales reps, and continue doing both of these things on an ongoing basis.

Read this before you sign up for BOA Merchant Services or think about switching processors. You’ll get the insider scoop, including a closer look at prices and real statements that you won’t find anywhere else on the web.

MCC Quick Take on BOA Merchant Services

BOA is an ISO (independent sales organization) that uses Fiserv’s technology to process payments on the backend. While BOA does have its own in-house acquiring services, this isn’t something we typically see based on reporting from our clients.

Like other ISOs, they’ll try to get away with charging as much as possible—pushing tiered plans and marking up American Express transactions even higher.

Most of what BOA offers is geared toward smaller businesses. They get their leads through banking relationships and try to upsell those merchants with payment processing services.

What We Like About BOA Merchant Services

- Interchange-plus pricing is available for certain businesses.

- Discount rates can be competitive for high-volume merchants.

- No long-term contracts (for most businesses).

- No early termination fees (double-check your merchant agreement before signing).

- Same-day funding is available for qualified merchants.

What We Don’t Like

- Monthly reporting is incredibly deceptive (more on this later).

- BOA’s technology is outdated, which is why they need to rely on Fiserv.

- Sales reps will try to push tiered pricing and overcharge for Amex.

- Rates are unjustifiably high.

- We had one client come to us because they were paying a 7% effective rate, which is nearly triple what they’d be paying with another processor.

Bank of America Merchant Services Pricing and Credit Card Processing Rates

Bank of America offers transparent flat-rate pricing with rates starting at:

- 2.65% + $0.10 per transaction for swipe, dip, and tap

- 2.99% + $0.30 per transaction for ecommerce

- 3.50% + $0.15 per transaction for keyed entry

Do not accept these prices.

While they aren’t as high as PayPal or Stripe, flat-rate pricing is one of the worst deals in payment processing—despite its transparency and simplicity.

BOA offers discounts for its Preferred Rewards business members. But even if you’re a Platinum Honors member (with over $100,000 daily bank balance), the 0.10% discount dropping you down to 2.55% + $0.10 for in-person transactions is still very high.

Instead, you need to negotiate a custom interchange-plus deal to get the best rate from BOA Merchant Services.

Unfortunately, not every business will qualify for this. If you’re brand new or a small business with low volume, BOA might stand firm on its flat-rate deal or push you into a tiered contract (which is arguably worse).

Tiered deals dangle a lower qualified rate to get your attention. But in reality, most of your transactions will end up in the mid-qualified or non-qualified bucket—potentially pushing you into rates that are even higher than the flat-rate prices shown above.

Everything Else You Need to Know About Bank of America Merchant Services

Beyond pricing, there are some other insider tips you should be aware of before you sign up or consider using BOA Merchant Services.

Some of these are red flags, and others are just “nice to know.” Either way, it will put you in a better position to get the best possible rate—either from BOA or another processor.

Beware of Deceptive Reporting

Deceptive reporting is one of my biggest pet peeves in the payment processing space. It’s not quite as bad as interchange padding (which isn’t something we’ve caught BOA doing), but it’s probably a close second or third in terms of the worst traits of a processor.

Let’s look at a real example from a client’s statement so you can see what I mean.

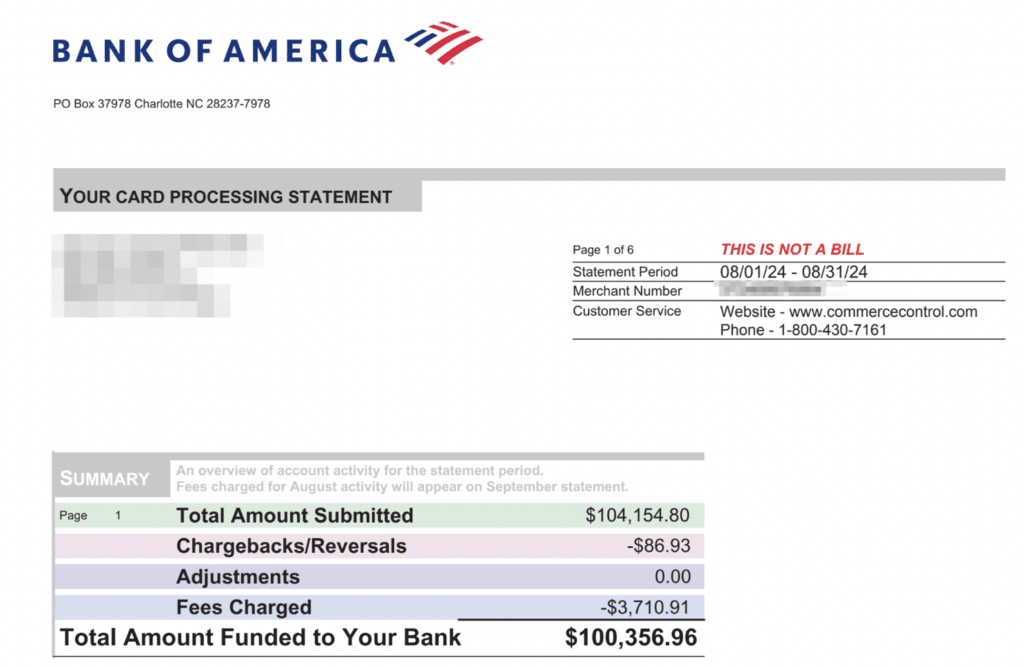

This is the first page of a standard monthly statement from BOA Merchant Services.

At first glance, it looks like the merchant submitted $104,154 in transactions and paid $3,710 in fees. Some quick math translates to a 3.56% effective rate—which is high, but maybe not enough to lose sleep over.

Here’s the problem. This statement is for August’s transactions.

Now look closely at that light grey print at the top of the summary. It says that fees charged for August’s activity will appear on September’s statement.

So the Fees Charged line item ($3,710) shown above isn’t actually from this statement period—it’s from the PREVIOUS month.

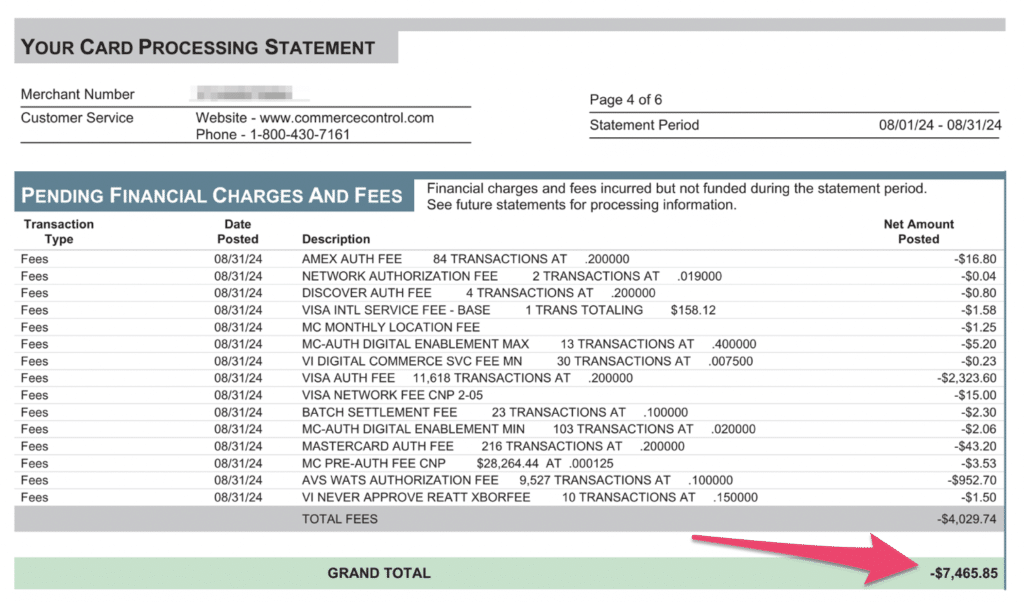

Instead, we have to navigate page four of this statement and find the Grand Total line item, which is a more accurate representation of August’s total fees.

The number is drastically different from the fee summary on page one.

This merchant actually paid $7,456 in fees on $104,154 of payments—resulting in a criminally high effective rate of over 7%.

The high rate is a problem on its own. But this is even worse because the real costs feel buried in the report.

A busy business owner might quickly glance at their statement, see the summary on page one, and just move on—not realizing the summary doesn’t accurately represent their costs.

BOA Relies on Fiserv For its Technology

First and foremost, Bank of America is and always will be a large commercial bank. Traditional banking is what they do, and the merchant services are just gravy.

Why is this important?

Because Bank of America isn’t in the business of building and maintaining robust payment technology. Instead, they leverage an ISO partnership with Fiserv to offer hardware (like Clover POS) and software to merchants.

So whatever custom requests or setups you need from BOA will ultimately be coming from Fiserv.

Most of BOA’s biggest merchants will be brick-and-mortar retailers because it’s simple enough that they can handle on their own. But for complex setups and gateways, the technology just isn’t up to standard with the rest of the industry.

BOA Has its Own Acquiring Services, But Don’t Really Push it

Bank of America, alongside Wells Fargo, has been one of the largest Fiserv ISOs on the market.

Shortly after Fiserv acquired First Data in 2019, Bank of America ended their joint venture and established its own independent payment processing solution.

However, most of what we see from our clients using Bank of America Merchant Services still comes from Fiserv.

We see Clover systems and statements that are basically identical to Fiserv’s. So I don’t think BOA is really pushing its own services too hard—at least based on our experience.

I think this is directly related to what I mentioned above in my last point in that BOA isn’t interested in building and maintaining the latest and greatest technology. It’s much easier for them to just get that stuff elsewhere and resell it.

If They Can Get Away With it, BOA Will Charge High Rates For Credit Card Processing

I wouldn’t go as far as to say that the BOA sales reps are predatory. However, they’re going to try to charge you as much as possible.

This is tough for smaller businesses or merchants who just simply aren’t educated enough on how payment processing works.

For example, 90% of the time we see BOA marking up Amex transactions significantly higher than others. When we talk with our clients and look back at the communication they had with BOA sales reps, it’s clear that those reps have been trained to say, “Amex is so much more expensive” as a justification for the inflated rates.

But everyone in the payment processing space knows that this is bogus.

Latest BOA Merchant Services Rate Increases, Updates, and Noteworthy News

Bank of America doesn’t increase rates too frequently. Most of the updates they send to merchants are tied to pass-through fees or interchange changes coming directly from the card networks.

You can check out a full history of those updates here.

Should You Switch to BOA Merchant Services?

I wouldn’t.

I honestly can’t think of a single scenario that would make sense for a business that’s already set up with another processor to switch to BOA merchant services.

There are two reasons for this answer.

One, it’s rare that switching providers ever makes sense (regardless of who you’re switching to). If your rates are too high, which is why most merchants consider switching, you have a much better chance of negotiating directly with your current processor.

Two, even if you determine that switching processors is the best move for your business, BOA doesn’t offer anything that you couldn’t get elsewhere. Their rates are high and technology is subpar.

It only makes sense to use BOA Merchant Services if you’re a simple, high-volume brick-and-mortar-only retailer that someone managed a great discount rate. But for anything else, BOA just isn’t as good as other options out there.

Our Final Thoughts on BOA Merchant Services

BOA Merchant Services will always have clients because of its name and popularity of the bank. But overall, they’re below average.

The deceptive reporting is a huge red flag for me. It’s one thing if you’re going to charge high rates, but at least be upfront about it.

There are a few perks and a handful of reasons why it makes sense to use them for some businesses. I just can’t see myself recommending them to anyone in the foreseeable future.

With all of this in mind, it doesn’t mean you should cancel your contract with BOA Merchant Services. Our team here at MCC can help you negotiate a better rate. Just reach out for a free statement audit to get the ball rolling and find out how much you can save.